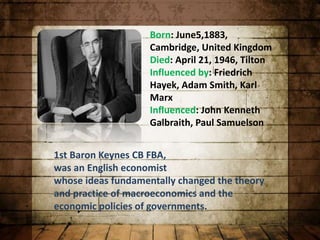

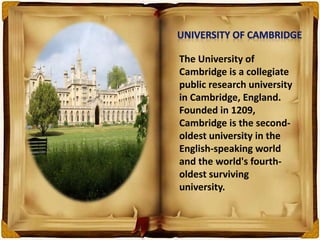

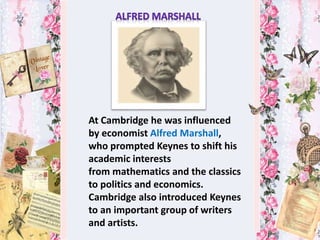

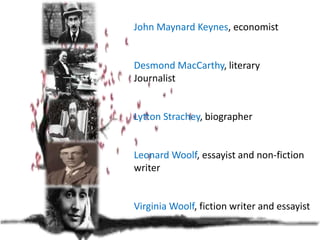

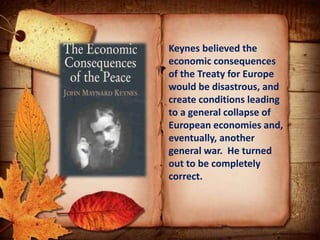

John Maynard Keynes was a highly influential 20th century English economist. He studied at Cambridge University where he was influenced by economist Alfred Marshall. Keynes' ideas fundamentally changed macroeconomic theory and policy, arguing that government should intervene during economic downturns through spending and deficit spending to stimulate demand. His work challenged classical economic theories of his time.