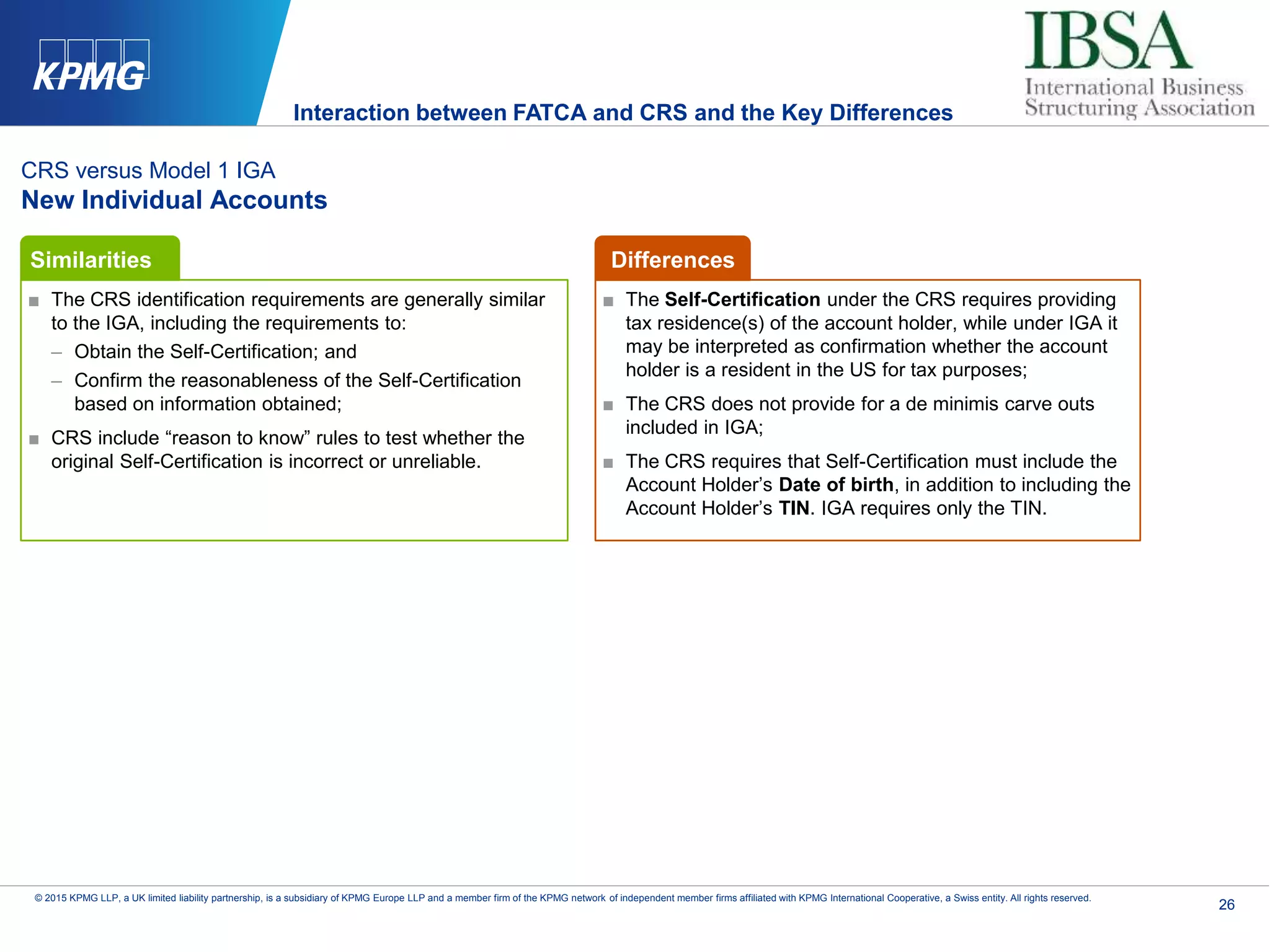

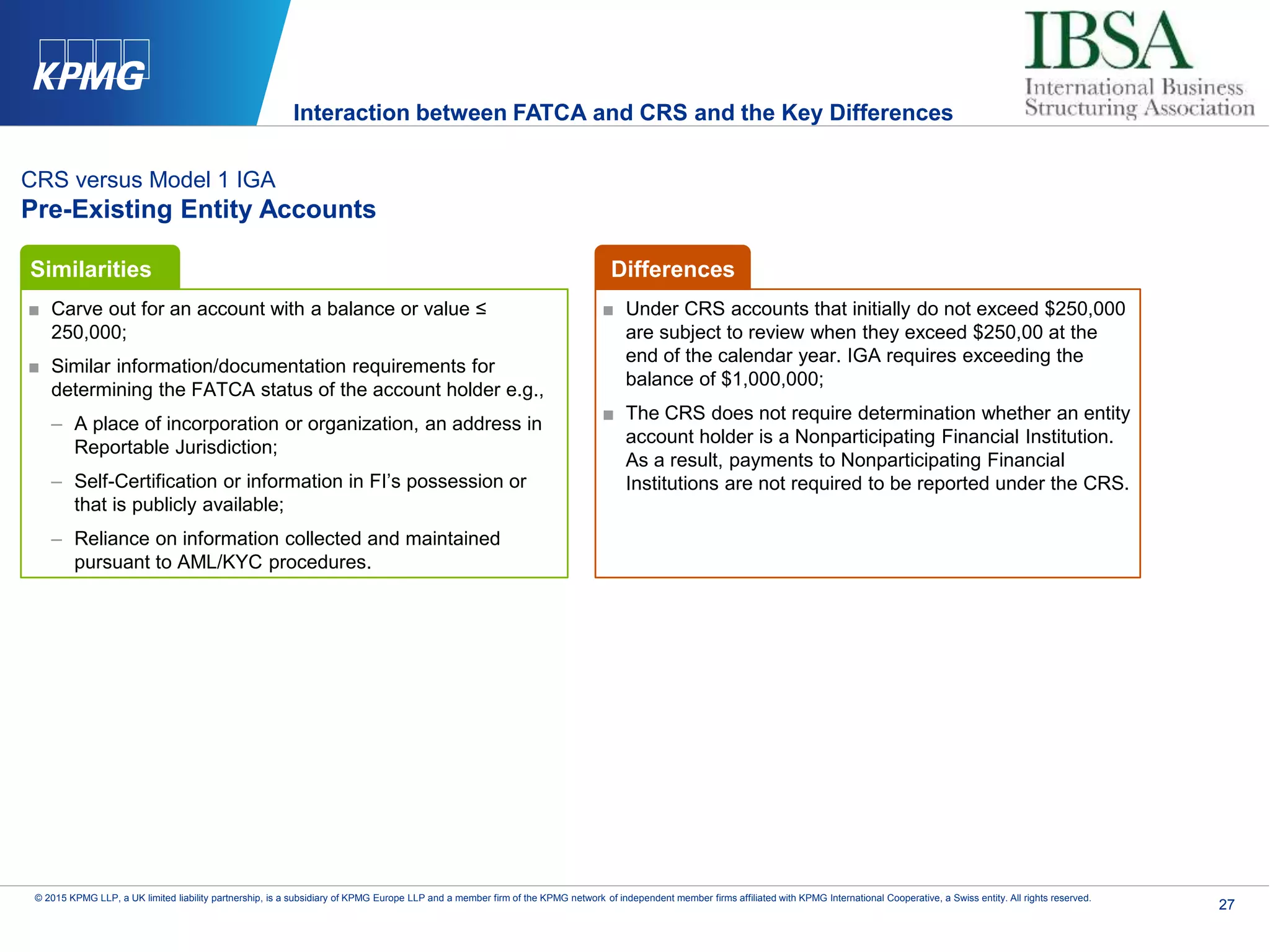

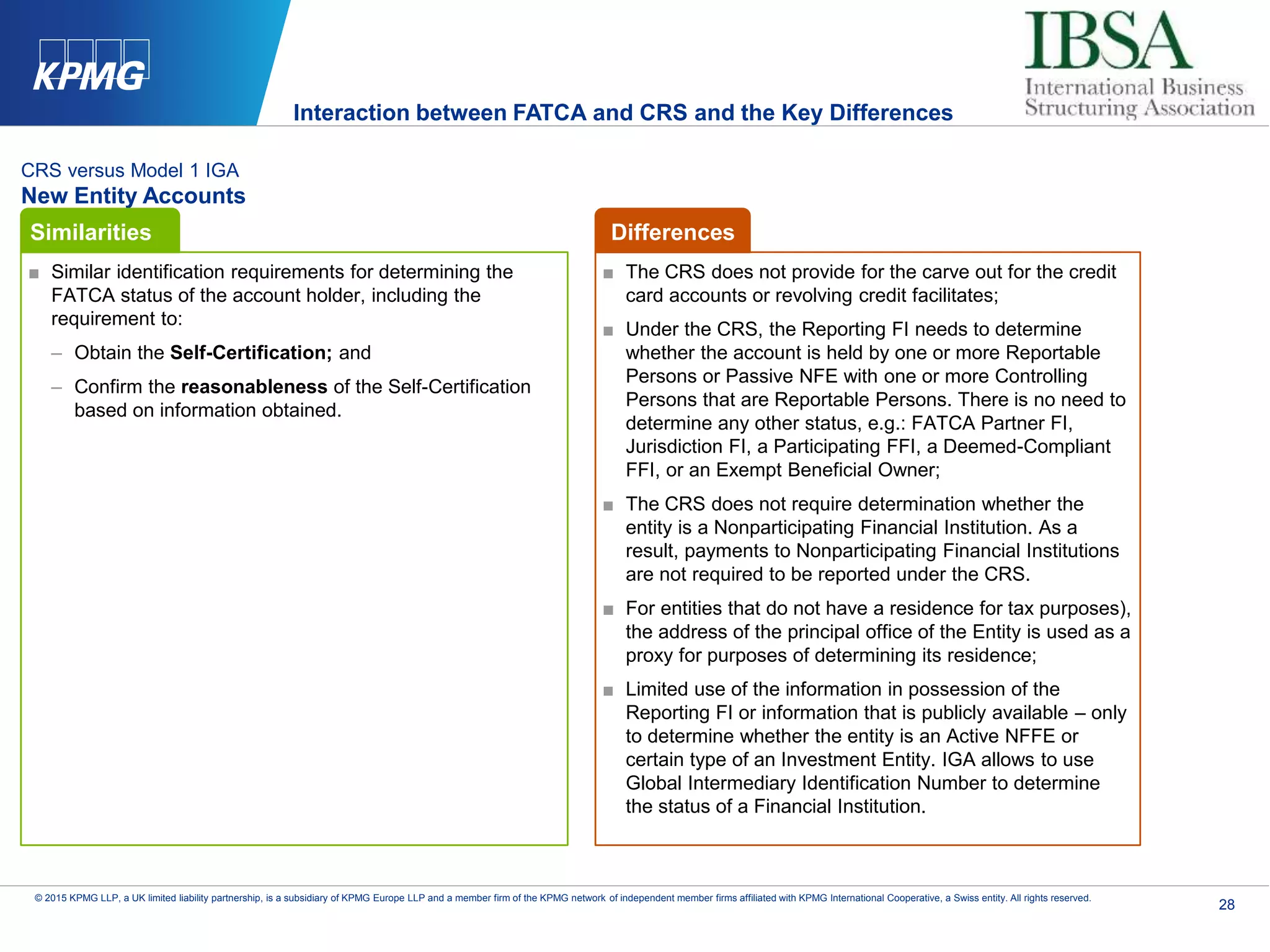

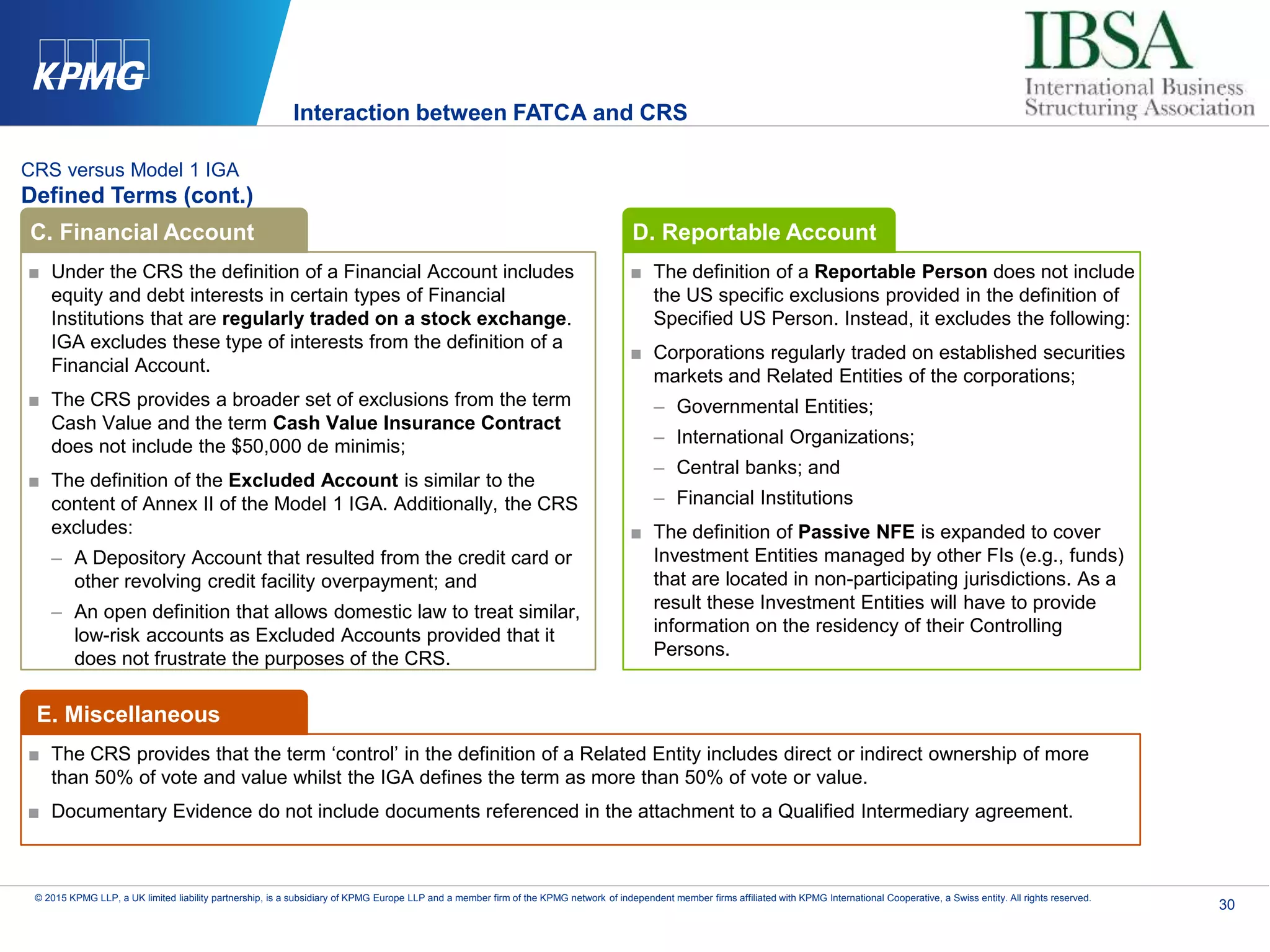

