In This chapter, we were recording effects of business transactions using the accounting equation format. This, however, is not cost-and time-effective when an organization has large volume of transactions to process and several asset, liability, capital, revenue and expense items. As a result, as the volume of transactions grows and the number of specific elements of the financial statements increases, it will be necessary to design and use systematic way of processing transactions and generating accounting information. The following sections discuss an improved system of transforming business transactions into useful accounting information.

2. Basic accounting records - refer to records organizations use in transforming business transactions into useful accounting information and include Accounts, Ledgers and Journals.

Nature and Classification of Accounts

1. Definition - an account is the basic storage unit for accounting data. It is used to classify transactions in terms of their effects on specific asset, liability, capital, revenue and expense items. Thus, a separate account is kept to record and accumulate/store monetary effects of transactions on such specific items that appear on the financial statements as Cash, Supplies, Accounts Payable, Bank Loan Payable, Owner’s equity (Capital) , Service revenue (Fees Earned), Rent Income, Salary Expense and Supplies Expense.

Business organizations practically use the so-called two-column, three-column or four-column accounts for recording and storing business transactions. The purpose of the first two columns is to separately record the increases and decreases (debits and credits) in the account and that of the additional columns is to keep running (debit or credit) balance of an account.

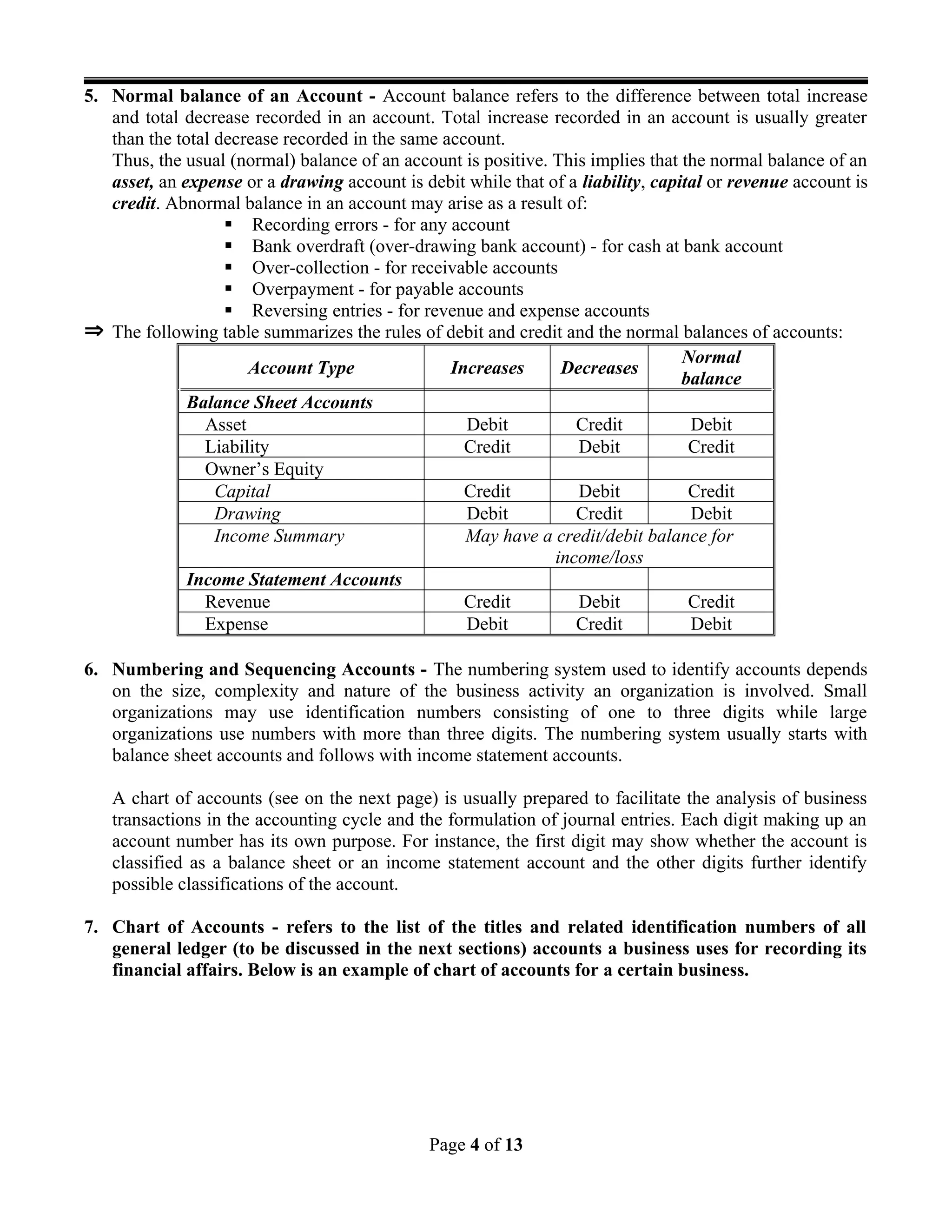

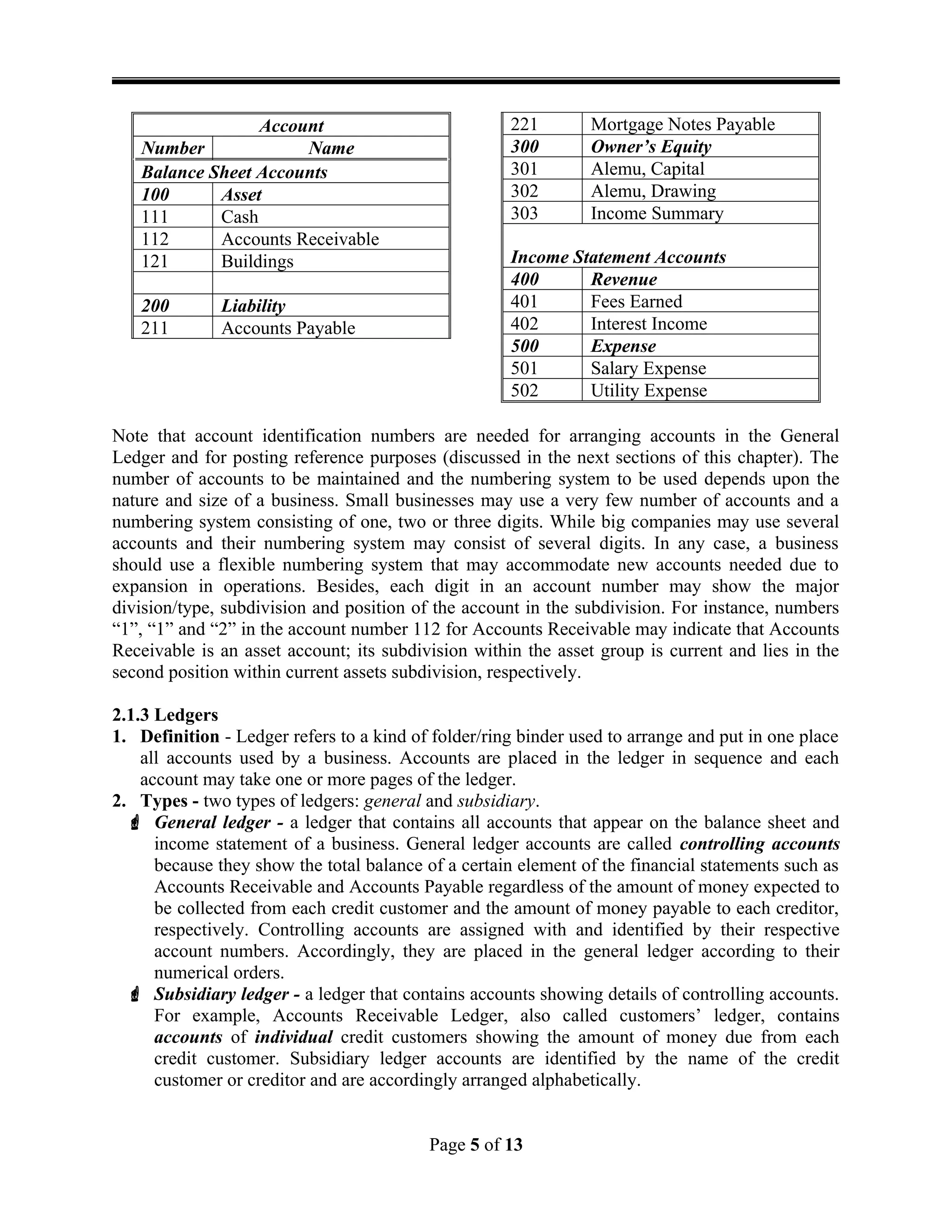

6. Numbering and Sequencing Accounts - The numbering system used to identify accounts depends on the size, complexity and nature of the business activity an organization is involved. Small organizations may use identification numbers consisting of one to three digits while large organizations use numbers with more than three digits. The numbering system usually starts with balance sheet accounts and follows with income statement accounts.

A chart of accounts (see on the next page) is usually prepared to facilitate the analysis of business transactions in the accounting cycle and the formulation of journal entries. Each digit making up an account number has its own purpose. For instance, the first digit may show whether the account is classified as a balance sheet or an income statement account and the other digits further identify possible classifications of the account.

Note that account identification numbers are needed for arranging accounts in the General Ledger and for posting reference purposes (discussed in the next sections of this chapter). The number of accounts to be maintained and the numbering system to be used depends upon the nature and size of a business. Small businesses may use a very f