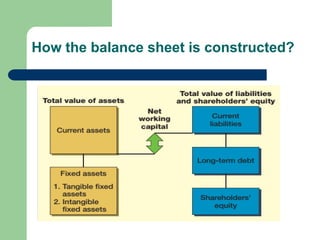

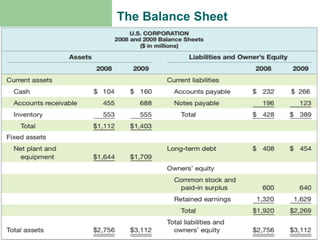

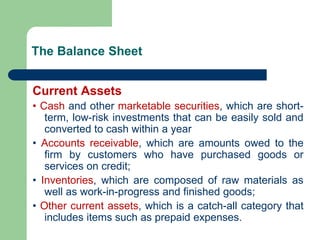

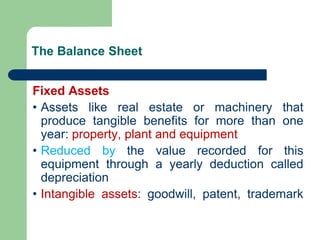

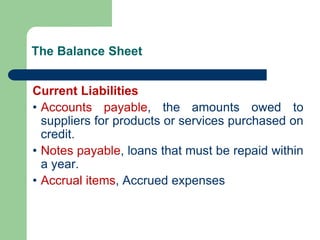

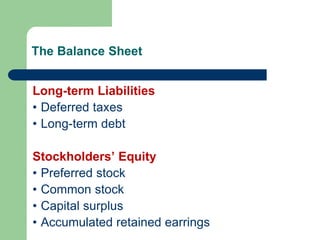

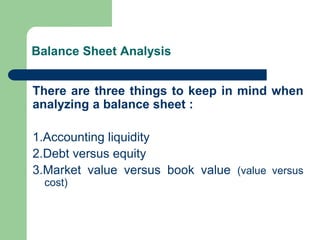

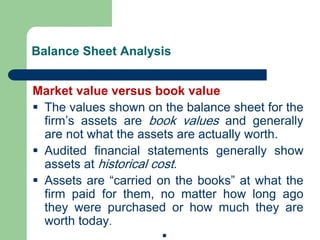

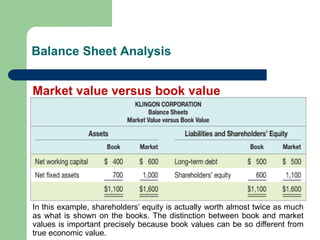

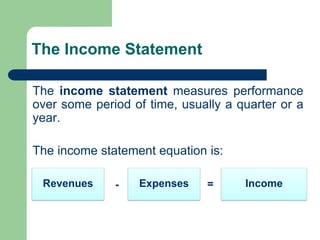

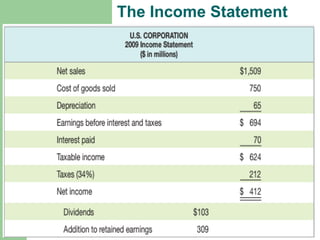

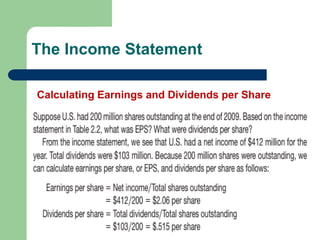

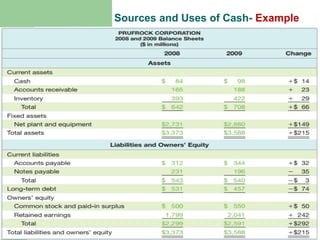

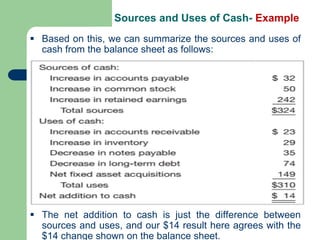

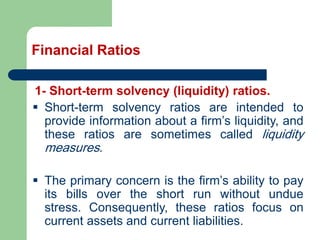

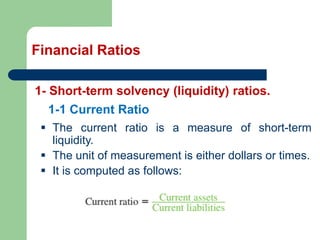

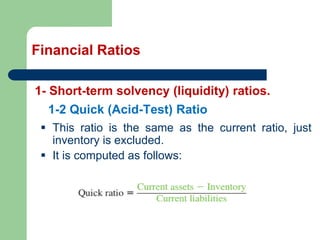

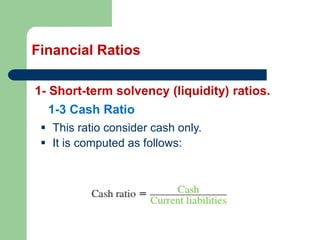

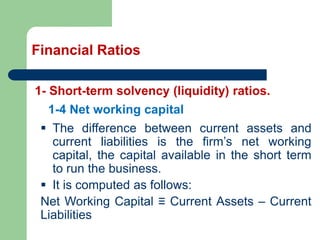

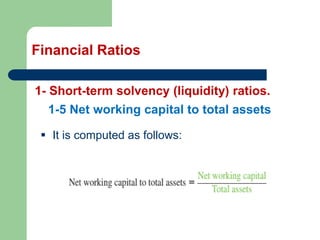

The document discusses various aspects of financial analysis including the four main financial statements: balance sheet, income statement, shareholders' statement, and statement of cash flows. It provides details on how to analyze each statement. The balance sheet shows a company's assets, liabilities, and equity at a point in time. The income statement measures performance over a period of time by showing revenues and expenses. Cash flow analysis examines sources and uses of cash by tracing changes in the balance sheet. Financial ratios are also covered as tools to analyze liquidity, leverage, asset management, profitability, and market value.