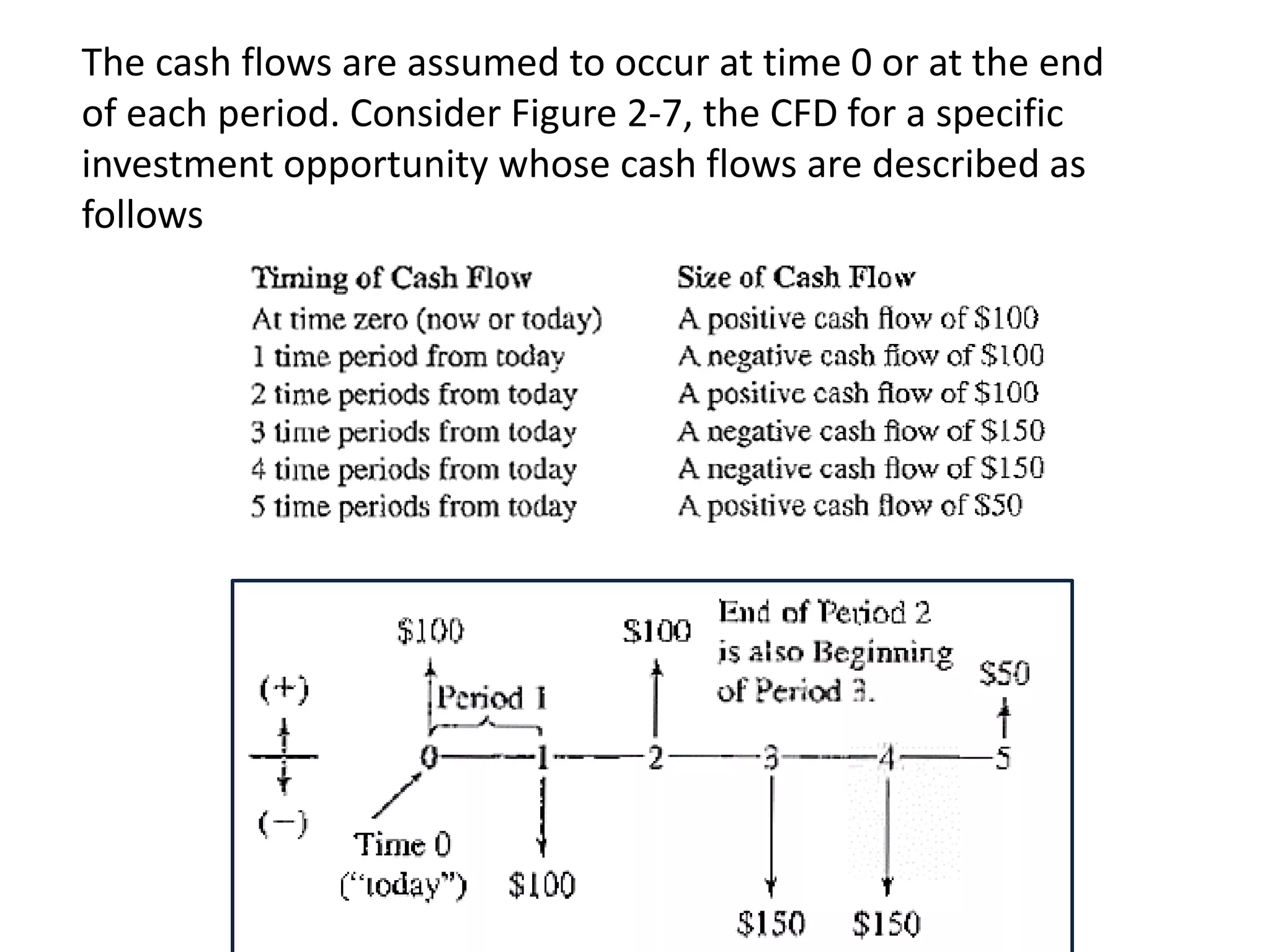

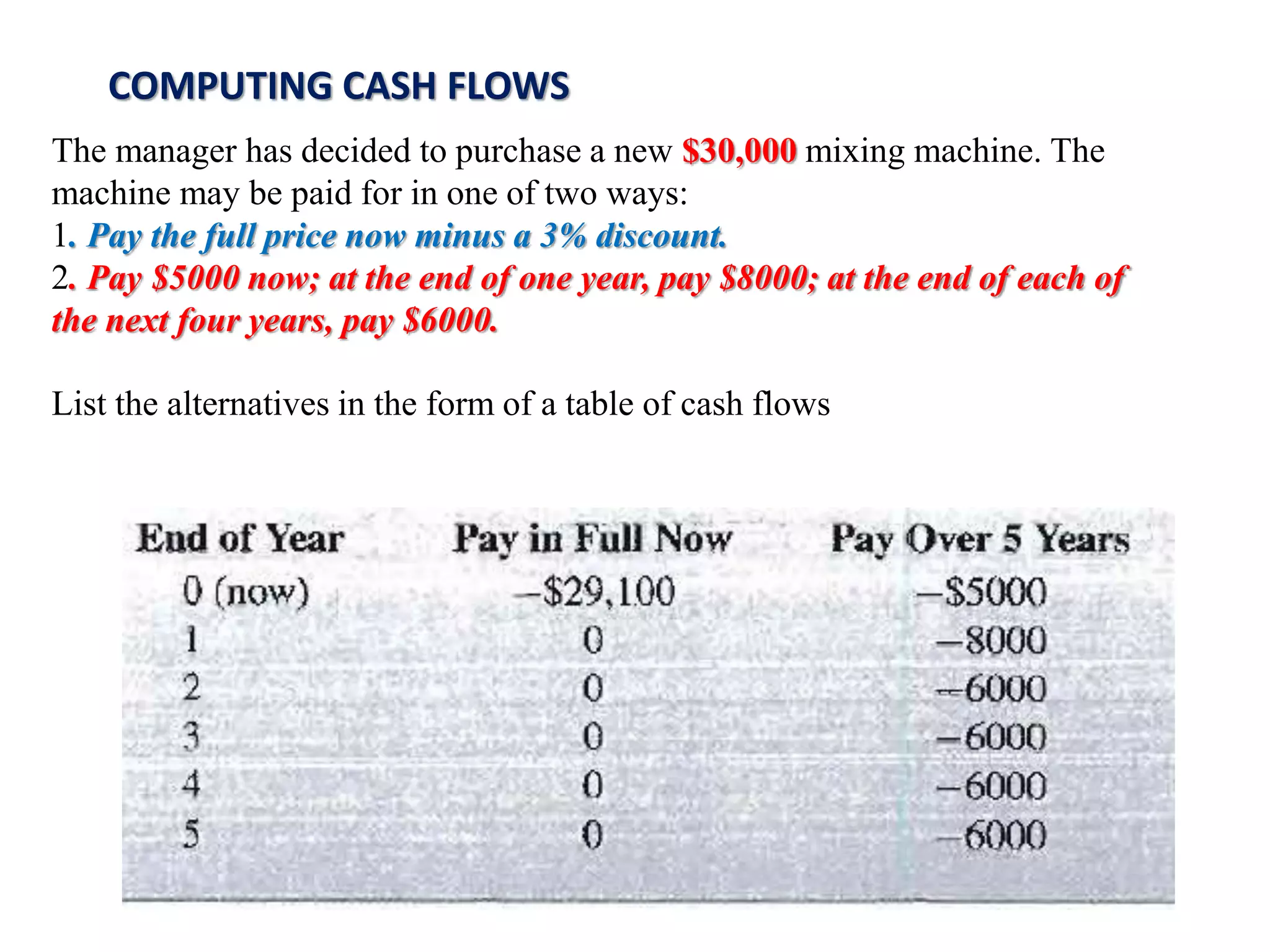

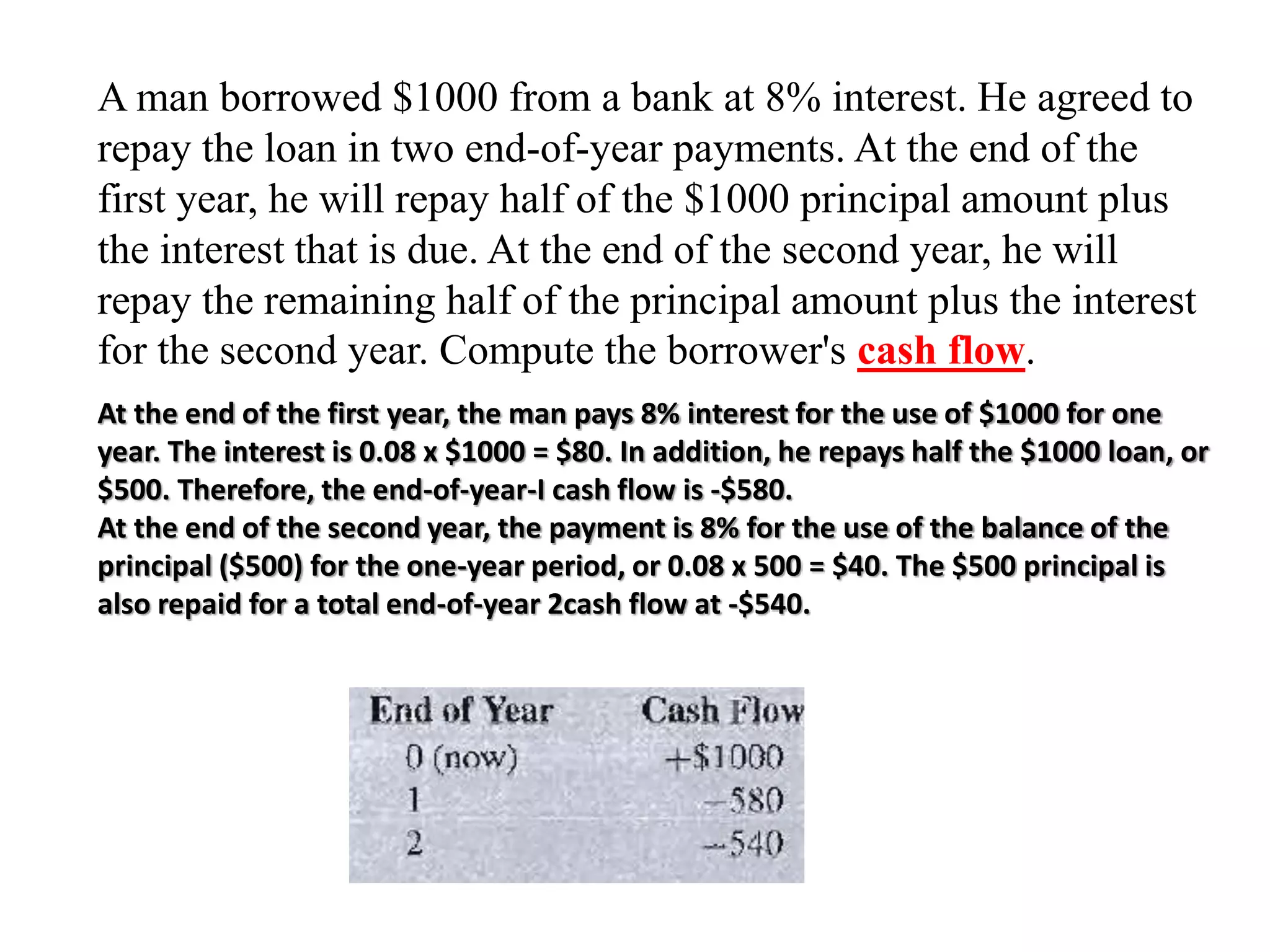

