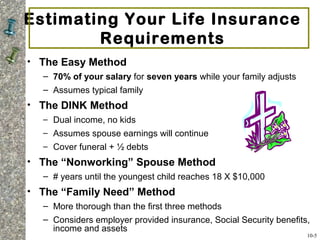

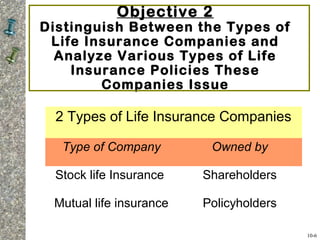

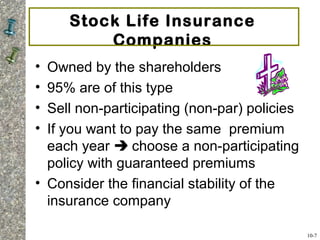

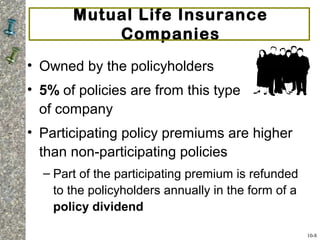

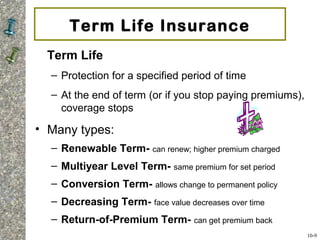

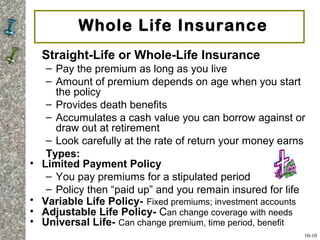

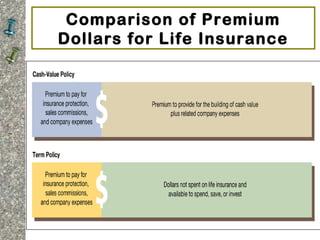

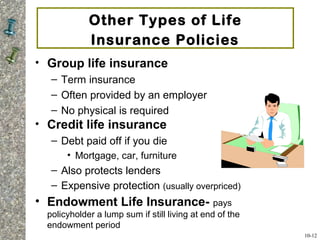

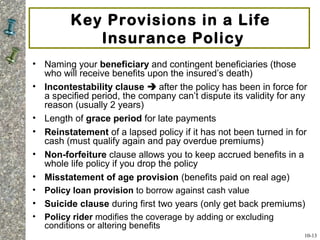

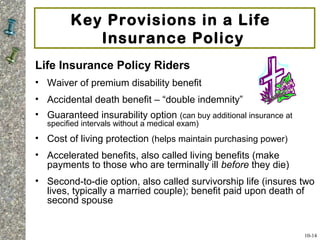

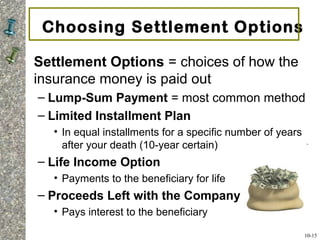

This document discusses life insurance, including its primary purposes of protecting dependents from financial loss due to death and reducing survivors' financial burdens. It defines life insurance as a policy purchased from an insurance company that pays a lump sum death benefit to beneficiaries upon the policy holder's death. The document provides information on determining life insurance needs, the types of life insurance companies and policies, key policy provisions, and factors to consider when buying a policy. It also discusses annuities and how they can provide financial security and supplement retirement income.