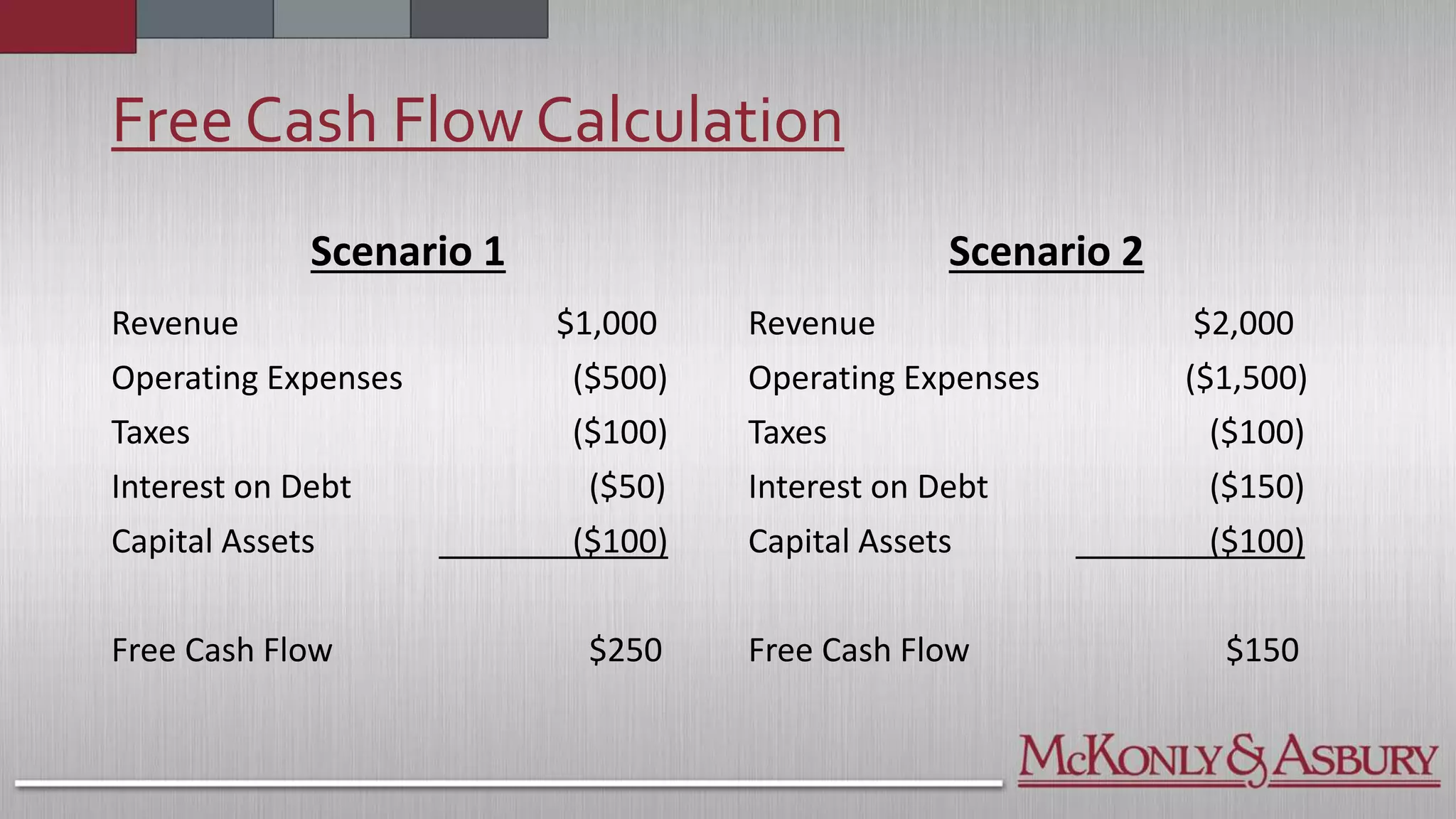

The webinar presented by Kurt M. Trimarchi and David B. Blain focuses on essential planning and preparation topics for business transitions, including understanding business value, tax consequences, and common pitfalls. Key elements discussed include forming a supportive professional team, financial reporting, cash flow analysis, and valuation considerations. Emphasis is placed on the importance of thorough preparation and communication throughout the transition process.