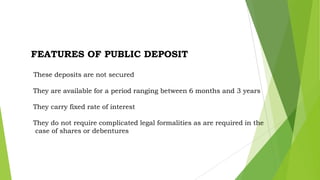

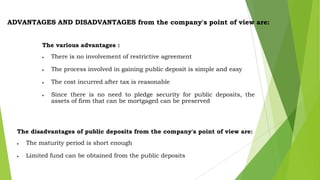

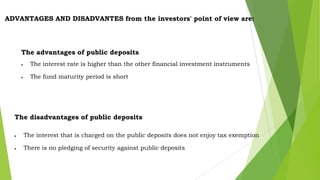

Public deposits are an important source of financing for companies' medium and long-term requirements. Public deposits refer to money received from the general public, employees, and shareholders through deposits or loans, excluding money from shares and debentures. Companies offer interest rates of 8-11% for deposits ranging from 1-3 years. Companies advertise deposit rates and repayment terms in newspapers. Regulations require a minimum 6 month maturity, and limit deposits to 25% of reserves and capital. Public deposits do not require security but have shorter maturity periods than other instruments and limited funds.