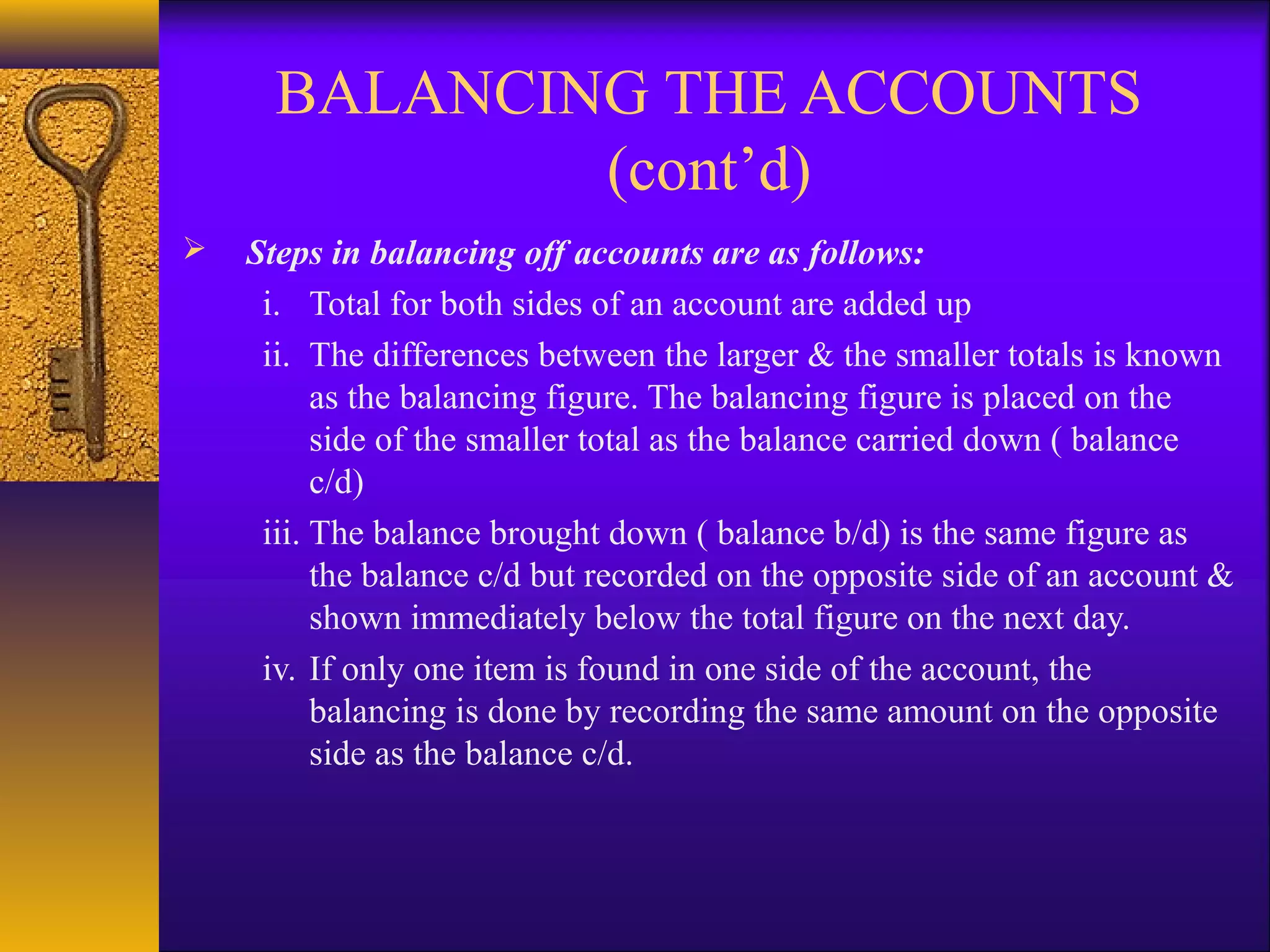

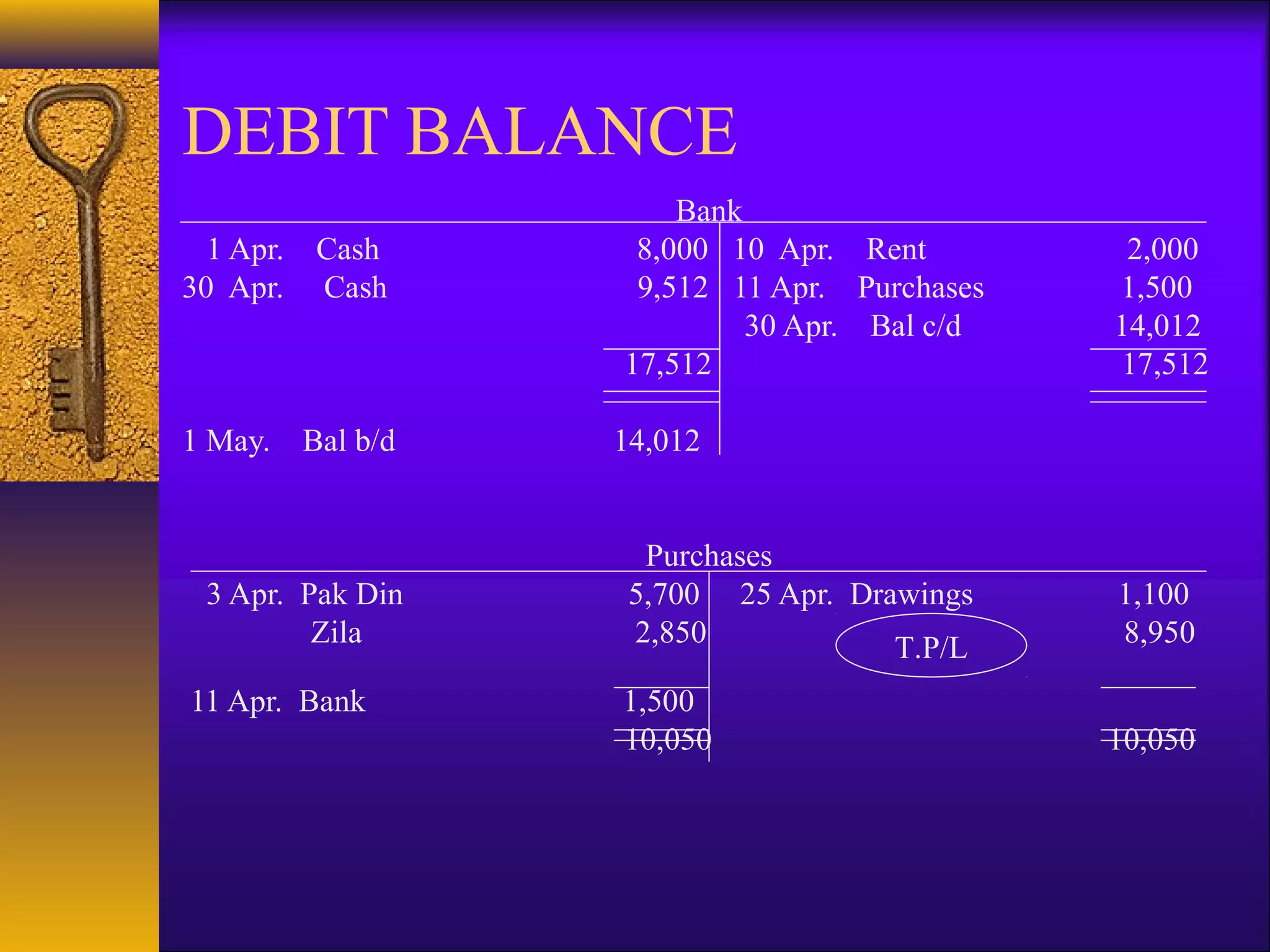

