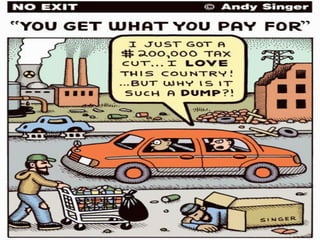

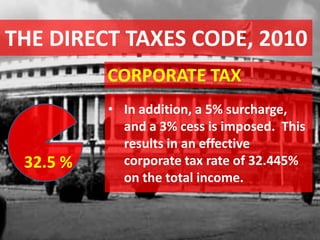

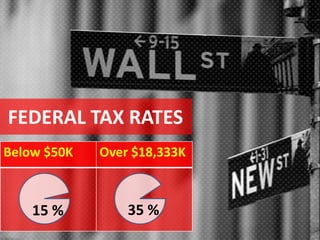

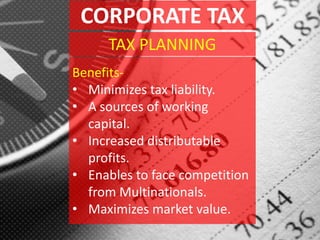

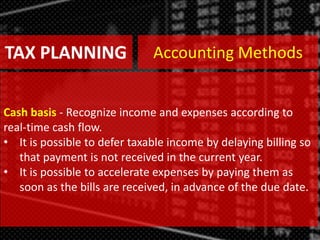

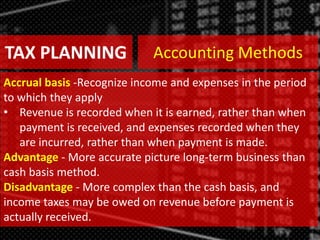

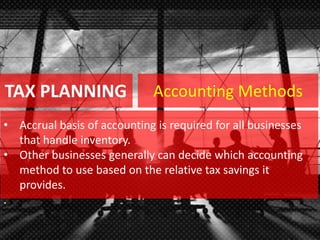

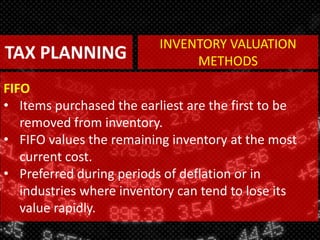

The document provides an overview of corporate taxes. It defines a corporation as a separate legal entity that can be incorporated through legislation or registration. Corporations have legal personhood and can be responsible for crimes. They provide benefits like liability protection and raising funds through stock sales. The document then discusses taxes in general and how they are imposed by governments. It outlines different types of taxes including corporate taxes. Corporate tax rates vary globally from around 15-35% in different countries. The document provides details on India's corporate tax rates and regulations. It concludes with discussing tax planning strategies that corporations can use like accounting methods, inventory valuation, equipment purchases and benefits plans.