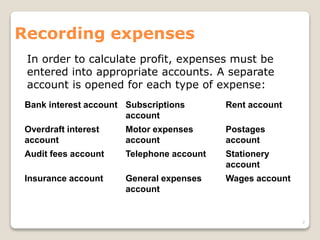

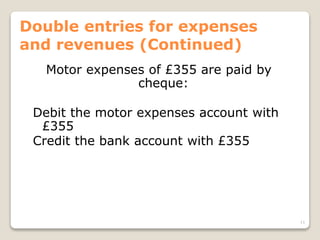

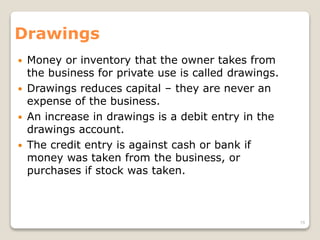

This chapter discusses calculating profit and loss, and the double entry system for recording expenses and revenues. It explains that profit is calculated as revenue minus expenses, and how profit or loss affects the accounting equation and capital. Separate accounts are used for each type of expense and revenue, with expenses recorded as debits and revenues as credits. The chapter also covers how drawings by the business owner are recorded, decreasing capital rather than being an expense.