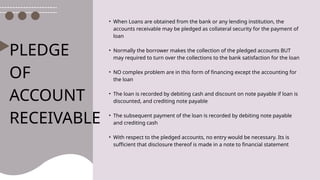

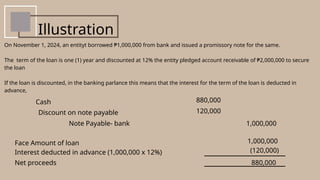

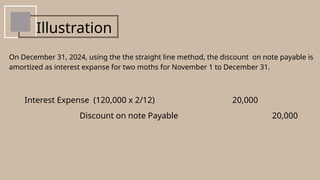

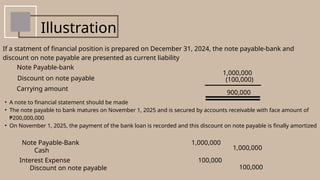

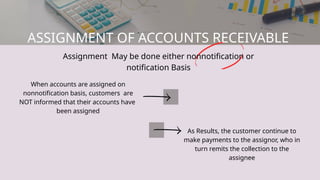

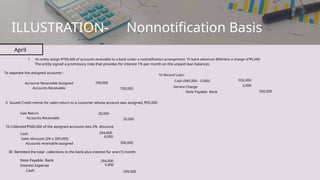

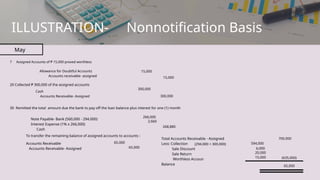

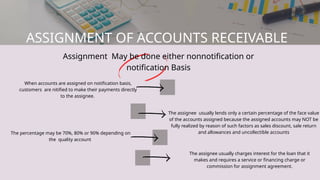

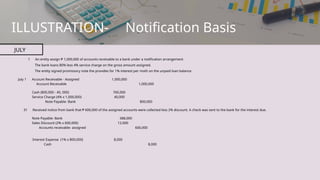

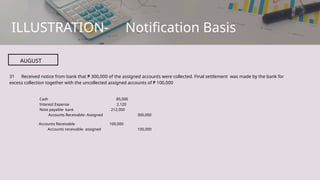

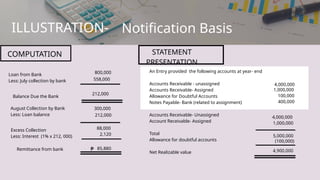

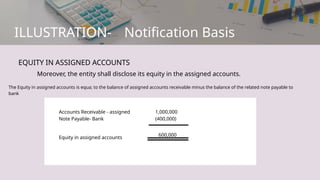

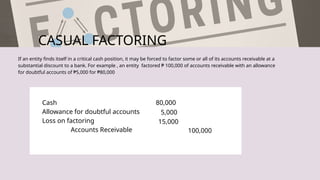

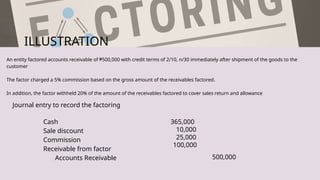

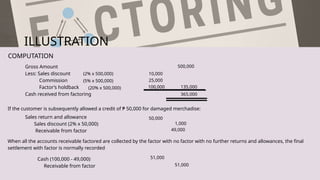

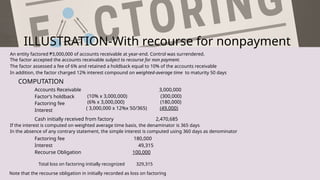

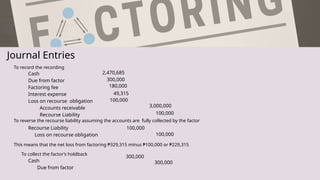

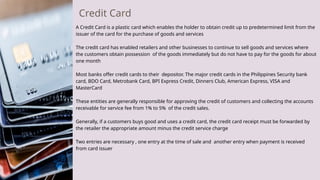

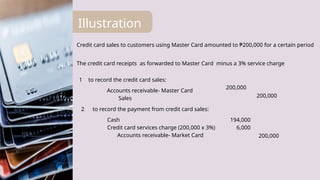

The document discusses various methods of receivable financing including pledging, assignment, and factoring of accounts receivable, highlighting their accounting implications and processes during financial distress. It explains how these methods can provide liquidity to entities faced with cash flow issues and details journal entries required for each method, including calculations for loans, interest, and service charges. Additionally, it addresses the differences between assignment with notification and non-notification, along with the implications of factoring on ownership and responsibility for uncollectible accounts.