Central excise duty is levied on goods manufactured in India. The key points are:

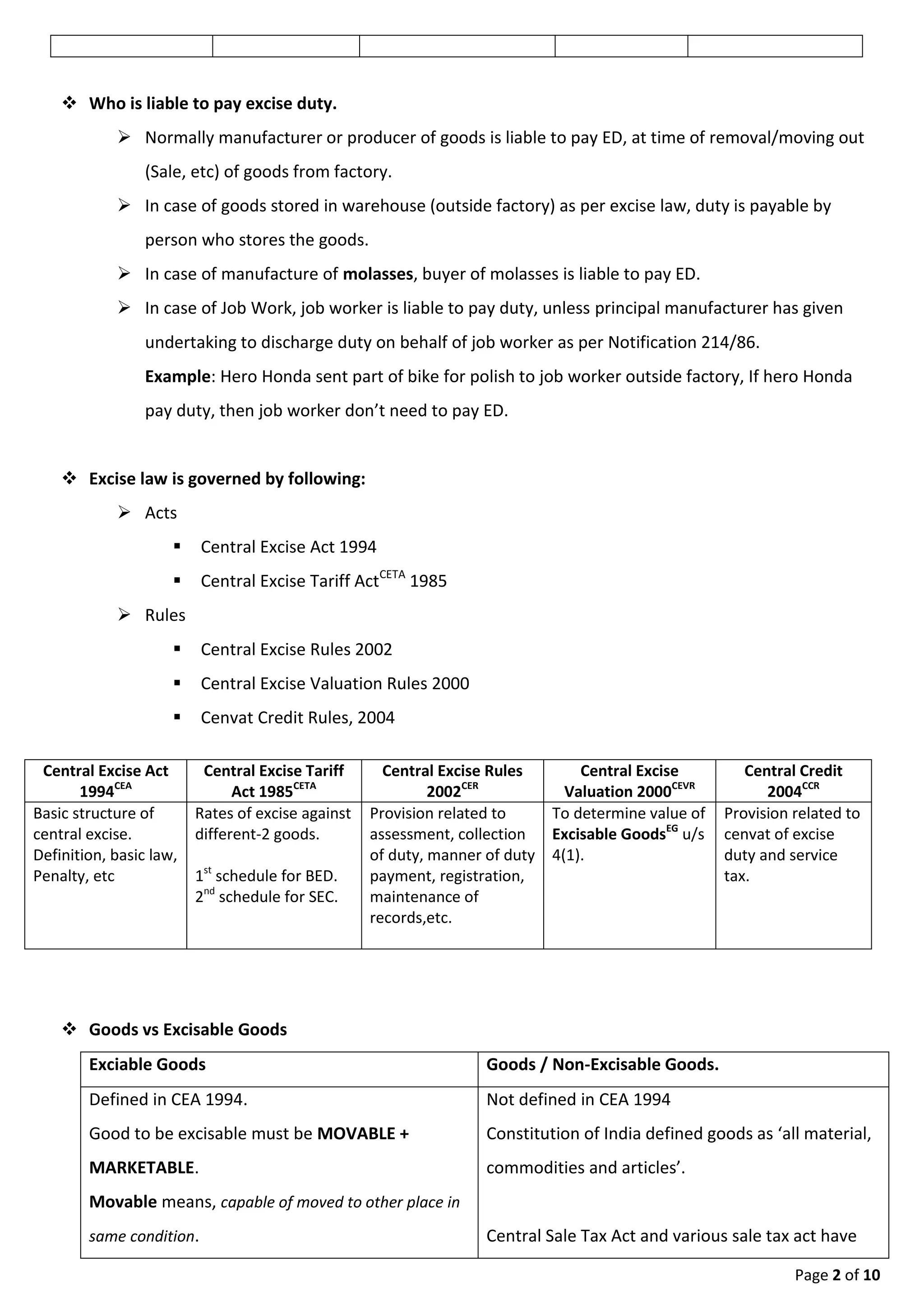

1. Excise duty is governed by the Central Excise Act 1994 and is normally paid by the manufacturer at the time goods are removed from the factory.