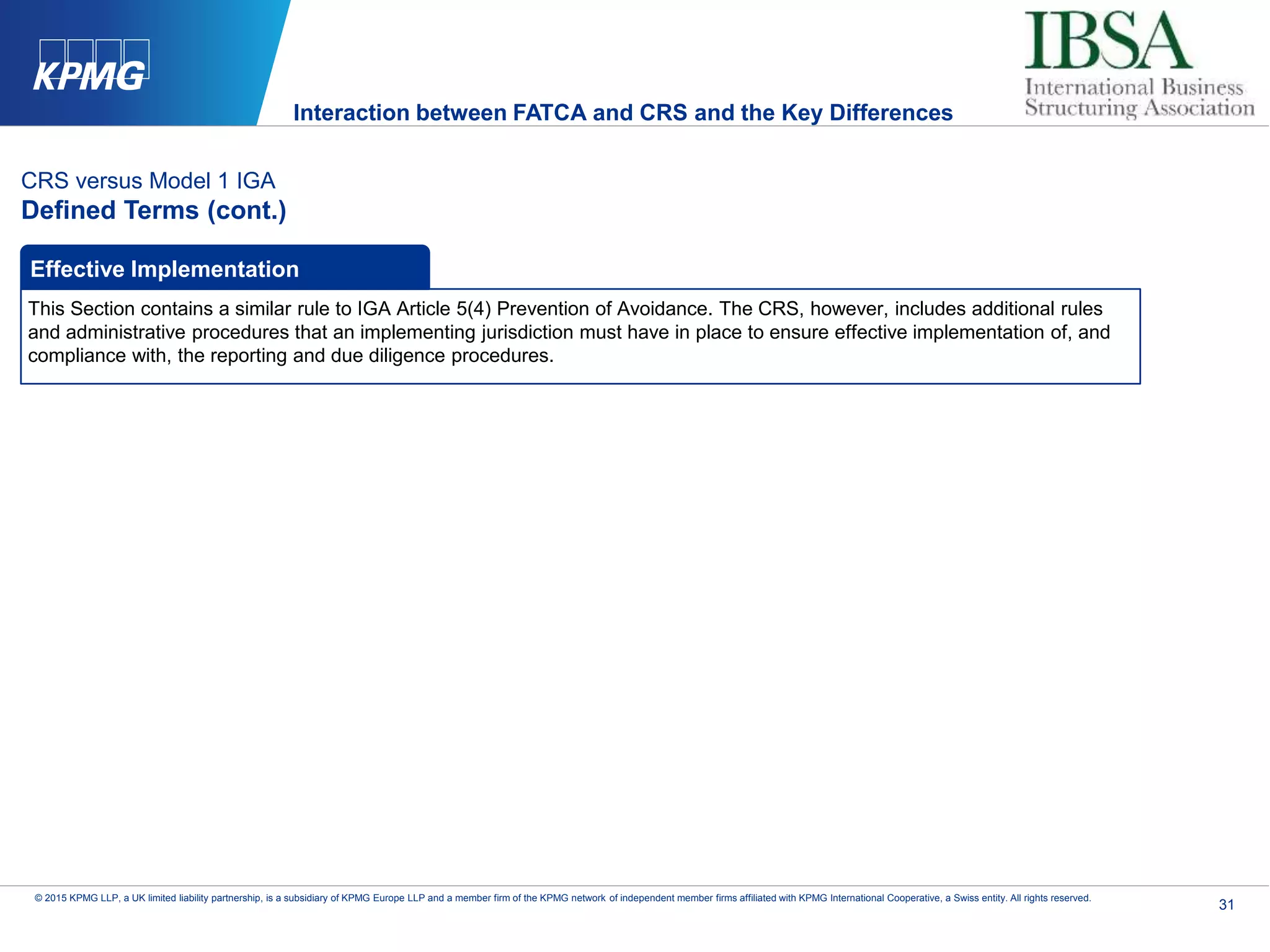

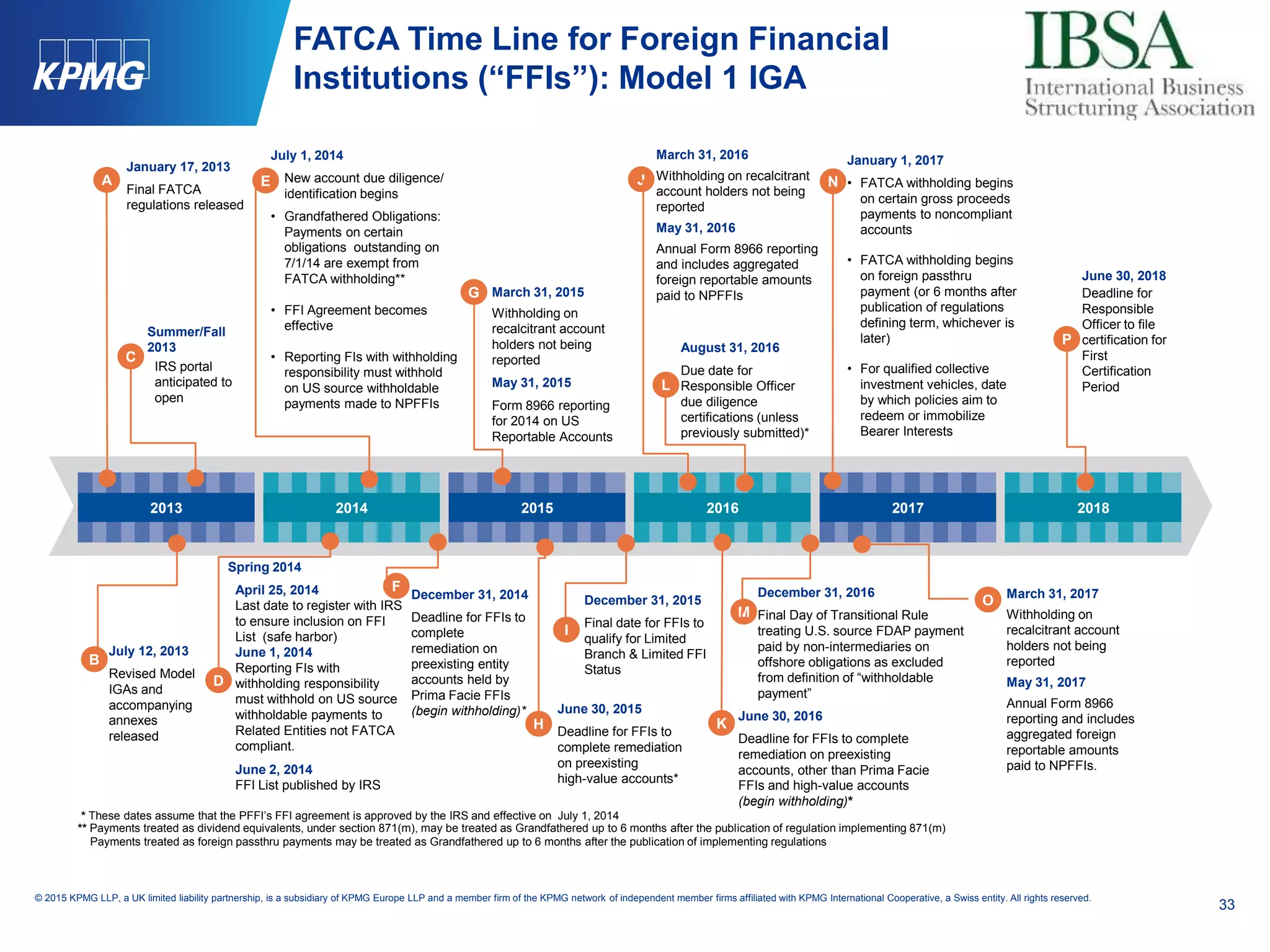

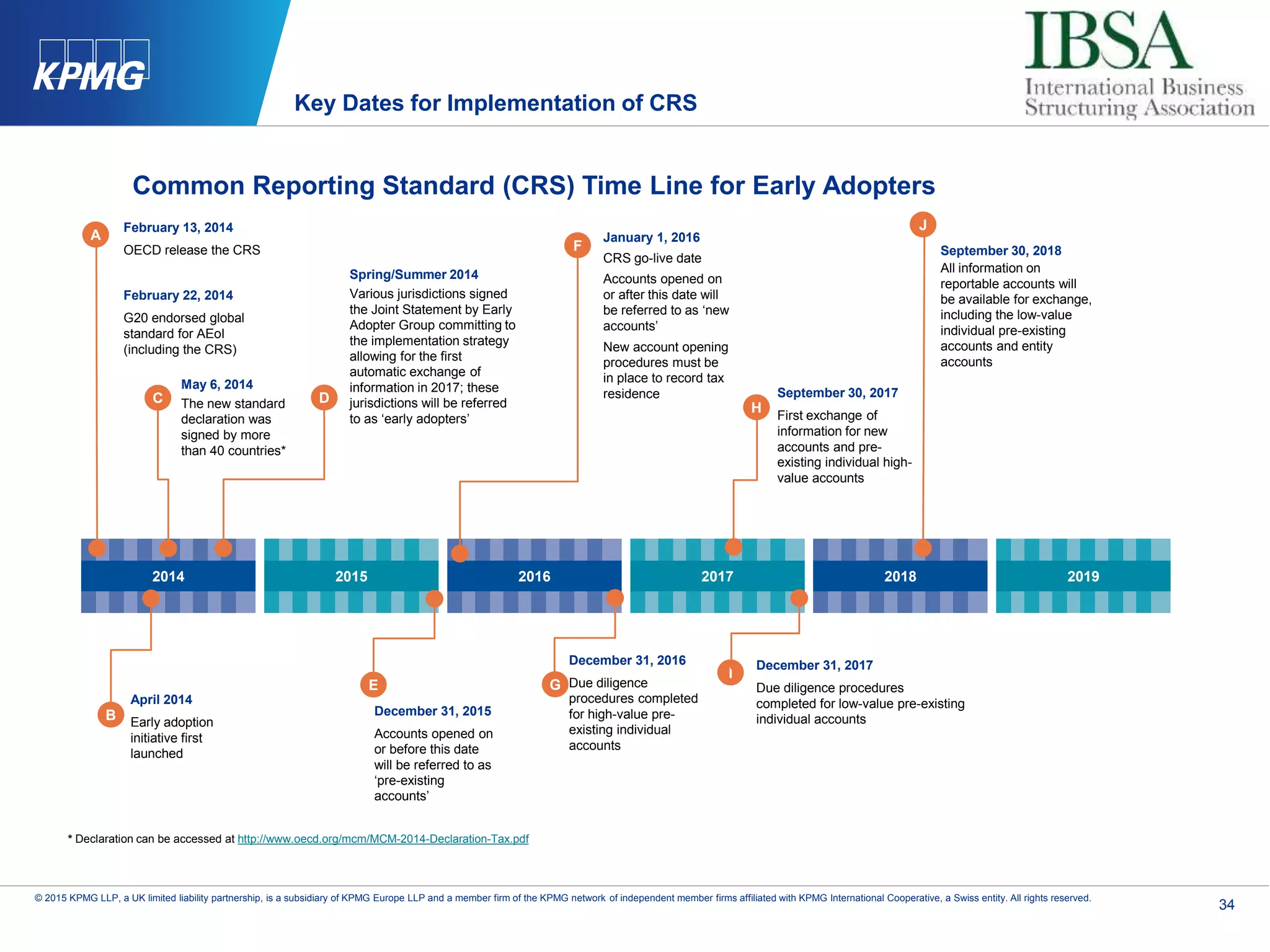

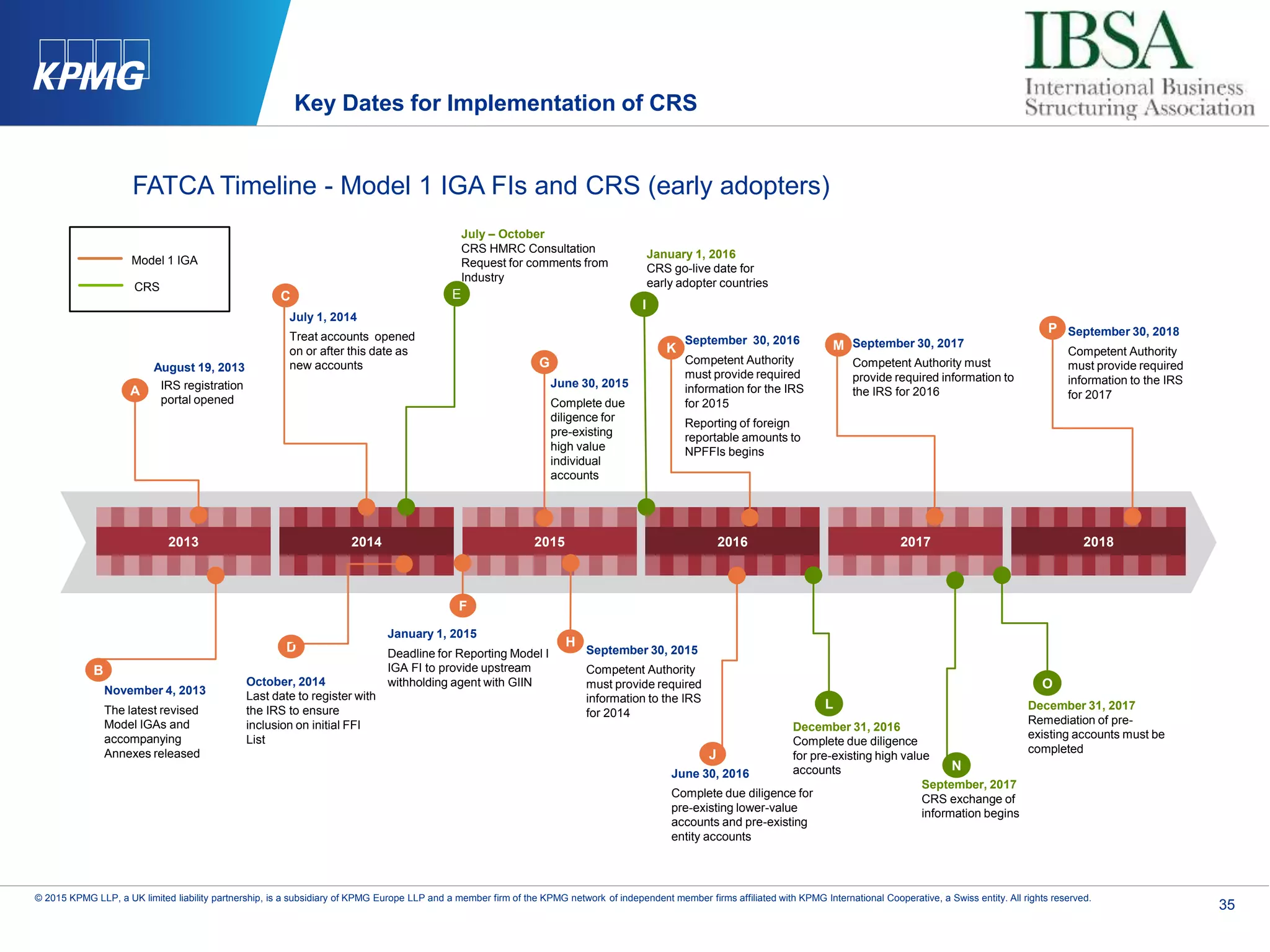

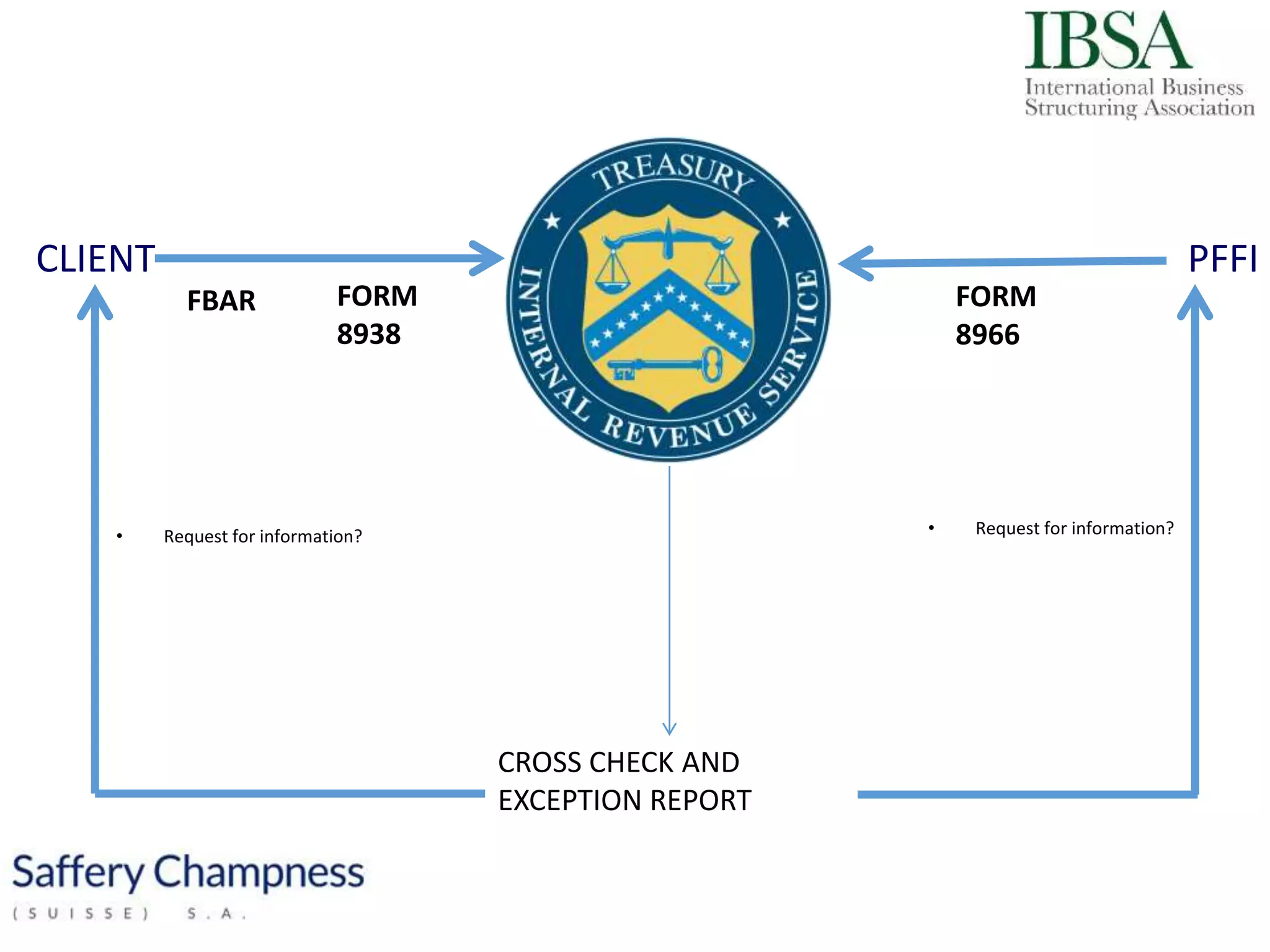

