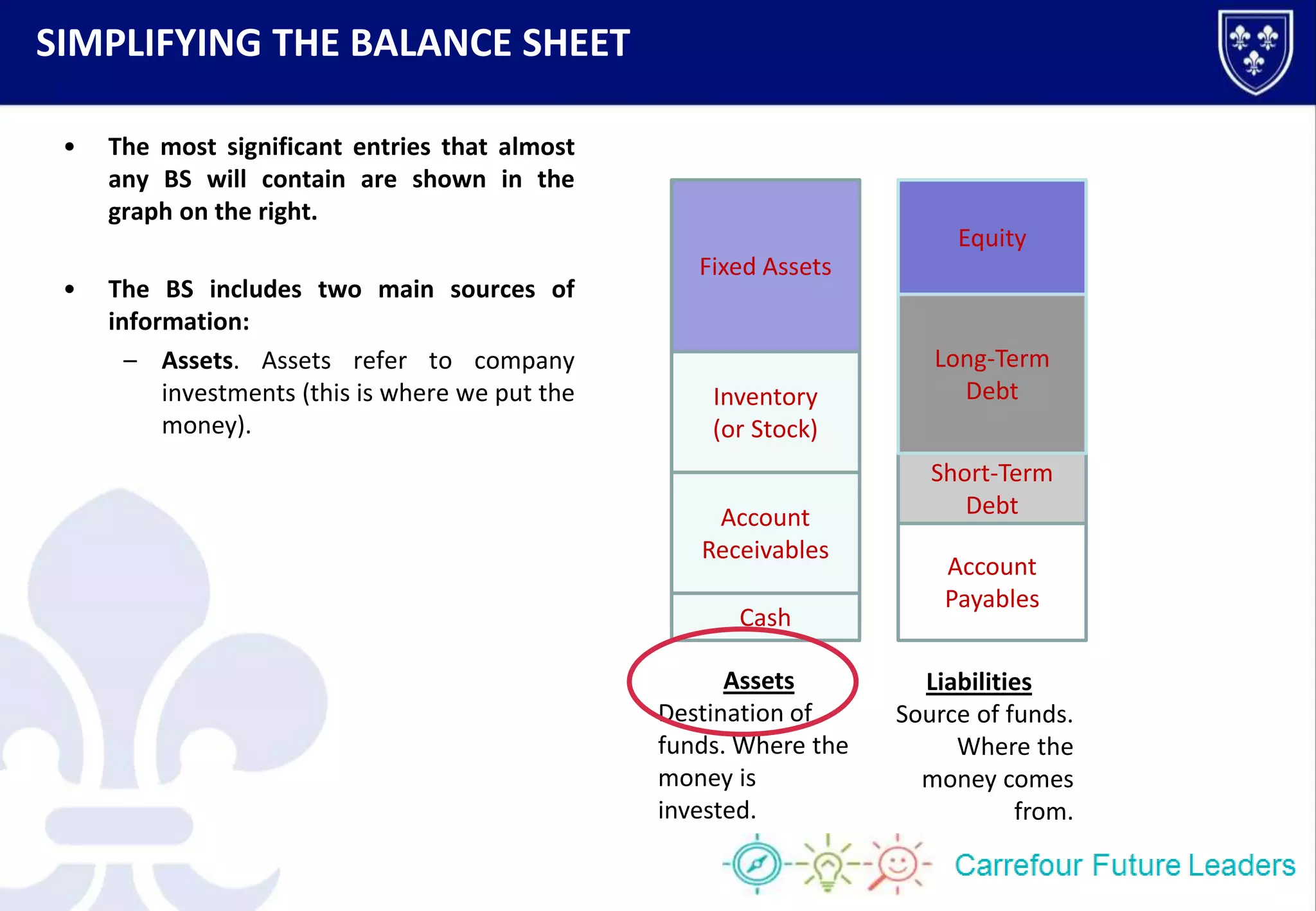

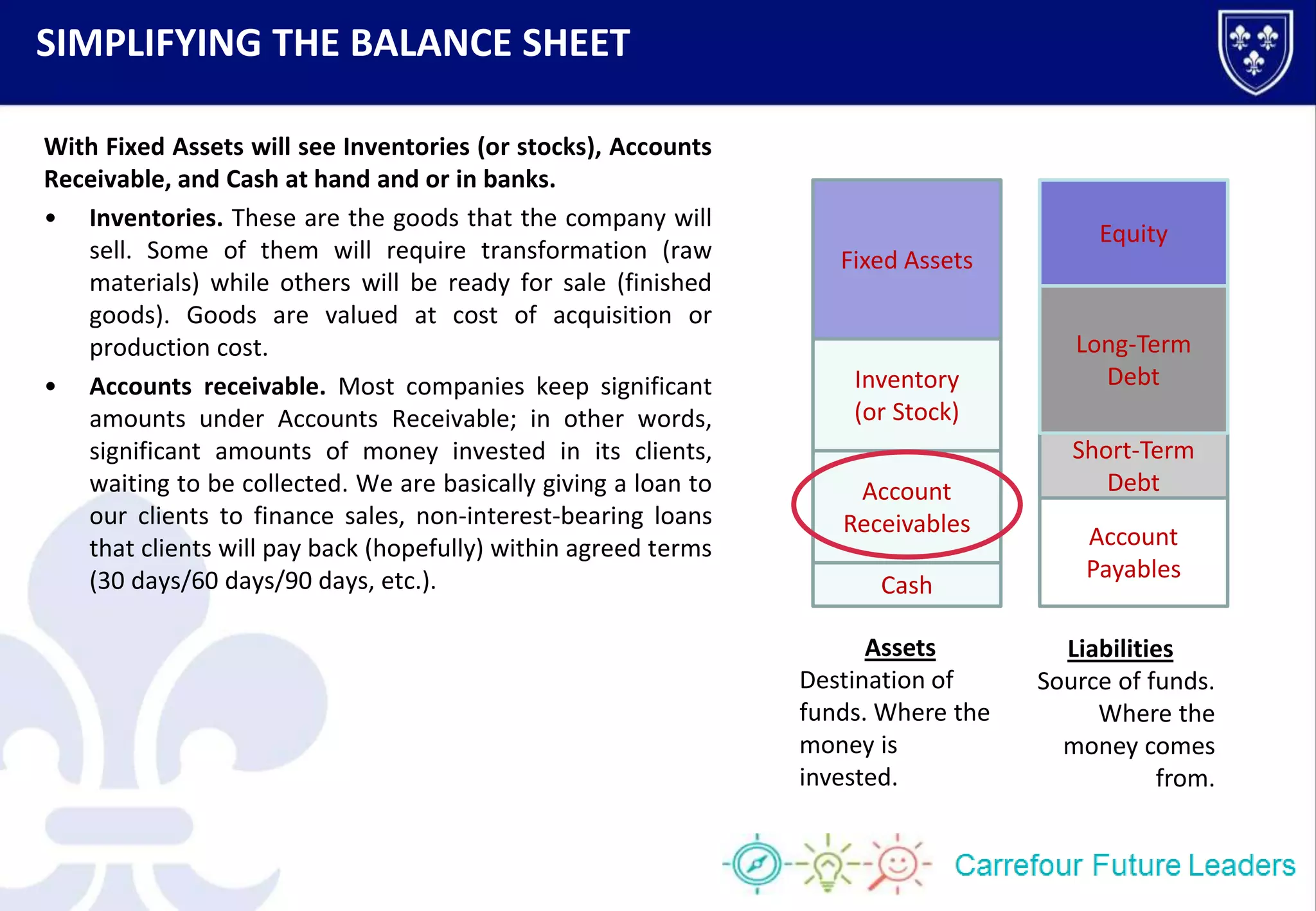

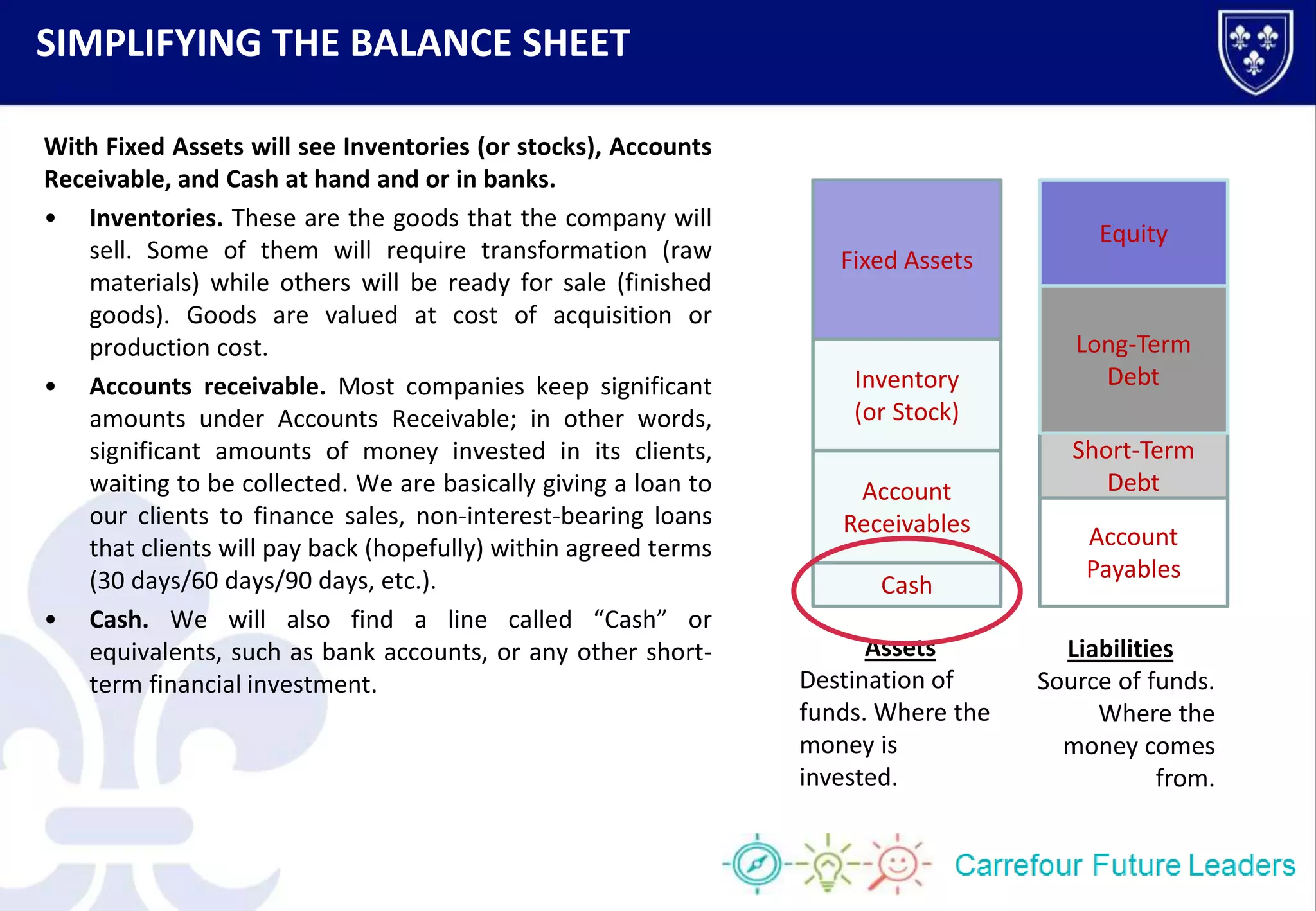

