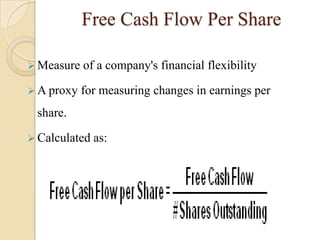

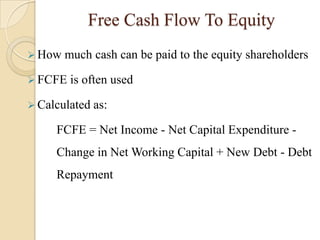

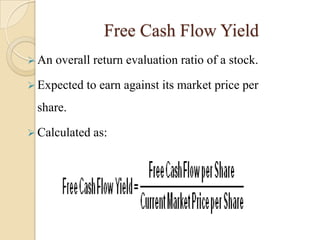

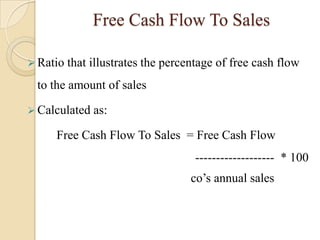

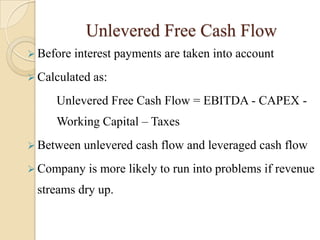

This document discusses various types of free cash flow metrics used to evaluate a company's financial performance and flexibility. It defines free cash flow, free cash flow per share, free cash flow to equity, free cash flow yield, free cash flow to sales, and unlevered free cash flow. Formulas are provided for calculating each metric.