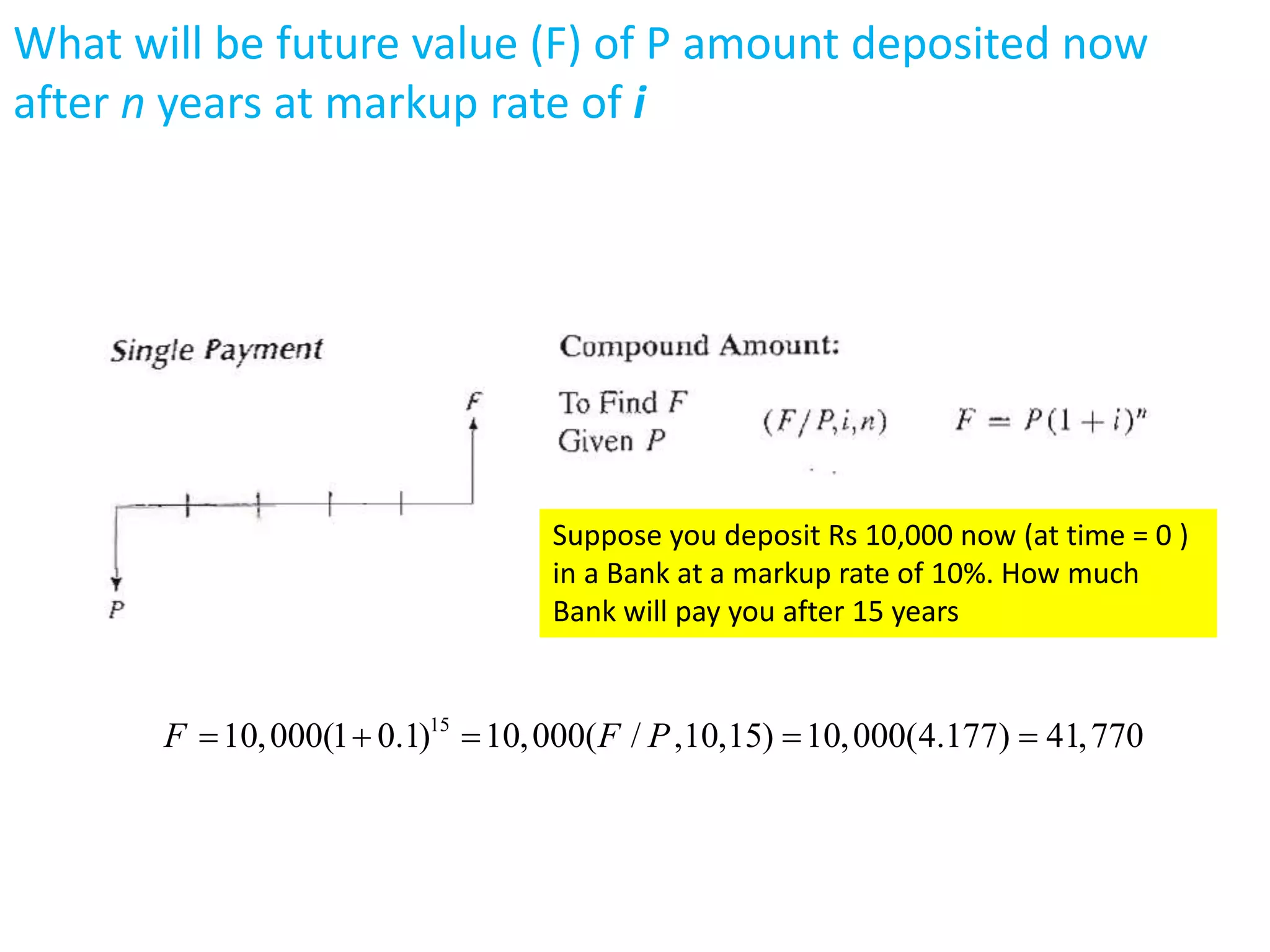

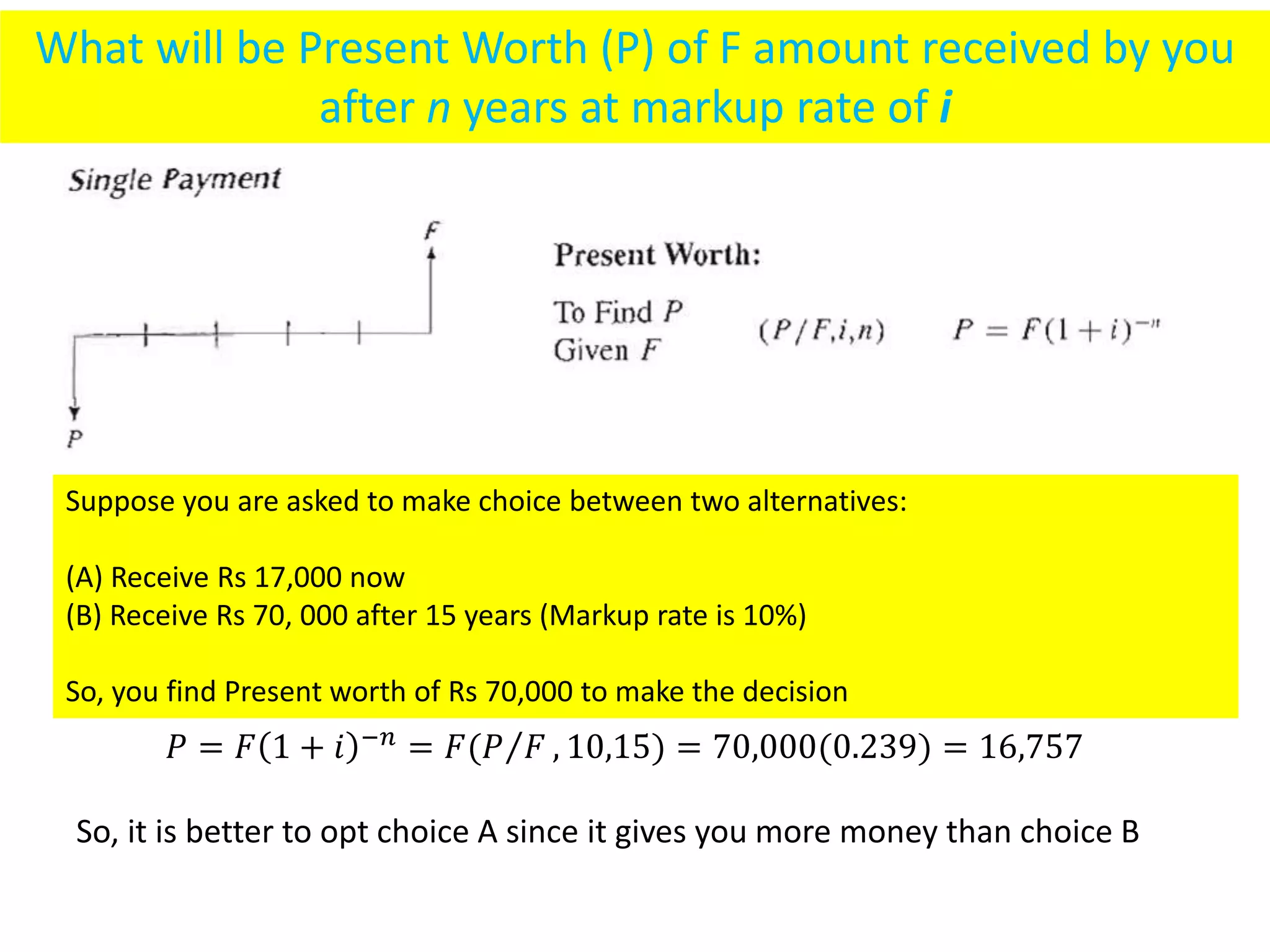

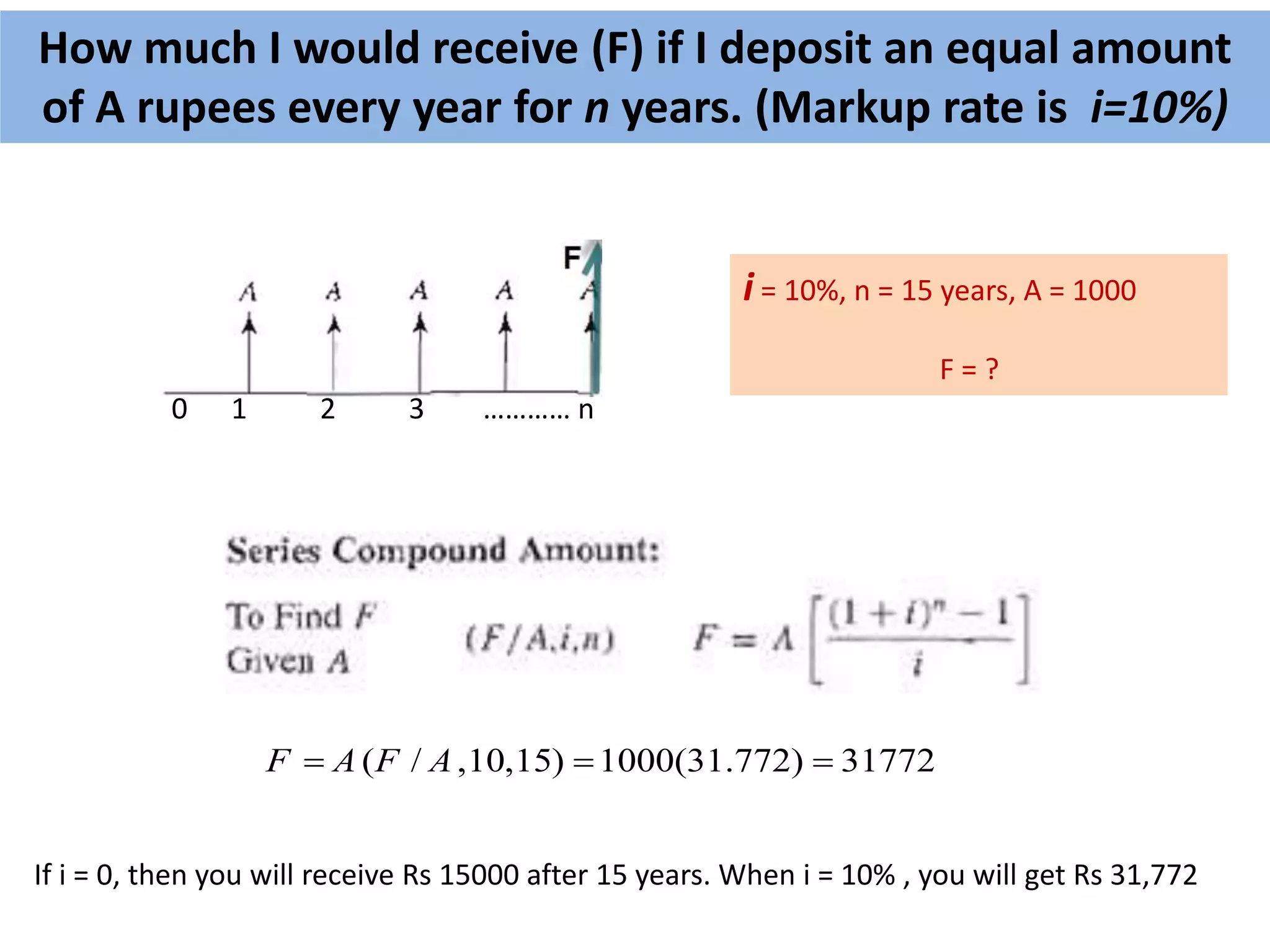

