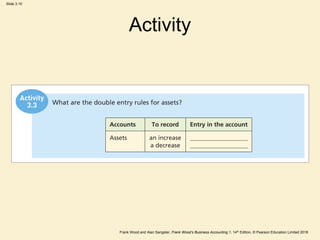

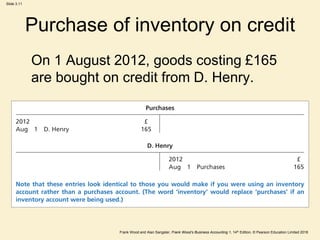

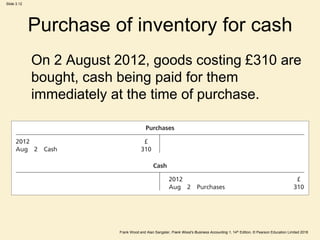

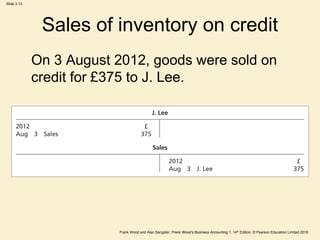

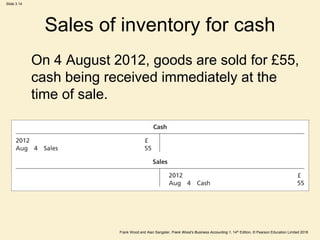

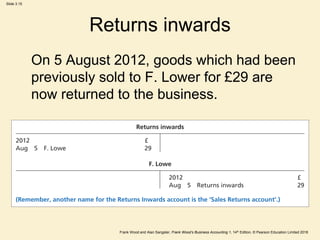

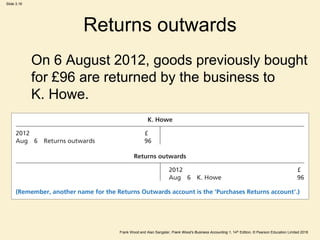

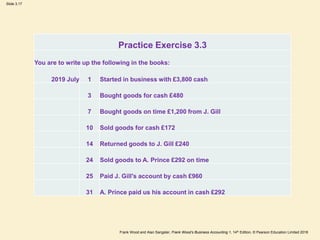

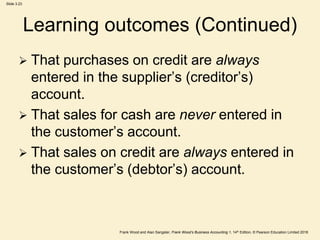

The document discusses accounting for inventory. It explains that inventory accounts should not be used to record increases and decreases in inventory. Increases can occur due to purchases or returns from customers, while decreases can occur due to sales or returns to suppliers. Separate accounts should be used for purchases, returns inwards, sales, and returns outwards to properly track changes in inventory. The meanings of "purchases" and "sales" in accounting are also defined.