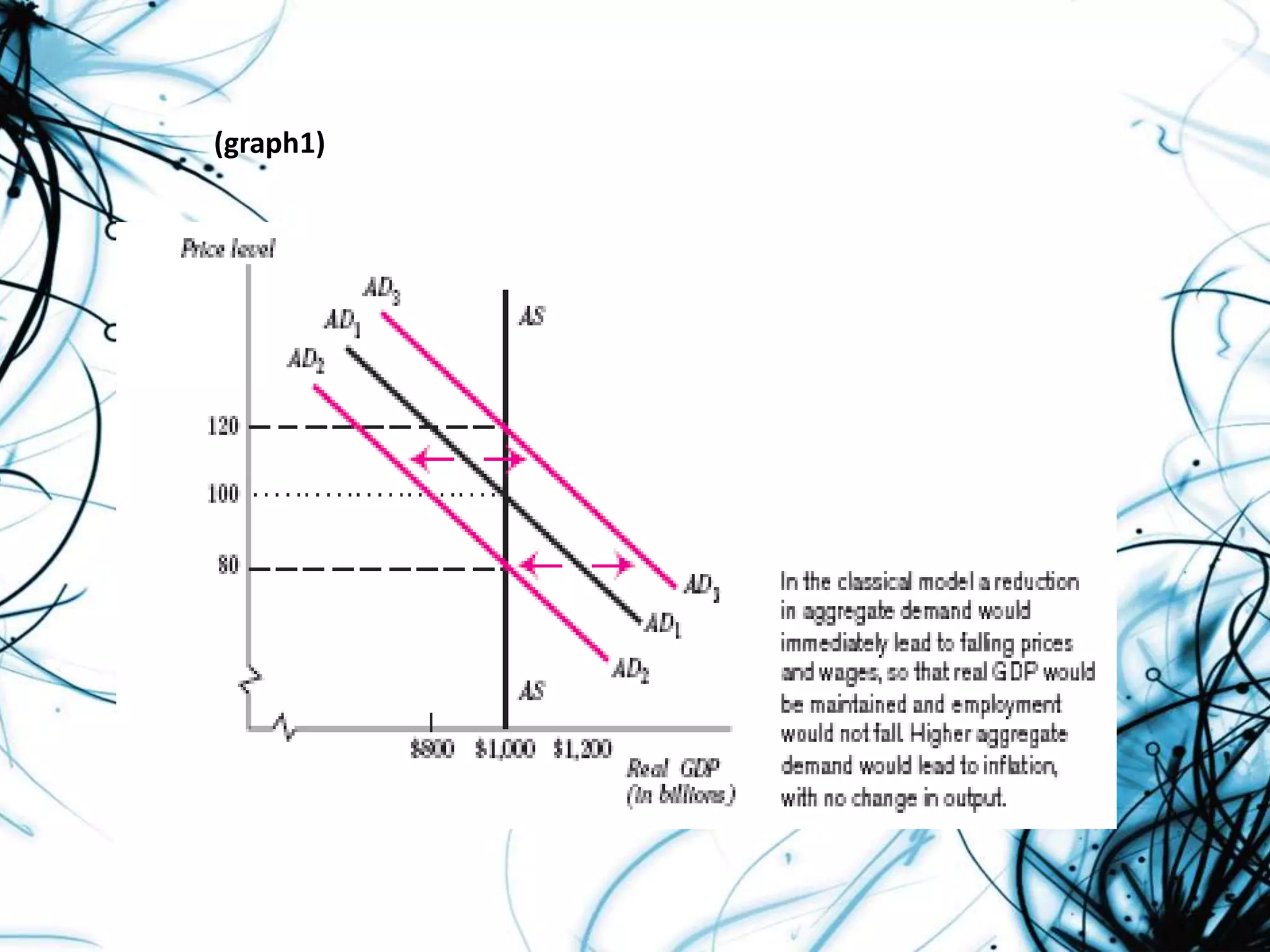

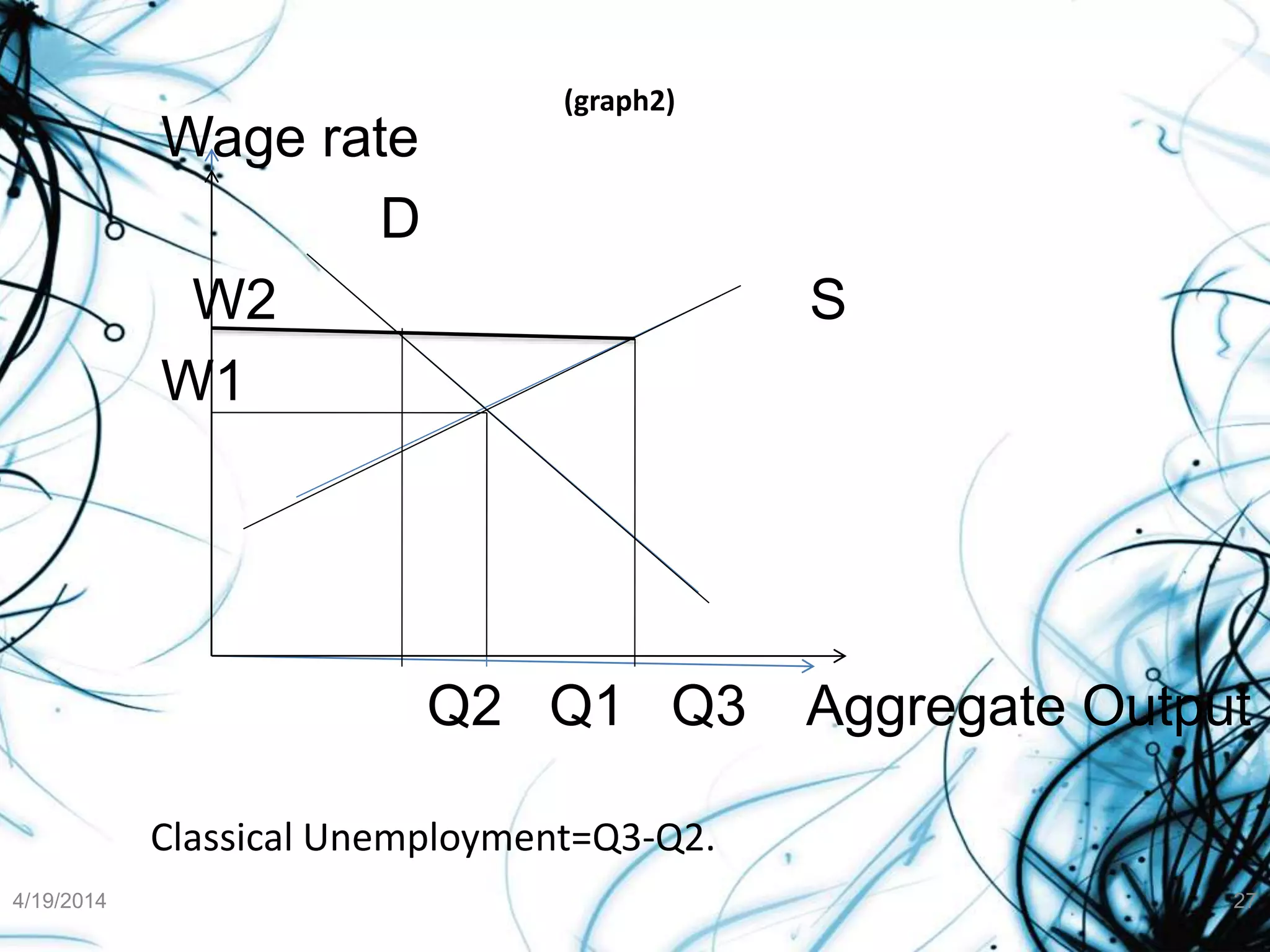

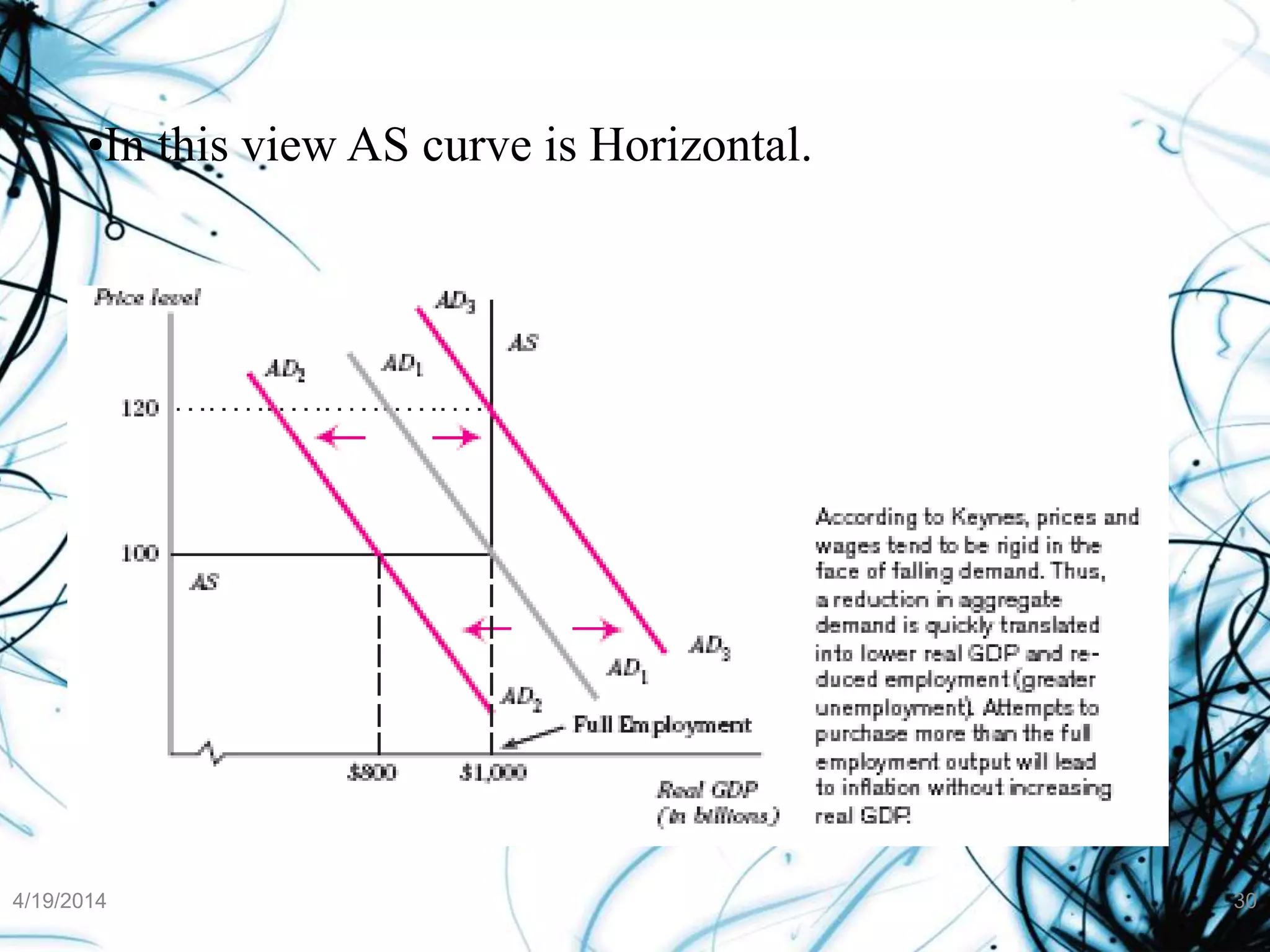