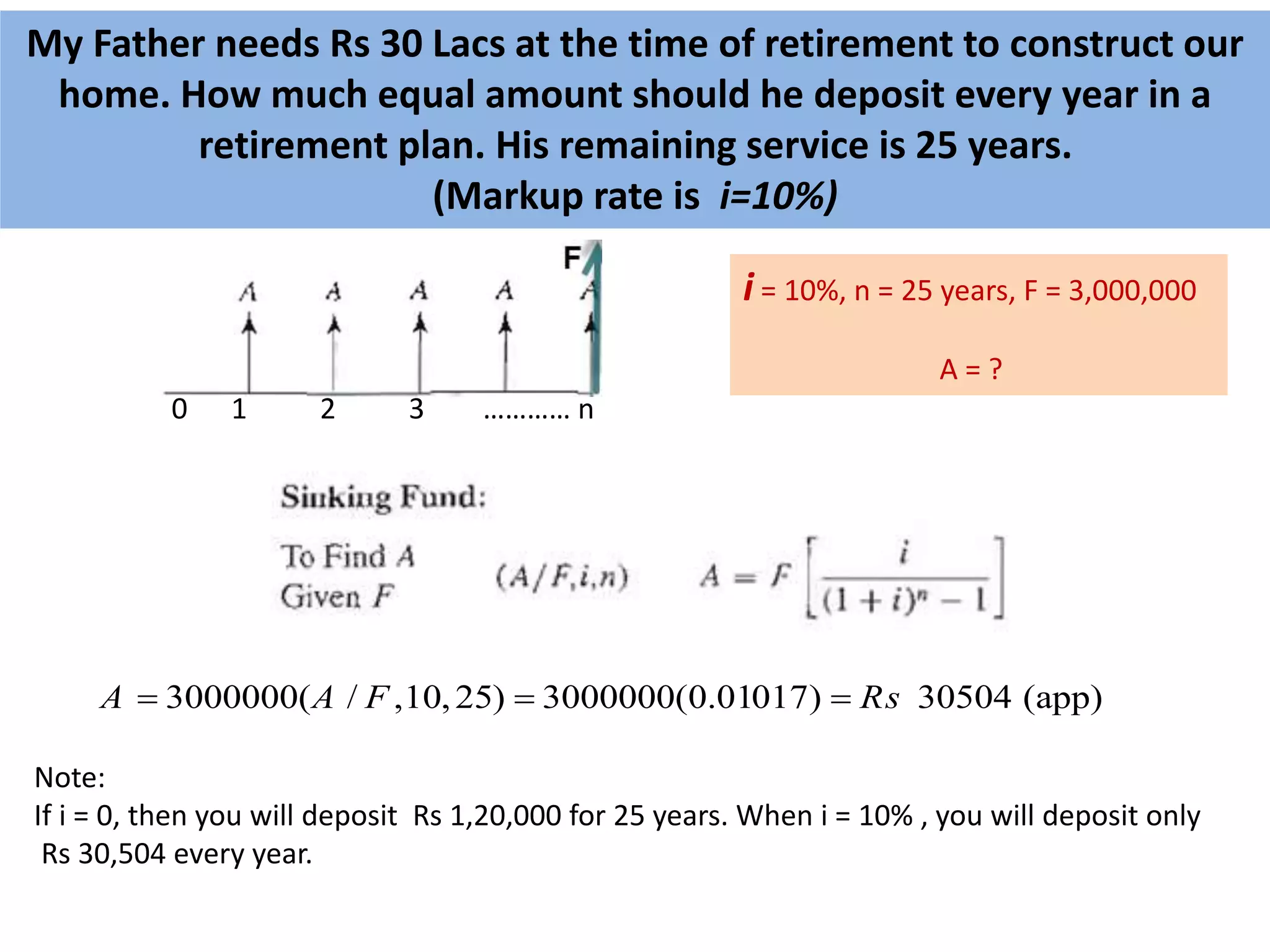

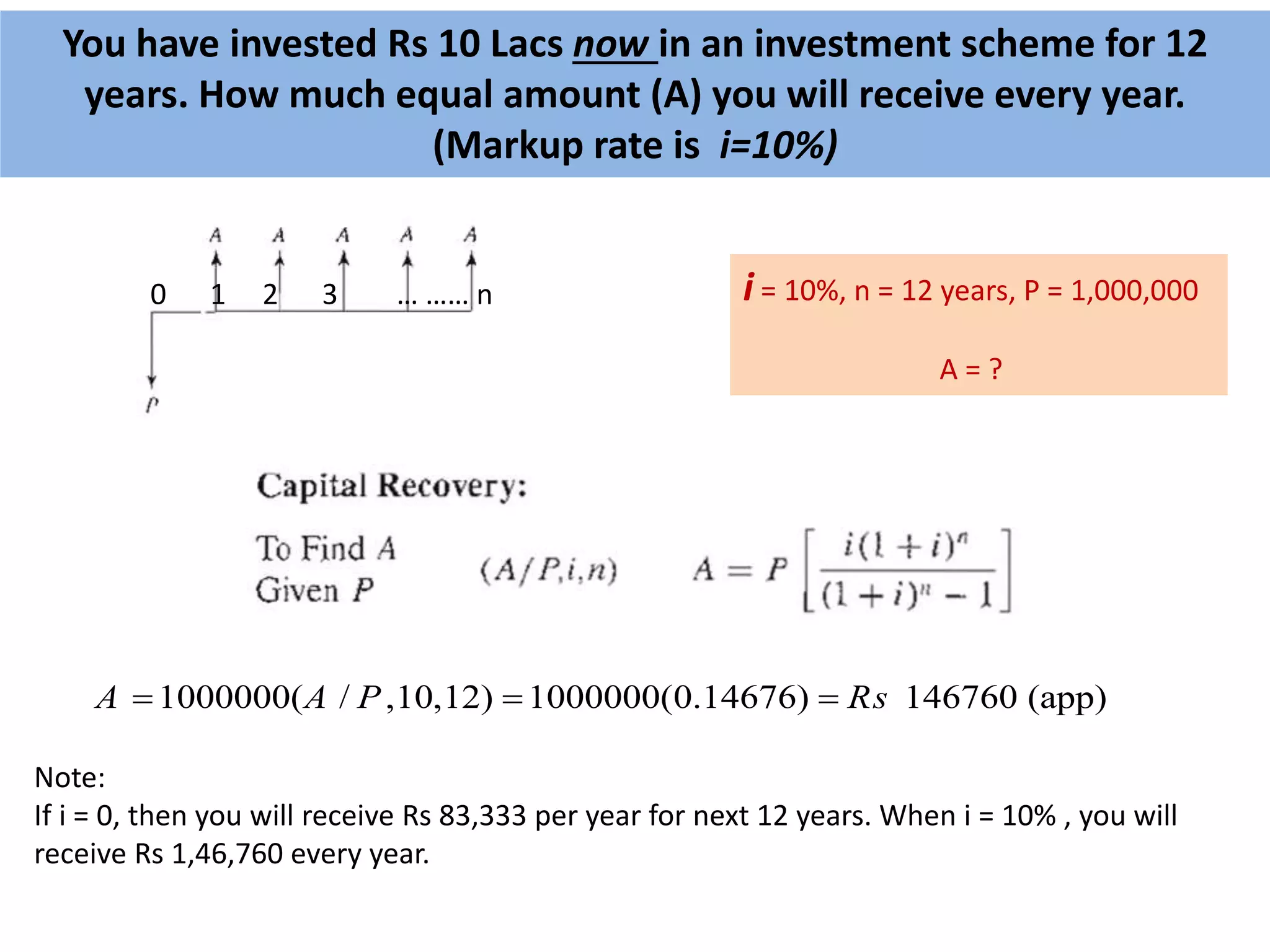

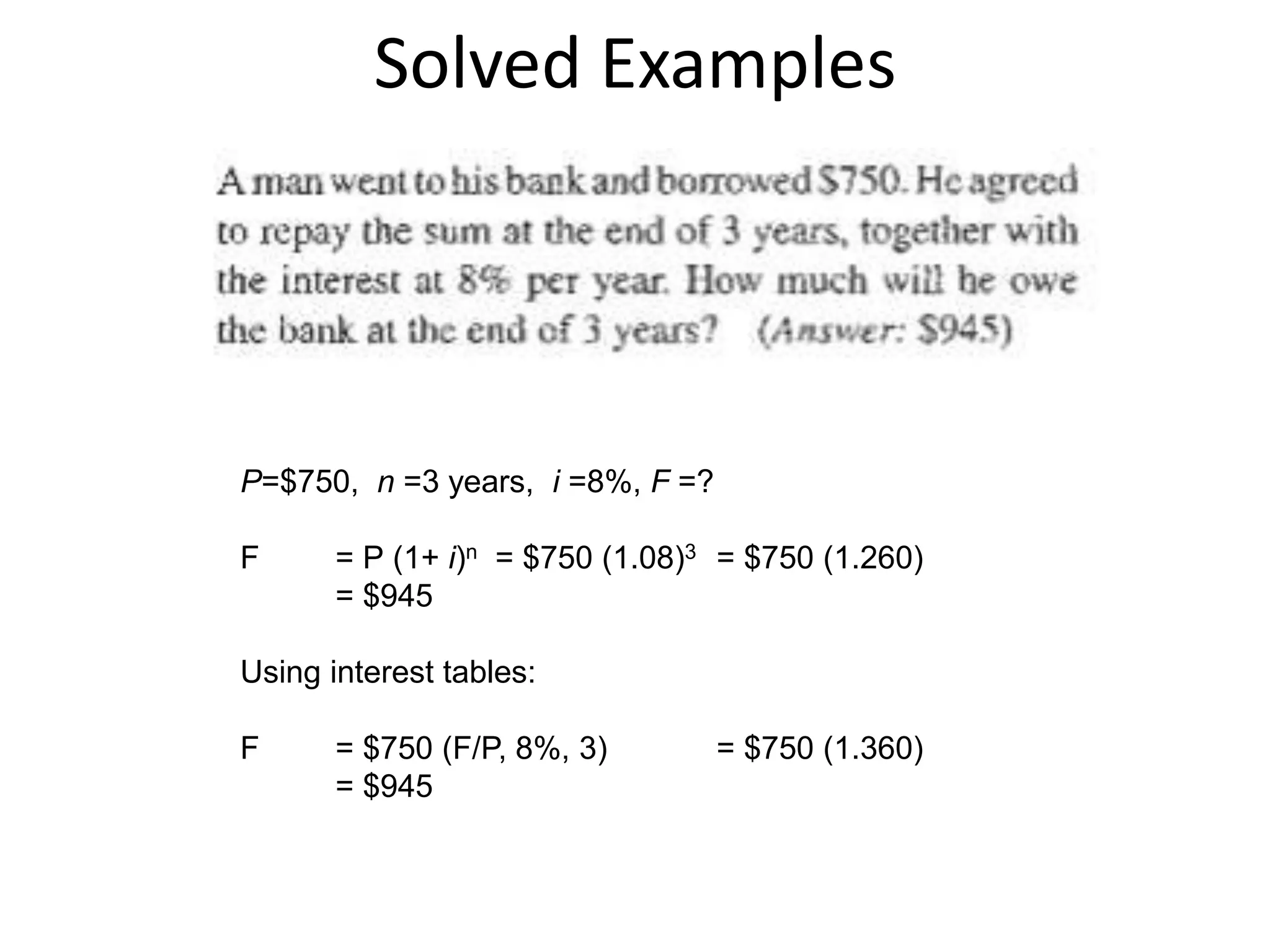

