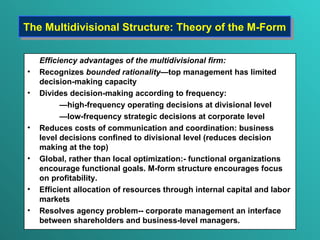

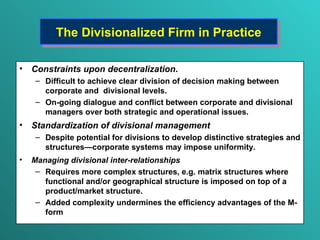

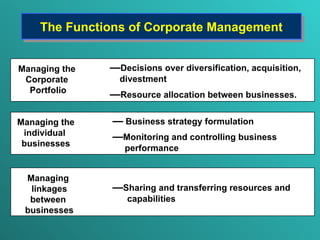

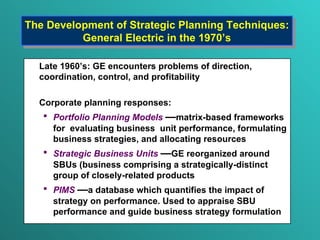

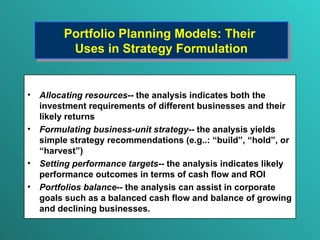

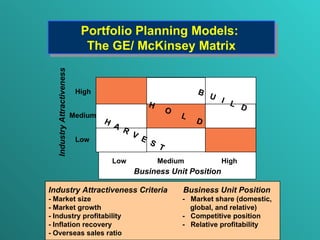

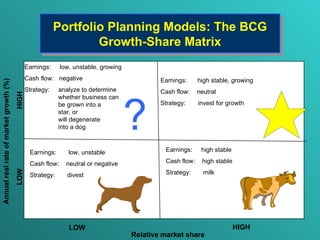

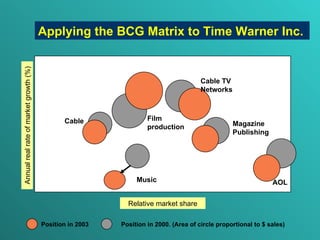

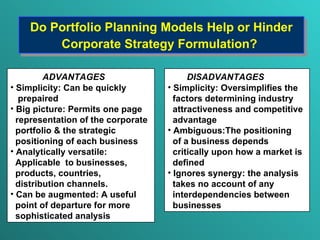

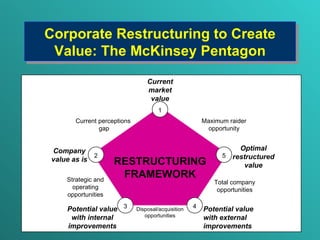

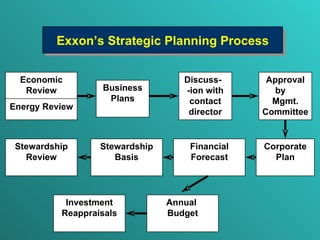

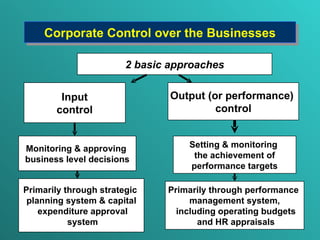

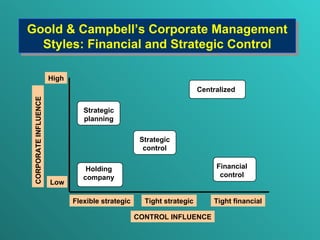

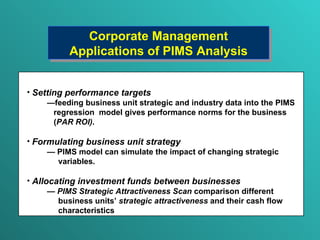

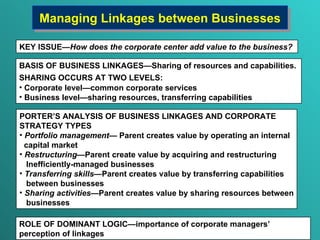

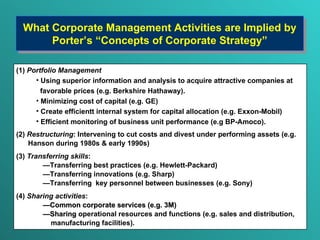

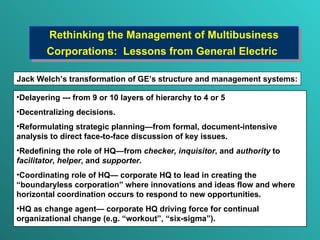

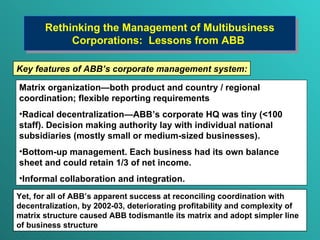

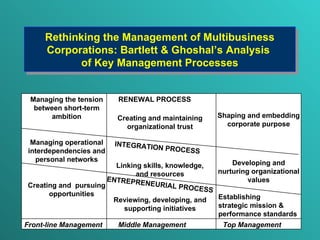

This document outlines theories and practices related to managing multibusiness corporations. It discusses the multidivisional structure and its efficiency advantages. It also examines challenges like balancing decentralization and standardization. The document reviews the functions of corporate management and the development of strategic planning techniques like portfolio models. It discusses uses and limitations of these models as well as trends like delayering decision making and reformulating strategic planning processes.