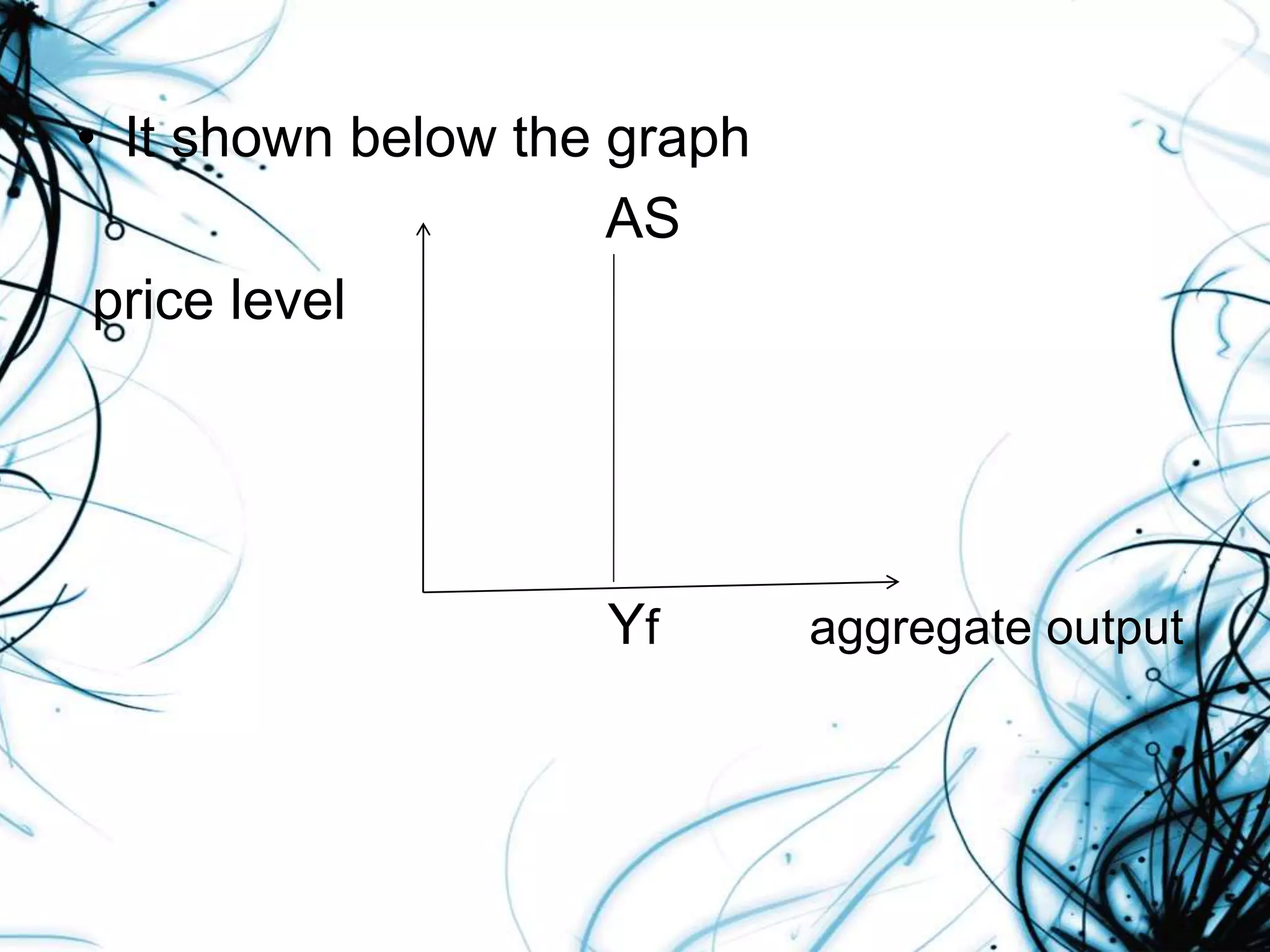

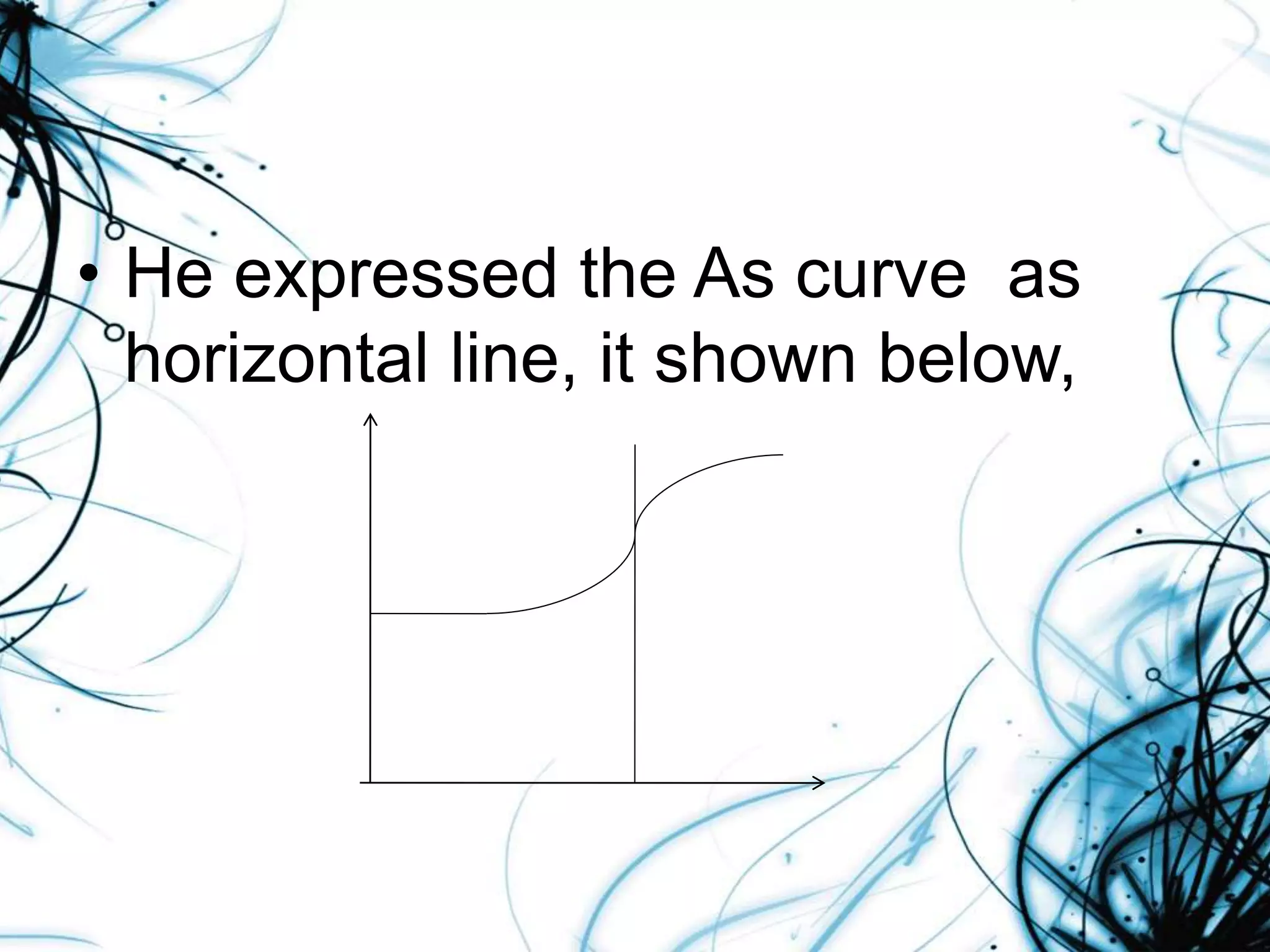

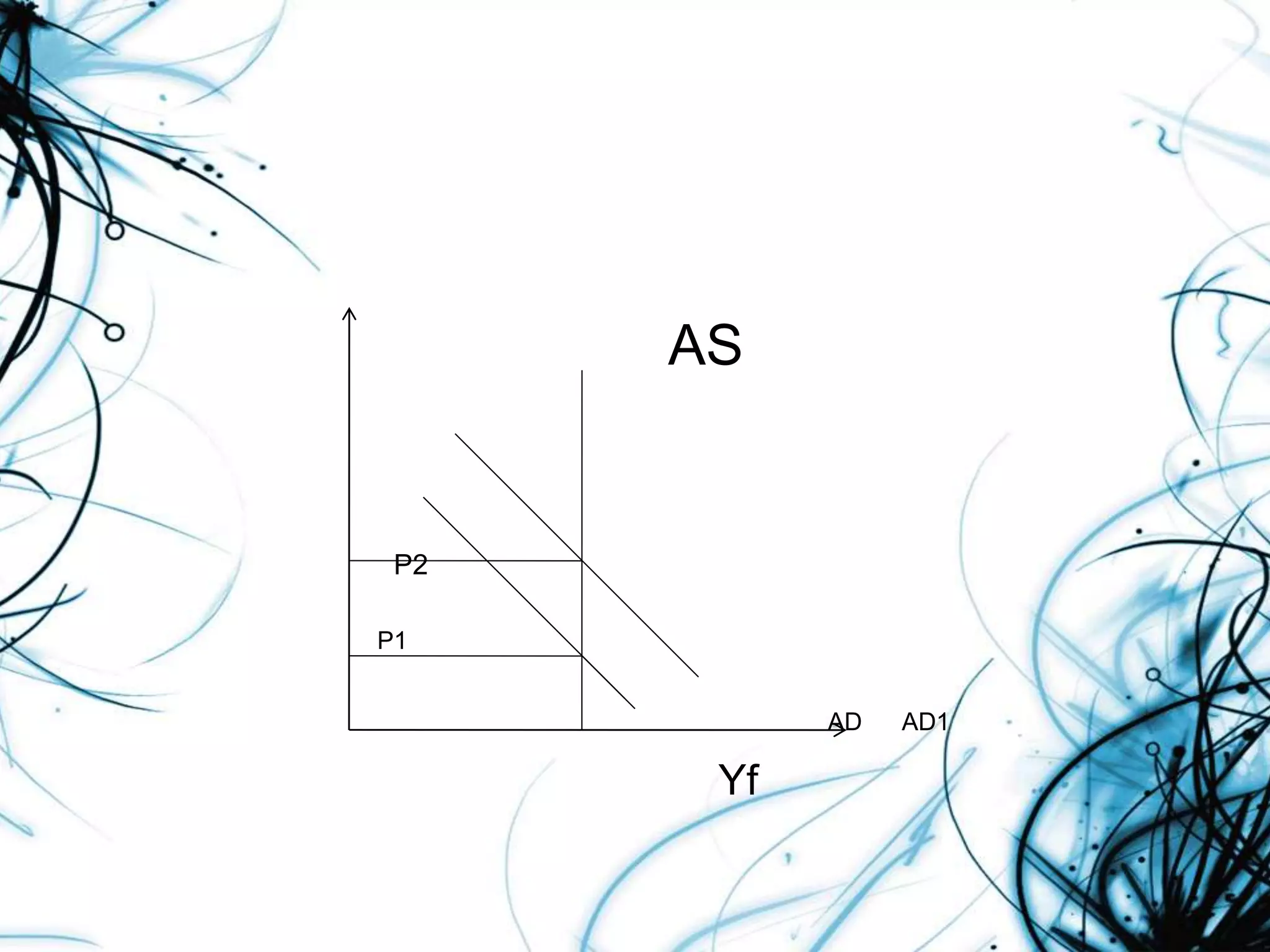

This document discusses macroeconomics and macroeconomic policy debates from classical and Keynesian perspectives. It covers unemployment, price stability, and exchange rates. On unemployment, classical economists believe full employment is always achieved through flexible wages, while Keynesians believe unemployment is normal and government intervention is needed. On price stability, classical economists see prices adjusting to maintain full employment while Keynesians see stable prices with variable output. Exchange rates are influenced by demand and supply factors in both frameworks.