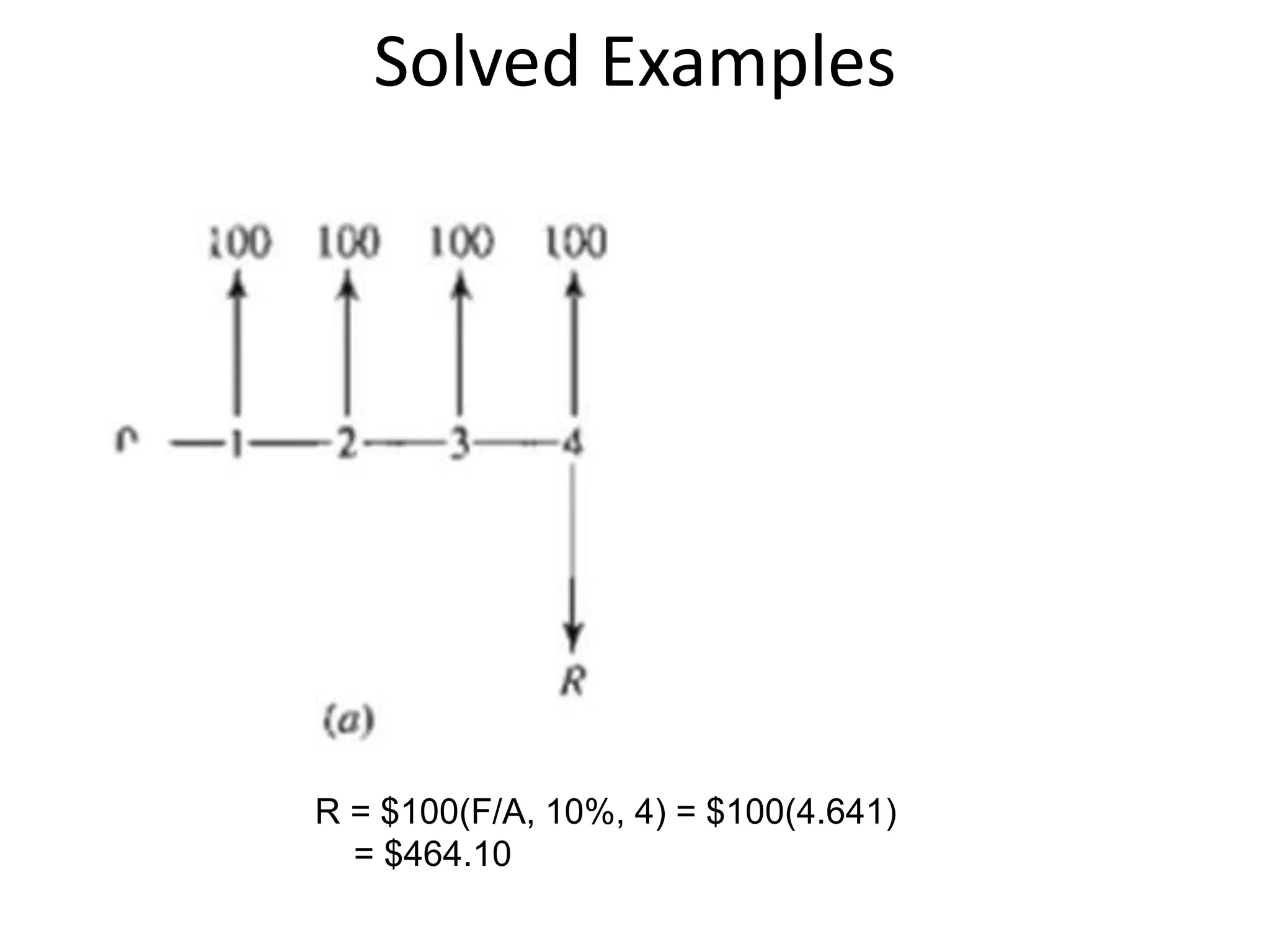

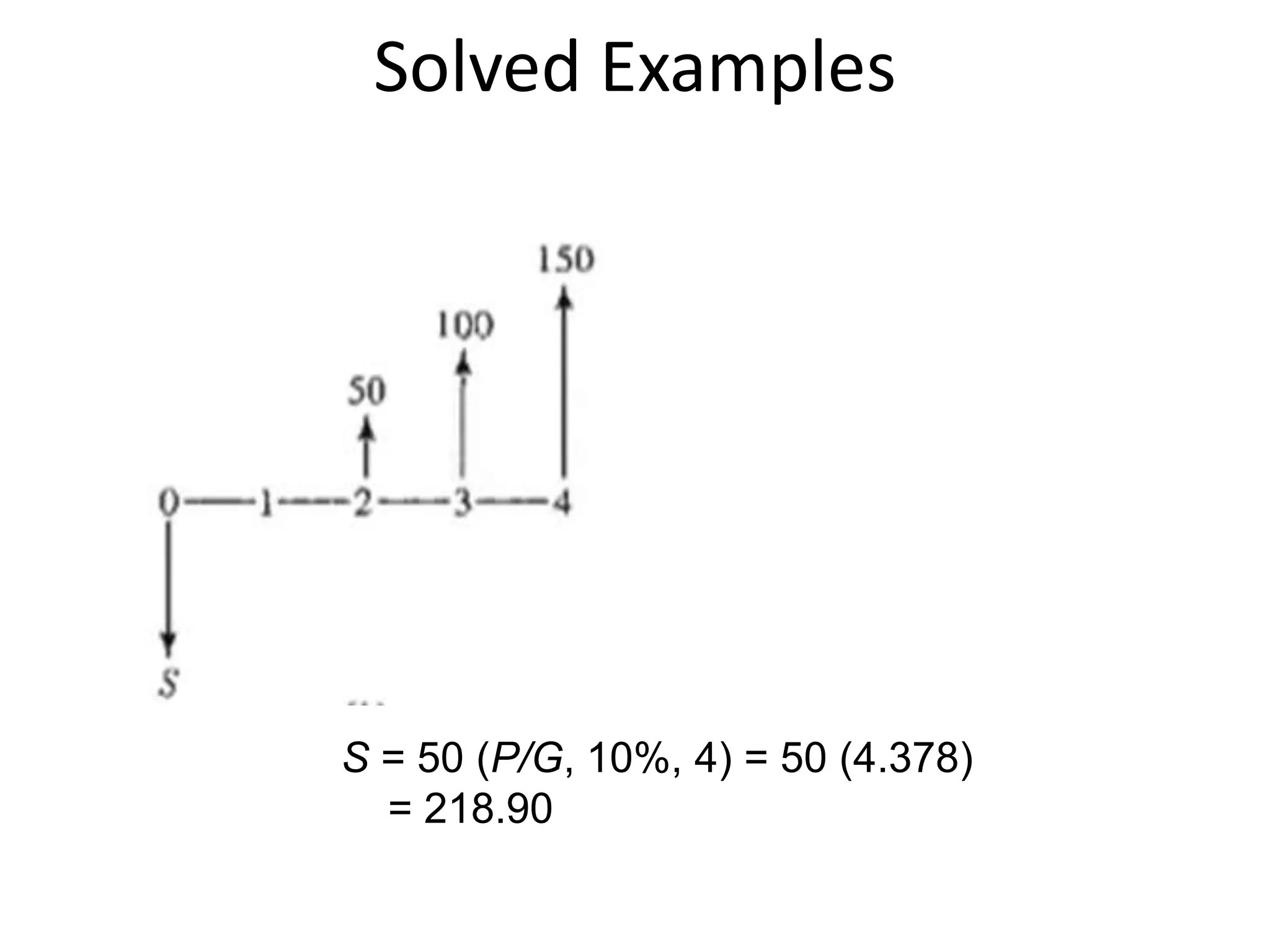

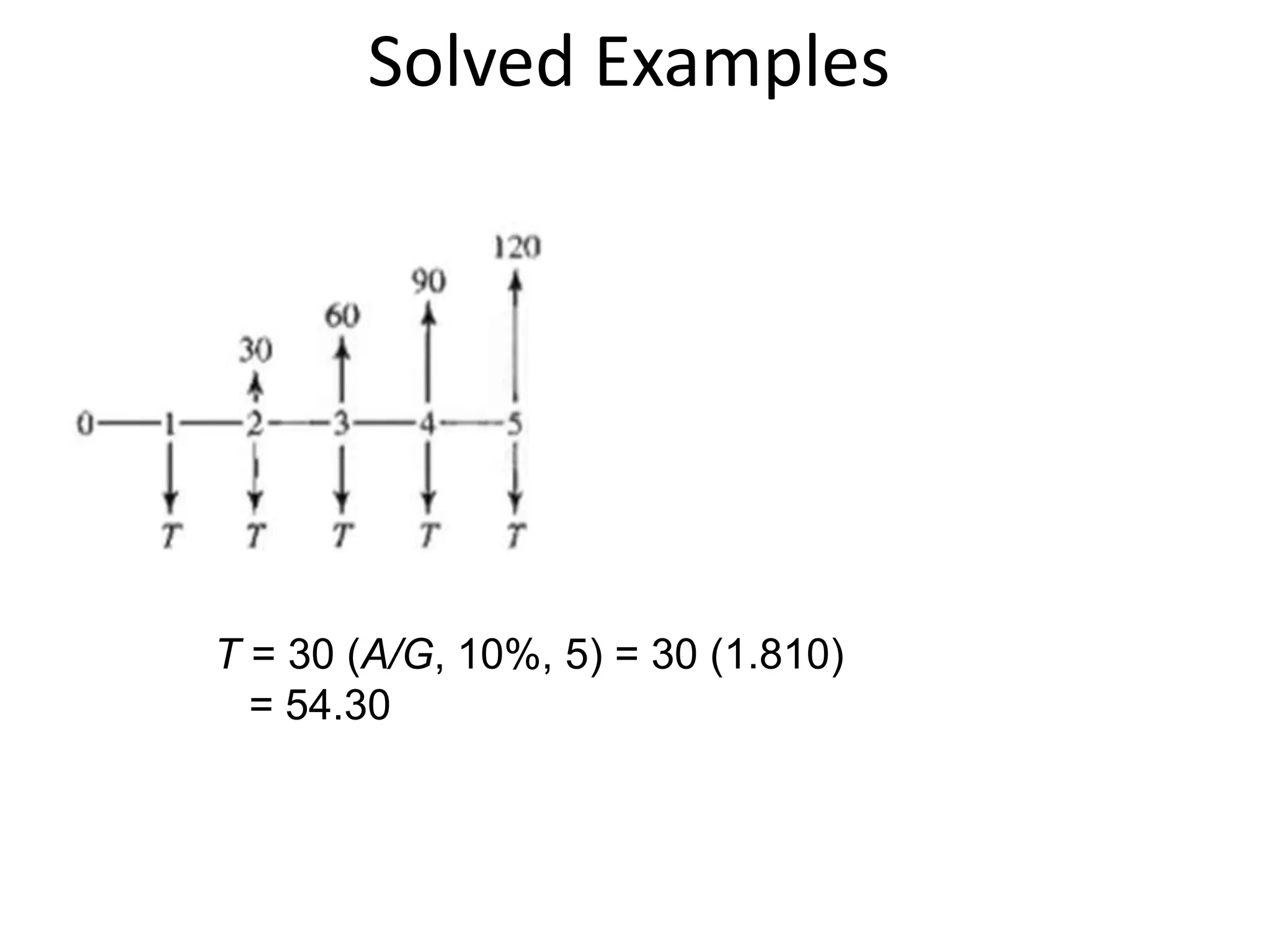

- Cash flow diagrams (CFDs) illustrate the size, timing, and direction (positive or negative) of cash flows from engineering projects over time.

