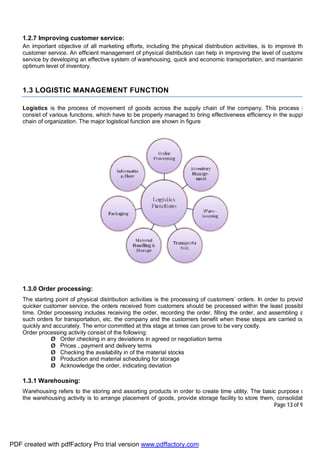

The document provides details about Chirag Shah's summer internship project report on the logistics industry at Logistic Integrators (I) Pvt. Ltd. It includes an acknowledgement, preface, executive summary, table of contents, and the beginning of chapter 1 which provides an introduction to logistics including its origin, objectives, and key management functions such as order processing, inventory management, warehousing, transportation, material handling, packing, and information flow.

![Page 55 of 92

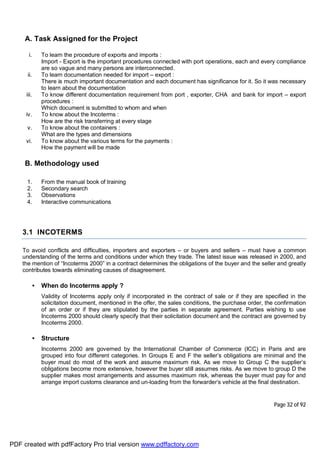

DGFT having jurisdiction over the district in which the Registered/ Head Office of the STPI unit is located shall

issue or amend the IECs.

Only one IEC would be issued against a single PAN number. Any proprietor can have only one IEC number

and in case there are more than one IECs allotted to a proprietor, the same may be surrendered to the

Regional Office for cancellation

.

Validity of IEC Code No

An IEC number allotted to an applicant shall be valid for all its branches/divisions/units/factories as indicated in

the format of IEC given in Appendix- 18B.

Duplicate Copy of IEC Number

Where an IEC Number is lost or misplaced, the issuing authority may consider requests for grant of a duplicate

copy of IEC number, if accompanied by an affidavit. Surrender of IEC Number If an IEC holder does not wish

to operate the allotted IEC number, he may surrender the same by informing the issuing authority. On receipt

of such intimation, the issuing authority shall immediately cancel the same and electronically transmit it to

DGFT for onward transmission to the Customs and Regional Authorities.

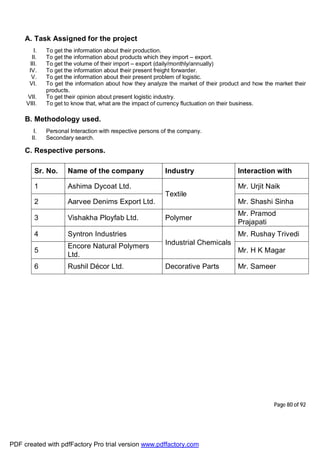

Particular Amount

Within local area 20 Rs.

Up to 200 kms 25 Rs.

Between 200 to 1000 kms 30 Rs.

Beyond 1000 kms 50 Rs.

IEC No: Exempted Categories

1. Importers covered by clause 3 (1) [except sub-clauses (e) and (l)] and exporters covered by clause 3(2)

[except sub-clauses (i) and (k)] of the Foreign Trade (Exemption from application of Rules in certain

cases) Order, 1993.

2. Ministries/Departments of the Central or State Government.

3. Persons importing or exporting goods for personal use not connected with trade or manufacture or

agriculture.

4. Persons importing/exporting goods from/to Nepal provided the CIF value of a single consignment does

not exceed Indian Rs.25,000.

5. Persons importing/exporting goods from/to Myanmar through Indo-Myanmar border areas provided the

CIF value of a single consignment does not exceed Indian Rs.25,000.

However, the exemption from obtaining Importer-Exporter Code (IEC) number shall not be applicable

for the export of Special Chemicals, Organisms, Materials, Equipments and Technologies (SCOMET)

as listed in Appendix- 3, Schedule 2 of the ITC(HS) except in the case of exports by category(ii) above.

6. The following permanent IEC numbers shall be used by the categories of importers/ exporters

mentioned against them for import/ export purposes..

