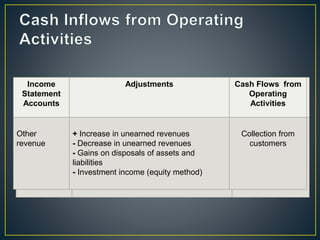

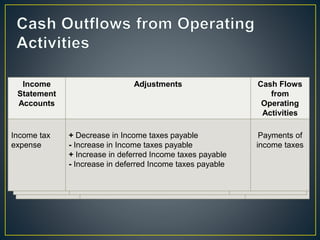

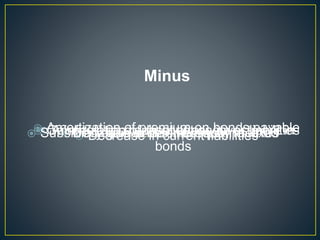

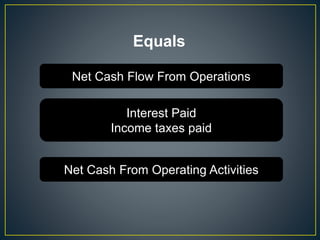

The document discusses the direct and indirect methods for reporting cash flows from operating activities according to PAS 7. It provides examples of income statement accounts and their related adjustments to reconcile net income to net cash flow from operating activities. Specifically, it discusses decreasing or increasing current assets and liabilities as adjustments to net income, along with other non-cash expenses like depreciation. The net cash flow from operations is calculated by adjusting net income for non-cash items and changes in balance sheet accounts and equals interest paid, income taxes paid, and net cash from operating activities.