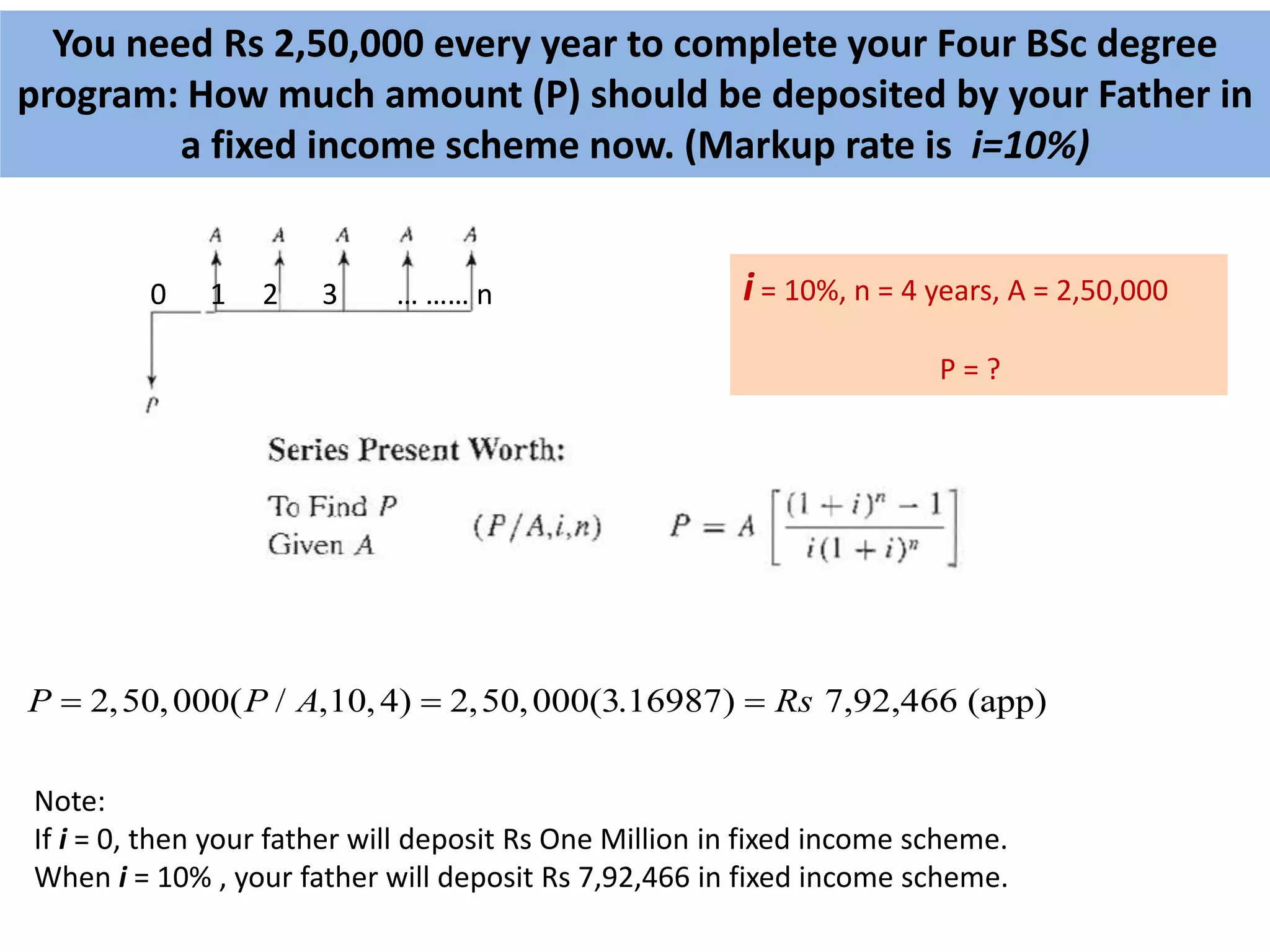

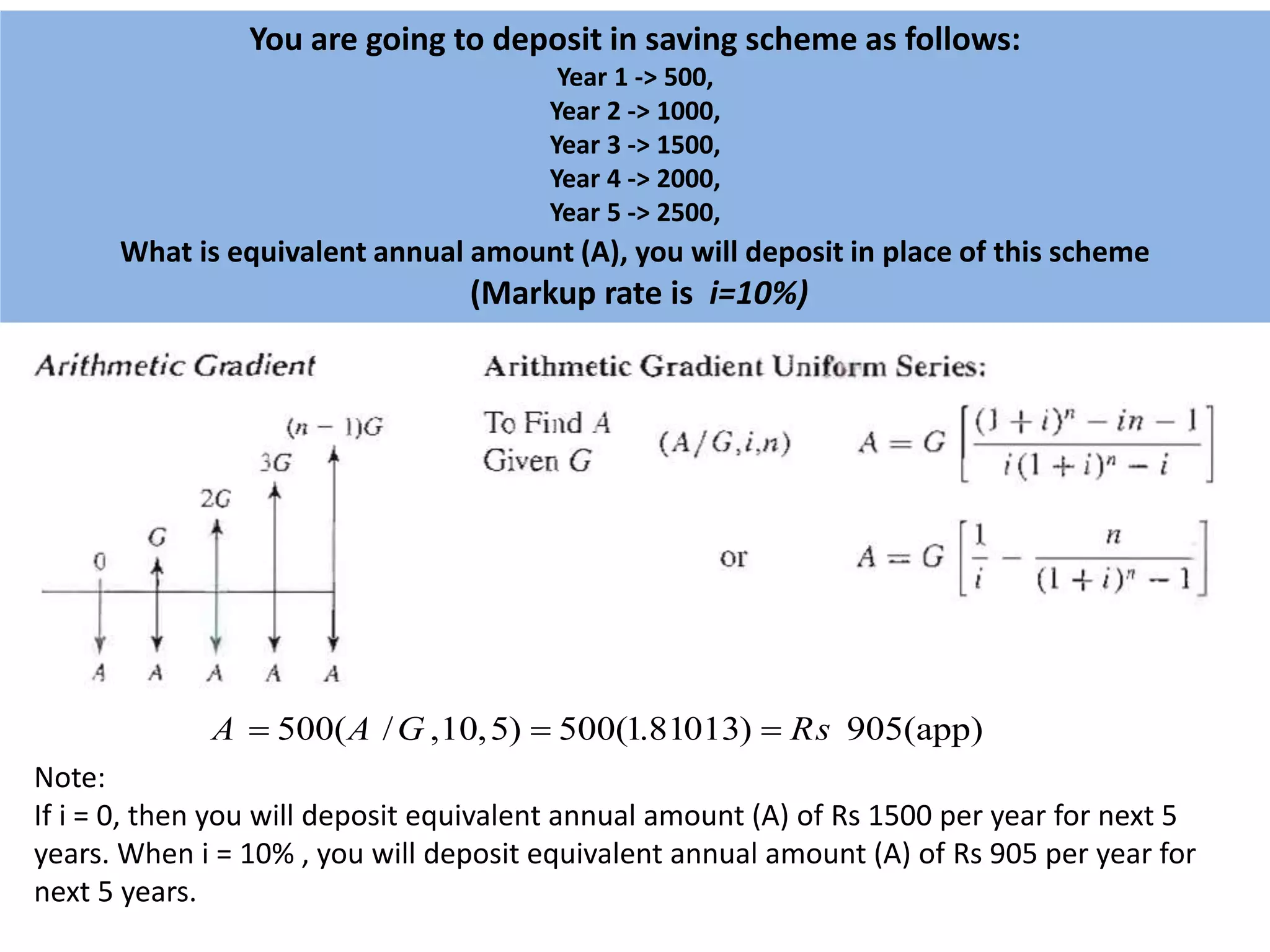

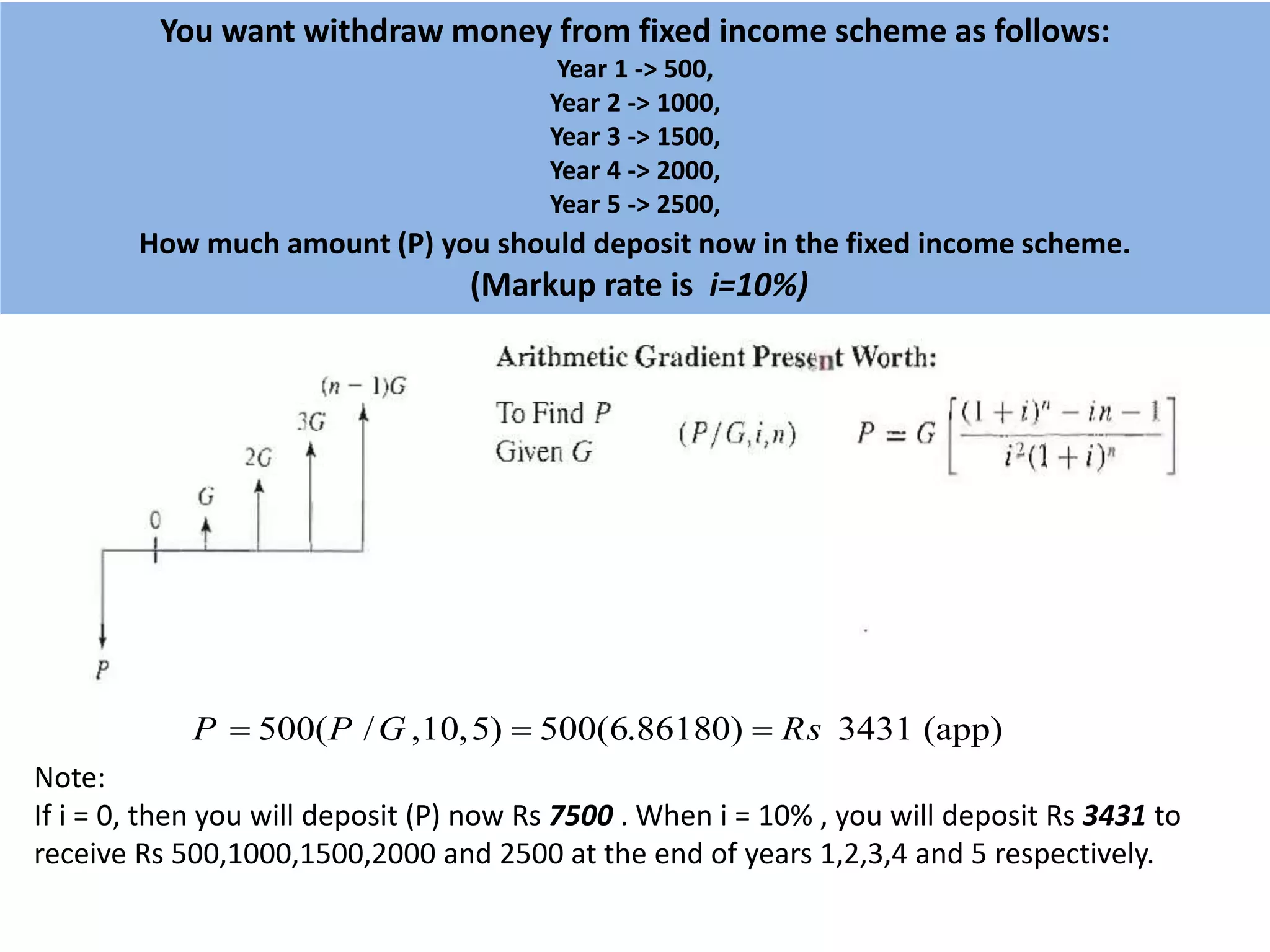

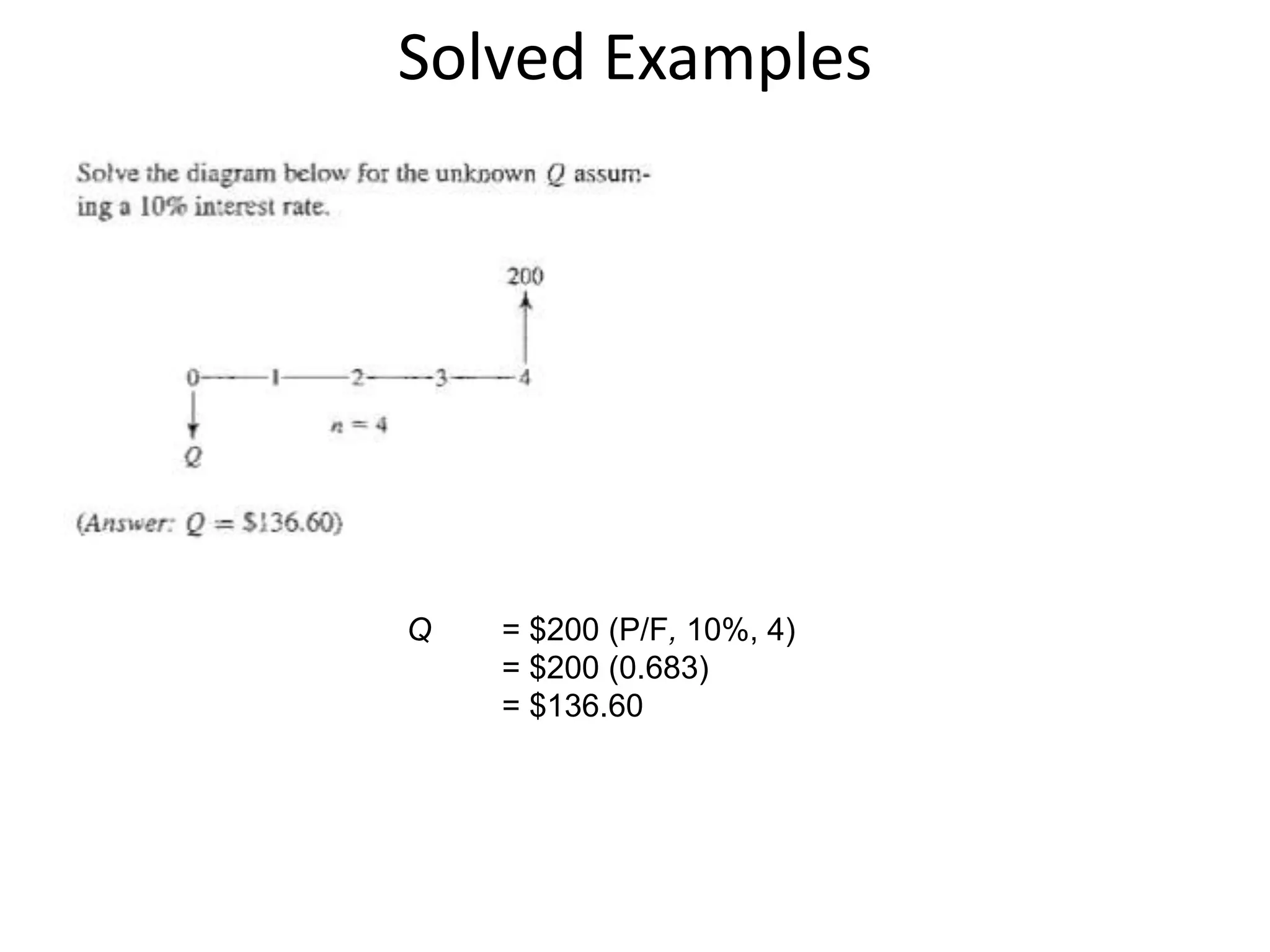

