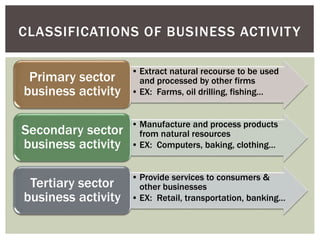

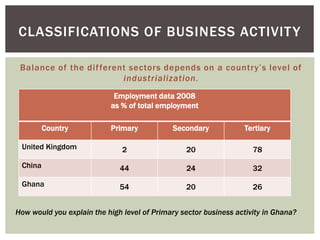

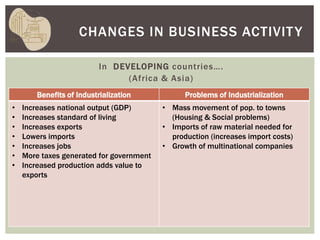

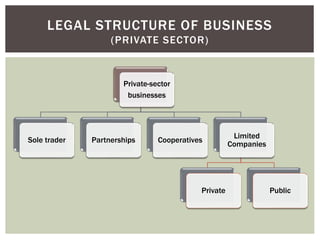

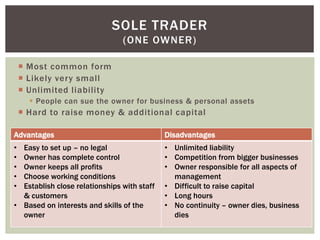

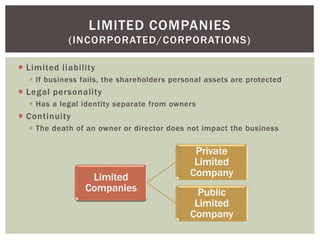

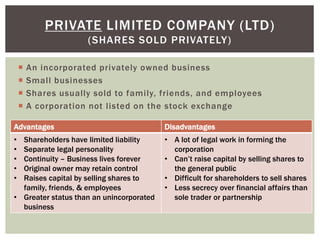

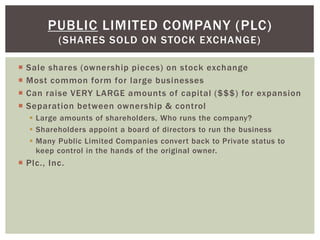

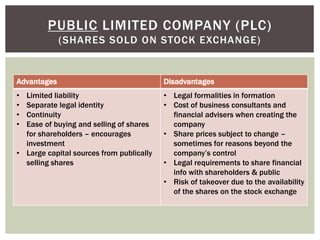

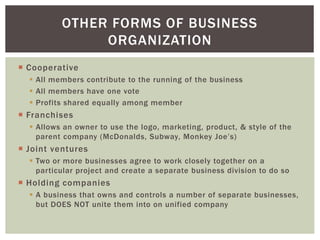

There are three main types of business structures: sole traders, partnerships, and limited companies. Sole traders have one owner with unlimited liability while partnerships have multiple owners with unlimited liability. Limited companies have shareholders with limited liability, can raise large amounts of capital through stock sales, and provide continuity. Countries also classify business activity as primary (extracting), secondary (manufacturing), or tertiary (services). Developing countries tend to have higher levels of primary activity while developed countries focus more on tertiary.