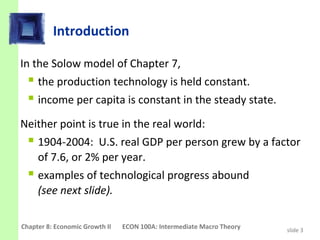

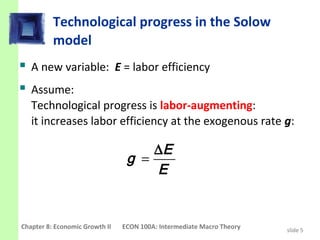

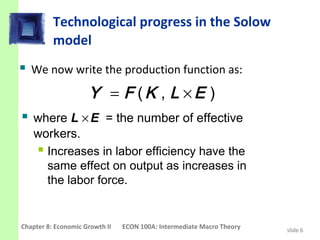

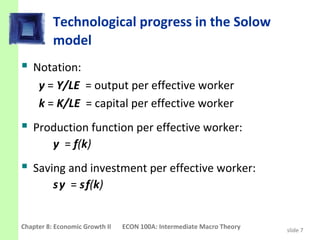

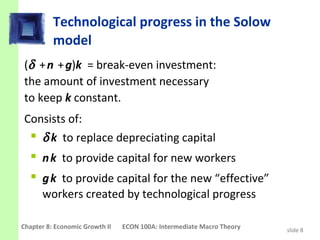

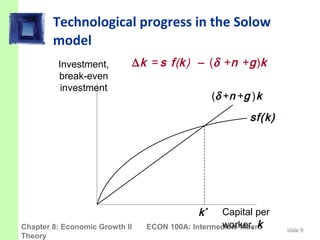

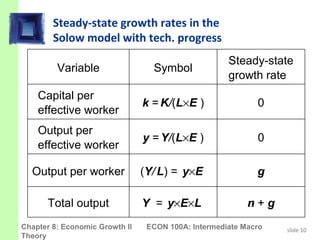

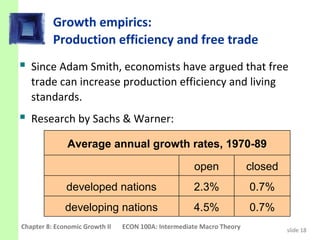

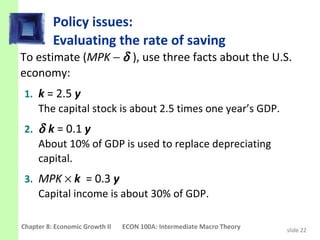

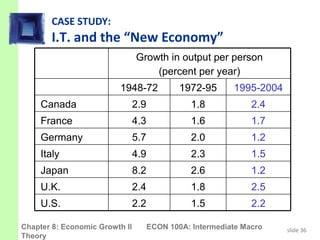

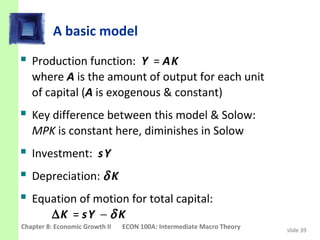

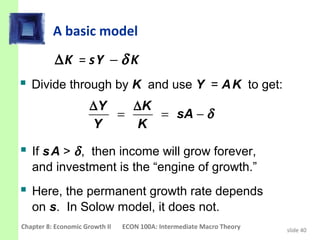

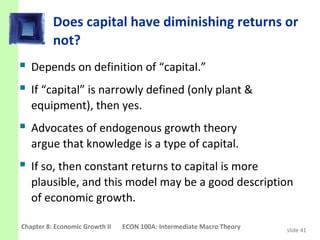

This document discusses economic growth and technological progress. It begins by introducing the Solow growth model and its limitations in accounting for long-run growth. The chapter then incorporates technological progress into the Solow model by including labor-augmenting technological change. It discusses how this affects the model's predictions and steady states. Later sections examine empirical evidence on growth, including balanced growth, conditional convergence between countries, and the roles of capital accumulation and productivity in determining income differences. The chapter concludes by considering how policies like free trade may impact productivity and long-run growth.

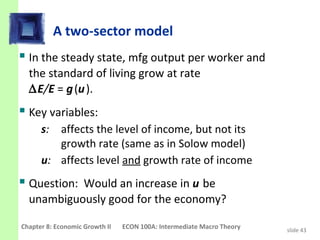

![A two-sector model

Two sectors:

manufacturing firms produce goods.

research universities produce knowledge that

increases labor efficiency in manufacturing.

u = fraction of labor in research

(u is exogenous)

Mfg prod func: Y = F [K, (1-u )E L]

Res prod func: ∆E = g (u )E

Cap accumulation: ∆K = s Y − δ K

Chapter 8: Economic Growth II ECON 100A: Intermediate Macro Theory slide 42](https://image.slidesharecdn.com/chapter8ec-222-130224060718-phpapp02/85/Chapter8-ec-222-42-320.jpg)