This document provides an overview of various capital budgeting techniques. It begins by introducing capital budgeting techniques under certainty, which are divided into non-discounted cash flow criteria and discounted cash flow criteria. The non-discounted criteria discussed are payback period and accounting rate of return. The discounted cash flow criteria discussed are net present value, internal rate of return, and profitability index. The document then explores each technique in detail and discusses their strengths and weaknesses for evaluating investment projects. It provides examples to illustrate how to calculate each technique.

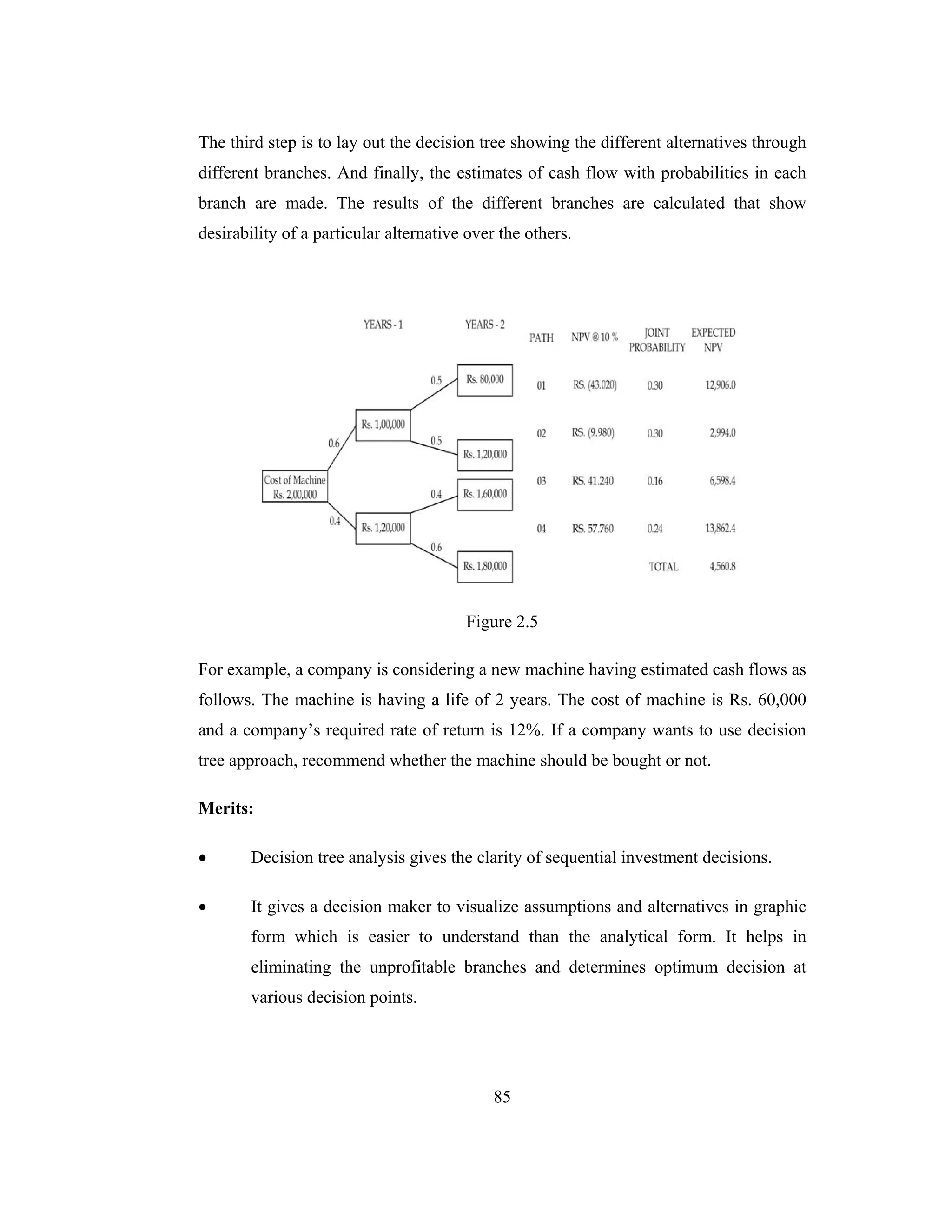

![36

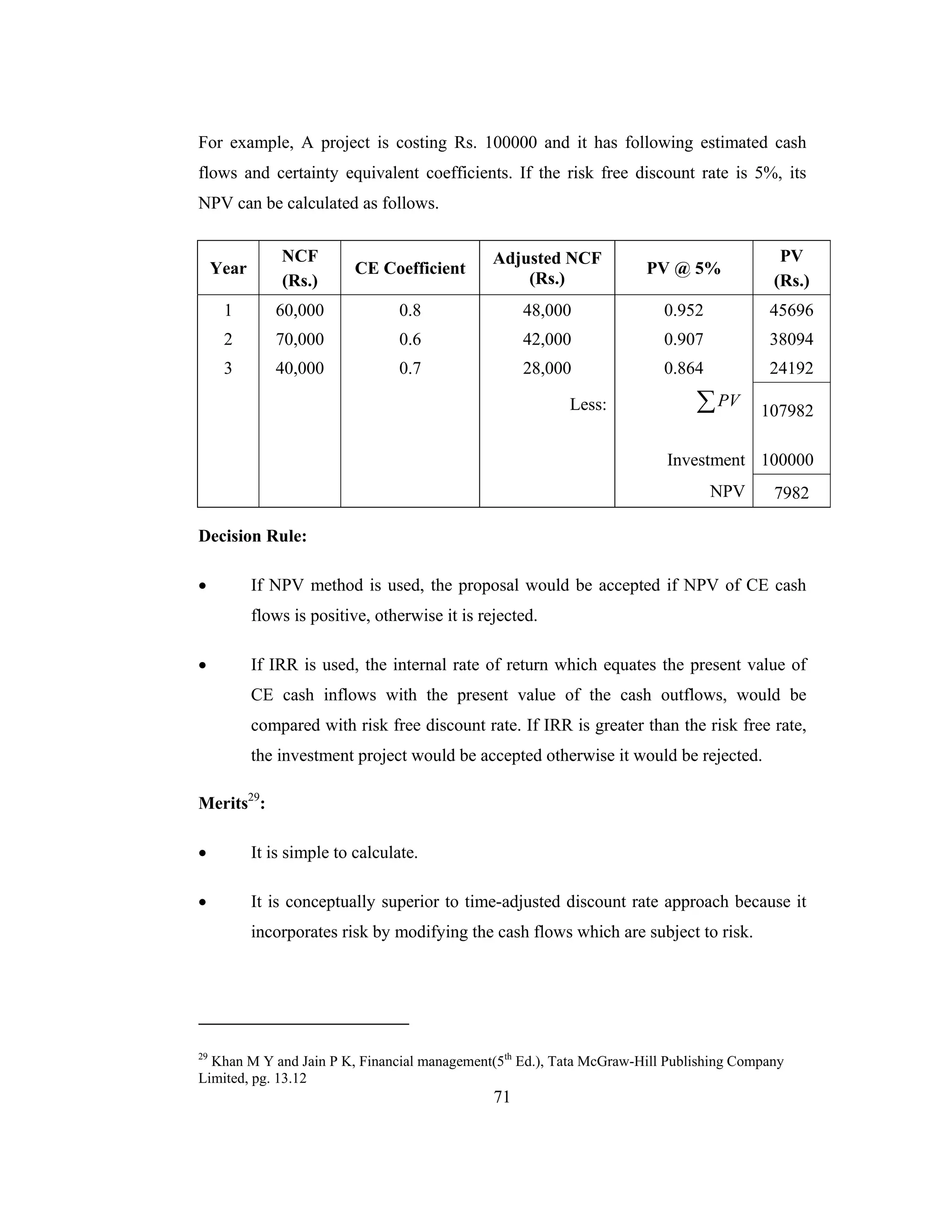

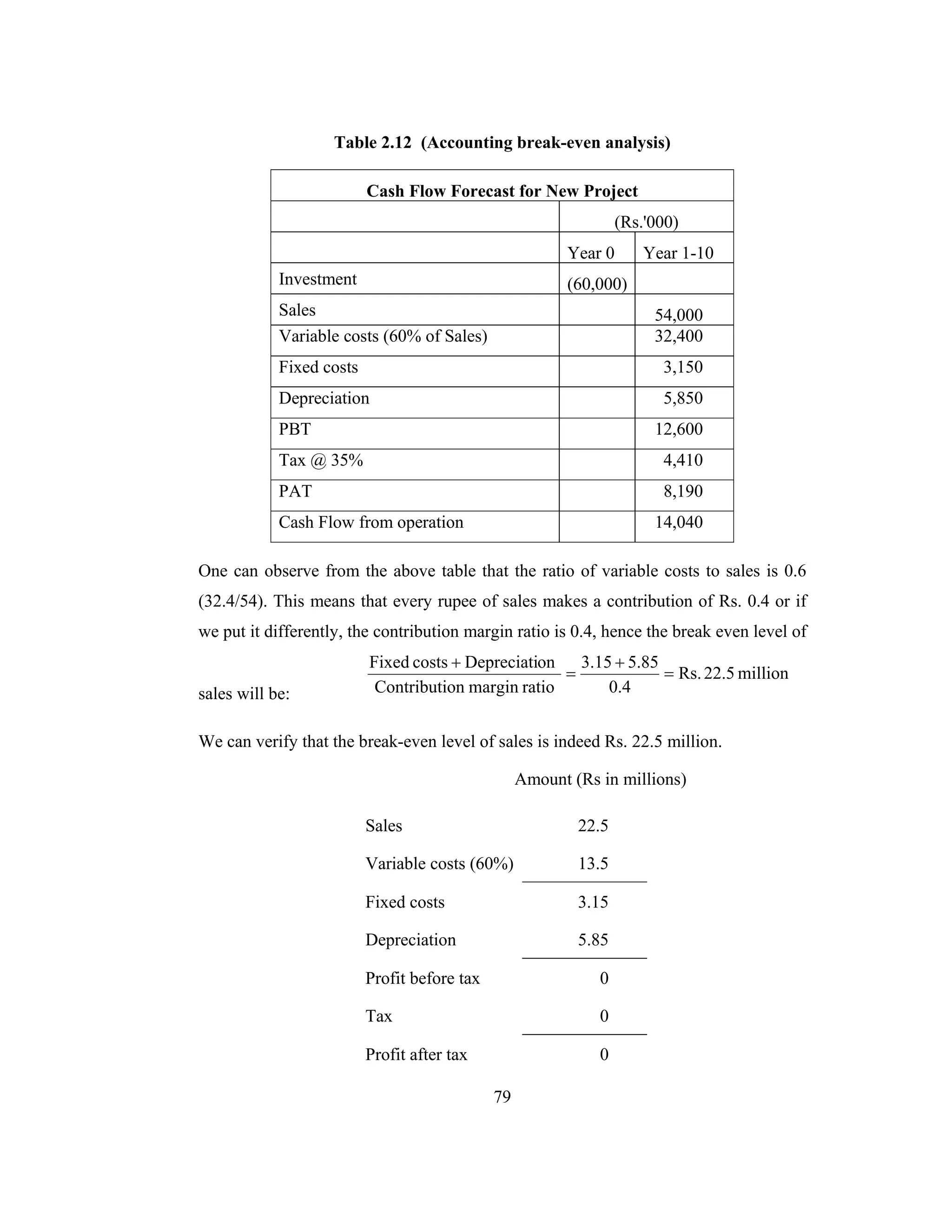

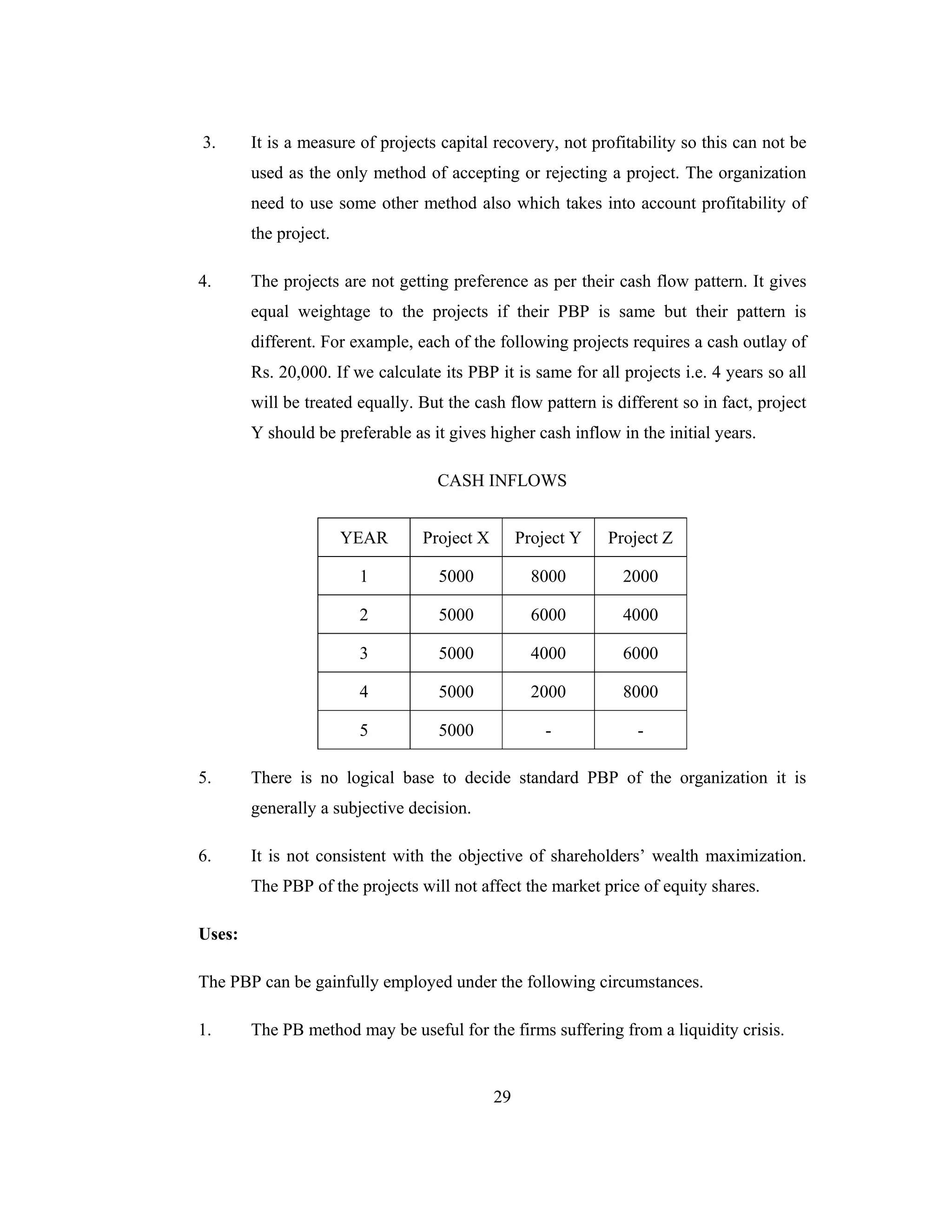

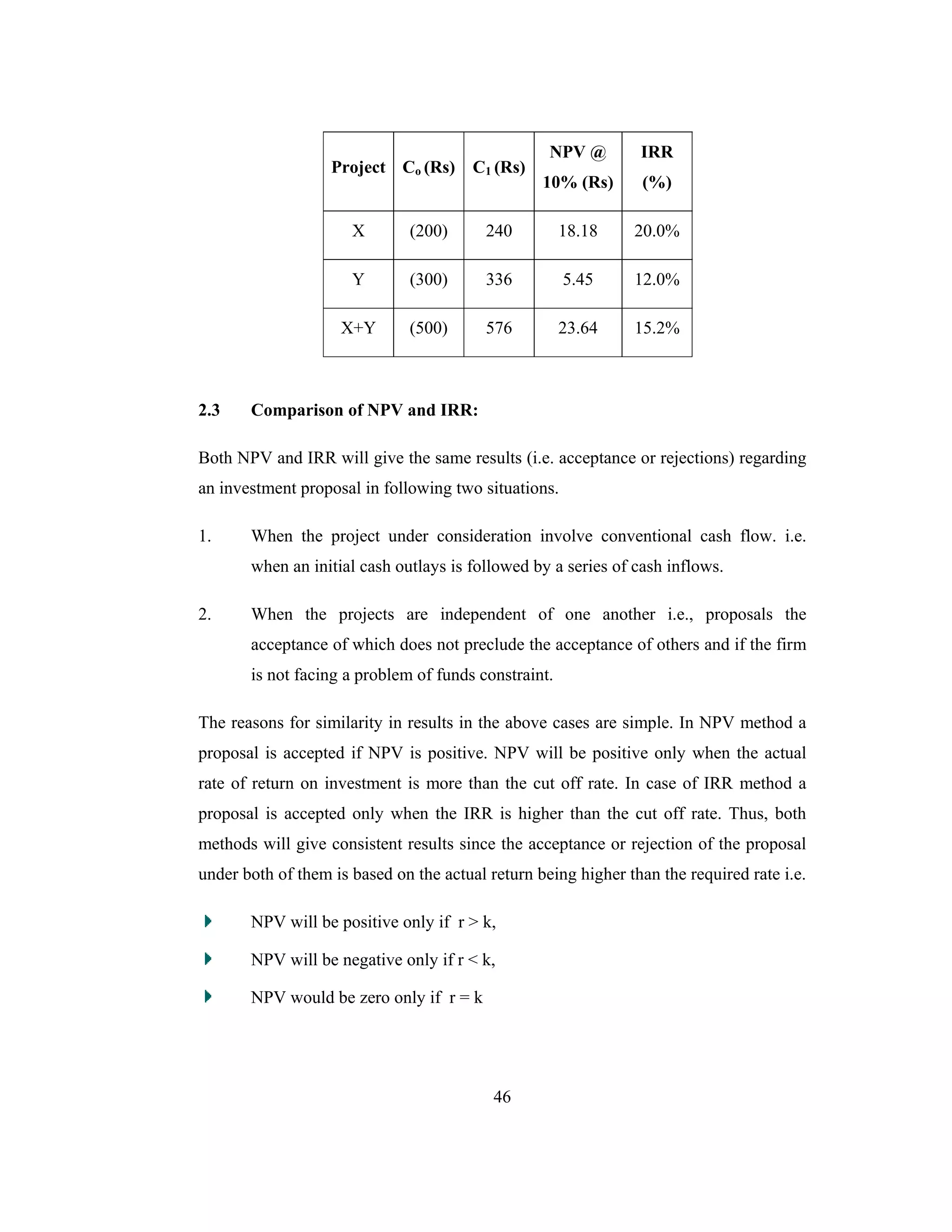

Decision Rule:

The present value method can be used as an accept-reject criterion. The present value

of the future cash streams or inflows would be compared with present value of

outlays. The present value outlays are the same as the initial investment.

If the NPV is greater than 0, accept the project.

If the NPV is less than 0, reject the project.

Symbolically, accept-reject criterion can be shown as below:

PV > C → Accept [NPV > 0]

PV < C → Reject [NPV < 0]

Where, PV is present value of inflows and C is the outlays

This method can be used to select between mutually exclusive projects also. Using

NPV the project with the highest positive NPV would be ranked first and that project

would be selected. The market value of the firm’s share would increase if projects

with positive NPVs are accepted.4

For example,

Calculate NPV for a Project X initially costing Rs. 250000. It has 10% cost of capital.

