This document discusses various savings and payment services. It provides information on:

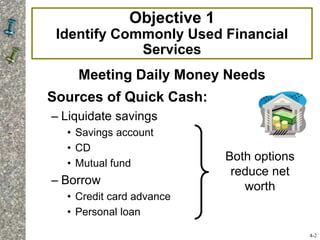

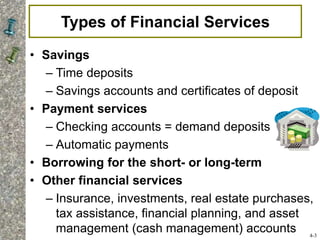

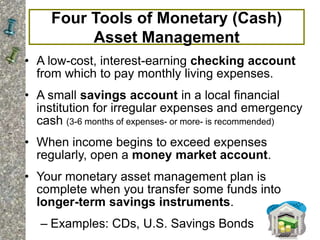

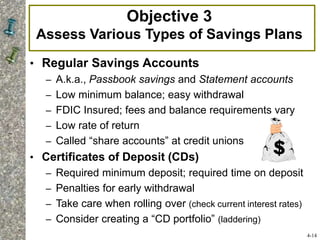

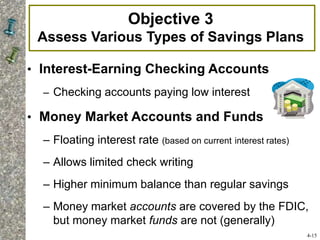

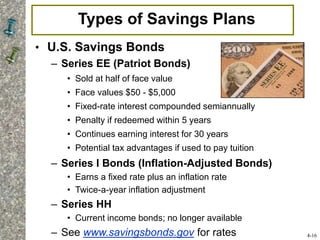

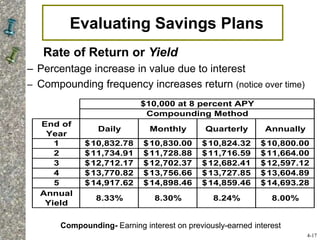

1. Common savings plans like savings accounts, CDs, money market accounts, and U.S. savings bonds. It emphasizes the importance of comparing rates of return and terms.

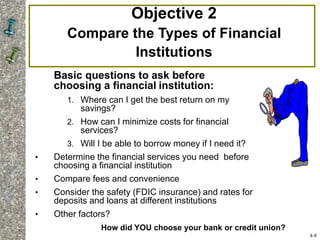

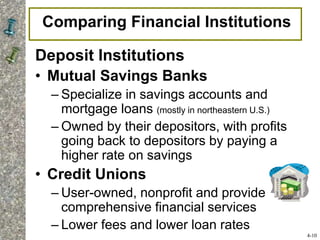

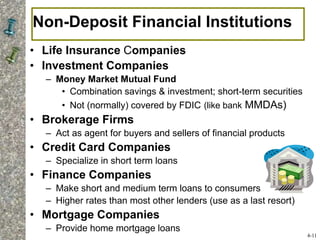

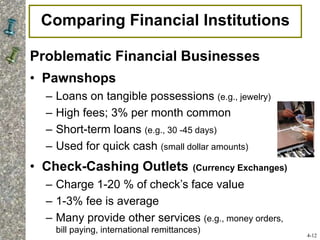

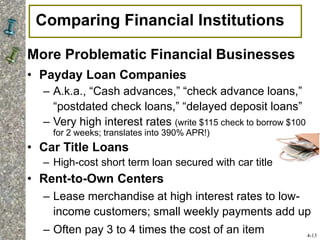

2. Different types of financial institutions like commercial banks, credit unions, and investment companies. It notes factors to consider when choosing an institution.

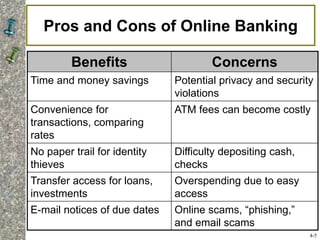

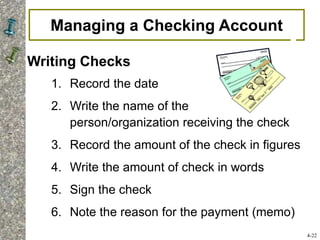

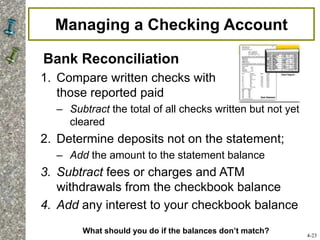

3. Various payment methods including debit cards, online payments, stored-value cards, and checking accounts. Managing a checking account through writing checks and bank reconciliation is also covered.

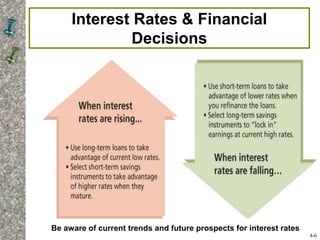

4. The importance of being aware of interest rate trends and choosing financial services and institutions to best meet daily money needs and minimize