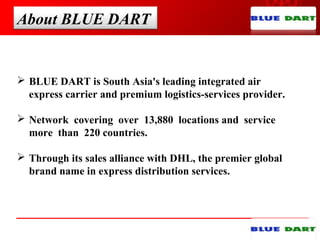

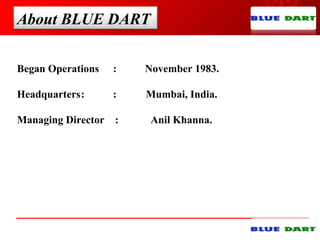

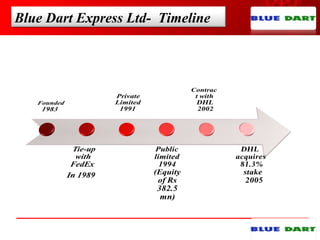

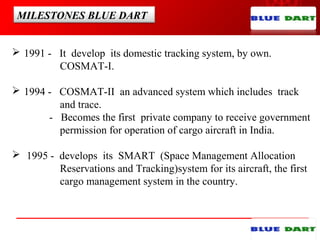

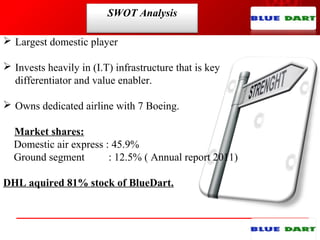

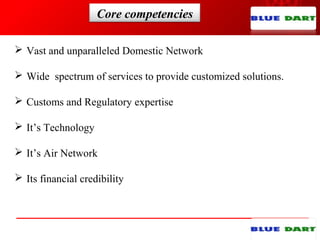

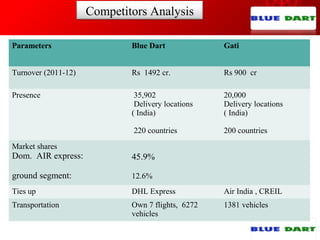

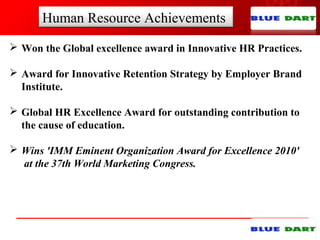

Blue Dart is a leading logistics company in India. It has two main competitive advantages - its strong human resource practices and economic prospects within the growing logistics market. Blue Dart ranked 12th in India's best places to work in 2012. It has a large market share and focuses on customer service, availability, performance and reliability. Blue Dart owns aircraft and has a wide domestic network, technology investments, and financial credibility as core competencies. It faces competition from other domestic and global players but has achieved various awards for its innovative HR practices.