1. The document discusses economic growth accounting and theories of economic growth.

2. Growth accounting explains that economic growth is due to increases in inputs like capital and labor as well as productivity increases from technological progress. The neoclassical growth model predicts economies will reach a steady state of constant per capita output and capital.

3. The document also examines factors that influence differences in economic growth rates between countries, such as capital accumulation, population growth, human capital development, and natural resources. It analyzes growth empirically and discusses implications of growth theory.

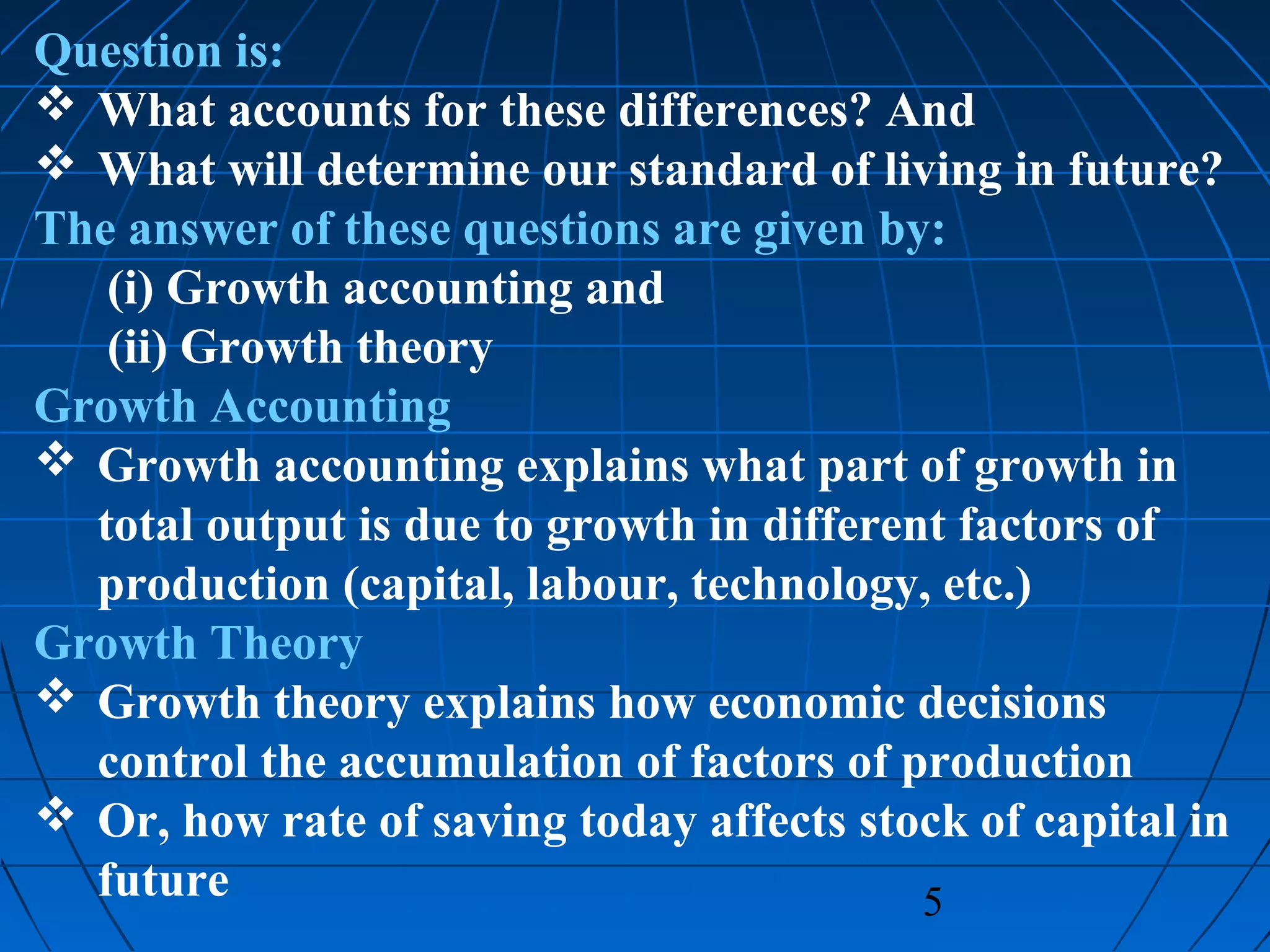

![8

Level of technology

A in production function is called

‘productivity’

