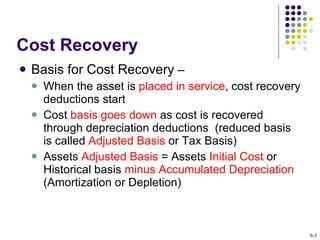

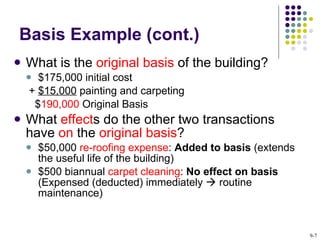

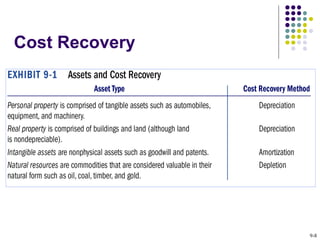

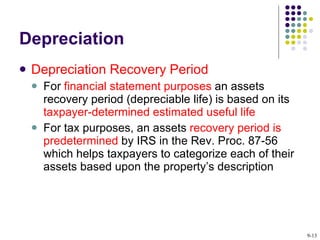

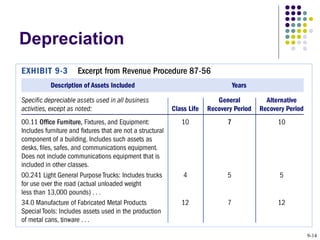

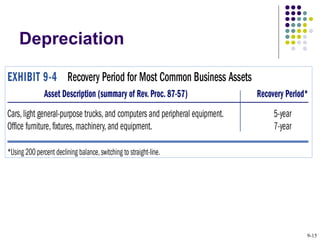

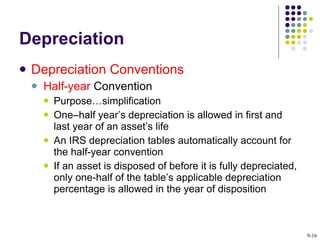

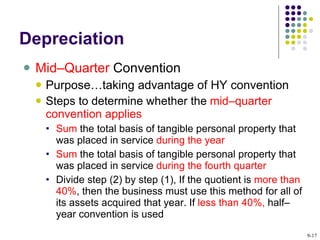

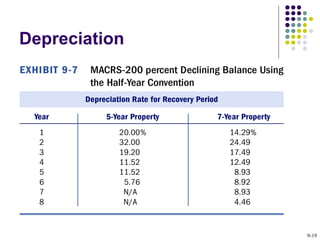

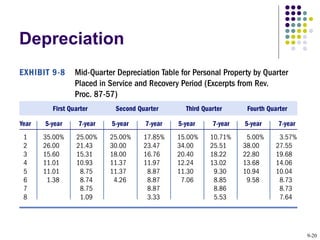

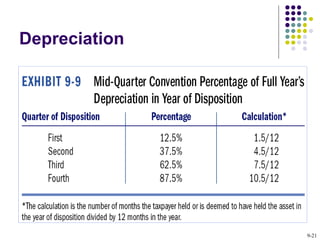

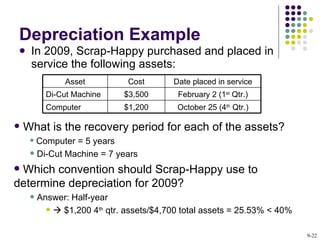

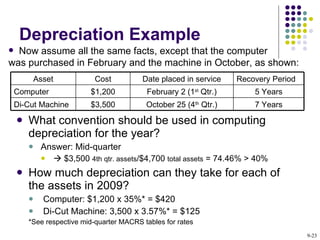

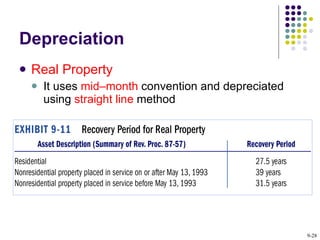

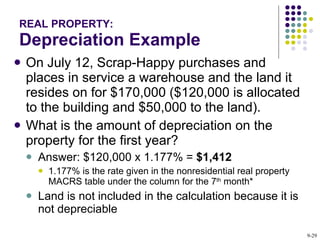

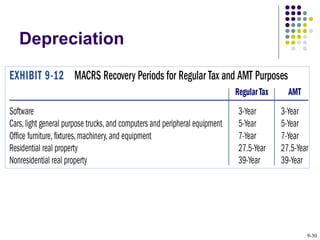

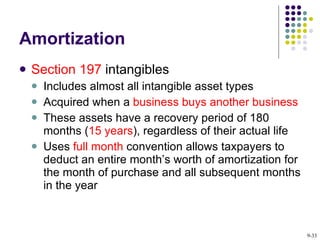

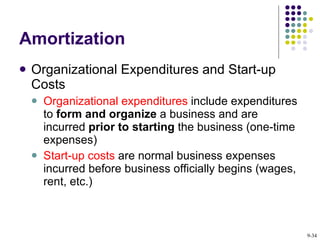

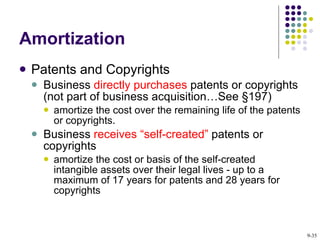

The document discusses cost recovery methods used under tax law to recover the costs of assets over time. It explains concepts of basis, adjusted basis, depreciation, amortization, and depletion. It provides details on determining cost recovery periods and methods for tangible and intangible assets. Examples are given for calculating depreciation of real property and personal property using MACRS tables.