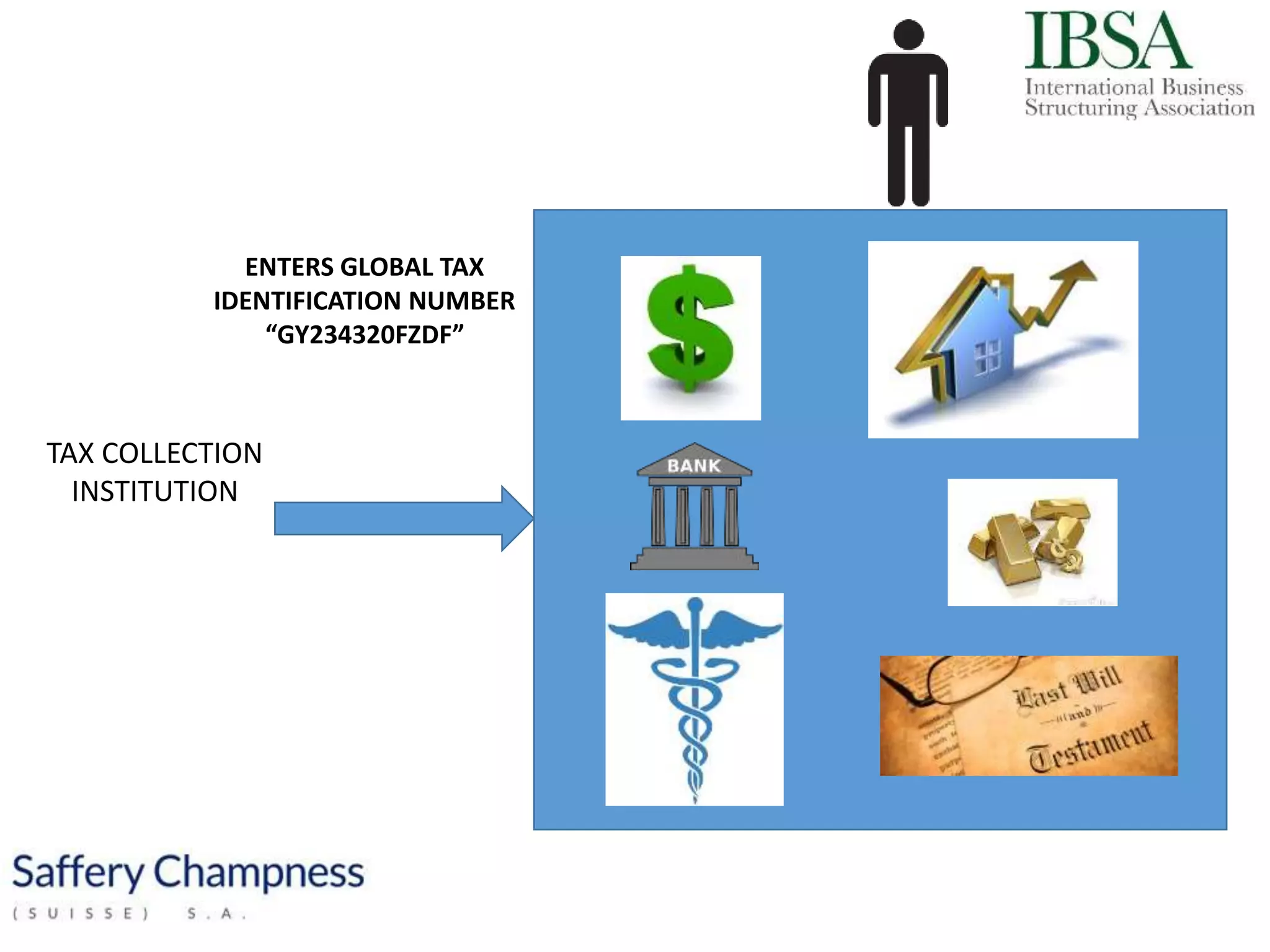

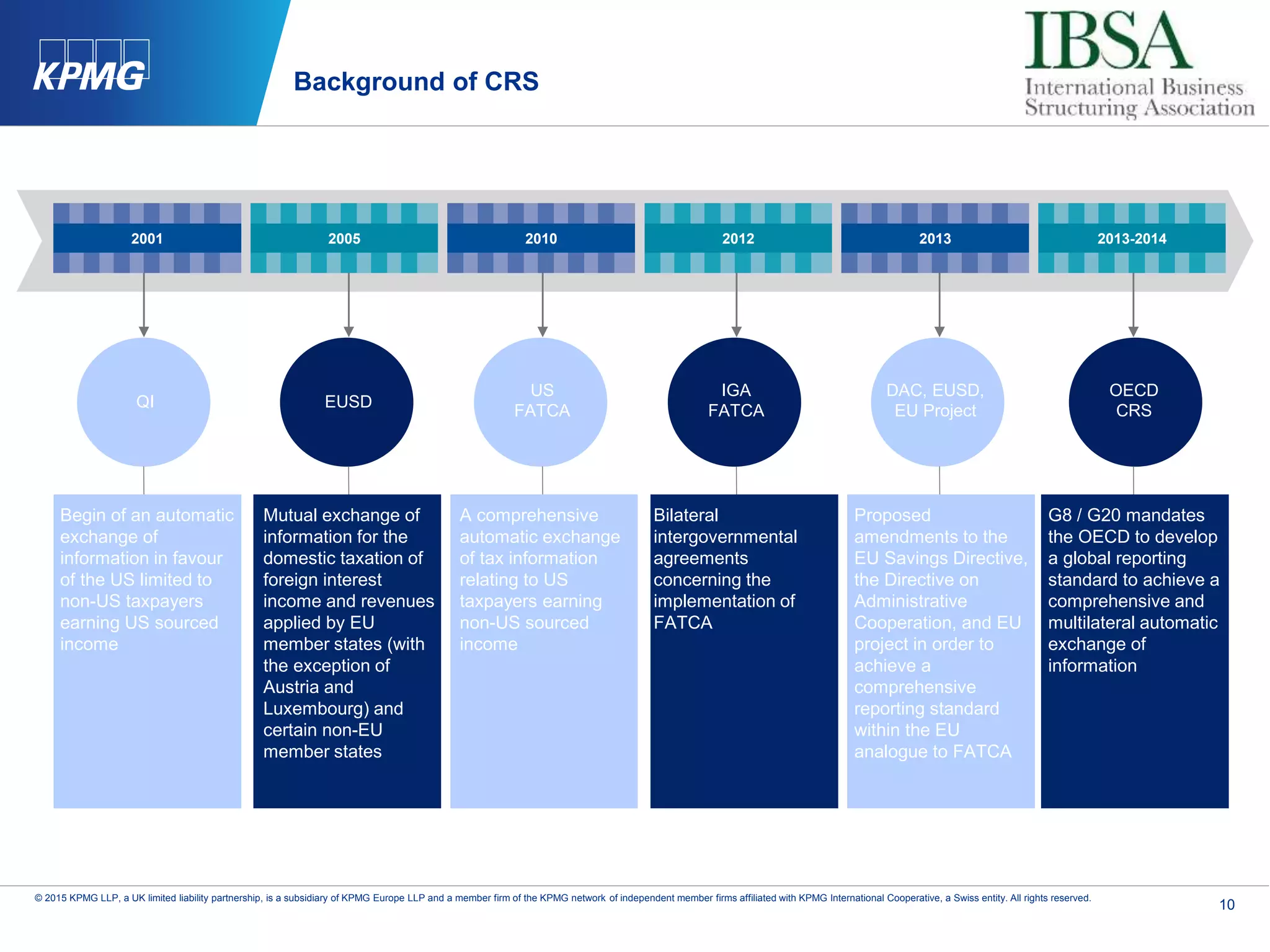

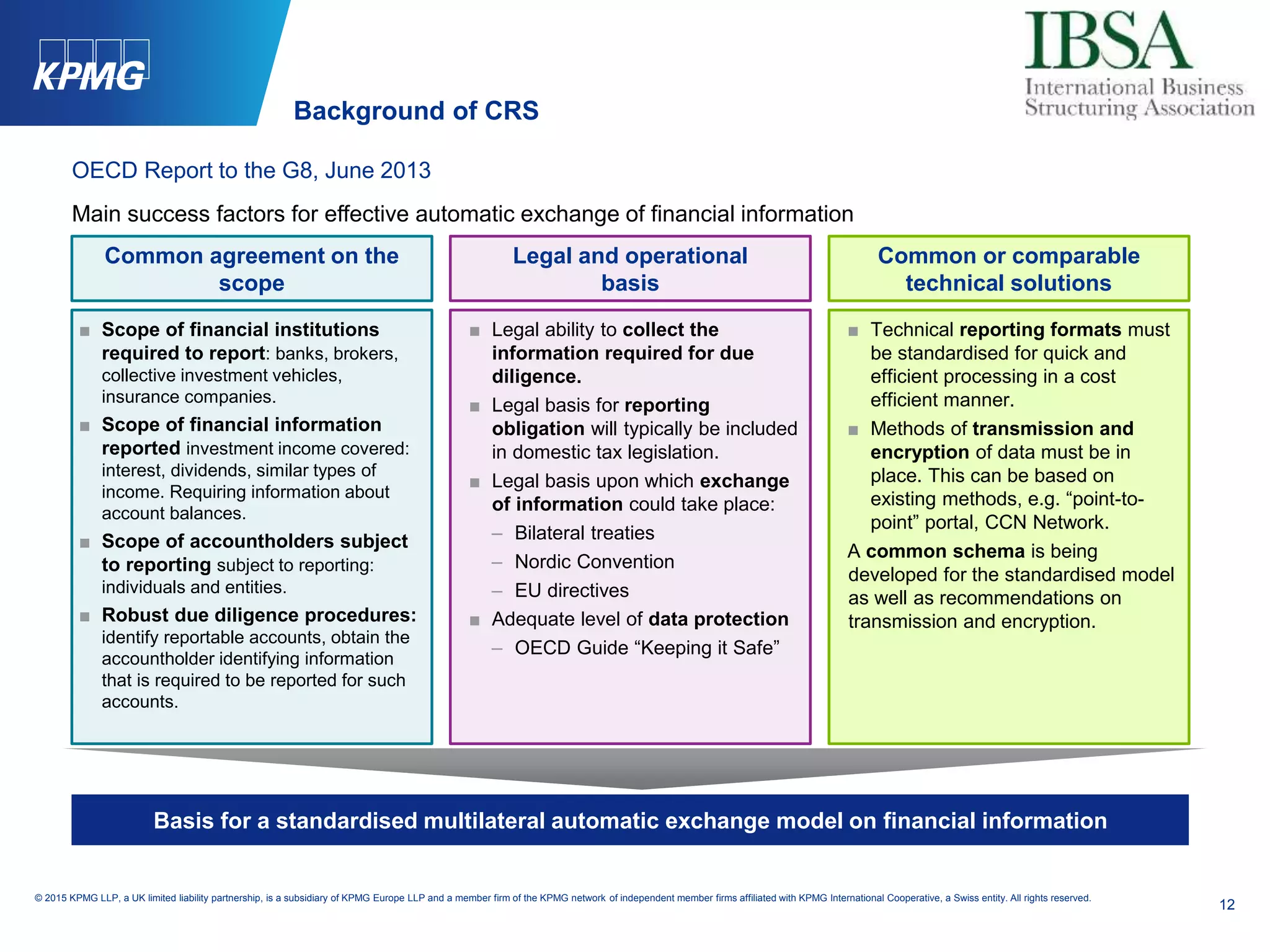

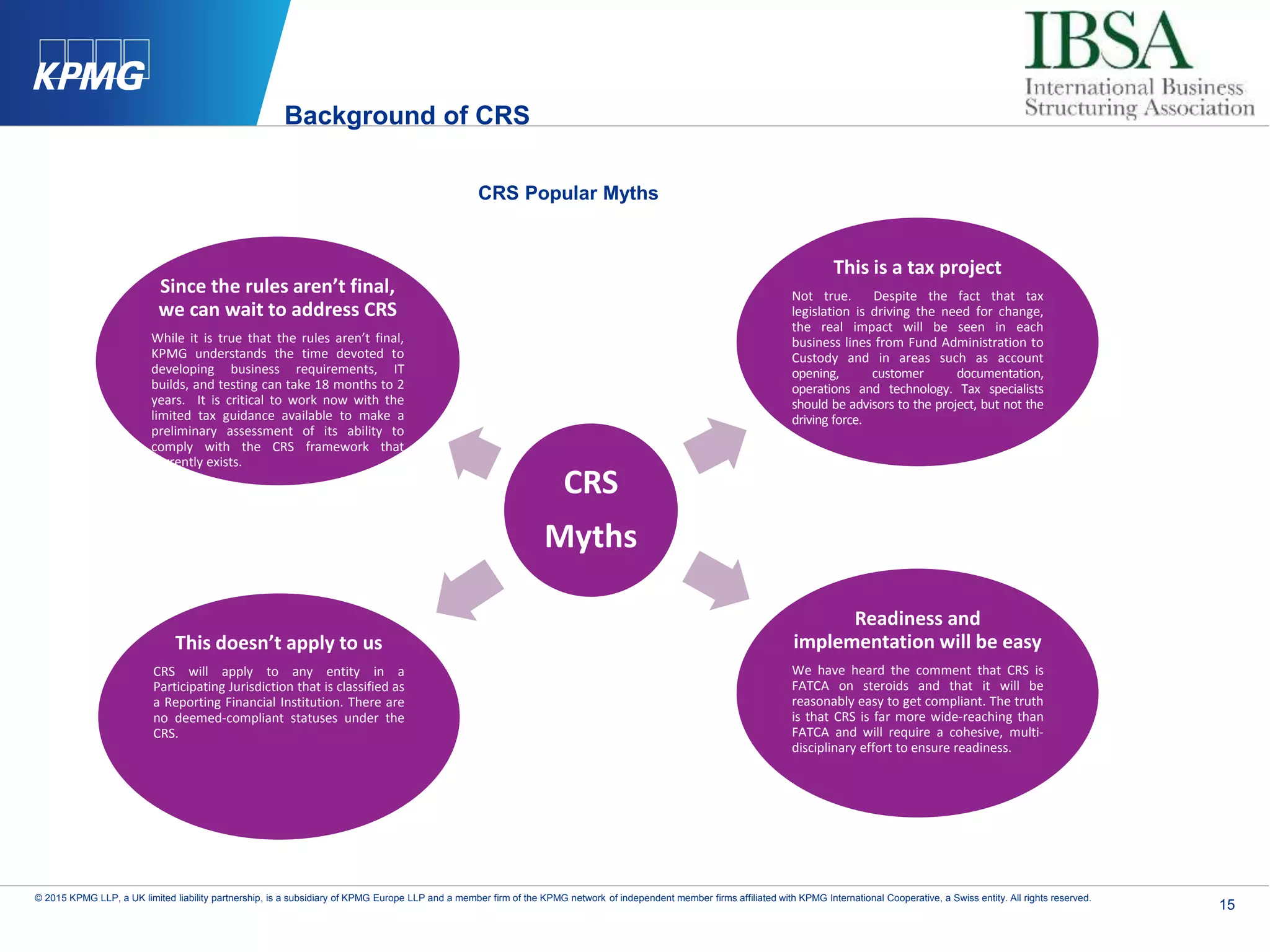