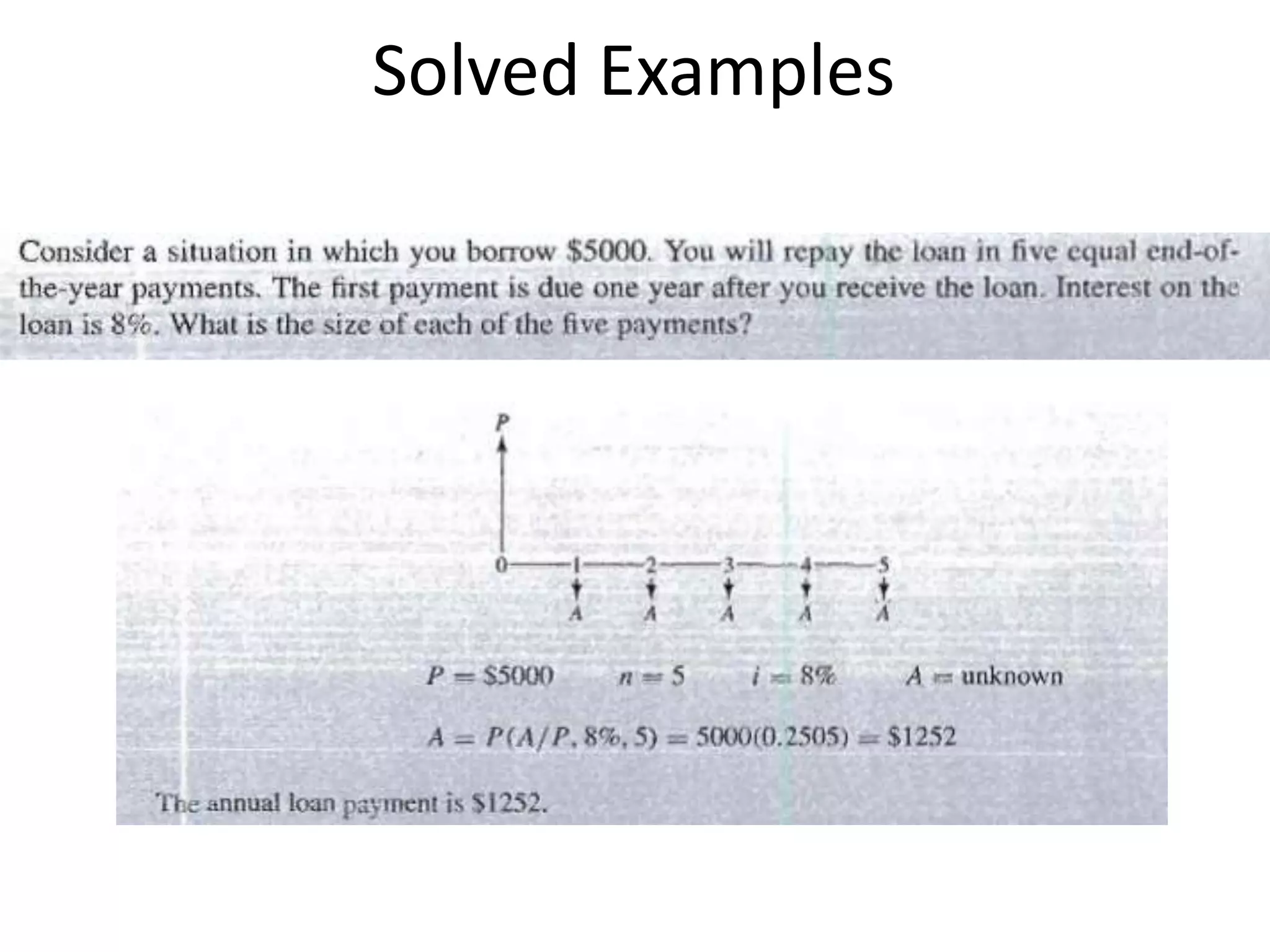

- A CFD is created by drawing a segmented time line and adding vertical arrows to represent cash inflows or outflows at each time period.

