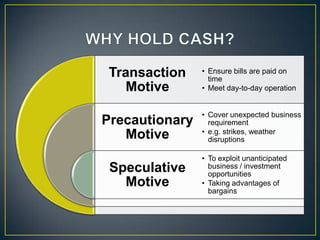

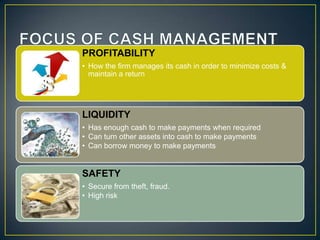

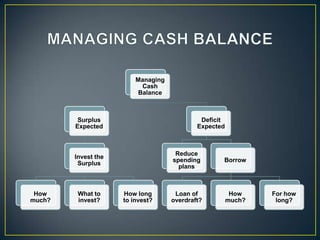

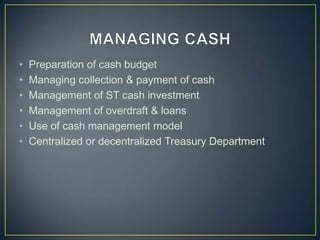

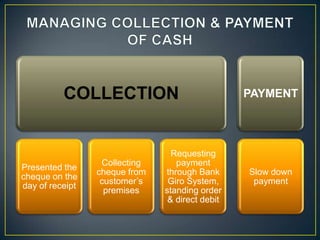

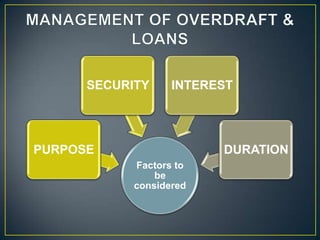

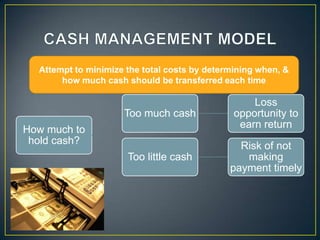

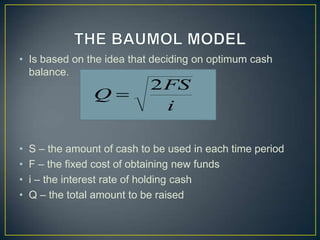

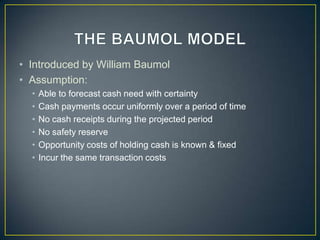

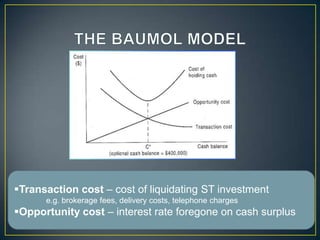

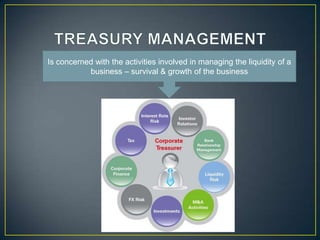

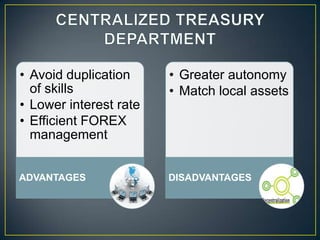

This document discusses cash management. It defines cash as actual cash held by a firm plus deposits that can be withdrawn on demand. It notes there are three motives for holding cash: transactional, precautionary, and speculative. It discusses techniques for accelerating cash collections and controlling payments. The key aspects of cash management are profitability, liquidity, and safety. It outlines strategies for managing cash surpluses or deficits, and factors to consider for cash investments. The cash budget and Baumol's cash management model are presented as tools for determining optimal cash levels. Large companies may have centralized or decentralized treasury departments to efficiently manage complex cash transactions.