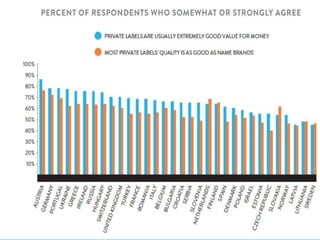

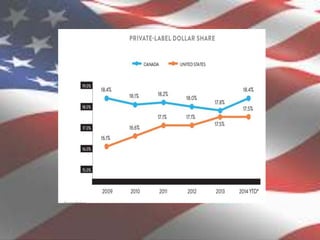

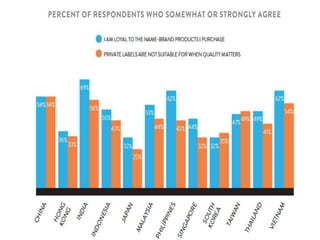

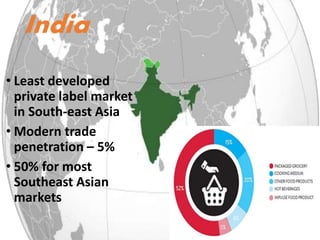

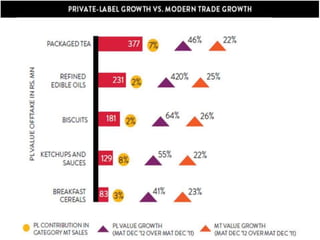

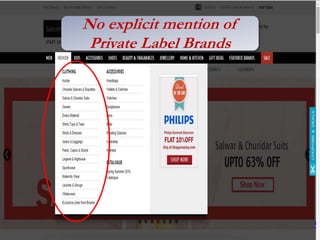

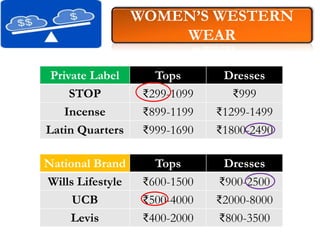

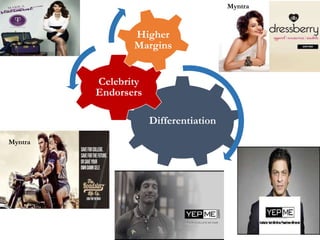

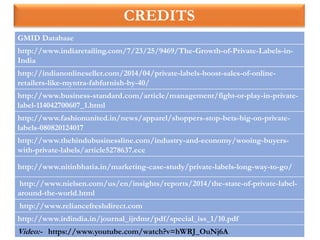

The document discusses private label brands in India across various retail categories like food, apparel, and ecommerce. It provides background on private labels globally and their growth in Europe. In India, private labels have a small market share compared to Southeast Asian countries due to low modern trade penetration. Some strategies discussed for growth of private labels in India include increasing store presence, improving product quality, offering variety, and focusing on in-store promotions. Online retailers are able to generate higher margins of up to 40% from private labels, which comprise 20-35% of their sales.