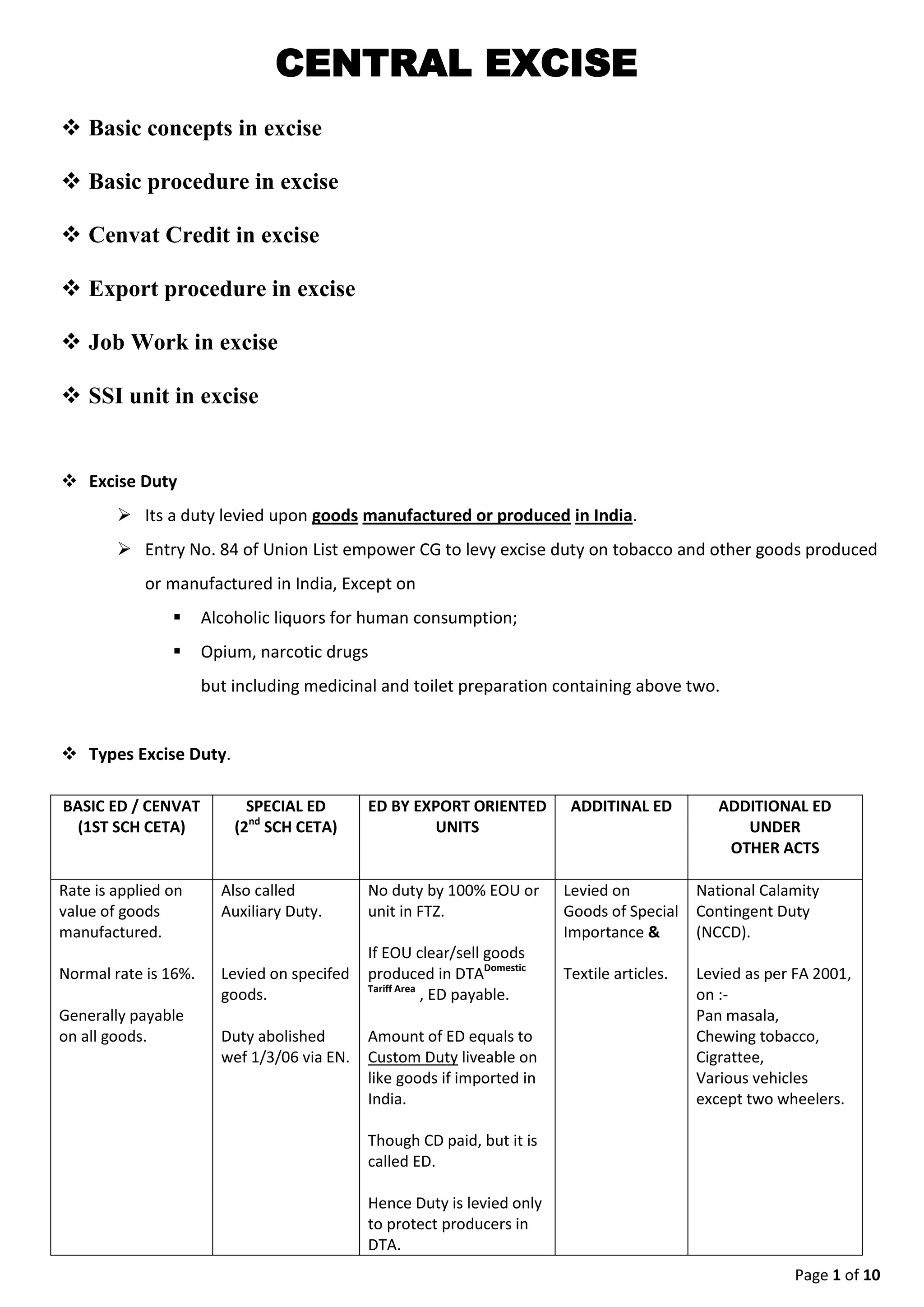

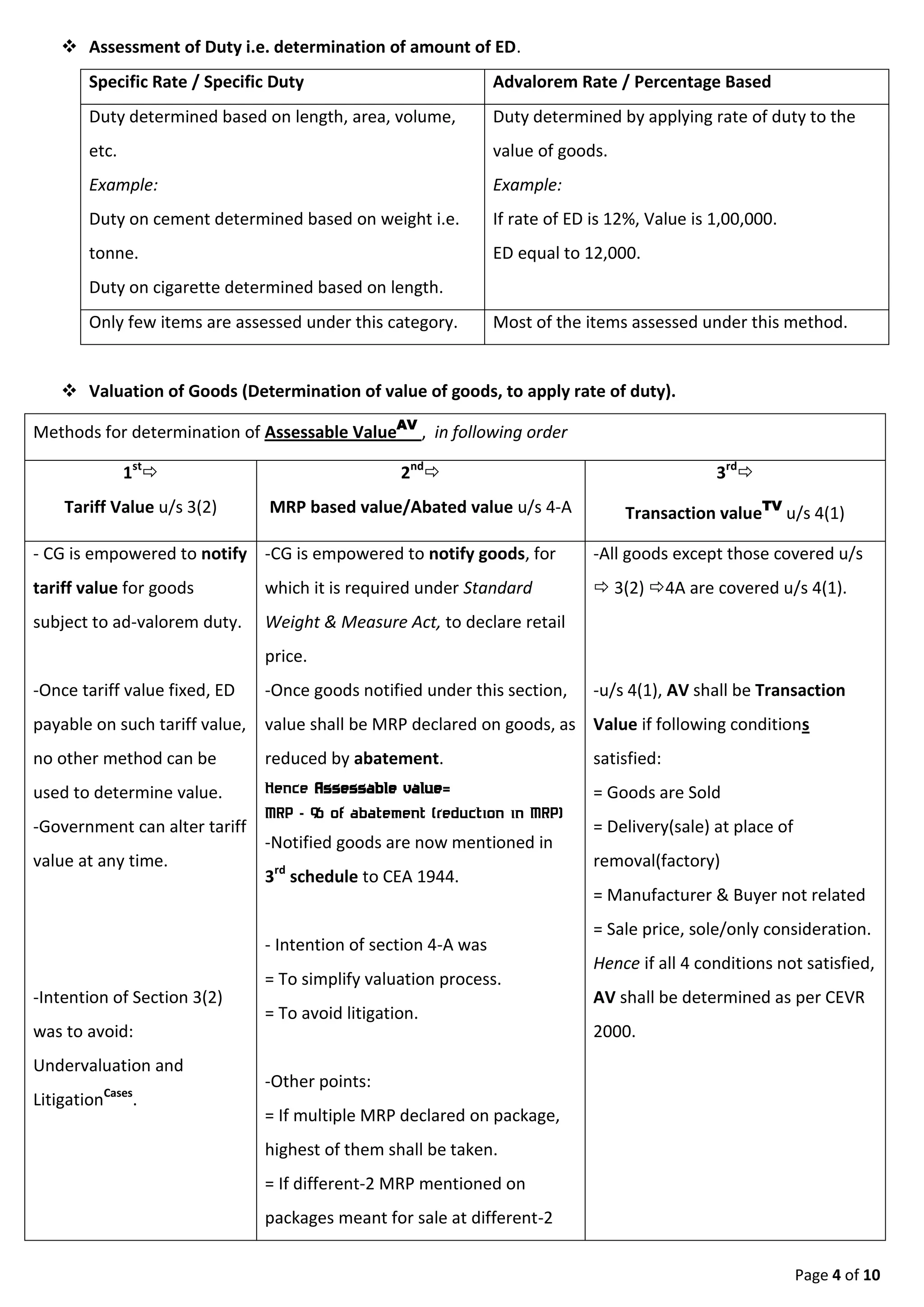

2. Excise duty can be a basic rate of 16% or a special additional duty specified for certain goods. Duty is determined based on the transaction value or MRP of goods.