It generates following cash flows:

4

Van Horne, J.C., Financial Management and Policy, Prentice-Hall of India, 1974, p.74](https://image.slidesharecdn.com/capitalbudgetingirrarr-170602182227/75/Capital-budgeting-irr-arr-14-2048.jpg)

![57

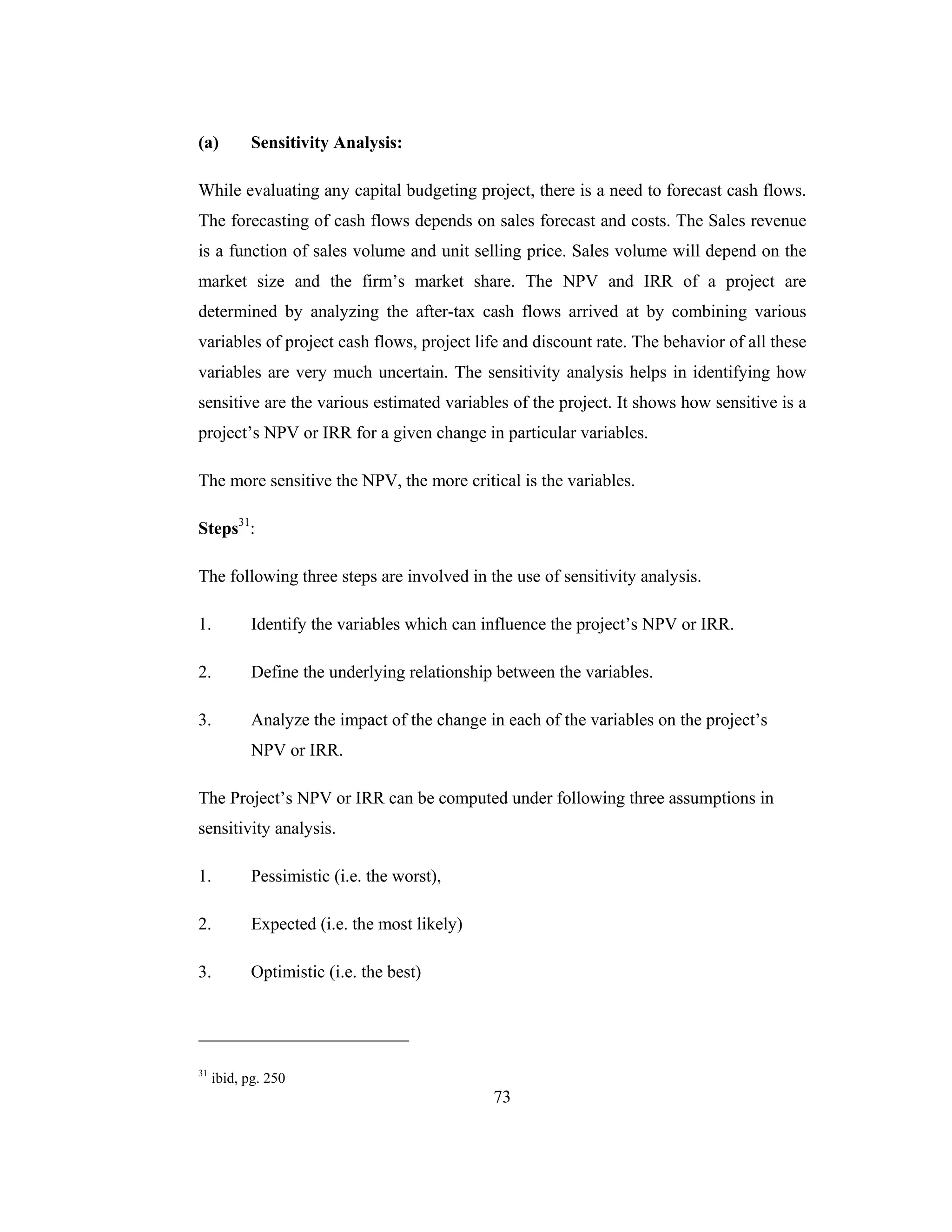

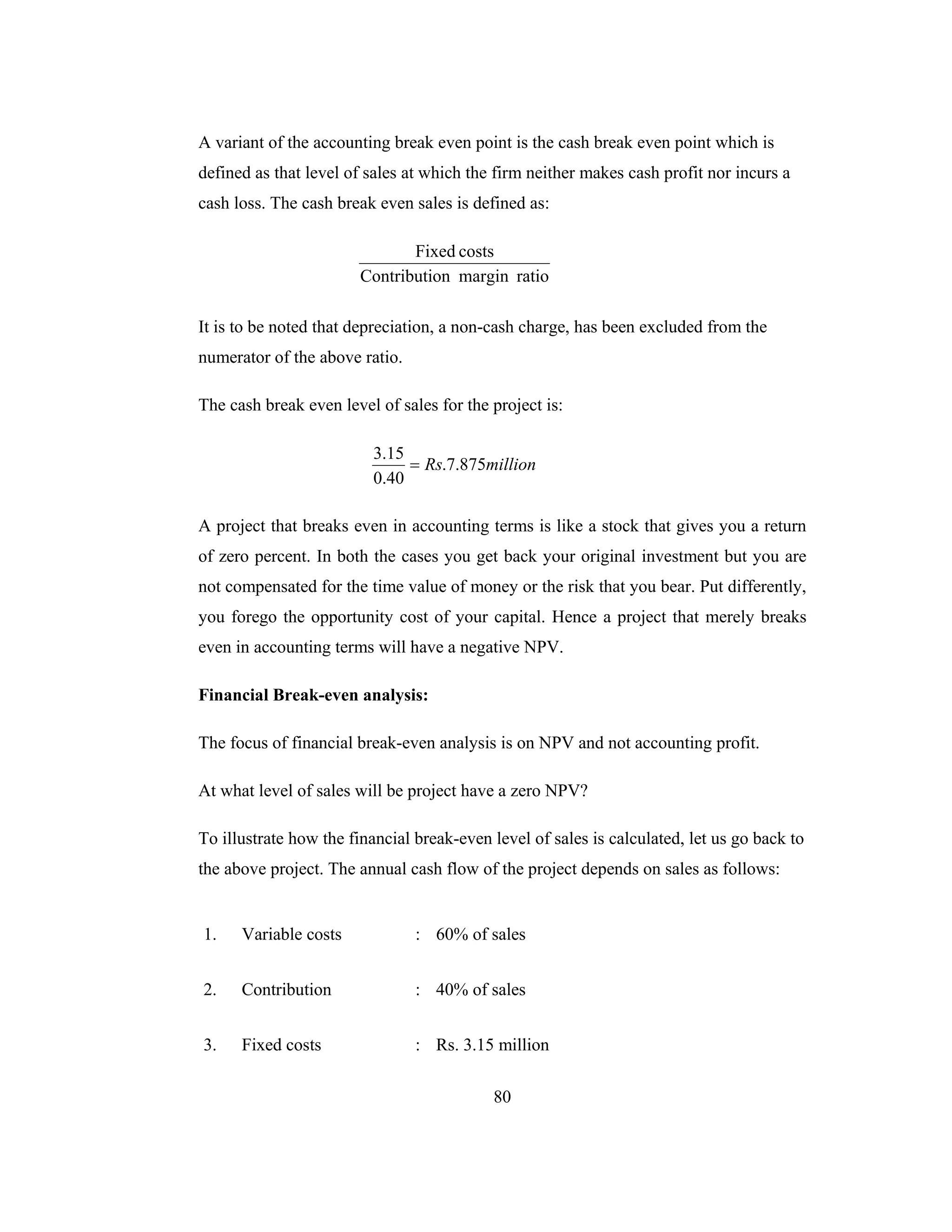

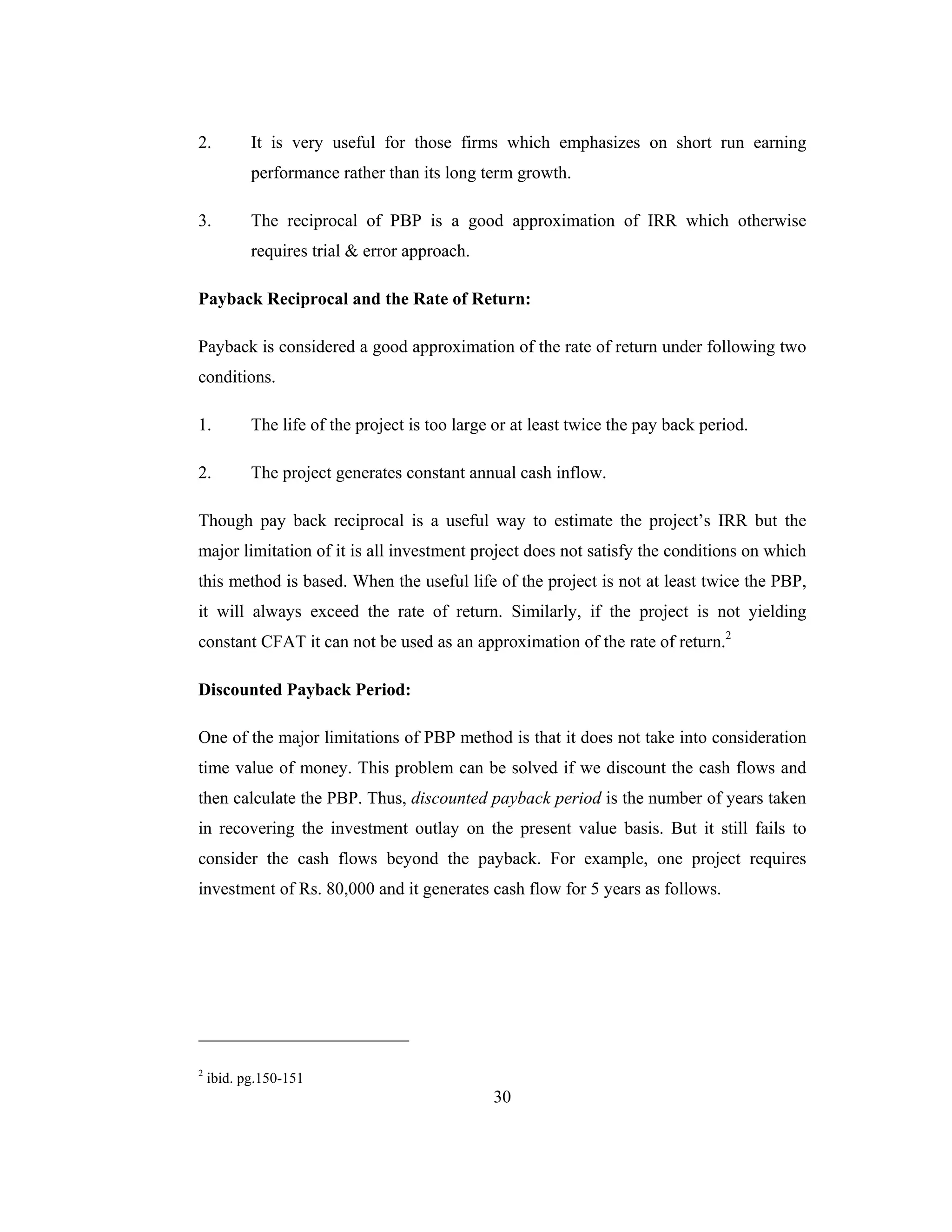

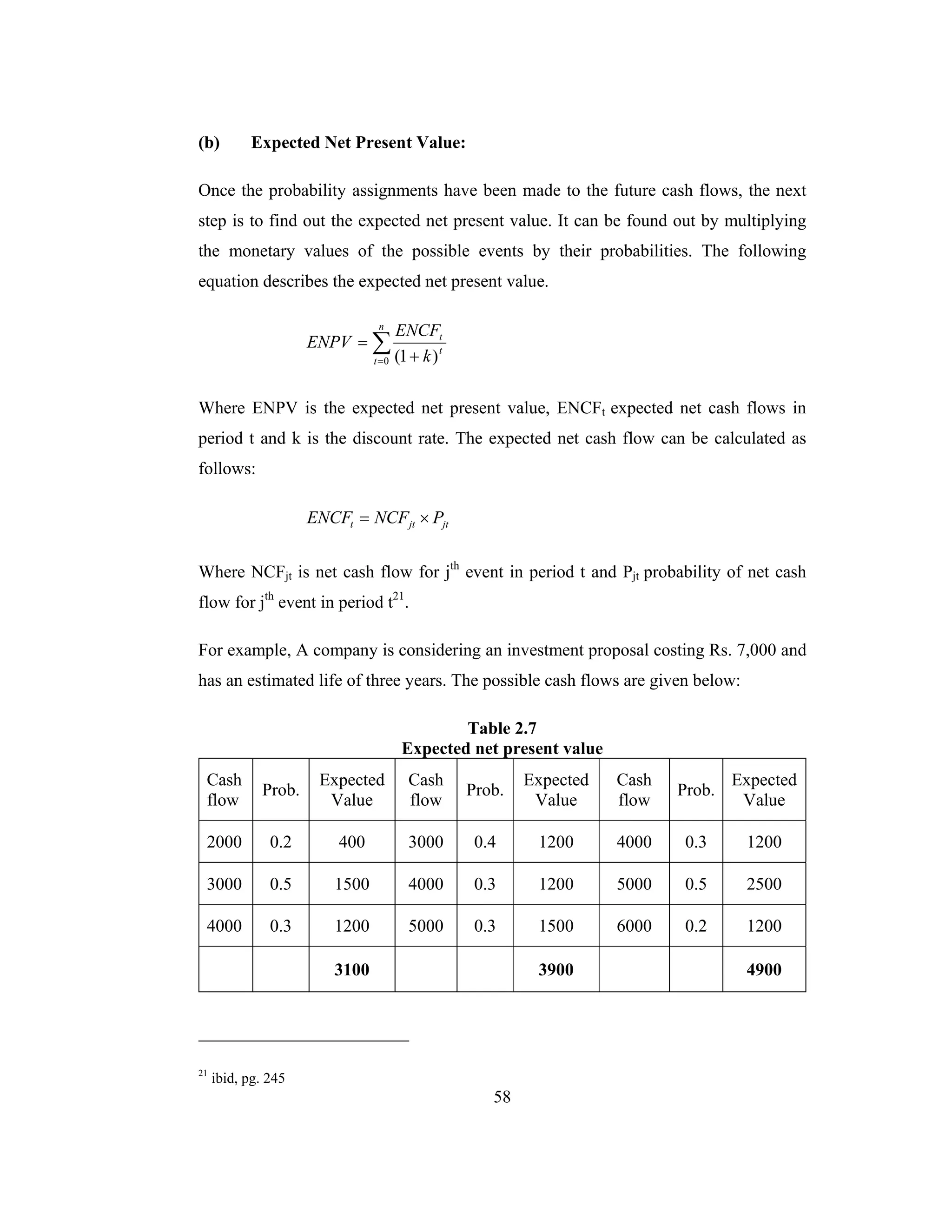

2.6.1 Statistical Techniques for Risk Analysis:

(a) Probability Assignment

(b) Expected Net Present Value

(c) Standard Deviation

(d) Coefficient of Variation

(e) Probability Distribution Approach

(f) Normal Probability Distribution

(a) Probability Assignment:

The concept of probability is fundamental to the use of the risk analysis techniques. It

may be defined as the likelihood of occurrence of an event. If an event is certain to

occur, the probability of its occurrence is one but if an event is certain not to occur,

the probability of its occurrence is zero. Thus, probability of all events to occur lies

between zero and one.

The classical view of probability holds that one can talk about probability in a very

large number of times under independent identical conditions. Thus, the probability

estimate, which is based on a large number of observations, is known as an objective

probability. But this is of little use in analyzing investment decisions because these

decisions are non-repetitive in nature and hardly made under independent identical

conditions over time. The another view of probability holds that it makes a great deal

of sense to talk about the probability of a single event without reference to the

repeatability long run frequency concept. Therefore, it is perfectly valid to talk about

the probability of sales growth will reach to 4%, the probability of rain tomorrow or

fifteen days hence. Such probability assignments that reflect the state of belief of a

person rather than the objective evidence of a large number of trials are called

personal or subjective probabilities20

.

20

Pandey I M: Financial Management [9th ed.], Vikas Publishing House Pvt Ltd, pg. 244](https://image.slidesharecdn.com/capitalbudgetingirrarr-170602182227/75/Capital-budgeting-irr-arr-35-2048.jpg)