It is a more neutral term than ‘technology’

Higher level of A means more output

It means more output is produced for a given

level of inputs

Production function (1) can be transformed

into a growth of output accounting equation

∆Y/Y = [(1 - θ) × ∆N/N] + (θ × ∆K/K) + ∆A/A (2)

It is called growth accounting equation](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-8-2048.jpg)

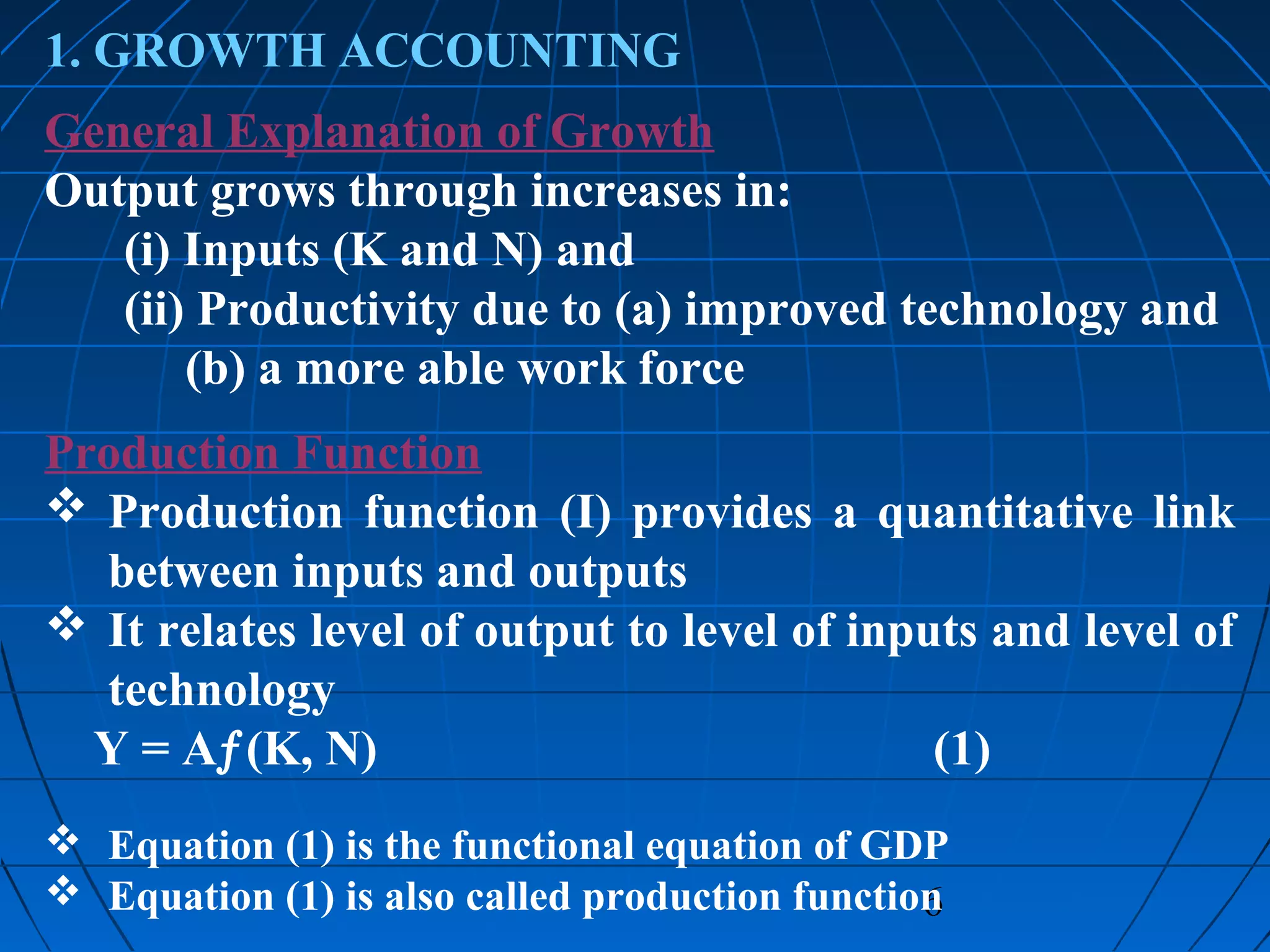

![10

Where:

