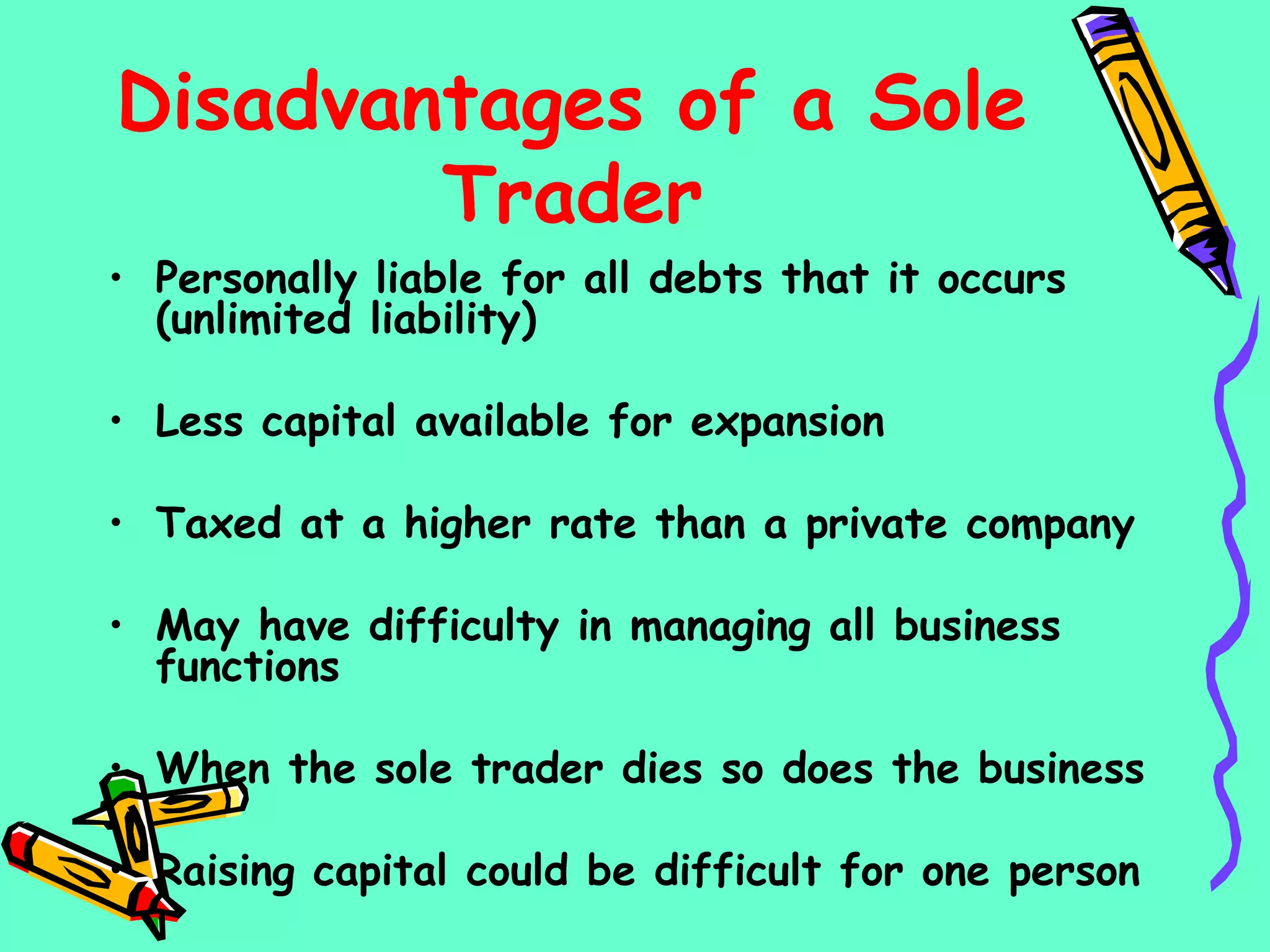

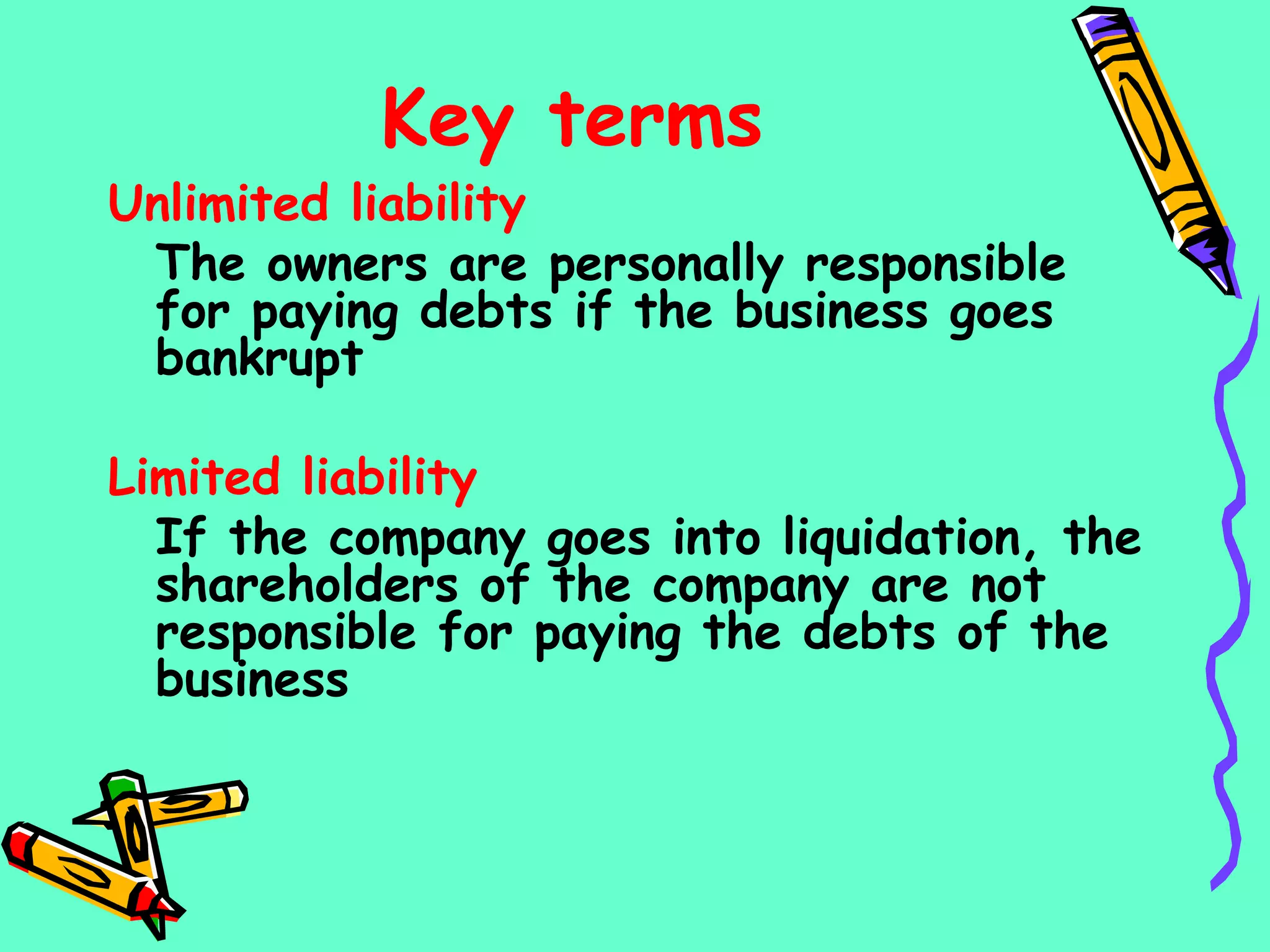

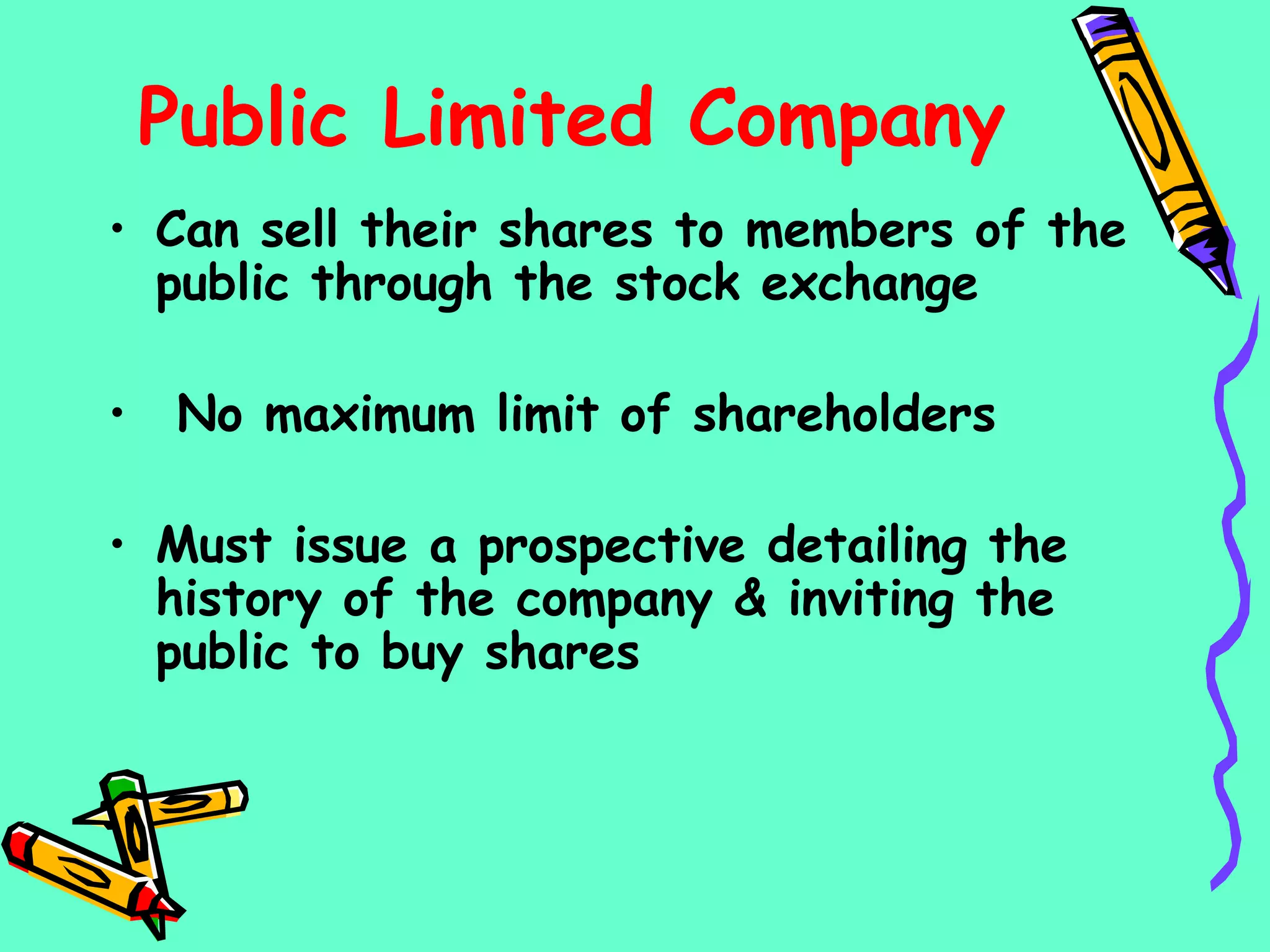

This document discusses different types of business structures including sole traders, partnerships, private limited companies, public limited companies, cooperatives, and franchises. It provides details on their key characteristics such as ownership, liability, management, and financing. For example, it states that a sole trader is an individual who owns and runs the business independently but has unlimited liability, while a partnership has between 2 to 20 partners who share profits but also have unlimited liability. It also outlines the differences between private and public limited companies in terms of shareholders, share trading, and financial reporting requirements.