![70

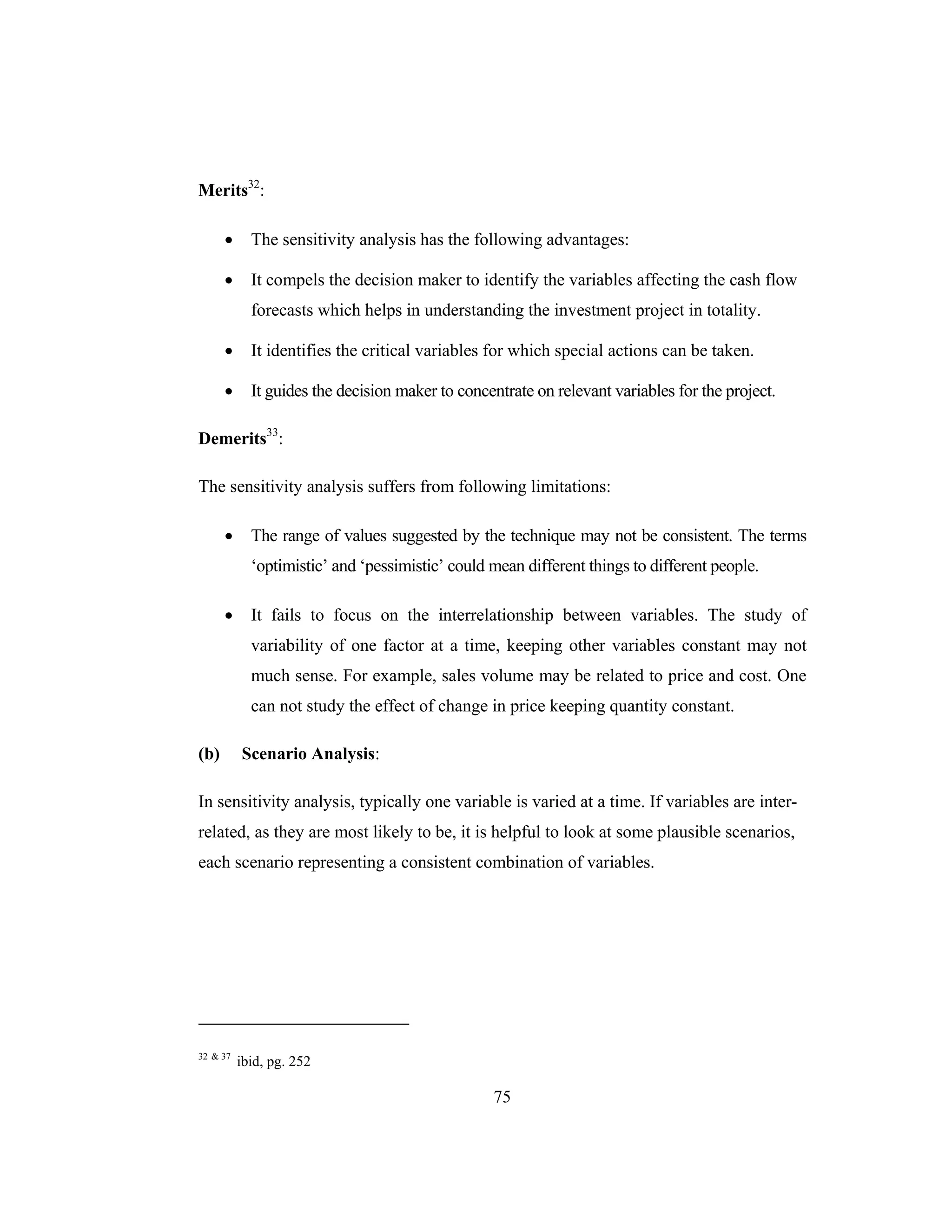

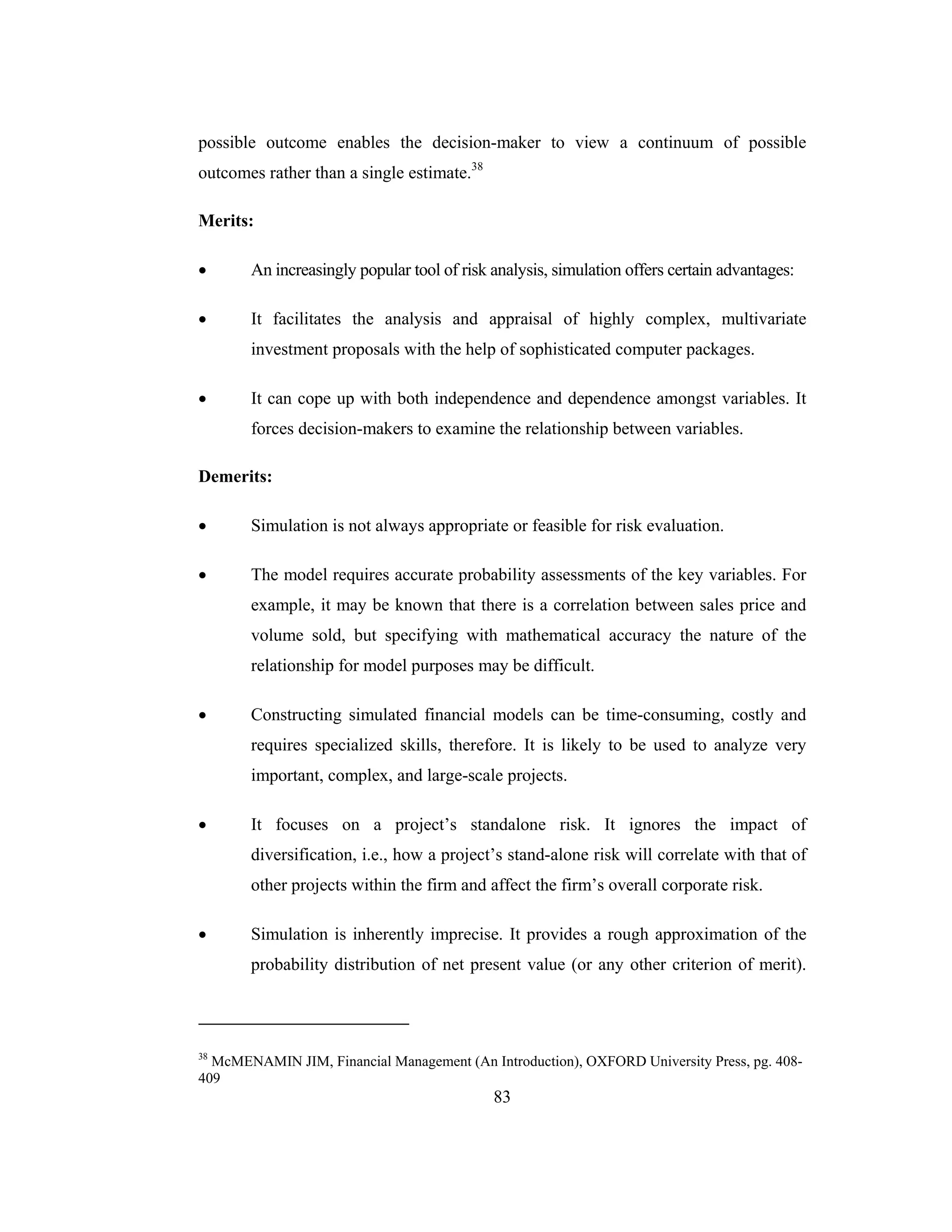

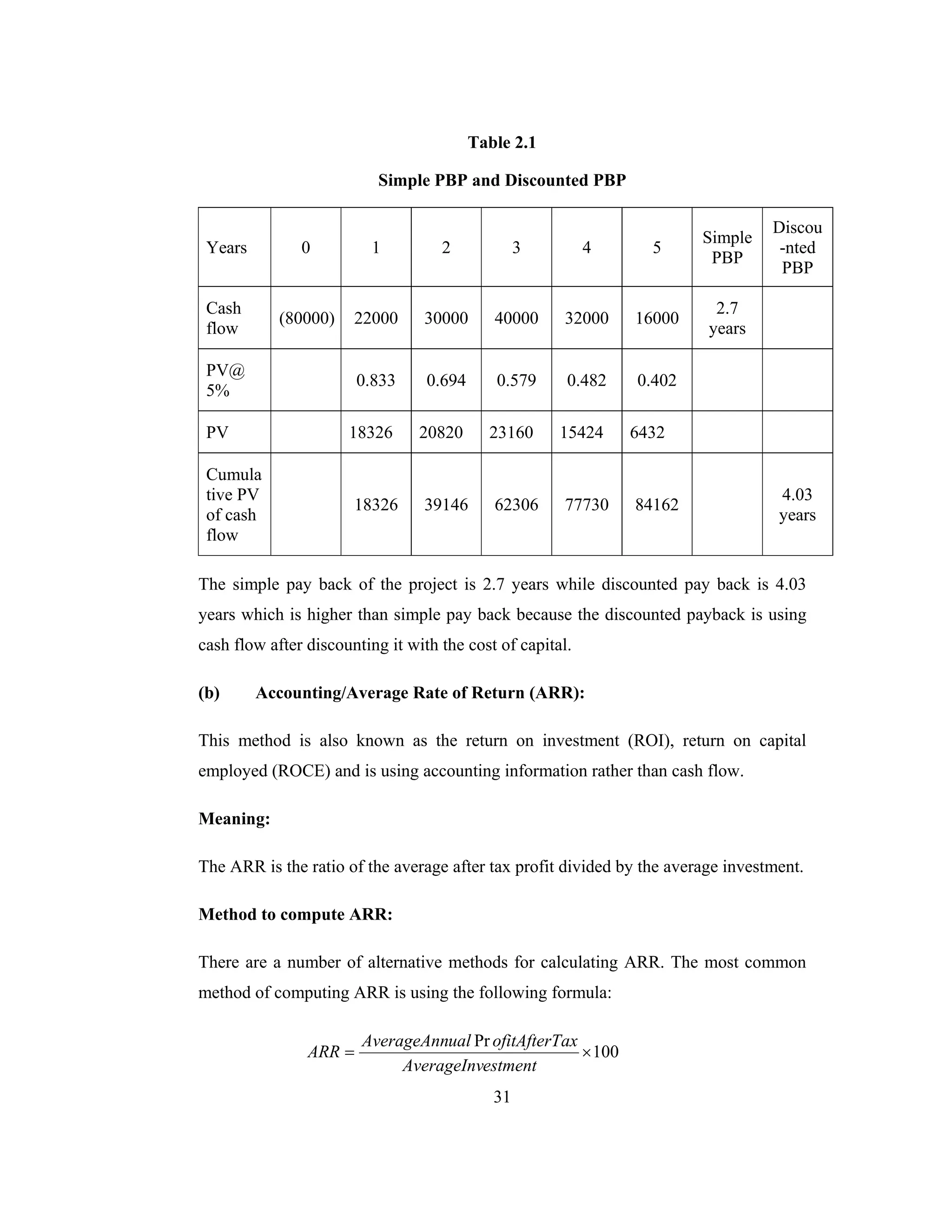

• Thus, this approach can be best described as a crude method of incorporating

risk into capital budgeting. 28

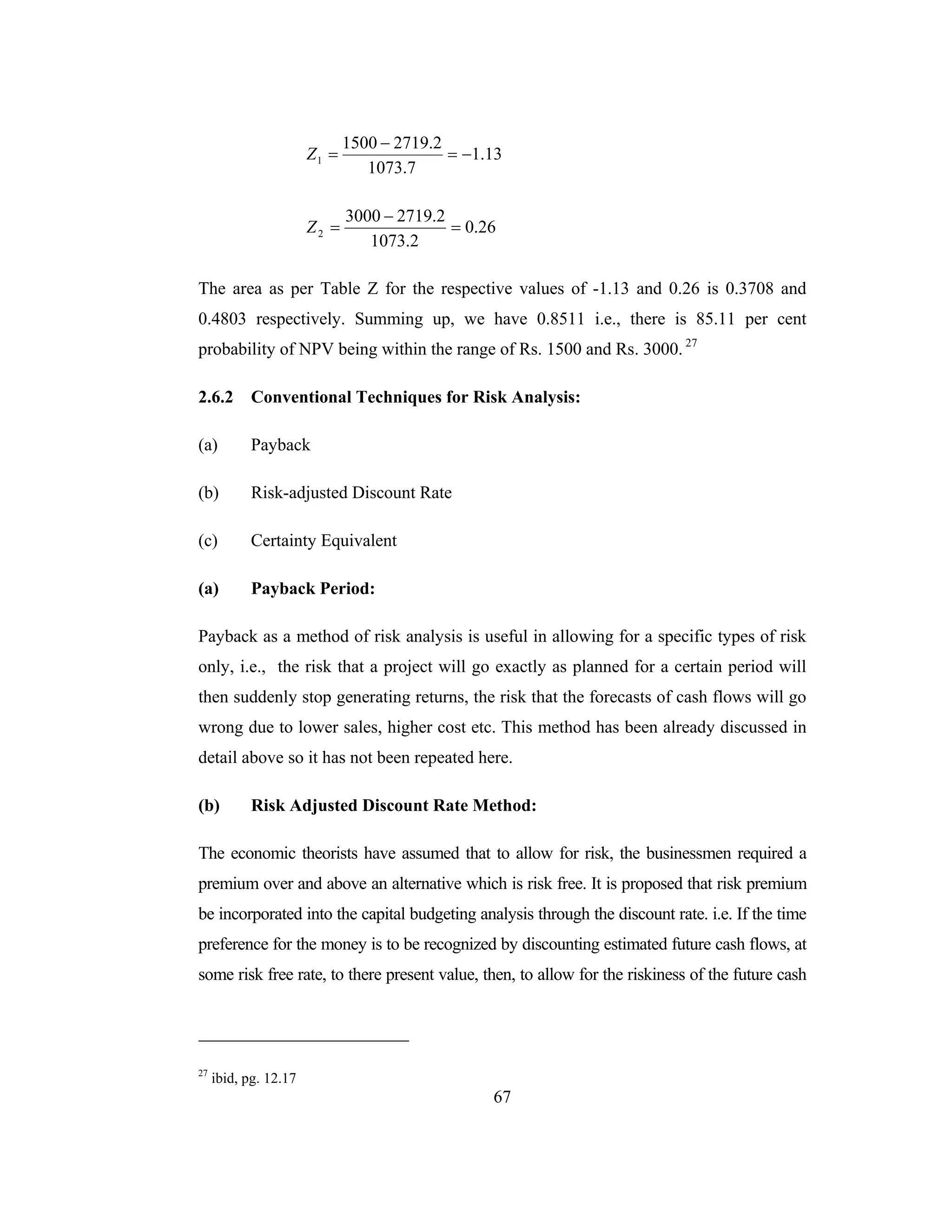

(c) Certainty Equivalent Approach:

This approach to incorporate risk in evaluating investment projects, overcomes

weaknesses of the RADR approach. Under this approach riskiness of project is taken

into consideration by adjusting the expected cash flows and not discount rate. This

method eliminates the problem arising out of the inclusion of risk premium in the

discounting process.

The certainty equivalent coefficient )( 1α can be determined as a relationship between

the certain cash flows and the uncertain cash flows. For example, if a company

expected a risky cash flow of Rs. 90,000 and a risk free cash flow of Rs. 65,000 then

its 1α will be calculated as follows:

7222.0

90000

65000

*

====

lowRiskycashf

shflowRiskfreeca

NCF

NCF

t

t

tα

The certainty equivalent coefficient ( )tα assumes a value between 0 and 1 and varies

inversely with risk. The higher the risk, the lower the tα and the lower the risk, the

higher the tα . The certainty equivalent approach can be expressed in the form of

equation as follows:

∑= +

=

n

t

t

f

tt

k

NCF

NPV

0 )1(

α

where, NCFt = Net cash flow,

tα = the certainty equivalent coefficient,

kf = Risk free rate

28

Pandey I M: Financial Management [9th

ed.], Vikas Publishing House Pvt Ltd, pg. 248](https://image.slidesharecdn.com/capitalbudgetingirrarr-170602182227/75/Capital-budgeting-irr-arr-48-2048.jpg)