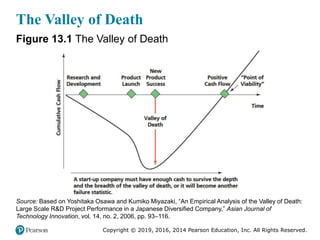

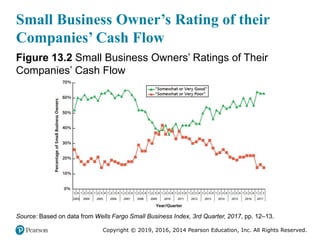

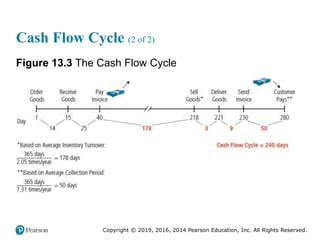

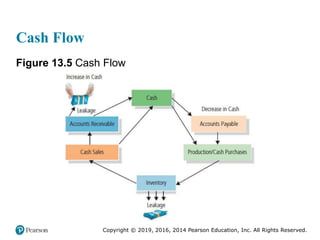

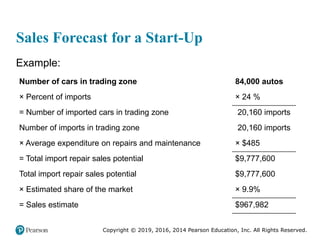

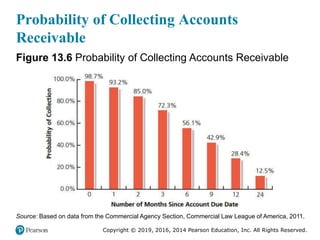

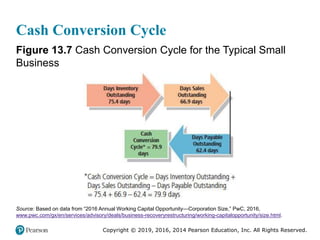

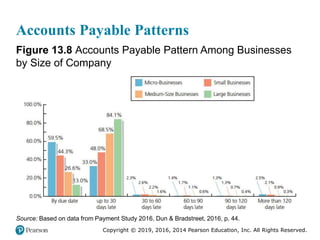

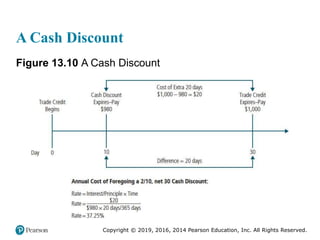

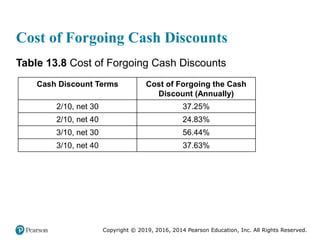

Managing cash flow is essential for a small business's success. Cash flow refers to the timing of a business's cash inflows and outflows, and is different from profits. The document outlines five steps to create a cash budget: 1) determining a minimum cash balance, 2) forecasting sales, 3) forecasting cash receipts, 4) forecasting cash disbursements, and 5) estimating the end-of-month balance. Managing accounts receivable, accounts payable, and inventory, known as the "Big Three", is also important for cash flow. Techniques to avoid cash flow crises include accelerating cash collections, stretching payment times, and minimizing inventory levels.