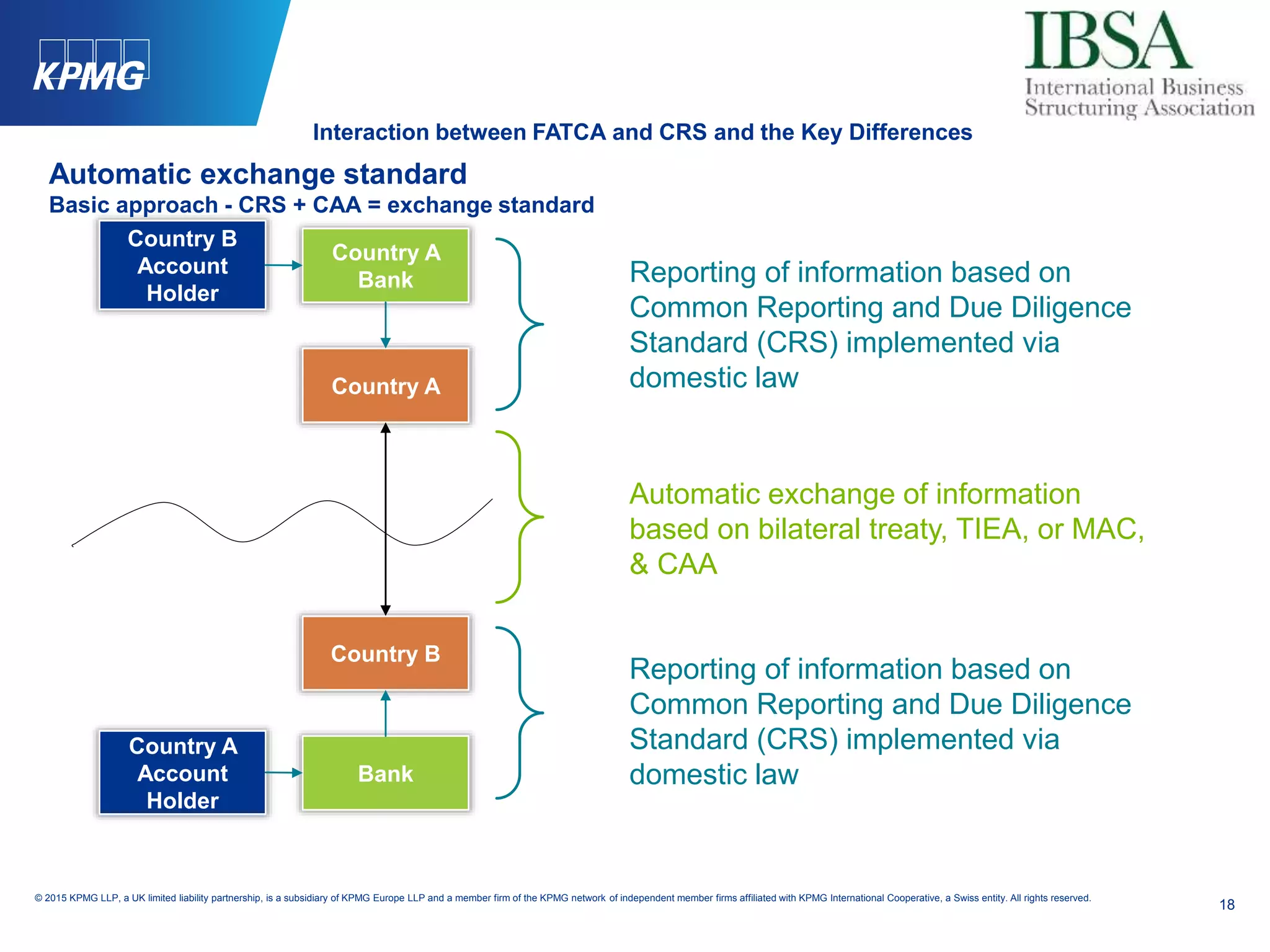

The document outlines the interaction between the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA), detailing the key differences and implications for financial institutions. It describes the implementation of CRS for automatic exchange of tax information among participating jurisdictions and emphasizes the need for compliance across various financial sectors. The document highlights the operational, legal, and reporting requirements necessary for effective implementation of CRS in comparison to FATCA.

