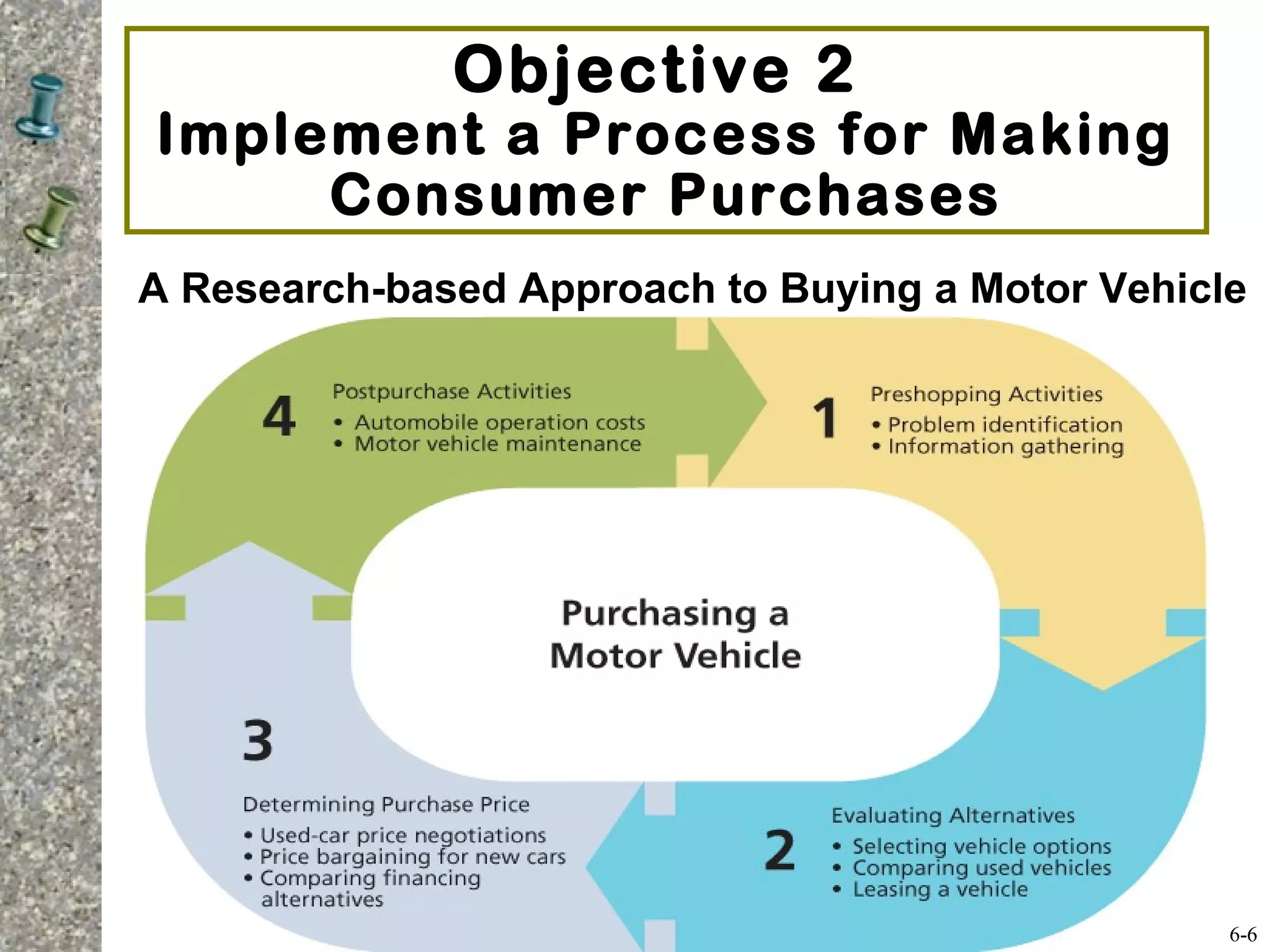

This document provides information on various consumer purchasing strategies and the process of researching and making major consumer purchases. It discusses timing purchases based on seasonal price variations, comparing store brands to national brands, unit pricing, coupons, warranties, used and new car warranties, researching alternatives, negotiating price on new cars, and post-purchase maintenance costs. The document also outlines the major steps in the consumer purchase decision process, including pre-shopping research, evaluating alternatives, determining price and selection, and post-purchase activities. It applies this framework to the example of buying a motor vehicle.