(1 - θ) is the weight equal to labour’s share of income

θ is weight equal to capital’s share of income

In words the equation can be written as

Growth of Output=[(weight of labour share)×(labour

growth)]+[(weight of capital share)×(capital growth)] +

technical progress

Equation 2 summarises the contribution of growth of

input and productivity to growth of output

It also says

There is growth in total factor productivity, when we get

more output from same factors of production](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-10-2048.jpg)

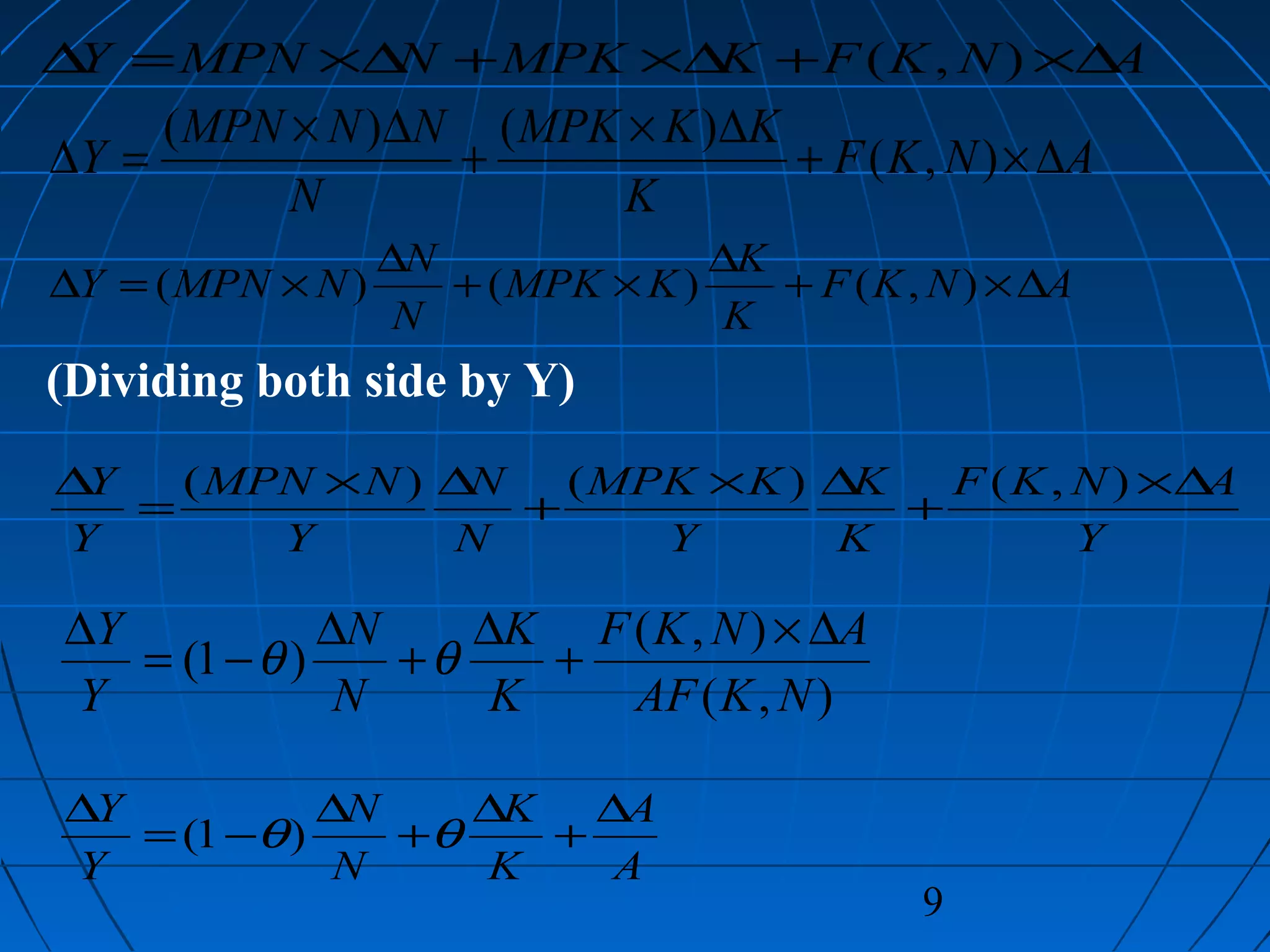

![13

Equation (2) helps deducing equation for accounting per

capita growth in output:

∆Y/Y = [(1 - θ) × ∆N/N] + (θ × ∆K/K) + ∆A/A

∆Y/Y = [∆N/N - θ×∆N/N] + (θ×∆K/K) + ∆A/A

∆Y/Y = ∆N/N - θ×∆N/N + (θ×∆K/K) + ∆A/A

∆Y/Y - ∆N/N= θ×∆K/K - θ×∆N/N + + ∆A/A

∆Y/Y- ∆N/N = θ×[∆K/K - ∆N/N] + ∆A/A

∆y/y = θ × ∆k/k + ∆A/A

y = θ×∆k/k + ∆A/A

y = θƒ(k) + ∆A/A (3)

Where:

∆Y/Y - ∆N/N = ∆y/y = per capita out put growth, and

[Growth rate of per capita GDP equals the growth rate of

GDP minus growth rate of population]

∆K/K = ∆k/k + ∆N/N = ∆k/k = k = per capita capital growth

[Growth rate of capital equals growth rate of per capita plus

growth rate of the population]](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-13-2048.jpg)

![17

There is another production function of GDP

It is the Cobb-Douglas production function of GDP:

Here θ is the capital share to the GDP

[For USA θ = .20]

Here 1-θ is the labour share to the GDP

Cobb-Douglas production function is at same time GDP accounting

equation

If K and N are known the Y could be calculated

Cobb-Douglas production accounting equation could be

transferred into per capita form:

In functional form this equation could be written as:

y = ƒ(k)

θθ −

= 1

NAKY

θ

θ

θ

θ

θθ

θθ

Ak

N

K

A

N

K

ANAK

N

NAK

N

Y

y =

===== −

−1](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-17-2048.jpg)

![25

Steady-state equilibrium

Steady-state equilibrium is the combination of per

capita GDP and per capita capital where economy

remains at rest

It means in the steady state:

Per capita economic variables are no longer changing

That is in steady state equilibrium:

Per capita GDP does not grow [∆y = 0]

Per capita capital does not grow [∆y = 0]](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-25-2048.jpg)