![24

© 2015 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

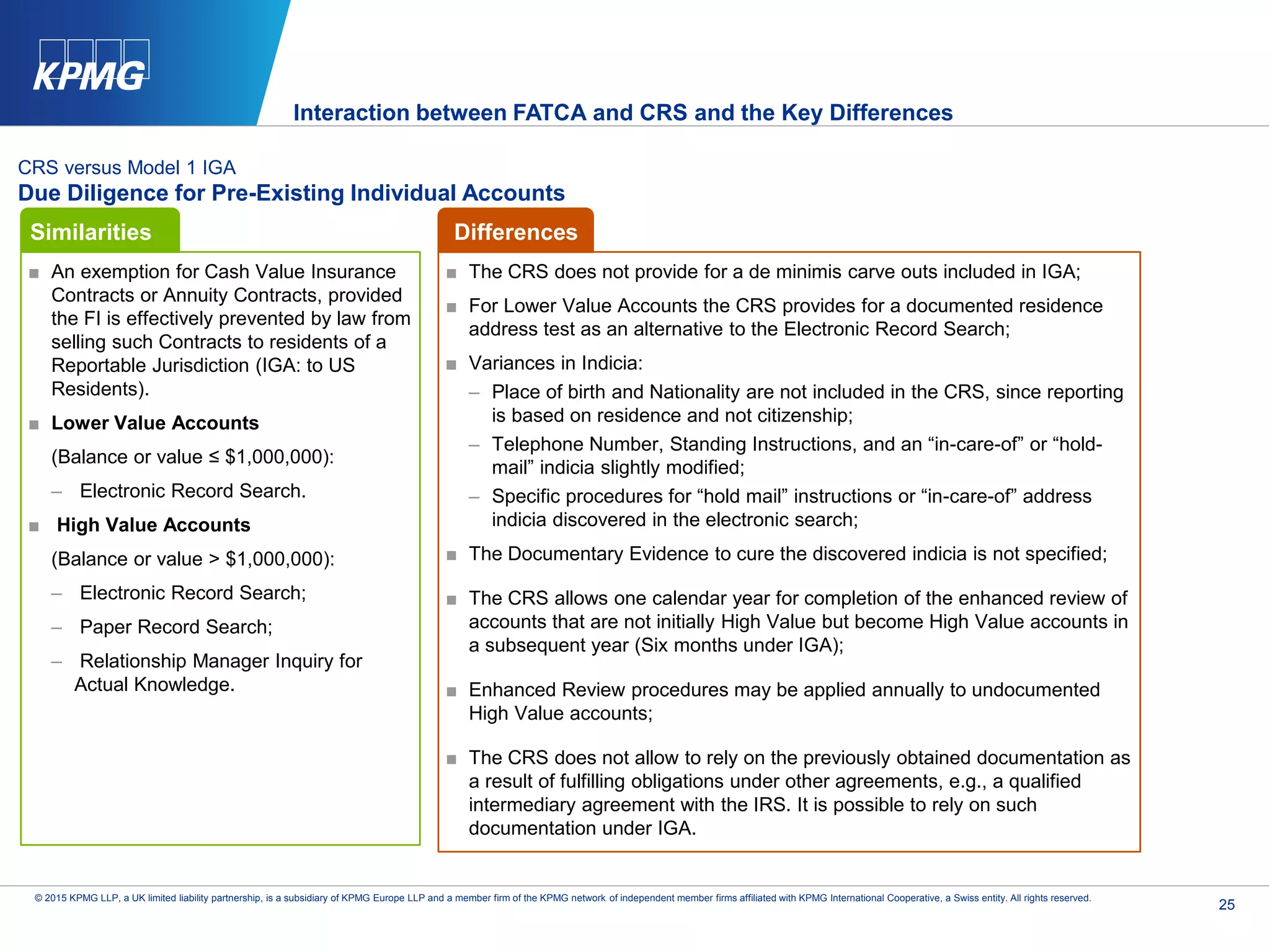

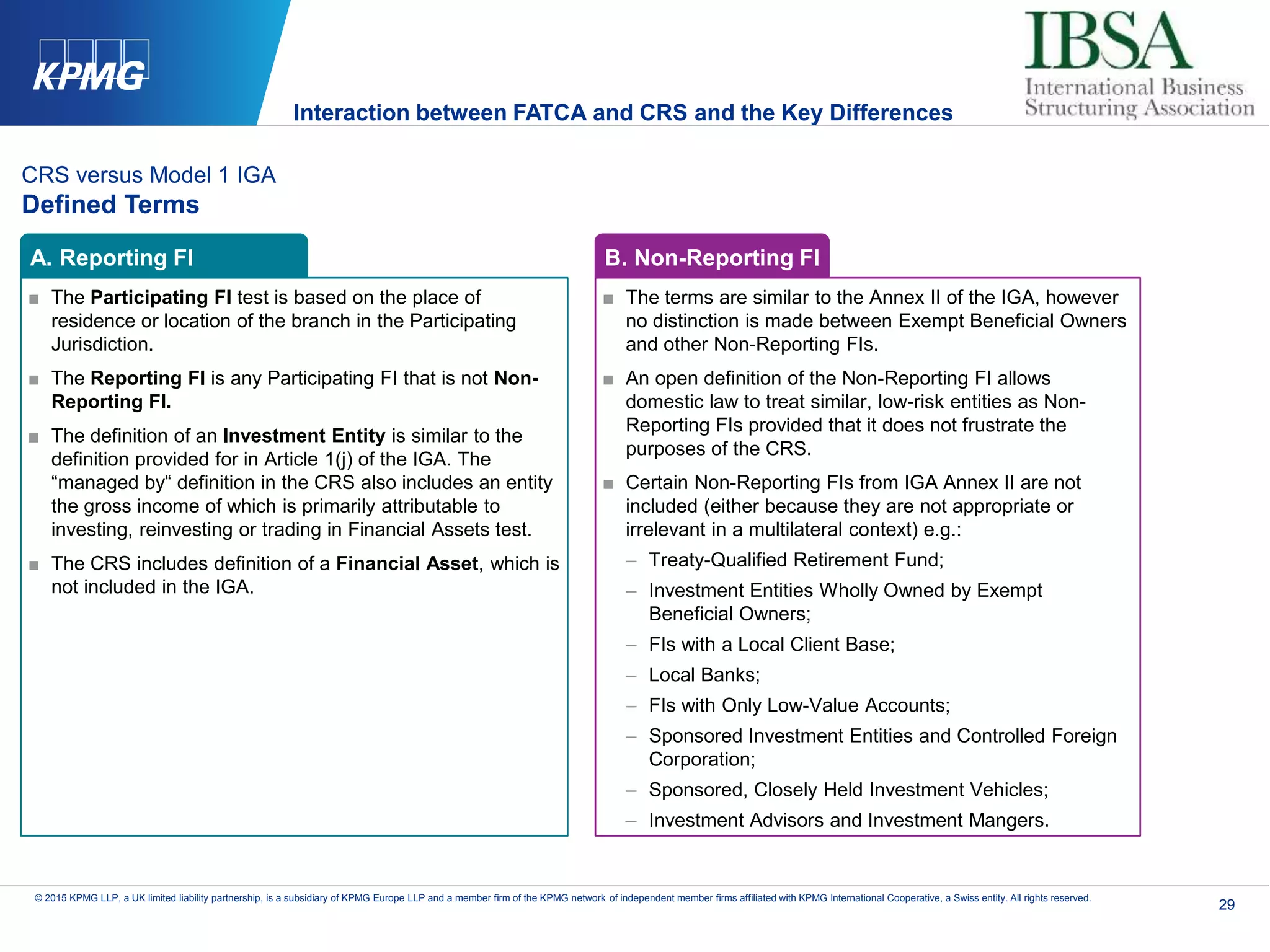

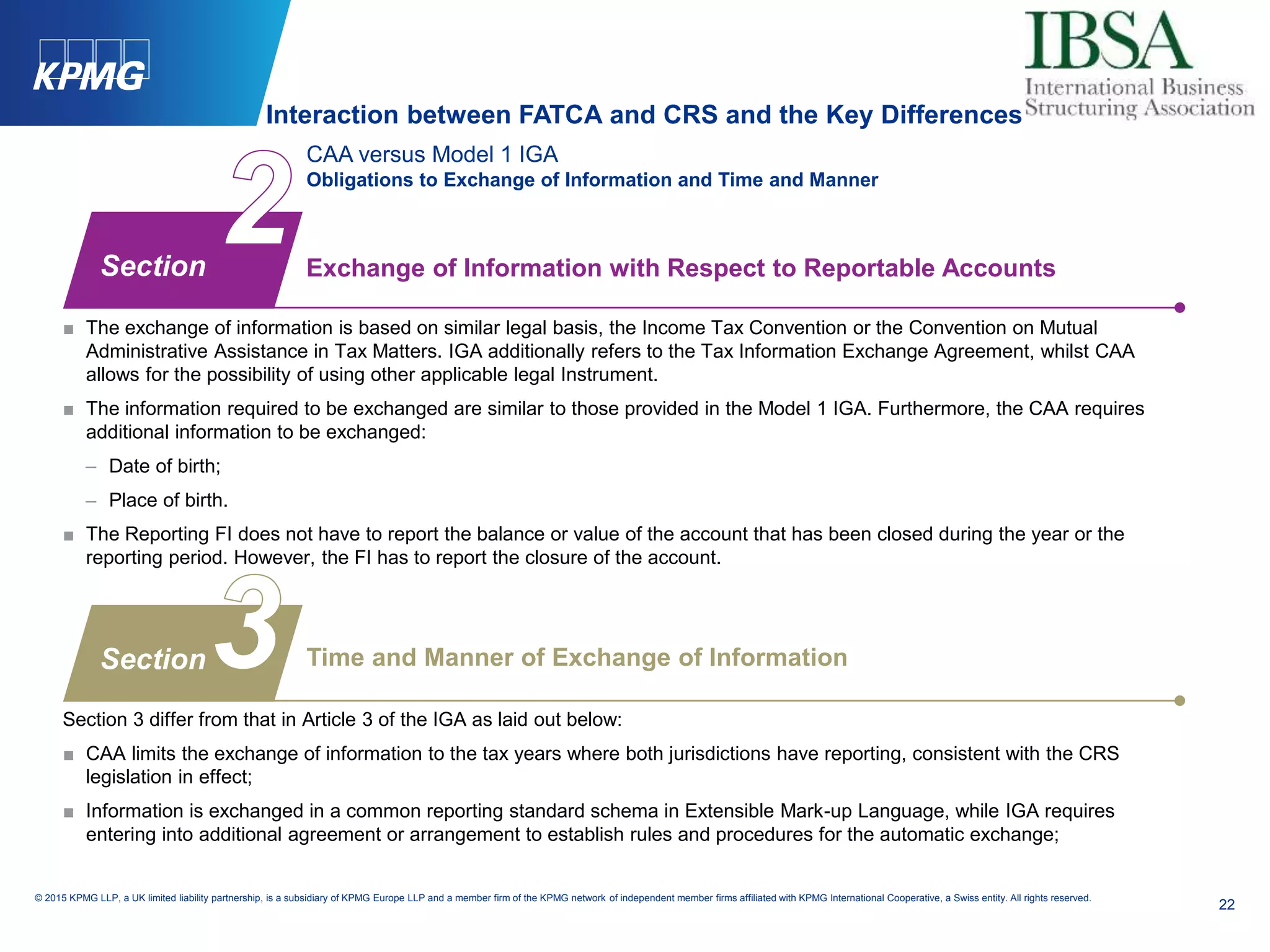

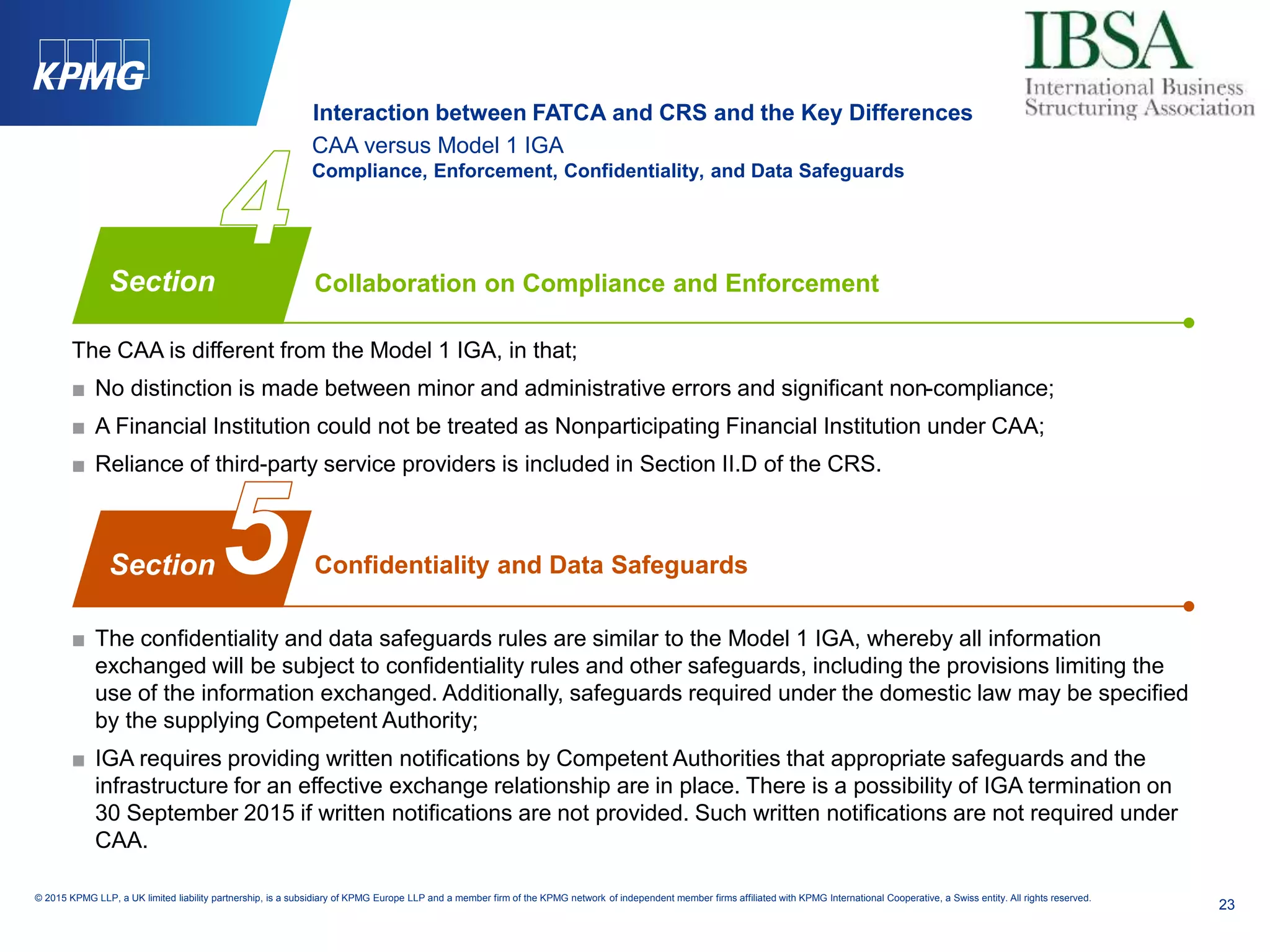

CAA versus Model 1 IGA

Consultations, Amendments, and Terms of Agreement

Terms of Agreement

■ This Section is similar to the Model 1 IGA (Article 10). Notifications are required that necessary laws are in

place (CAA) or necessary internal procedures are completed (IGA);

■ CAA allows for the suspension of the exchange of information in the event of significant non-compliance by

the other Competent Authority.

Article 4 – Application of FATCA to [FATCA Partner] FI,

Article 6 – Mutual Commitment to Continue to Enhance the

Effectiveness of Information Exchange and Transparency;

Article 7 – Consistency in the Application of FATCA to Partner

Jurisdiction; and

Article 9 – Annexes.

Consultations and Amendments

Similar to the Article 8 of the Model 1 IGA.

Section

Section

IGA Articles not included in CAA:

Interaction between FATCA and CRS and the Key Differences](https://image.slidesharecdn.com/fatcaexchangeofinformationfrontpage-150219041355-conversion-gate01/75/FATCA-Exchange-of-Information-24-2048.jpg)