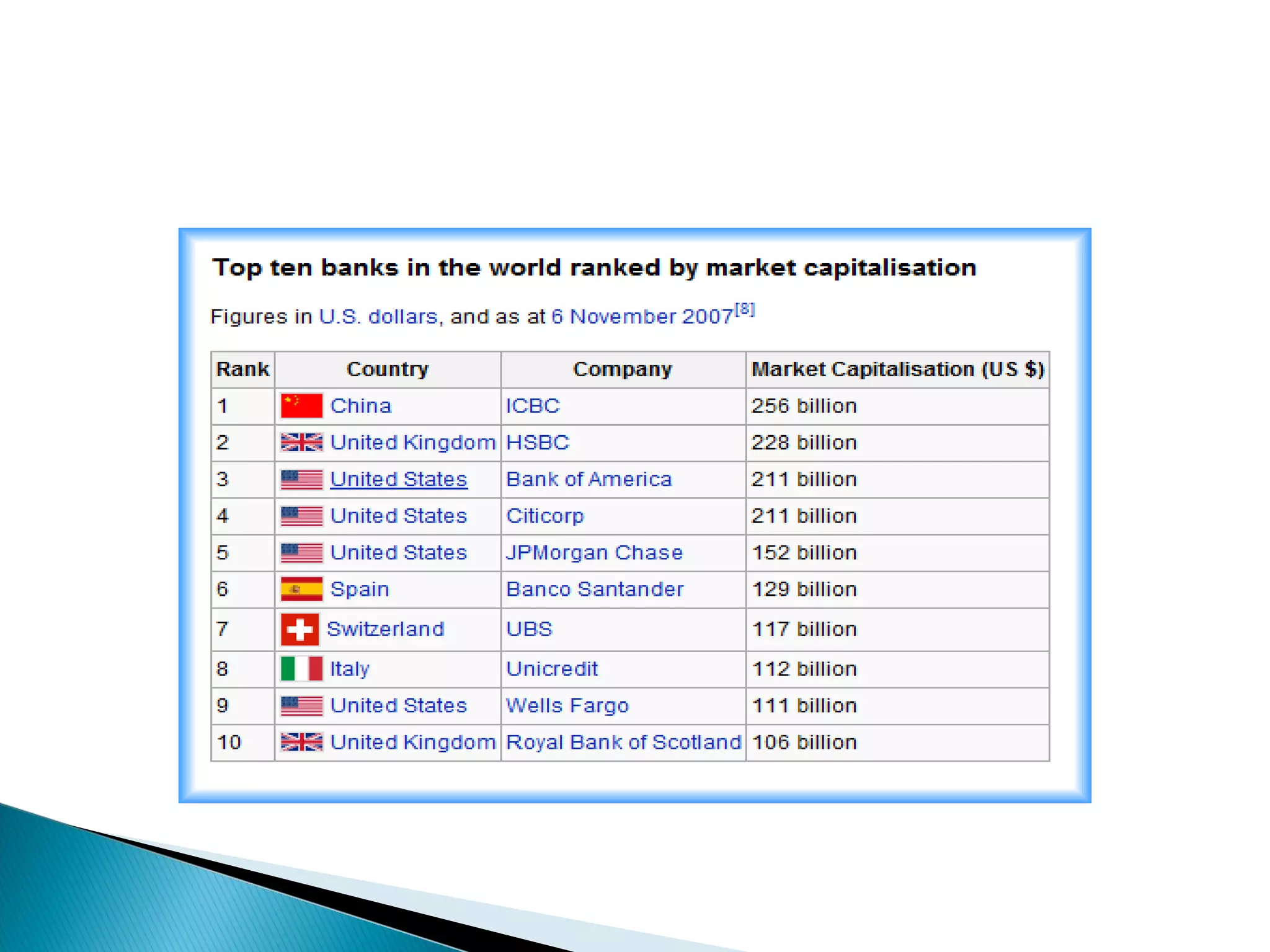

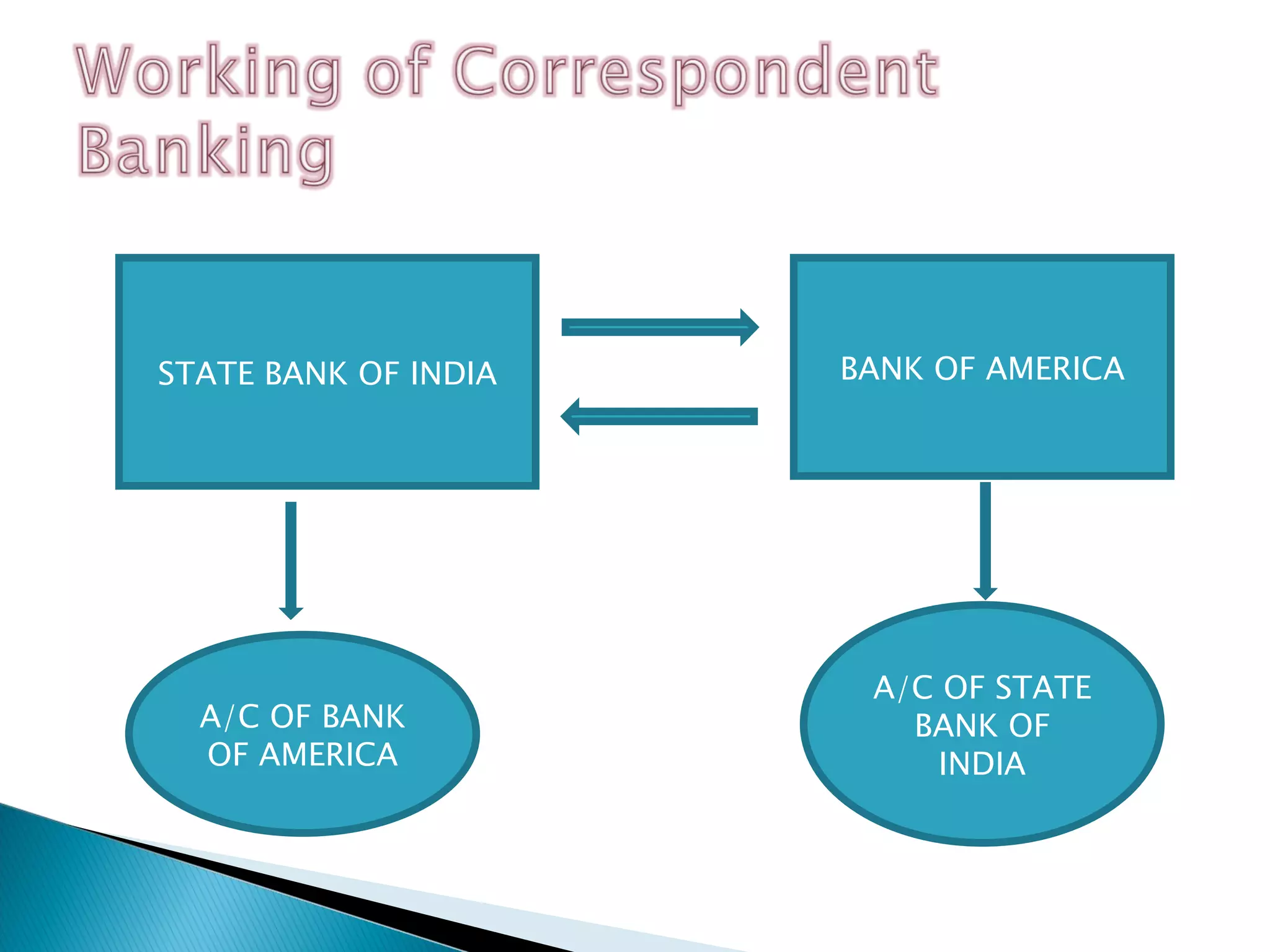

A bank is an organization chartered by the government to receive deposits, make loans, and offer related financial services. Multinational banks physically operate in more than one country, while international banks engage in cross-border operations without local offices. The top ten banking groups are ranked by shareholder equity. Regulatory changes, technology, financial innovation, and economies of scale impact banks' organizational structures and operations.