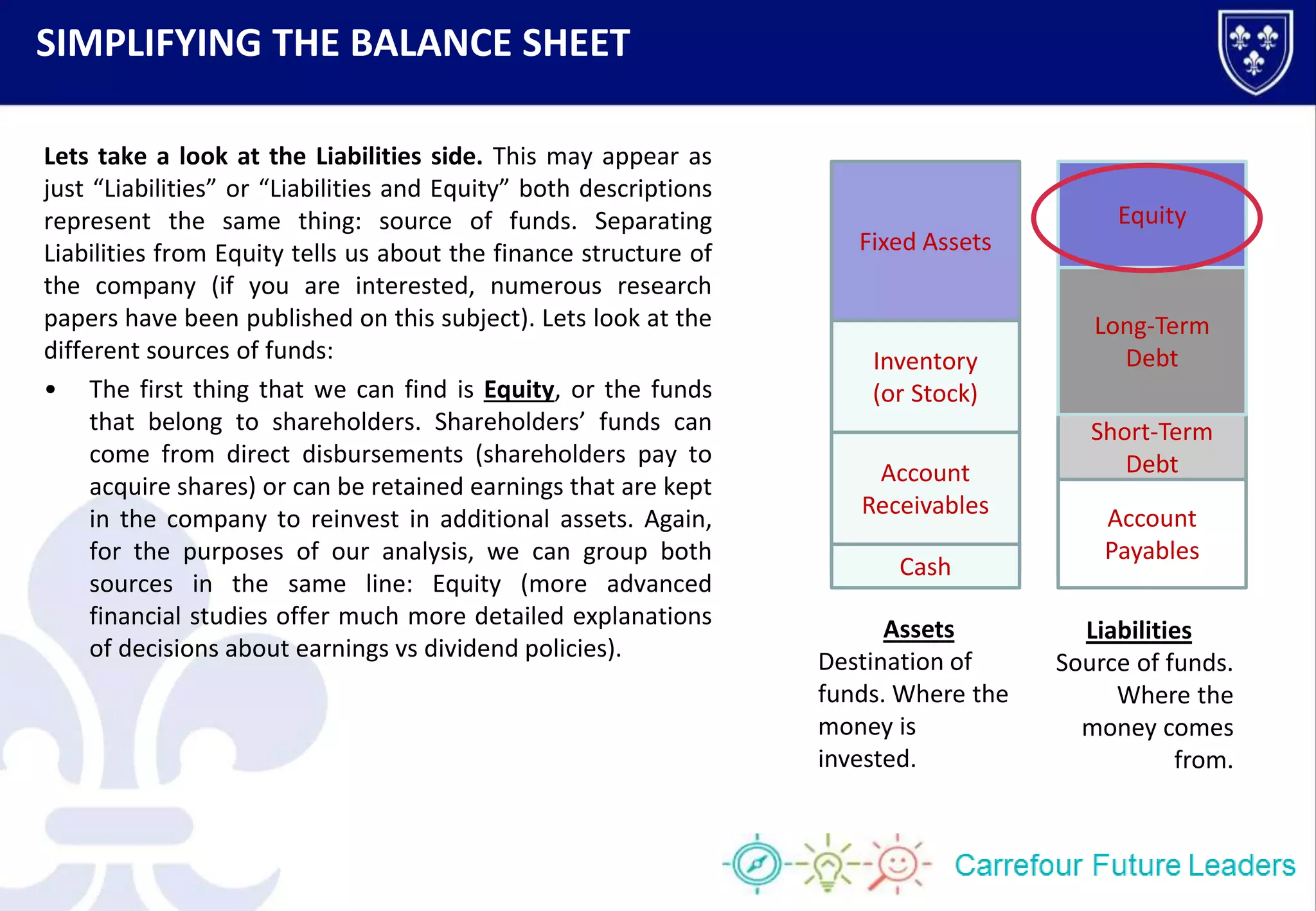

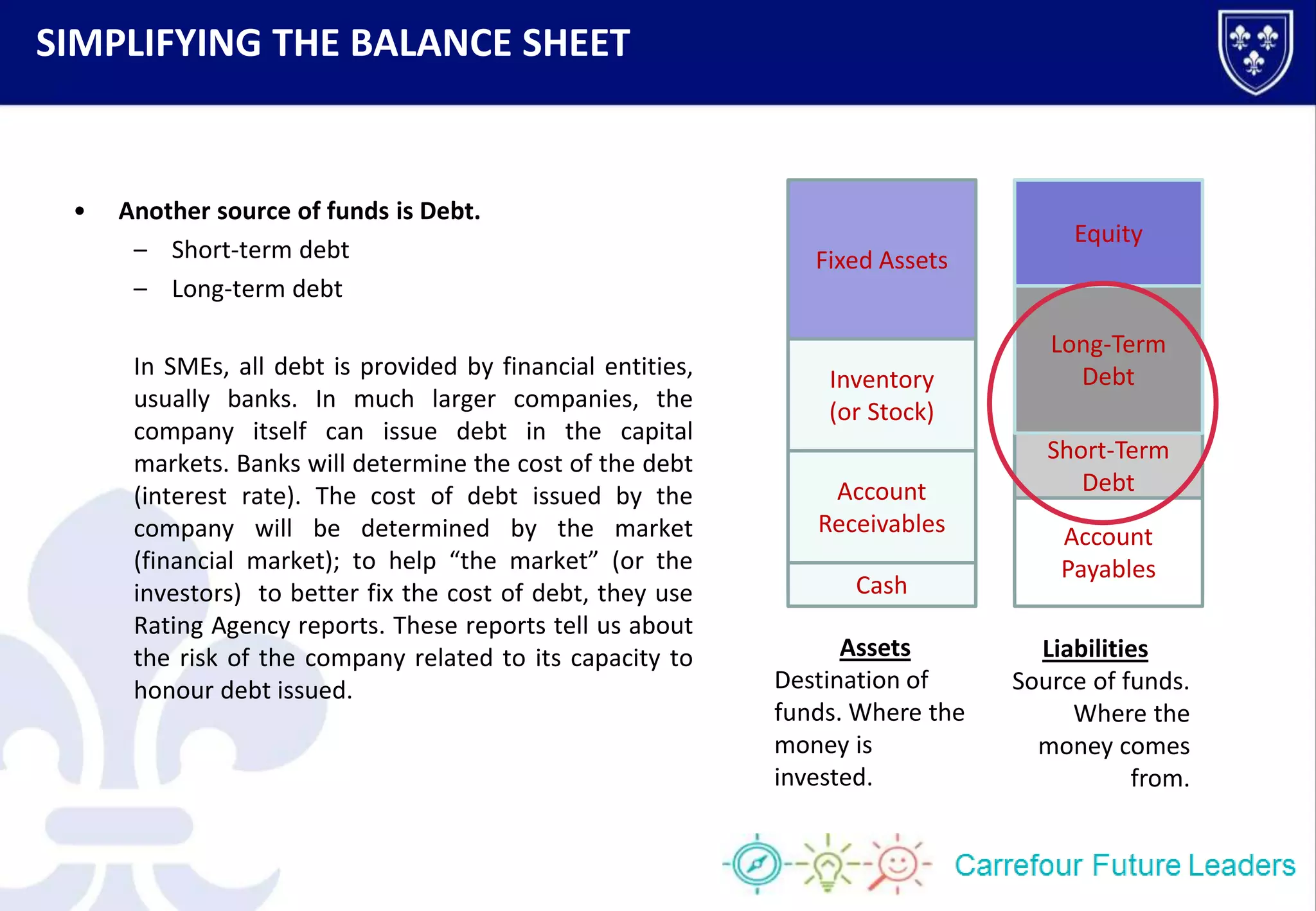

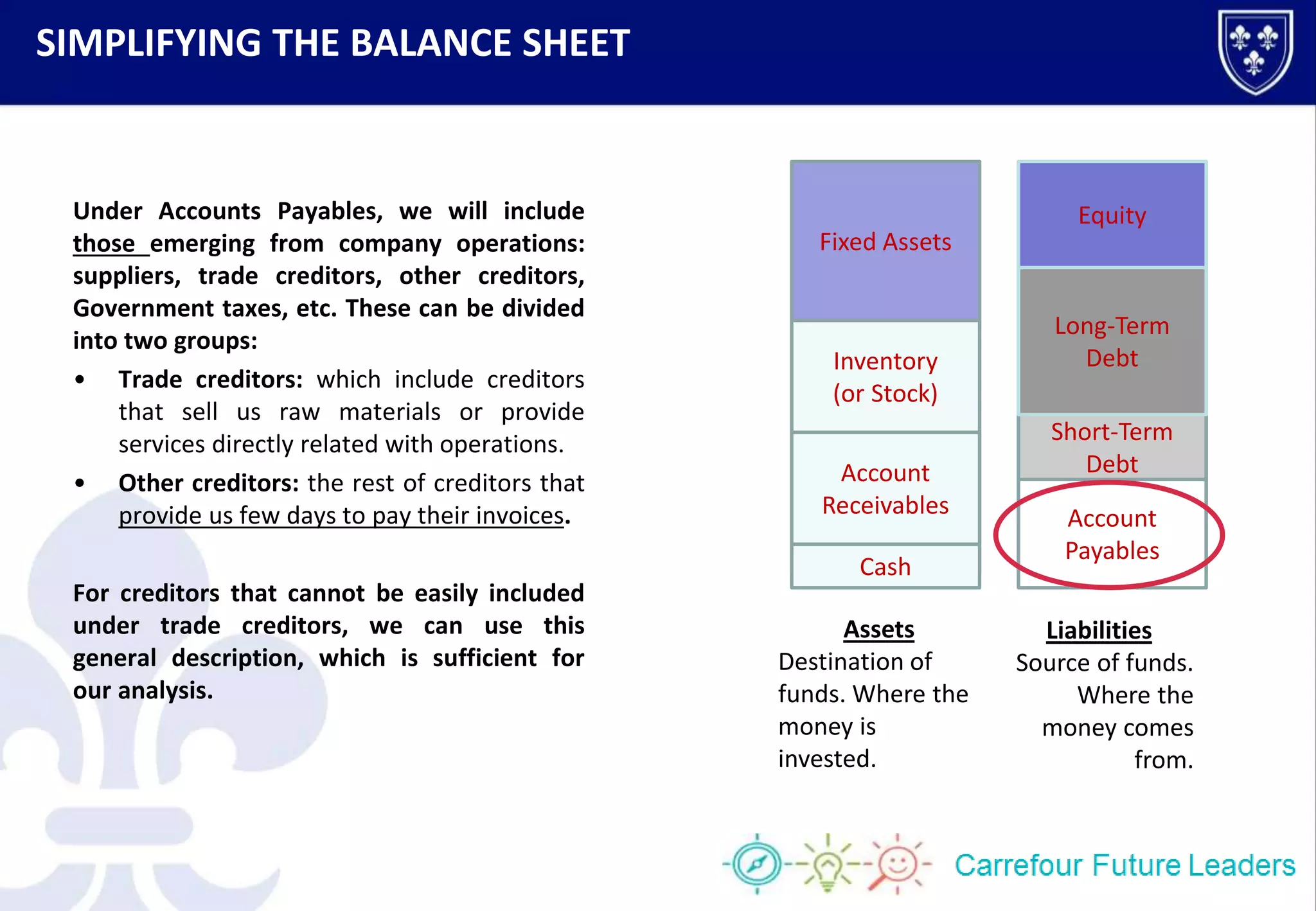

The document provides an overview of simplifying a company's balance sheet for understanding by non-financial professionals. It explains that the balance sheet contains key information about assets (where money is invested) and liabilities/equity (where money comes from). The most significant assets are typically fixed assets, inventory, accounts receivable, and cash, while liabilities include equity, short-term debt, and long-term debt. The document outlines each of these elements at a high level to help readers understand the overall financial position of a company based on the big numbers in a balance sheet.