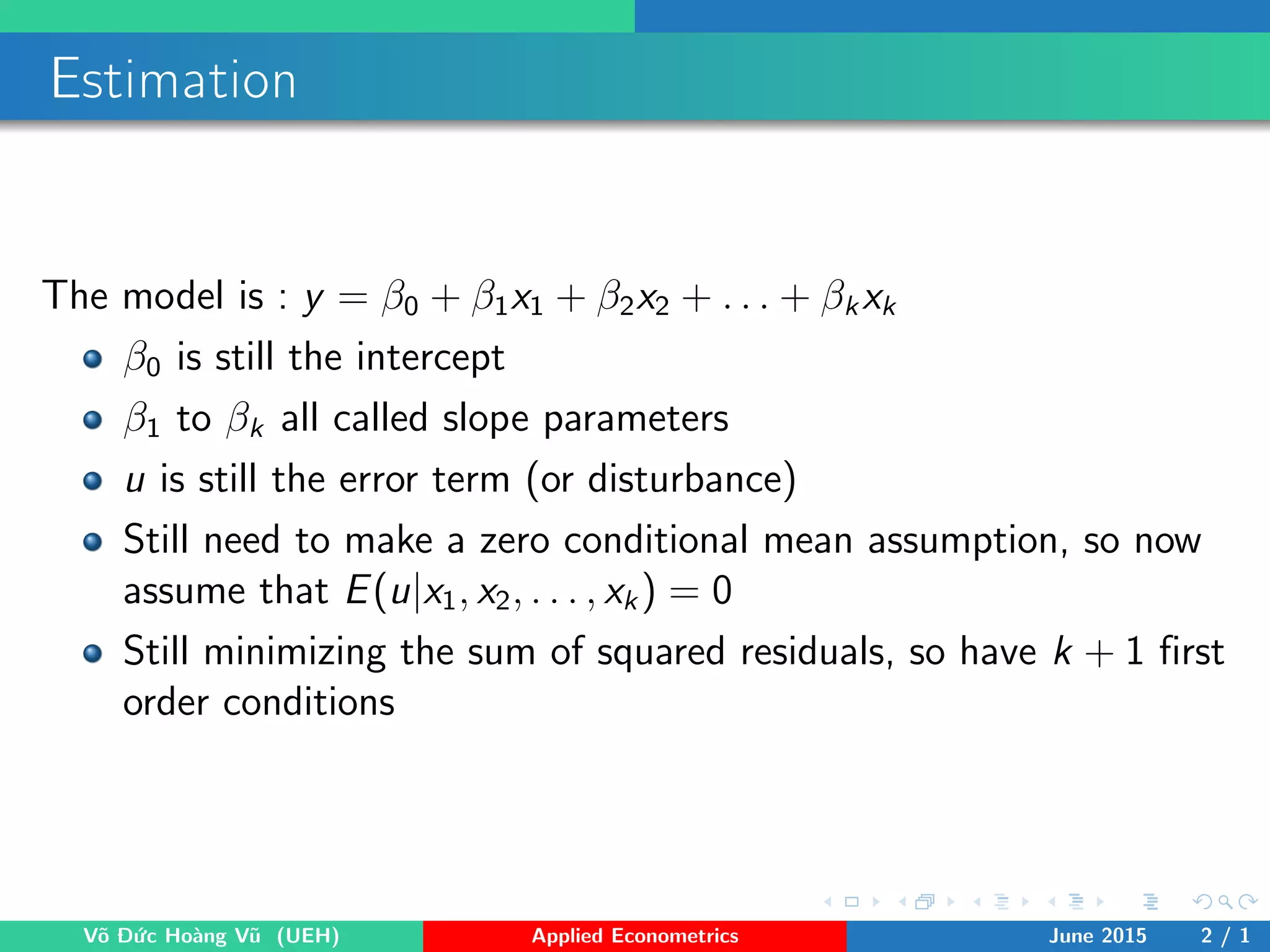

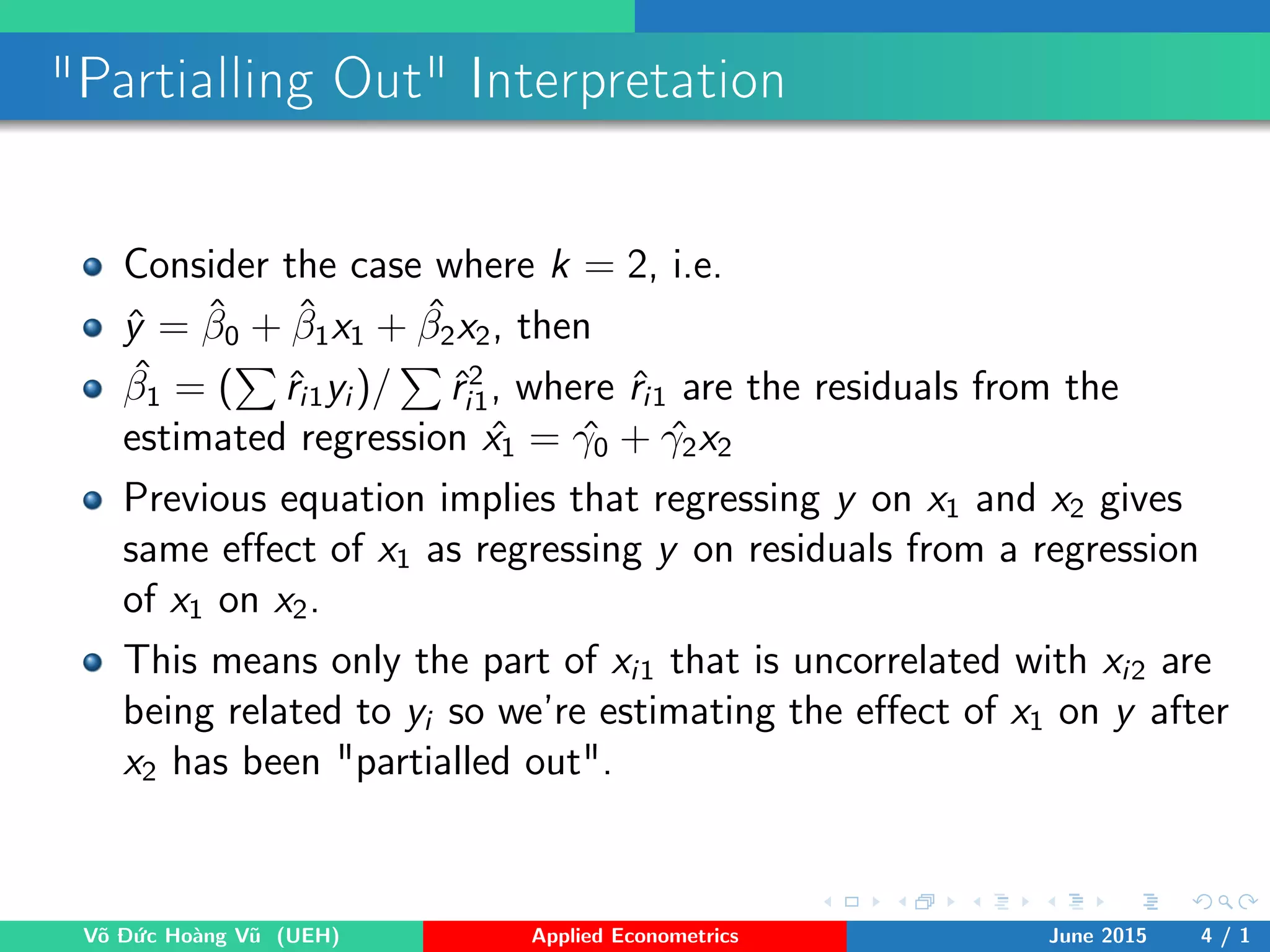

This document provides an overview of multiple regression analysis. It discusses estimating multiple regression models, interpreting estimated coefficients, omitted variable bias, goodness of fit measures like R-squared, assumptions of the model including exogeneity of regressors and homoskedasticity, variance of OLS estimators, and the Gauss-Markov theorem establishing OLS as the best linear unbiased estimator under the assumptions.

![Estimating the Error Variance

We don’t know what the error variance, σ2

, is, because we don’t

observe the errors, ui

What we observe are the residuals, ˆui

We can use the residuals to form an estimate of the error

variance

ˆσ2

= ( ˆu2

i )/(n − k − 1) ≡ SSR/df

thus, se(ˆβj ) = ˆσ/[SSTj (1 − R2

j )]1/2

df = n − (k + 1)

Võ Đức Hoàng Vũ (UEH) Applied Econometrics June 2015 19 / 1](https://image.slidesharecdn.com/chapter3econometrics-150712113659-lva1-app6892/75/Chapter3-econometrics-19-2048.jpg)