The document discusses key aspects of the US tax system including:

- Congress creates tax law which the IRS enforces through assessment and collection departments.

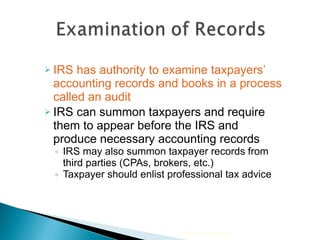

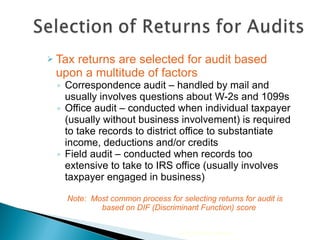

- The IRS has authority to audit taxpayers and summon records to examine income and deductions.

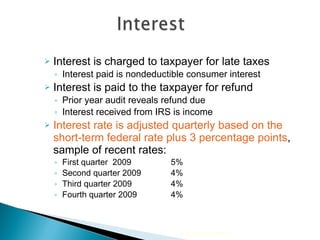

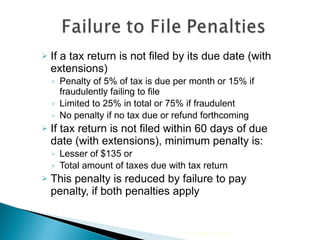

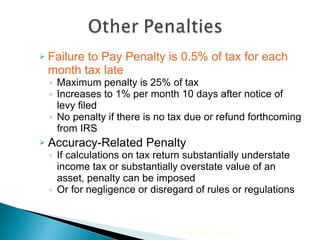

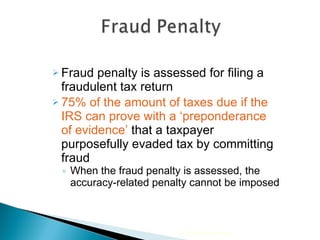

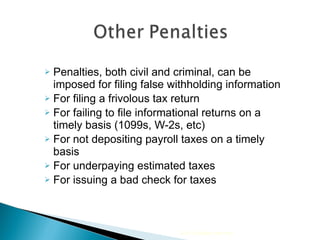

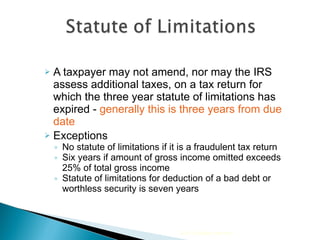

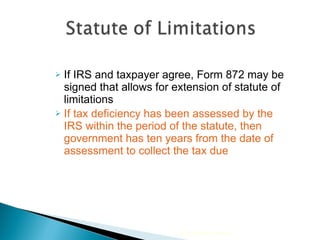

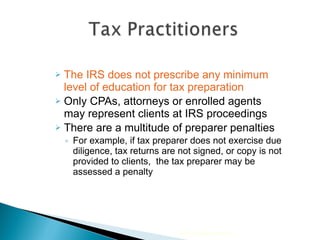

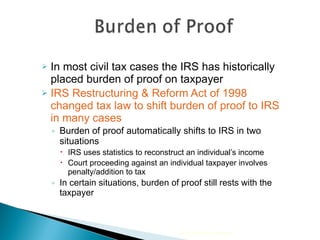

- Noncompliance with tax laws results in penalties for issues like filing late, failing to pay taxes owed, or filing a fraudulent return. Statutes of limitation apply.

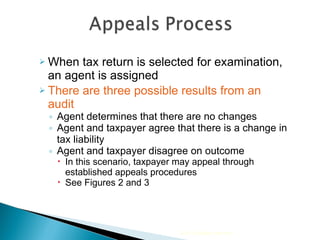

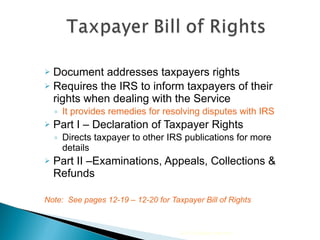

- Taxpayers have rights that are outlined in publications and when dealing with the IRS regarding audits, appeals and collections.