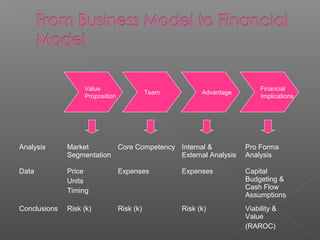

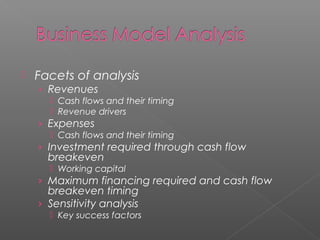

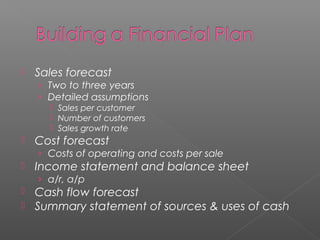

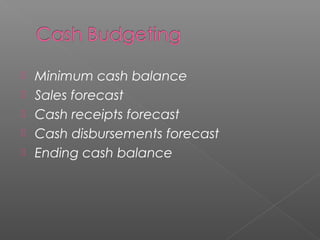

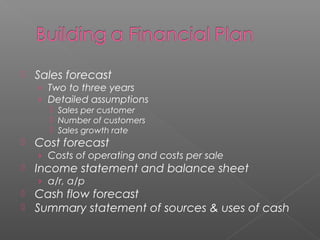

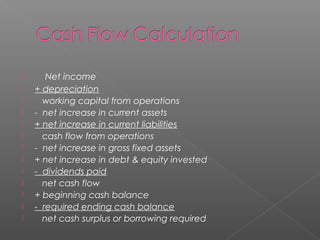

The document discusses the importance of developing a strong business model to identify opportunities, mitigate risks, and determine resource needs. An effective business model bridges ideas to action by explaining why a venture will be viable and valuable. It focuses on the value proposition, target markets, team strengths, competitive advantages, and financial projections without addressing specific "how" questions. Developing a business model involves analyzing revenues, expenses, cash flows, financing needs, and key success factors through revenue and cost forecasts, income statements, balance sheets, and cash flow projections.