PDF created with pdfFactory Pro trial version www.pdffactory.com](https://image.slidesharecdn.com/d0fe2eb4-3ea1-4239-9b7a-798f28f3145f-150304000607-conversion-gate01/85/SIP-Final-Report-Logistic-55-320.jpg)

![Page 70 of 92

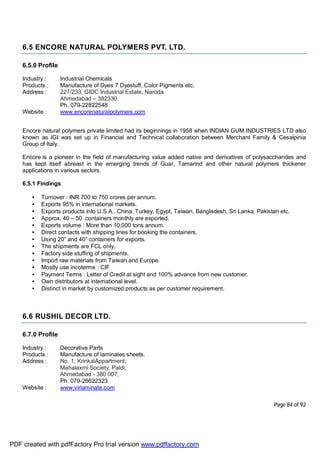

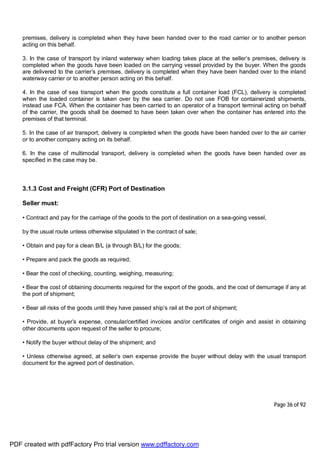

5.4 GEOGRAPHY

Taiwan is an island and an archipelago in East Asia, composed of Taiwan Island

and several much smaller islands such as the Penghu Islands, Orchid Island, Green

Island, and Lamay Island. The main island is located some 180 kilometres (112

miles) off the south eastern coast of China across the Taiwan Strait. It has an area

of 35,883 square kilometers (13,855 sq mi) and spans the Tropic of Cancer. The

East China Sea lies to the north, the Philippine Sea to the east, the Luzon Strait

directly to the south and the South China Sea to the southwest. The archipelago

makes up the majority (99%) of the territory of the Republic of China (ROC), after

the ROC lost its mainland China territory in the Chinese Civil War and fled to the

island in 1949. For this reason, Taiwan has become the common name of the

country itself.

The main island of the archipelago, comprising over 99% of ROC territory, is the

island of Taiwan, which is 394 km (245 mi) long, 144 km (89 mi) wide and has an area of 35,883 km2 (13,855

sq mi).[2] The shape of the main island is similar to a sweet potato oriented in a south-to-north direction, and

therefore Taiwanese, especially the Min-nan division, often call themselves "children of the Sweet Potato

The island of Taiwan is separated from the southeast coast of mainland China by the Taiwan Strait, which

ranges from 220 km (140 mi) at its widest point to 130 km (81 mi) at its narrowest.[3] Part of the continental

shelf, the Strait is no more than 100 m (330 ft) deep, and has become a land bridge during glacial periods.[6]

To the south, the island of Taiwan is separated from the Philippine island of Luzon by the 250 km (155 mi)-

wide Luzon Strait. The South China Sea lies to the southwest, the East China Sea to the north, and the

Philippine Sea to the east.[7]

Smaller islands of the archipelago include the Penghu islands in the Taiwan Strait 50 km (31 mi) west of the

main island, with an area of 127 km2 (49 sq mi), the tiny islet of Hsiao Liuchiu off the southwest coast, and

Orchid Island and Green Island to the southeast, separated from the northernmost islands of the Philippines by

the Bashi Channel. The islands of Quemoy, Matsu and Wuchiu near the coast of Fujian across the Taiwan

Strait, with a total area of 180 km2 (69 sq mi) and the Pratas and Taiping islets in the South China Sea, are

also administered by Taiwan,[3] but are not part of the Taiwanese archipelago.

5.4.0 Geographic Situation Chart

Population 23,234,936 (July 2012 est.)

Age structure 0-14 years: 14.7% (male 1,771,850/female 1,652,808)

15-24 years: 13.9% (male 1,654,984/female 1,564,132)

25-54 years: 47.9% (male 5,577,587/female 5,559,325)

55-64 years: 12.2% (male 1,388,020/female 1,441,167)

65 years and over: 11.3% (male 1,235,020/female 1,390,043)

(2012 est.)

Median age total: 38.1 years

male: 37.4 years

female: 38.8 years (2012 est.)

Population growth rate 0.29% (2012 est.)

Birth rate 8.7 births/1,000 population (2012 est.)

Death rate 6.7 deaths/1,000 population (July 2012 est.)

PDF created with pdfFactory Pro trial version www.pdffactory.com](https://image.slidesharecdn.com/d0fe2eb4-3ea1-4239-9b7a-798f28f3145f-150304000607-conversion-gate01/85/SIP-Final-Report-Logistic-70-320.jpg)