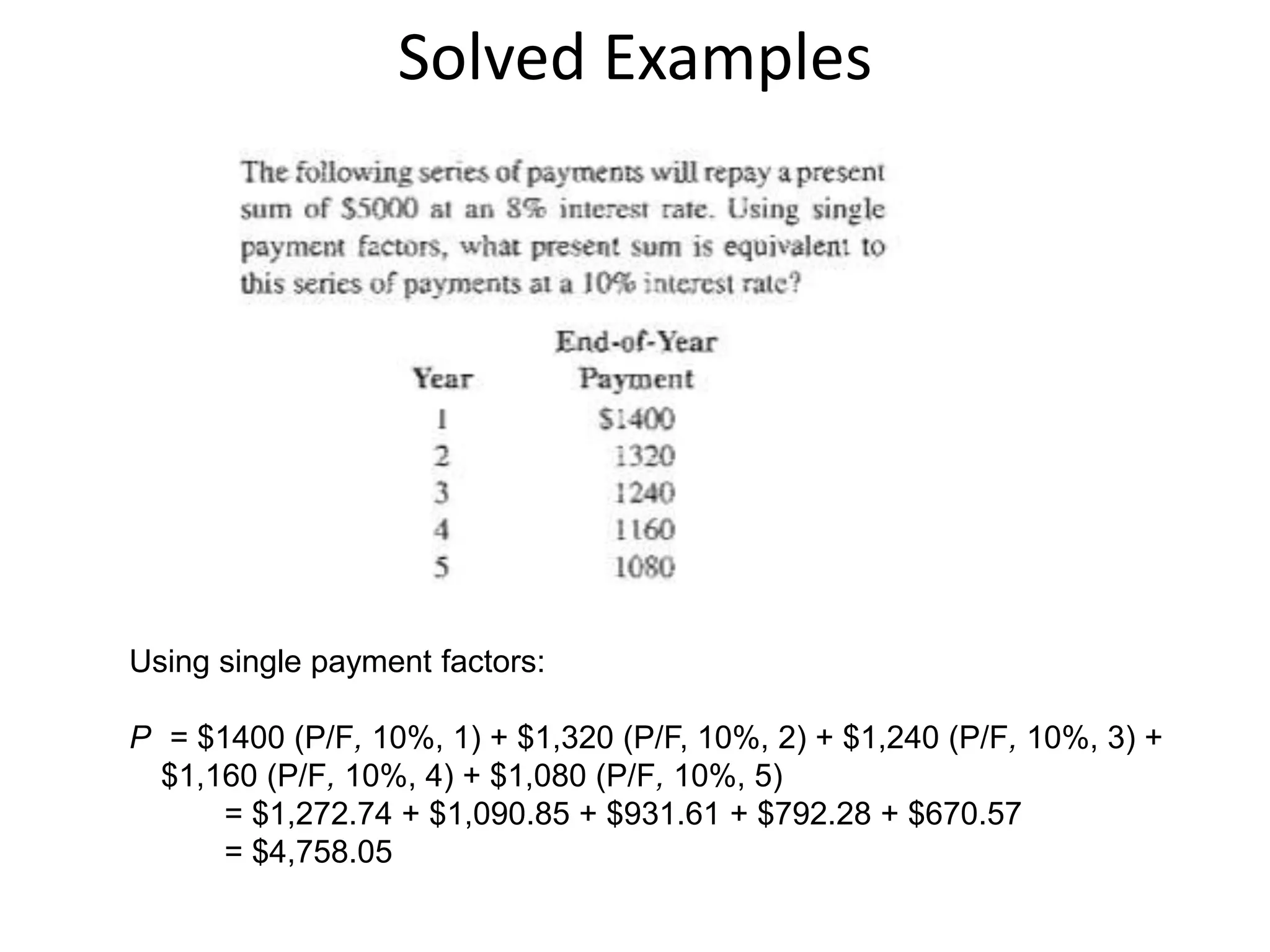

- Common categories of cash flows include first costs, operating/maintenance costs, salvage value, revenues, and overhauls.