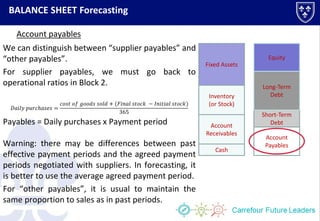

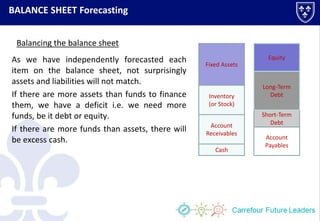

The document discusses how to forecast a company's balance sheet by formulating explicit parameters and formulas for each line item. Key aspects covered include:

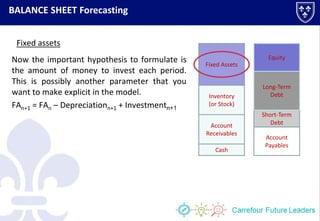

- Using depreciation and investment amounts to forecast fixed assets

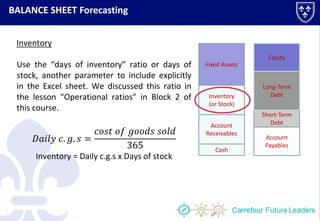

- Calculating inventory using days of inventory and cost of goods sold

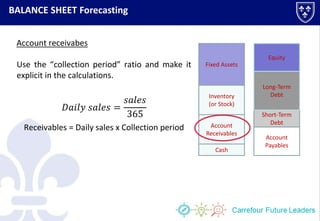

- Figuring accounts receivable using collection period and daily sales

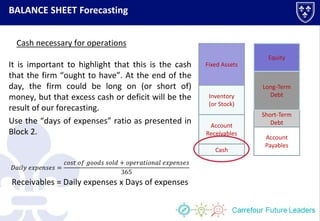

- Determining cash needed using days of expenses ratio

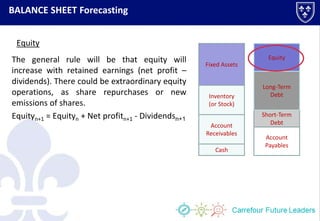

- Updating equity with retained earnings from net profit less dividends

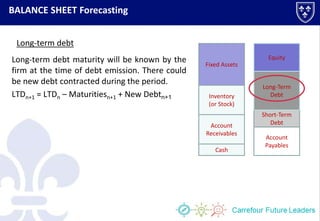

- Accounting for long-term debt maturities and new debt amounts

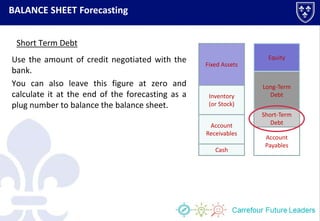

- Optionally leaving short-term debt as a plug number to balance the sheet