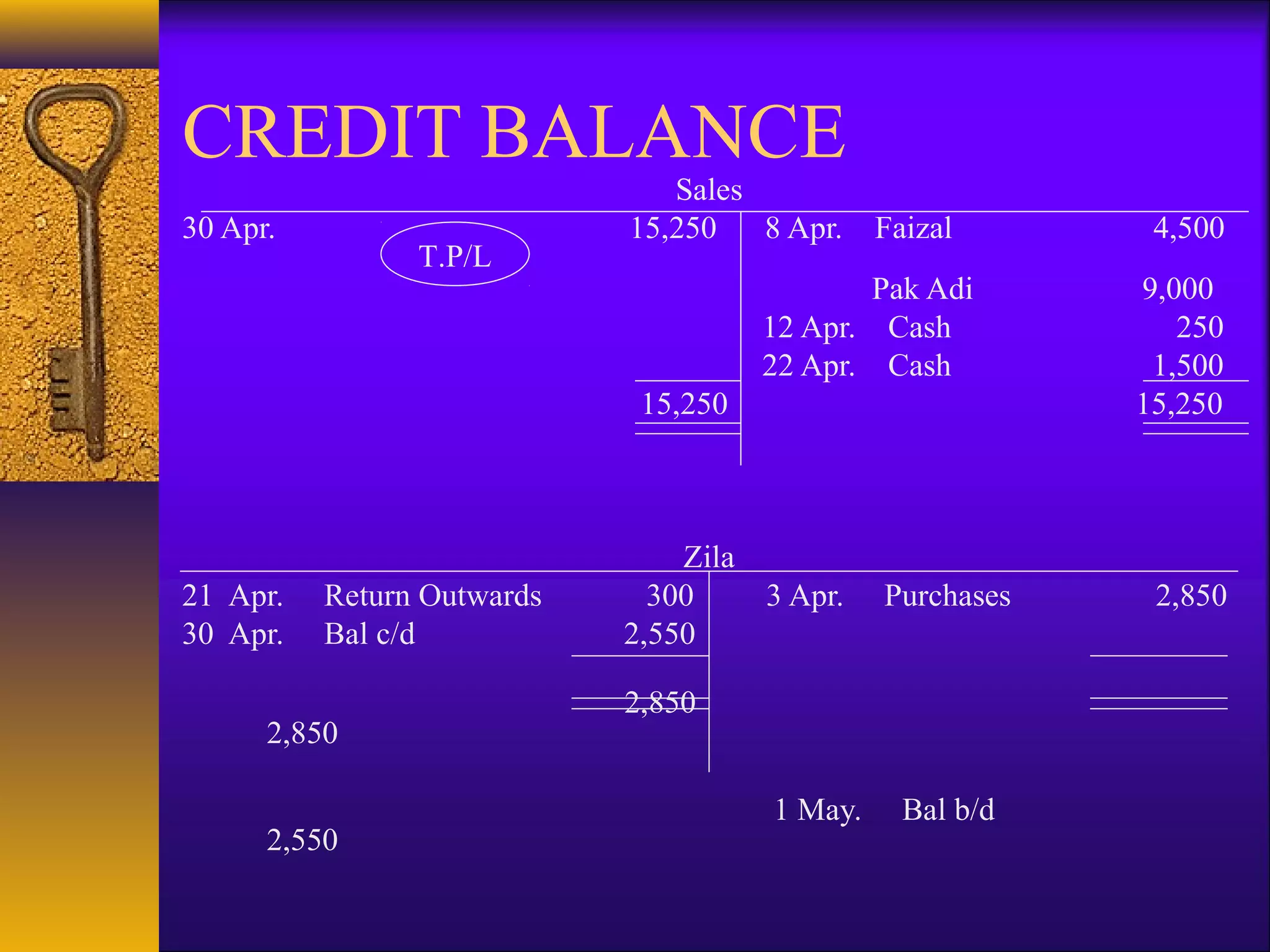

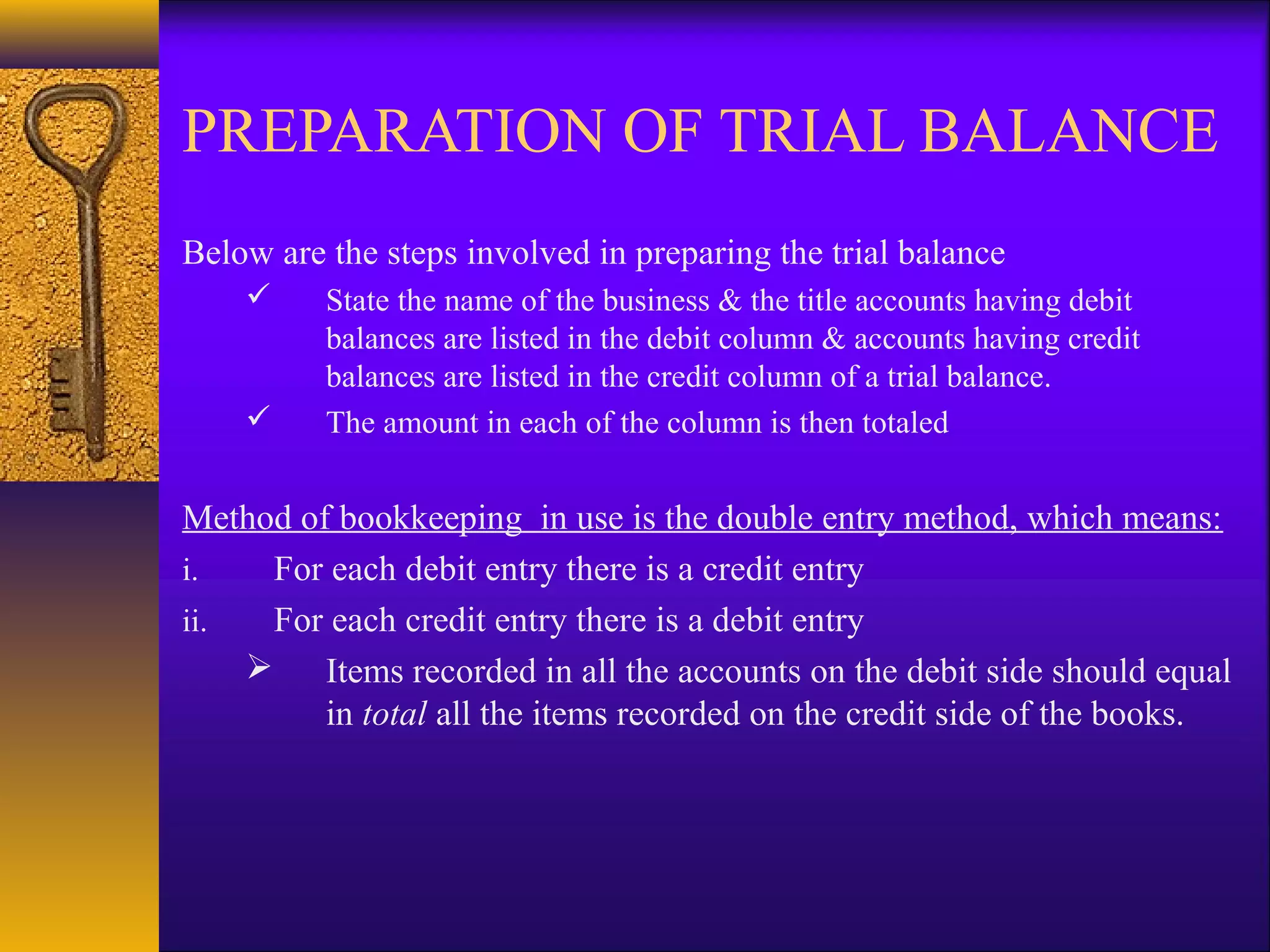

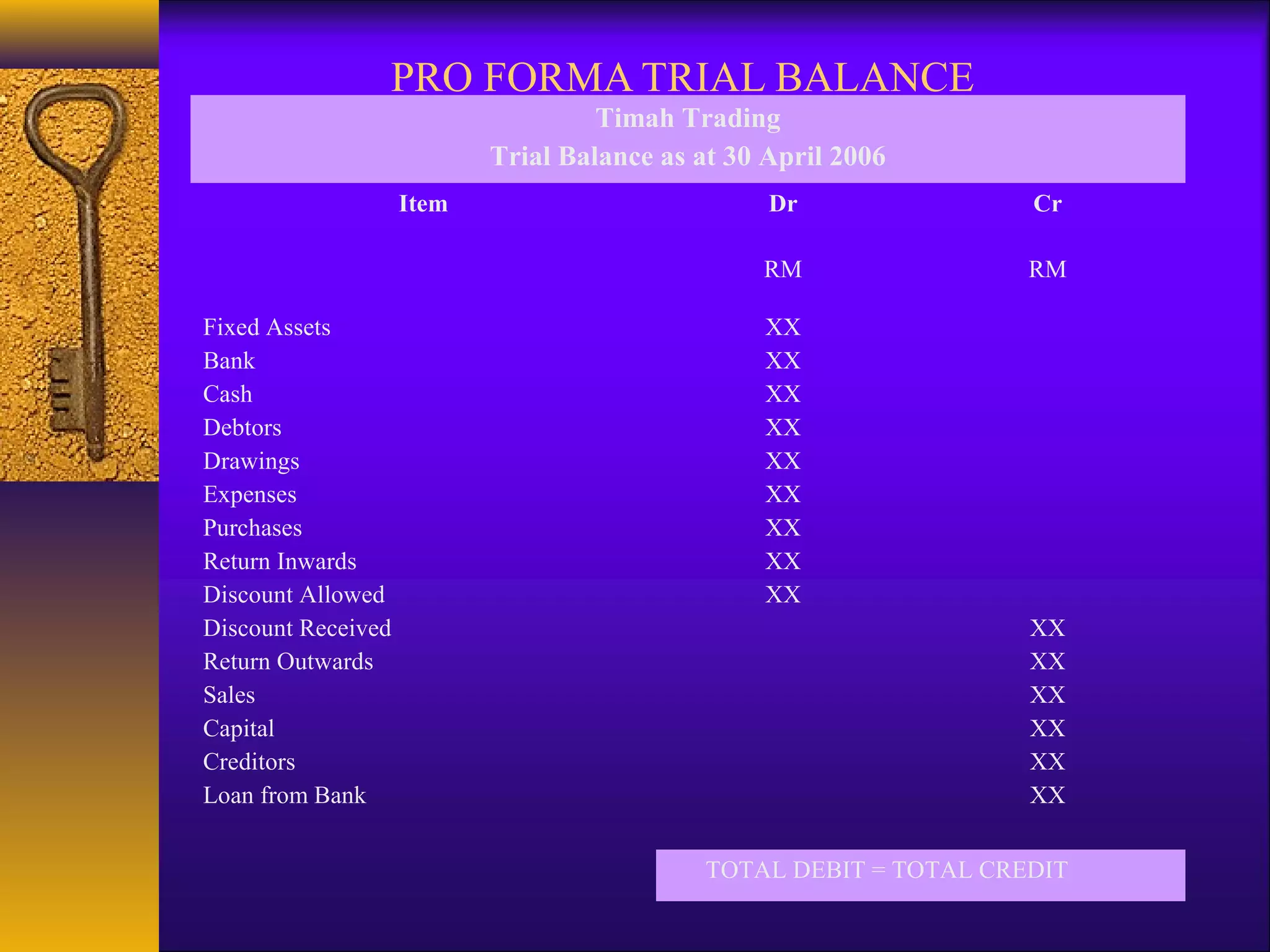

