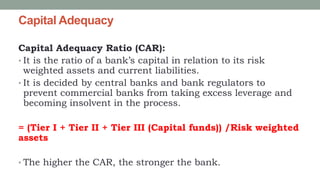

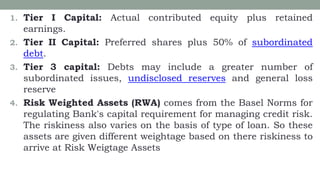

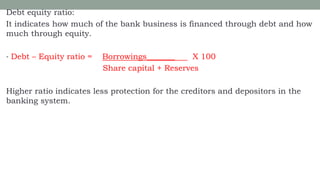

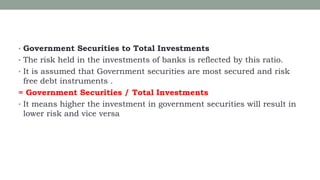

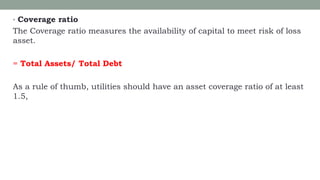

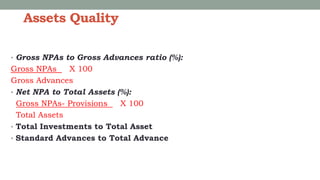

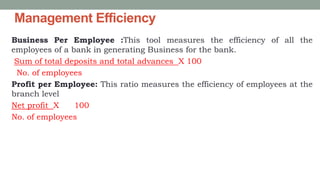

This document discusses various metrics used to evaluate the capital adequacy, asset quality, management efficiency, earnings quality, and liquidity of banks. It defines the capital adequacy ratio and its components like tier 1, 2, and 3 capital and risk weighted assets. It also covers other ratios like debt-equity, advances to assets, government securities to investments, gross NPAs to advances, investments to assets, business and profit per employee, credit deposit ratio, return on assets, net interest margin, liquid assets to deposits and demand deposits. All these metrics are used by regulators to evaluate the financial health and riskiness of commercial banks.