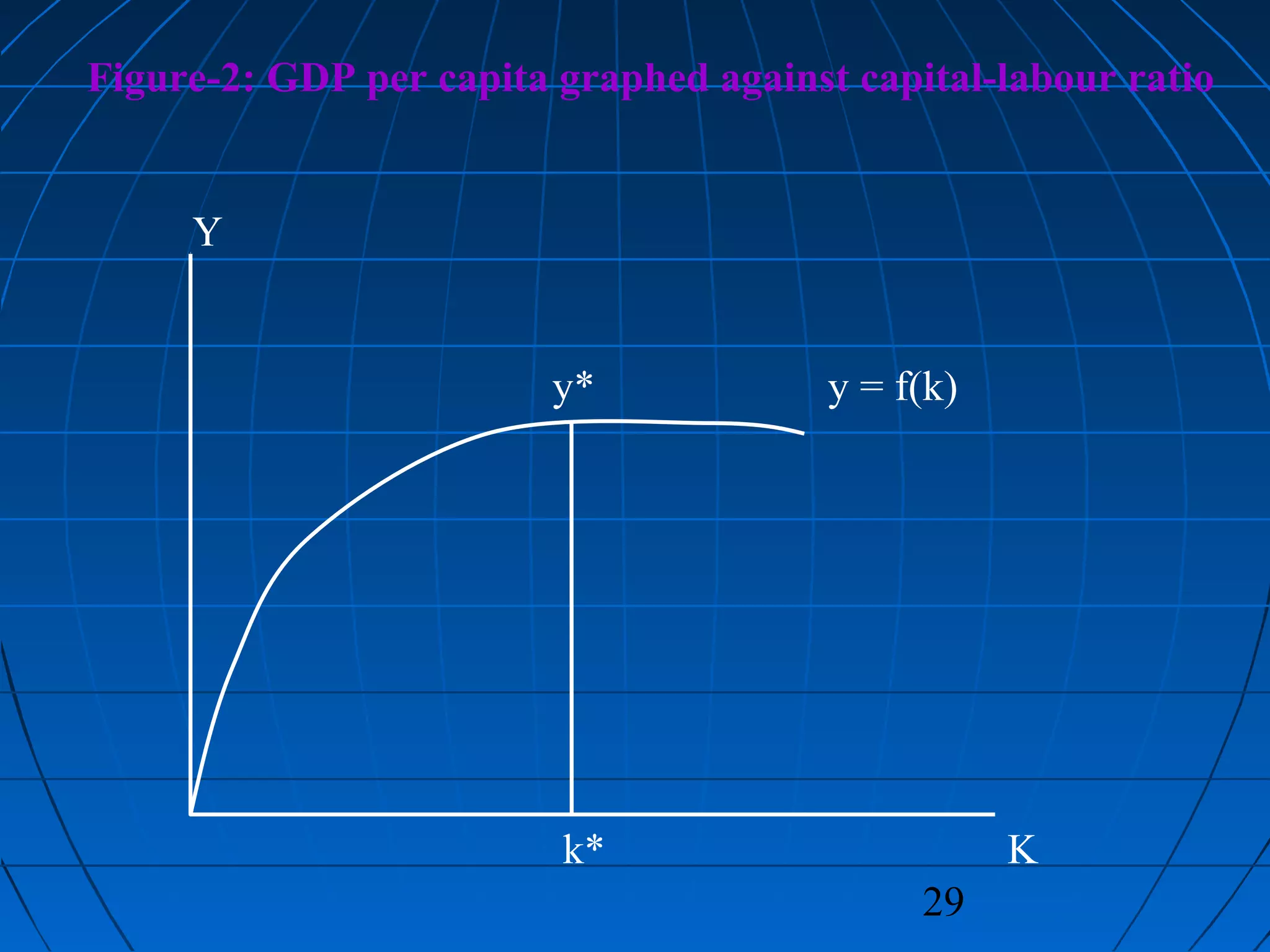

![28

Let us graph per capita GDP against capital-labour

ratio (Figure-2)

The graph shows that:

As capital rises, output rises (marginal productivity of

capital is positive)

However, output increases less at higher levels of

capital than at low levels

[Following law of diminishing marginal productivity

of capital]

Each additional machine adds to production, but adds

less than previous machine

Law of diminishing marginal productivity is the key

explanation why the economy reaches a steady state

rather than growing endlessly](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-28-2048.jpg)

![33

Let us now examine the link between saving and

growth in capital

[Let there is no government sector and no foreign

trade or capital flows]

Let the rate of saving is constant and s of income

So, per capita saving is sy

Since income equals production

So, we can also write sy (and sy = sf (k)

Change in per capita capital (∆k) is excess of saving over

required investment:

∆k = sy - (n + d)k (6)](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-33-2048.jpg)

![36

Curve sy:

Curve sy presents a constant proportion of output

[Here s is the rate of saving of per capita capital and y is the

per capital output]

Curve sy shows the level of saving at each capital-labour ratio

Straight-line (n + d)×k

Straight-line (n + d)×k shows amount of investment needed to

keep capital-labour ratio constant

Intersection of the curve sy and the straight-line (n + d)×k at

point C means balance of saving and required investment at

steady state

Here per capita capital is k*, that is steady-state per capita

capital (k*)

Here per capita capital is k*, that is steady-state saving rate

(k*)

Steady-state income (output) is read off the production

function at point D](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-36-2048.jpg)

![38

Key to the neoclassical growth model is the saving, sy

When sy exceeds the investment requirement (to

maintain running growth), k increases

[When sy exceeds (n+d)×k, k increases]

So, over time the economy grows (Figure-3)

Let economy the starts at capital-output ratio ko

(Figure -3)

At capital-output ratio ko-

investment at B is needed to

maintain current growth rate

However, more is saved at point A,

So, capital-output ratio increases and greater than ko-

Hence, the economy growths and shifts left](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-38-2048.jpg)

![42

That means, enough is saved to allow capital stock per head to

increase

Capital per head, k, rises until it reaches higher amount

At point C1

(Figure-4) both capital per head and output per

head have risen

However, economy has reached to its steady-state growth rate

Now: Savings rate does not affect growth rate

[Long run Neoclassical growth theory]

In transition, higher savings rate increases growth rate of

output and per capita output

It means, capital-labour ratio rises from k* to k**, steady state

Only way to achieve an increase in capital-labour ratio is:

Capital stock has to grow faster than the labour force

and depreciation](https://image.slidesharecdn.com/growthandaccumulation-150225142451-conversion-gate01/75/Growth-And-Accumulation-42-2048.jpg)