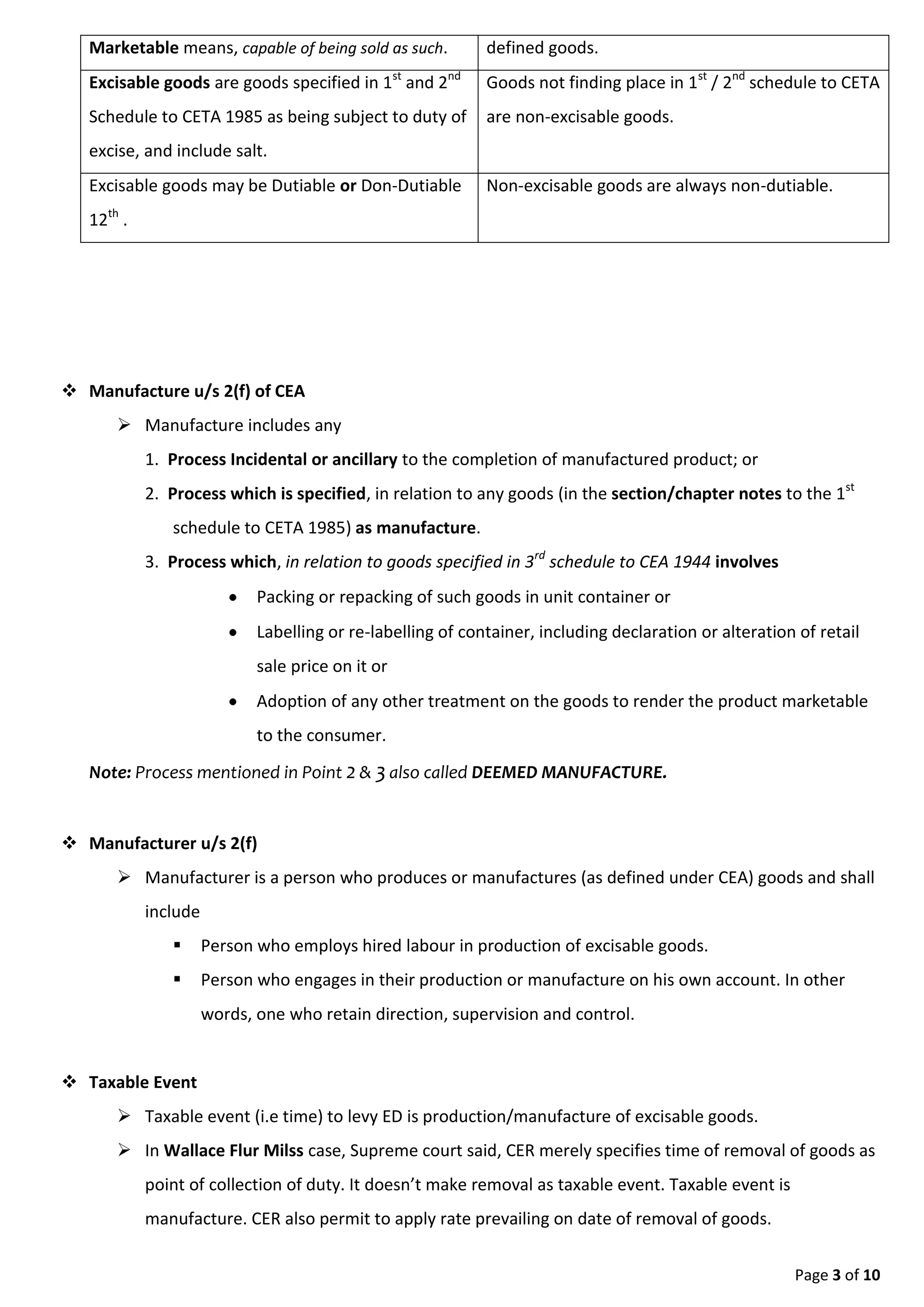

3. Manufacture is defined broadly and includes any process that produces a marketable good. The taxable event is manufacture of excisable goods in India.