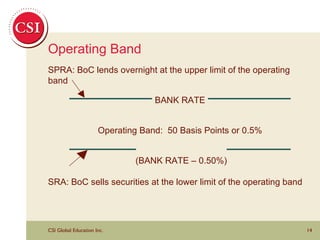

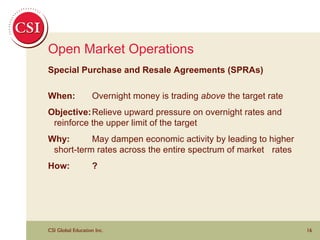

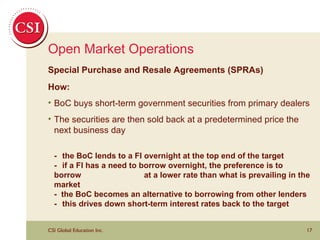

The document summarizes various aspects of economic policy in Canada, including the roles of fiscal and monetary policy. It discusses how the Department of Finance and Bank of Canada (BoC) use tools like taxation, spending, interest rates to influence economic growth and inflation. The BoC implements monetary policy through open market operations, using tools like Special Purchase and Resale Agreements (SPRAs) and Sale and Purchase Agreements (SRAs) to target the overnight lending rate within its operating band.