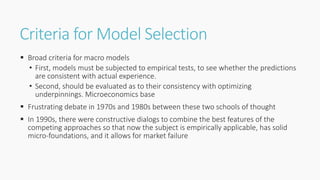

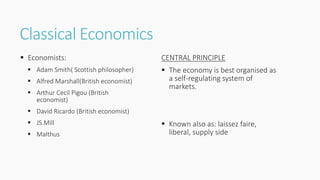

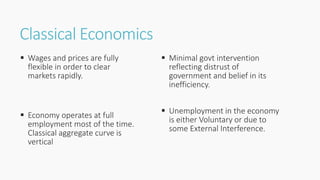

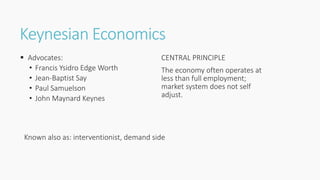

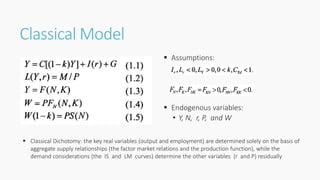

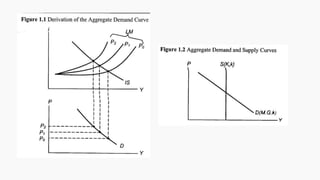

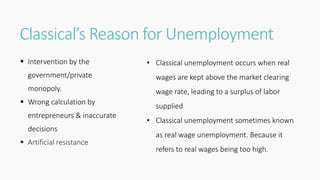

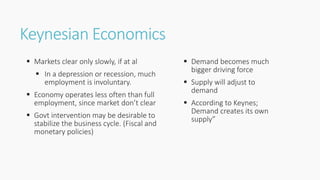

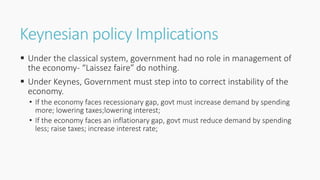

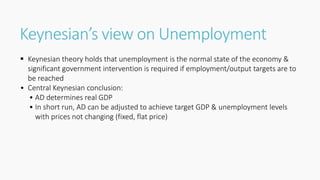

This document provides an overview of macroeconomics topics that will be covered in the Macroeconomics 2 course, including integrating classical and Keynesian schools of thought, the development of the New Neoclassical Synthesis, short and long run issues, and applications of macroeconomic models. It also summarizes the key differences between classical and Keynesian economics, including their views on unemployment, flexibility of wages and prices, and the appropriate role of government intervention in the economy.