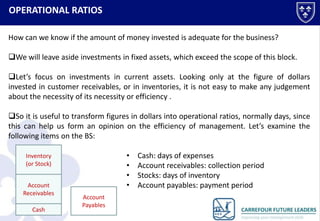

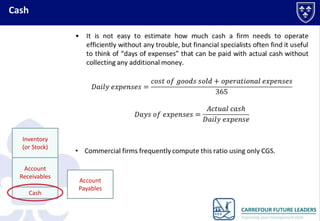

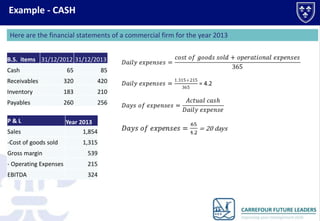

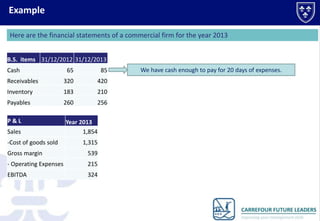

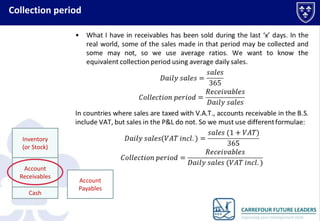

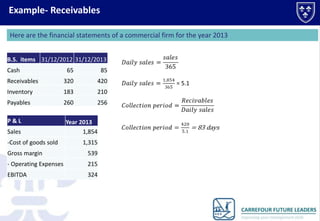

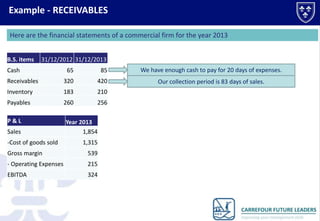

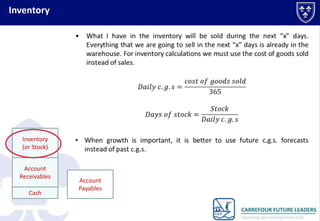

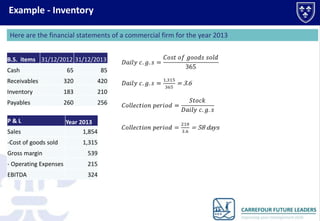

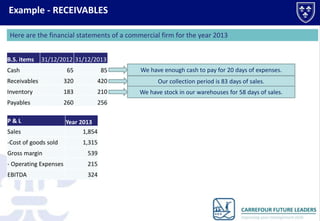

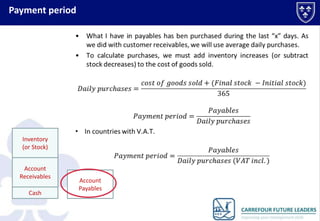

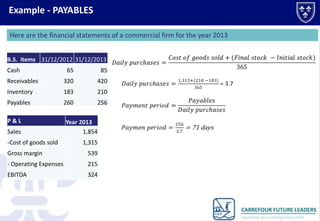

This document discusses operational ratios that can help determine if a business has invested an adequate amount in current assets. It provides examples to calculate cash ratio in days of expenses, collection period of receivables in days of sales, inventory in days of sales, and payment period of payables in days of purchases. Using a commercial firm's financial statements from 2013 as an example, it shows the calculations to determine the firm has enough cash for 20 days, a collection period of 83 days, inventory for 58 days, and a payment period of 71 days.