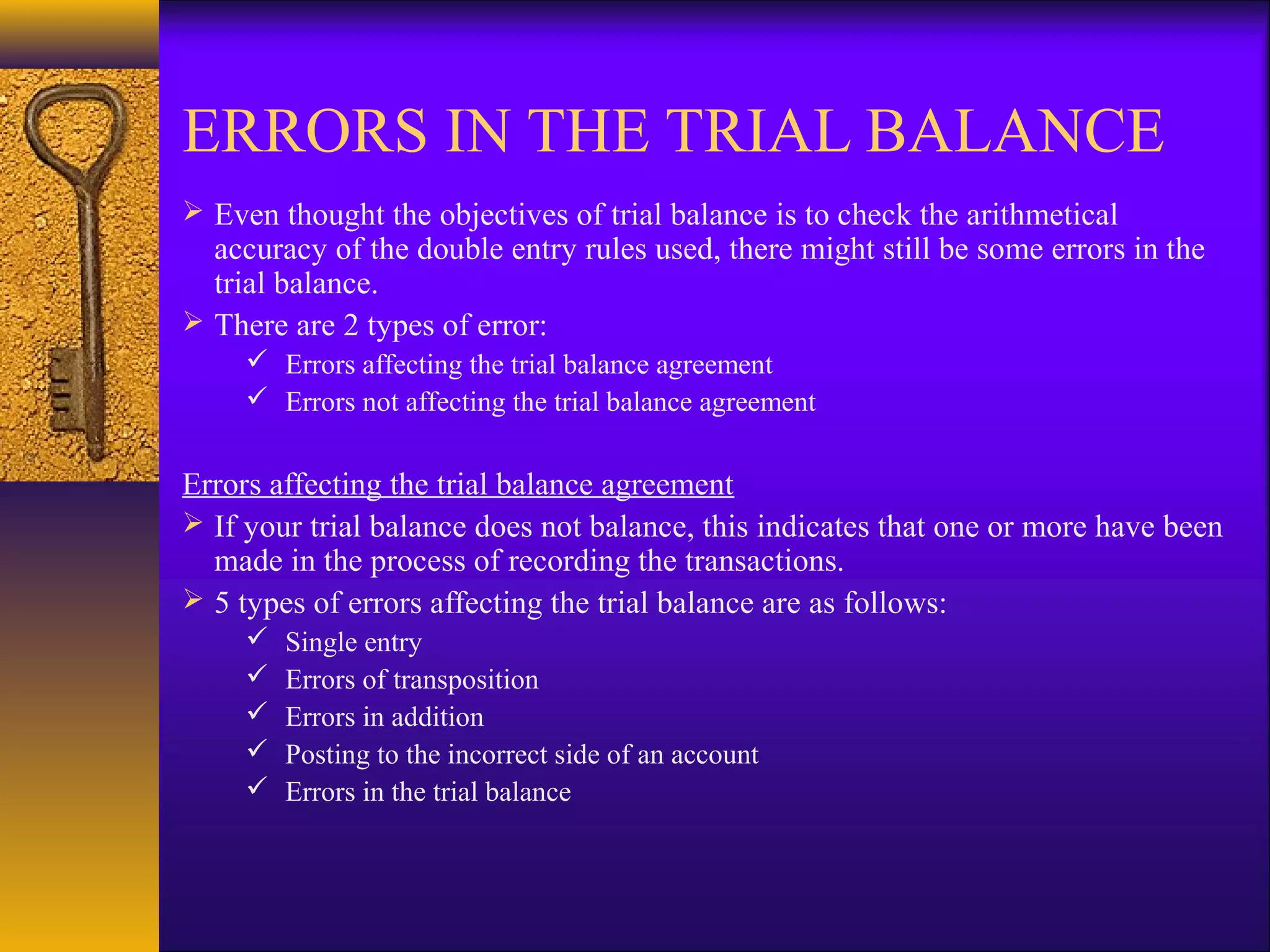

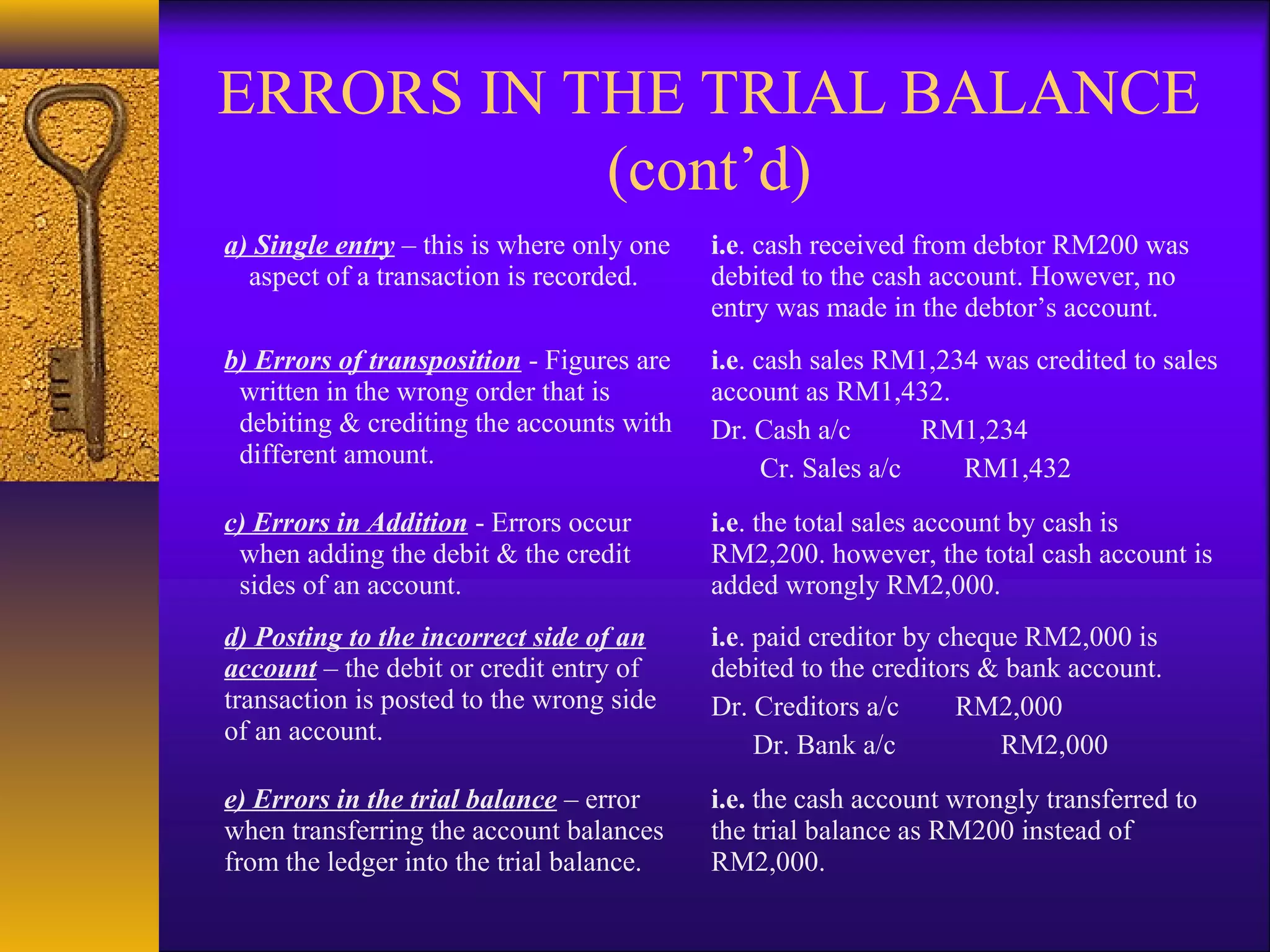

