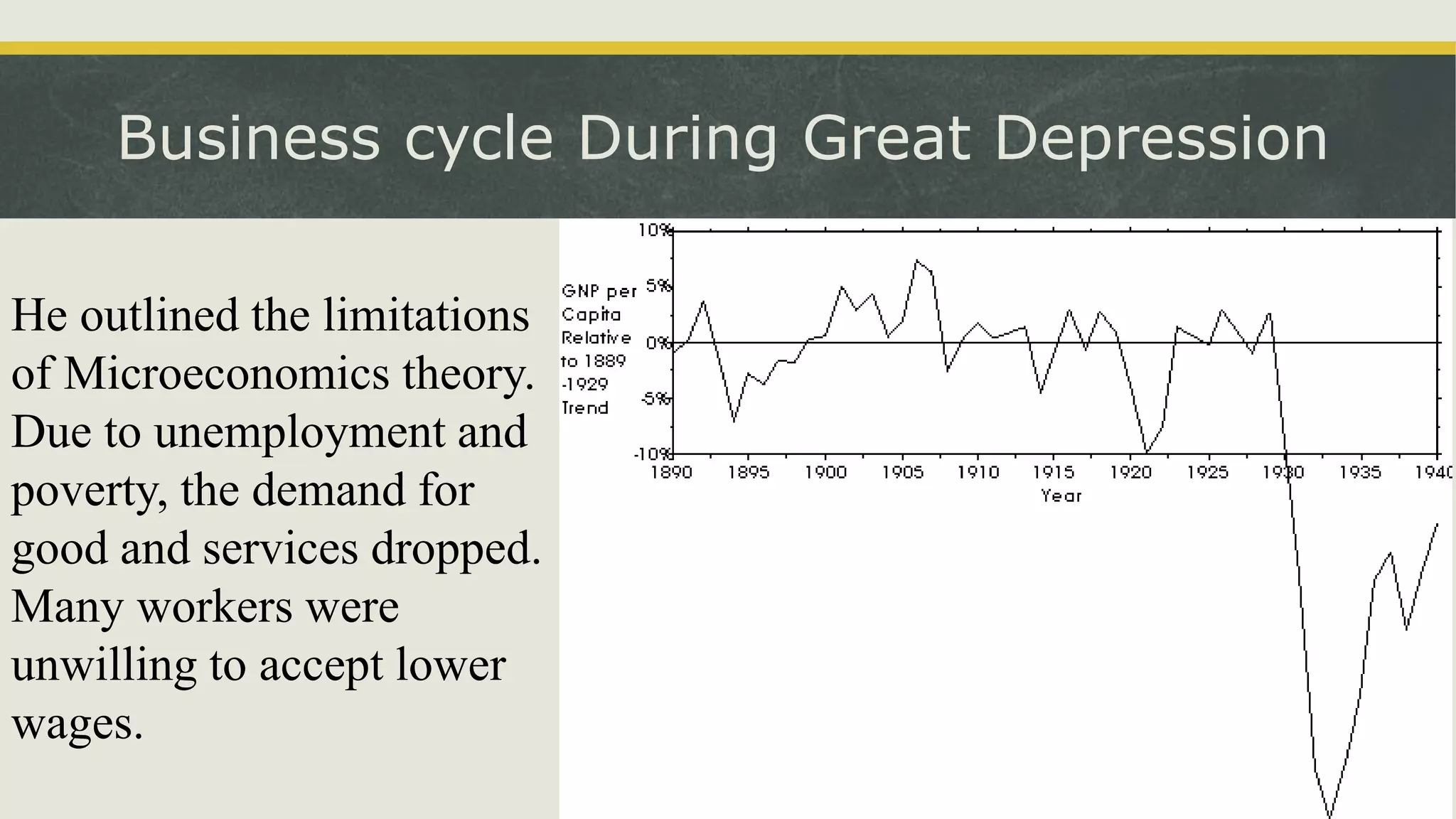

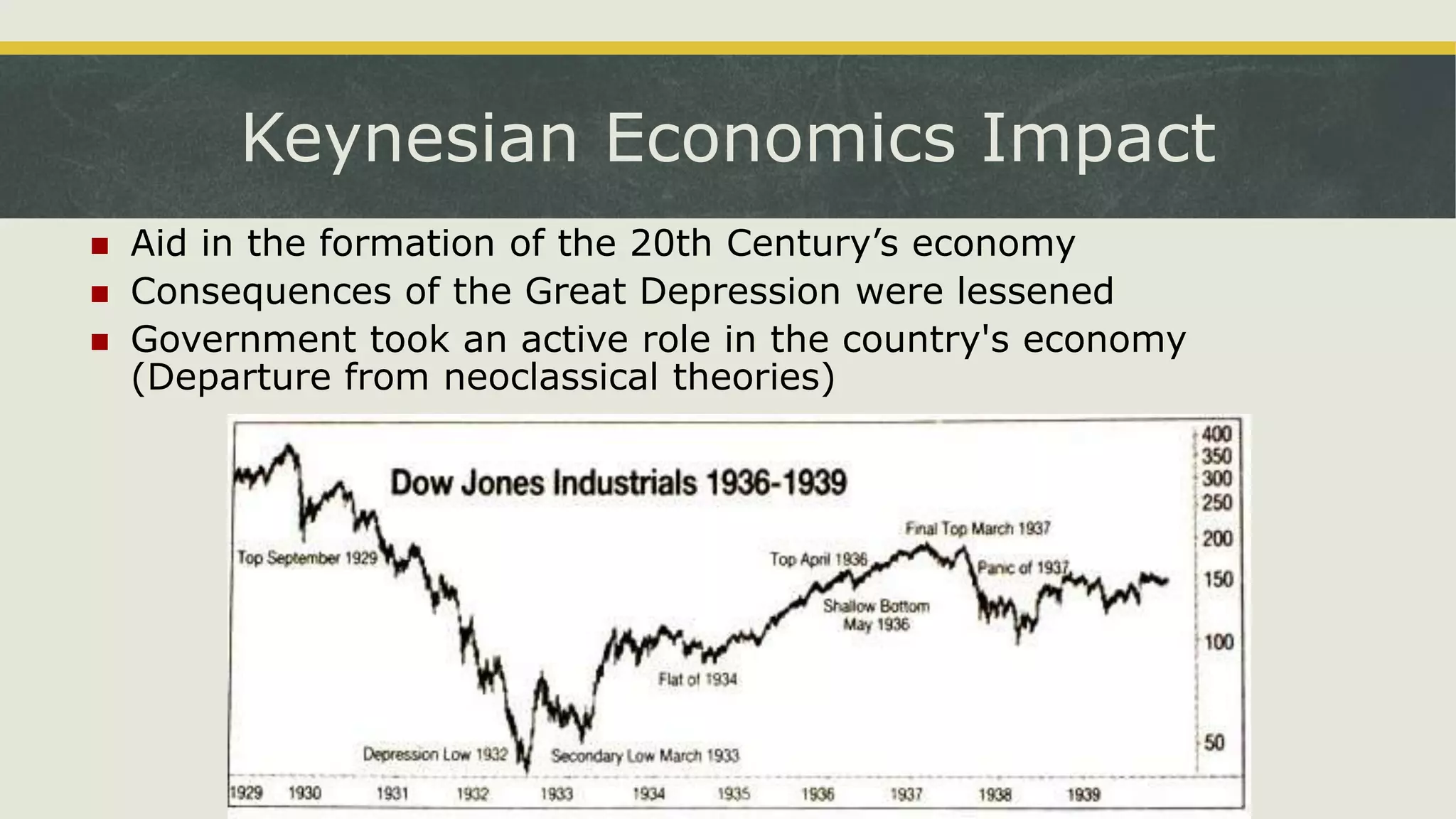

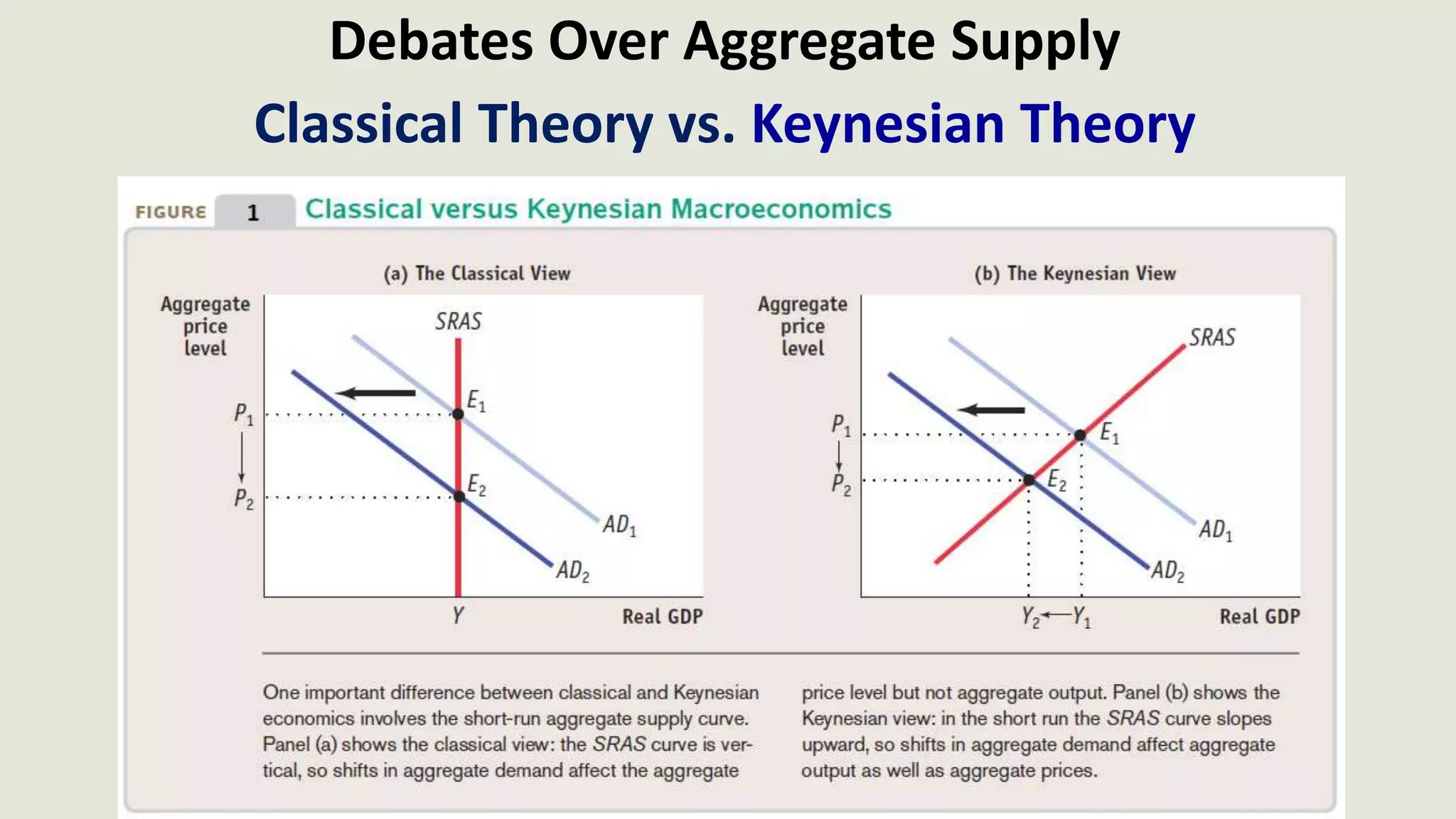

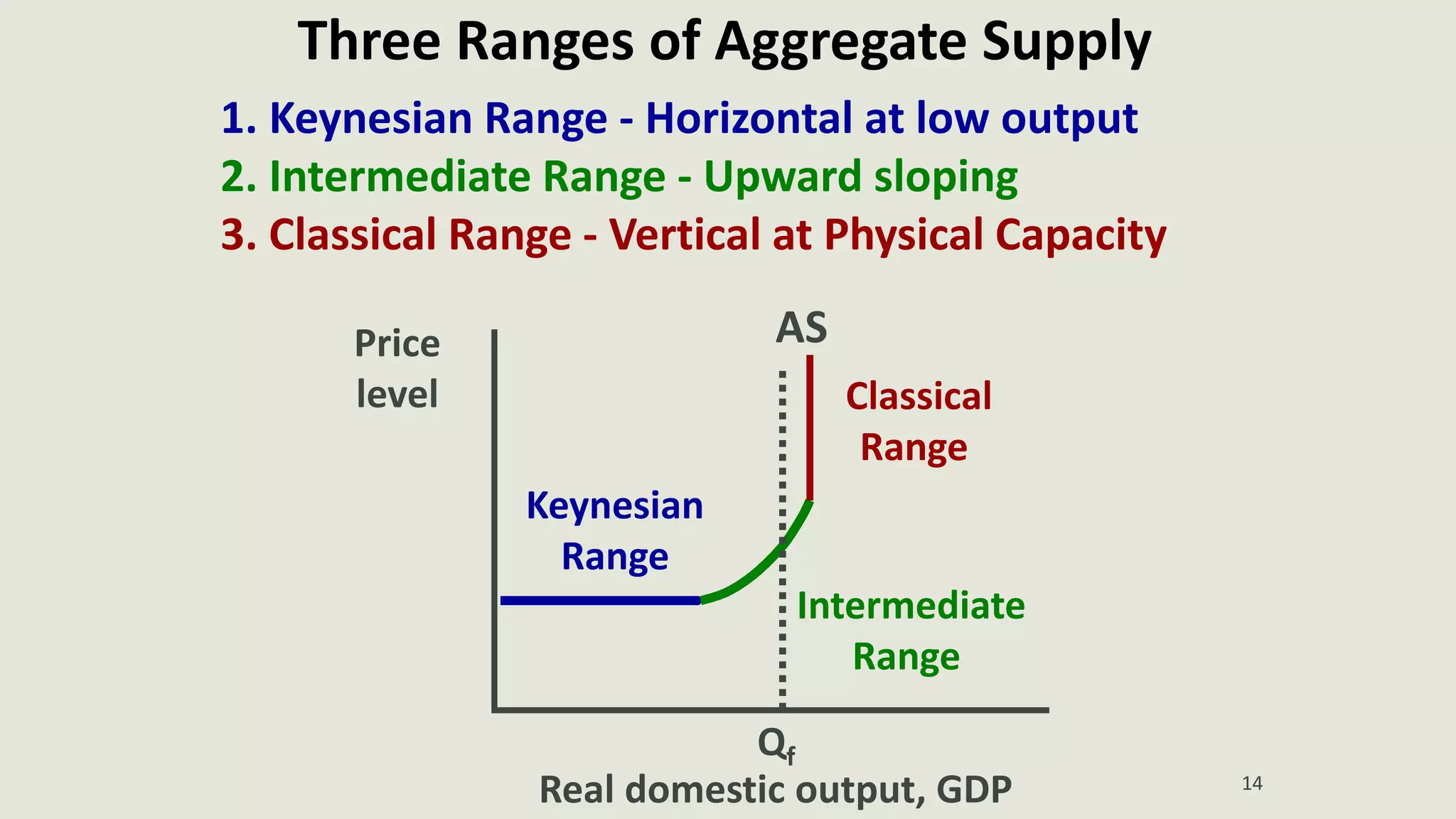

John Maynard Keynes was born in 1883 in Cambridge, England to an economics professor. He was a gifted student who attended Eton and King's College at Cambridge. After college, Keynes worked for the British government during World War 1. In the 1930s, he developed his theory of Keynesian economics, which argued that government intervention is needed to increase aggregate demand and stabilize the economy. Keynesian economics influenced governments to take a more active role in stimulating their economies and helped lessen the impact of the Great Depression. However, Keynesian policies faced limitations with high government spending leading to inflation and unemployment in the postwar period.