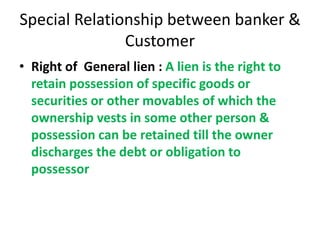

A banker is defined as a body corporate that accepts deposits from the public, lends money, invests deposited funds, and allows withdrawals. A customer is an individual or organization that conducts banking transactions. There are four types of customers: existing account holders, former account holders, non-account visitors, and prospective account holders. The core relationship between a banker and customer is that of debtor and creditor when a deposit is made, and creditor and debtor when a loan is given. Additional relationships include bailee and bailor regarding secured assets, and agent and principal regarding services performed on a customer's behalf.