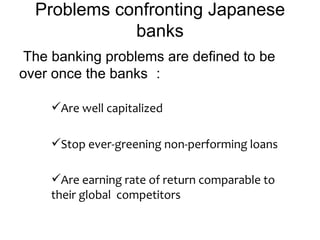

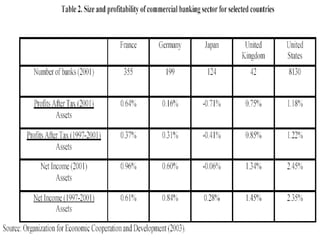

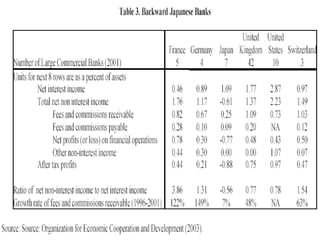

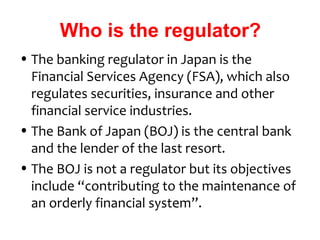

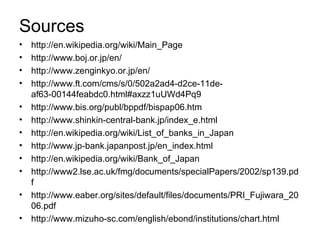

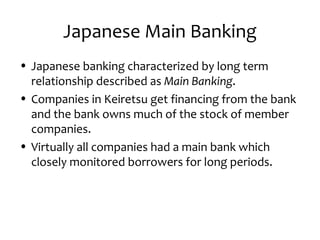

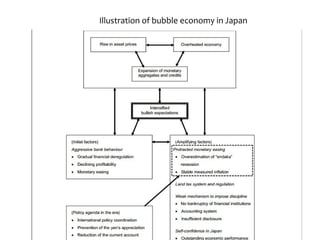

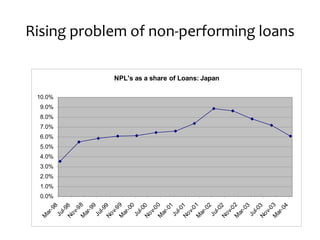

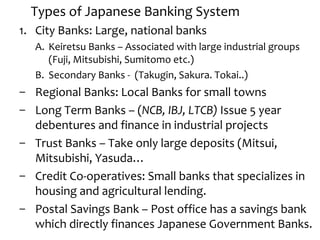

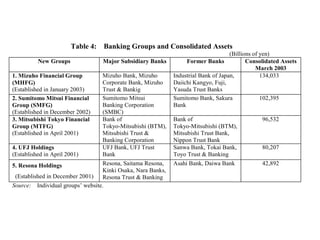

This document provides an overview of the Japanese banking system. It discusses the main features of Japanese banking including the main bank system where companies are closely associated with banks through long-term relationships. It also discusses the banking crisis in the late 1990s and early 2000s when non-performing loans became a major problem for Japanese banks. The regulatory system is also summarized, including the role of the Financial Services Agency as the primary banking regulator.

![Development Bank of Japan

• a Japanese corporation incorporated on 1 October 2008 under the

Development Bank of Japan Inc. Law

• According to its corporate philosophy of "applying financial expertise to

design the future," the new DBJ Mission is "to build customer trust and

realize an affluent society by problem-solving through creative financial

activities

• Based on the New DBJ Law, the Bank will provide integrated

investment and loan services to domestic and international clients.

• Total Asset : 14.0174 Trillion Yen (or 153.88 Billion USD)

Lending Balance : 12.0266 Trillion Yen (or 132.03 Billion USD)

Capital Ratio (BIS) : 18.69%

[Exchange Rate: 1 USD vs 91.09 Yen (on 18 September 2008)]](https://image.slidesharecdn.com/bankinginjapanfinaledit-120517111740-phpapp02/85/Banking-in-Japan-final-edit-8-320.jpg)