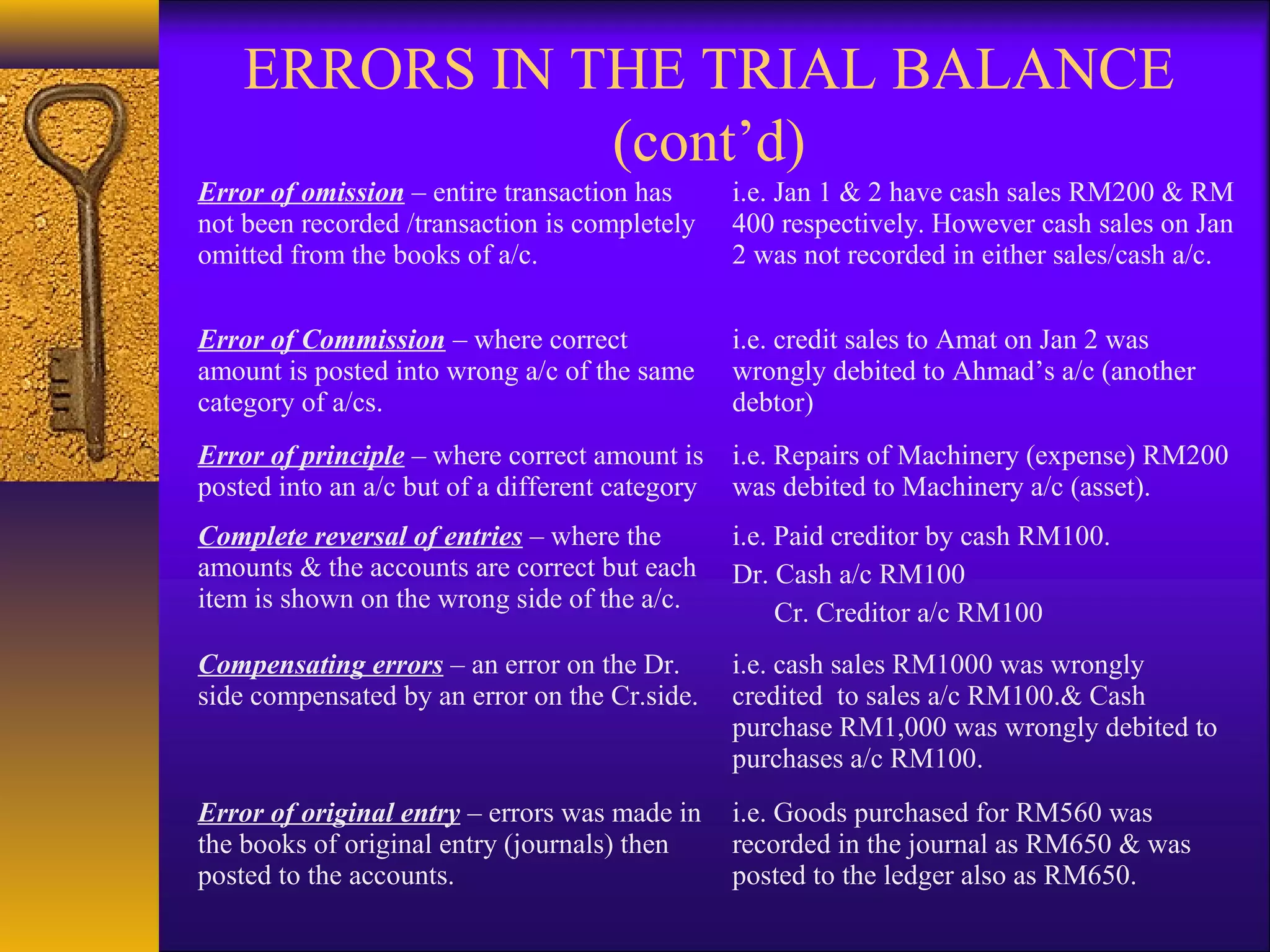

The document discusses balancing accounts and trial balances. It defines [1] balancing accounts as equalizing debit and credit totals to find account balances, [2] trial balances as lists of ledger account balances used to check the accuracy of double-entry bookkeeping. The key steps are: [1] balancing each account, [2] preparing a trial balance where total debits equal total credits, and [3] identifying possible errors if the trial balance is not in balance.