This document provides an overview of key concepts in Pakistan's sales tax system, including:

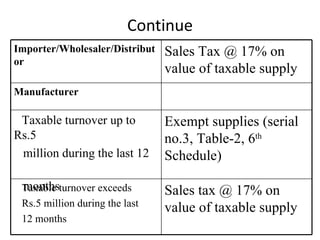

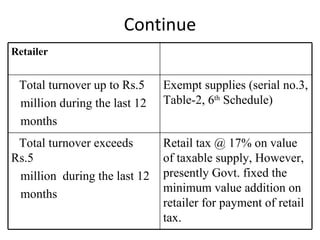

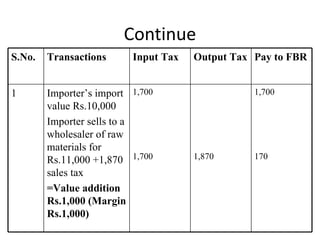

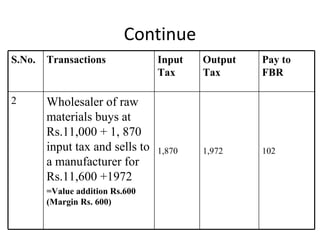

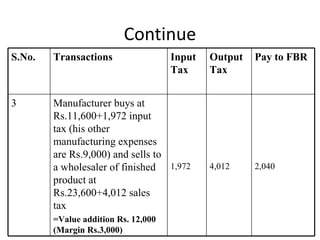

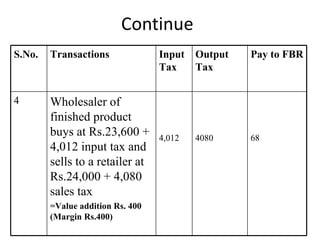

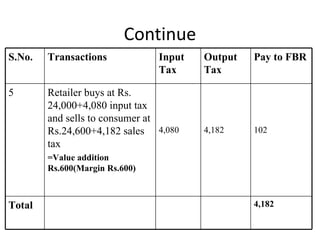

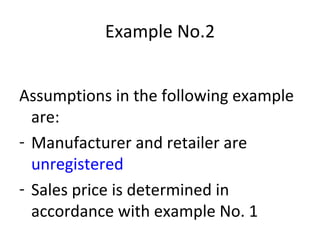

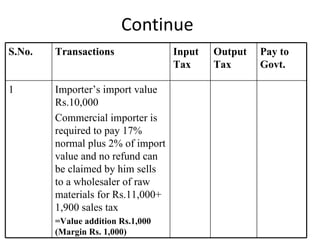

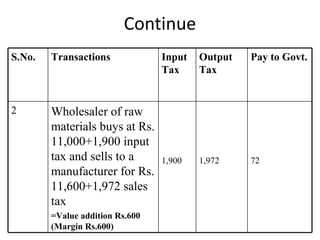

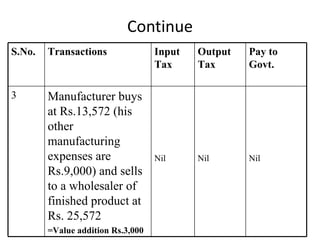

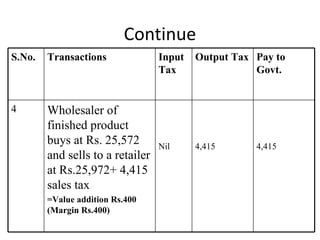

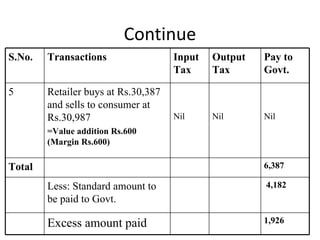

1) Sales tax is collected at multiple stages of the supply chain from importers to manufacturers to wholesalers and retailers.

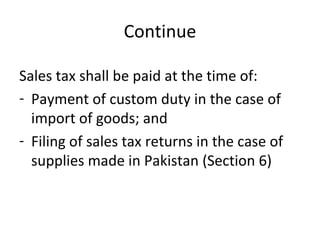

2) Liability for sales tax falls on the person making the supply or importing goods, with some exceptions.

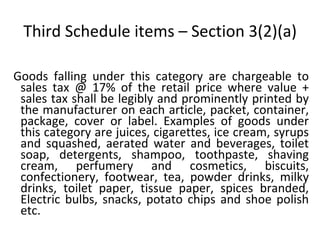

3) There are different sales tax rates and rules for importers, manufacturers, wholesalers, distributors, and retailers depending on their annual turnover.

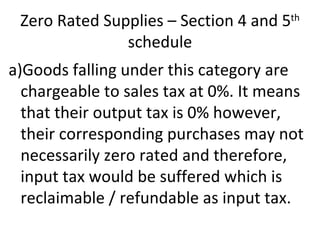

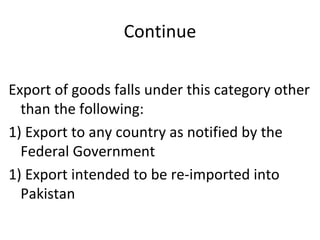

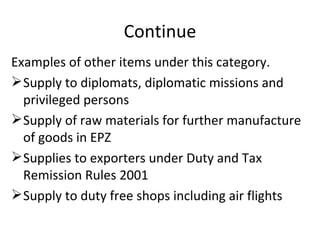

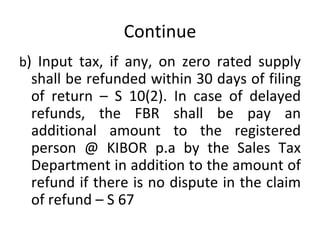

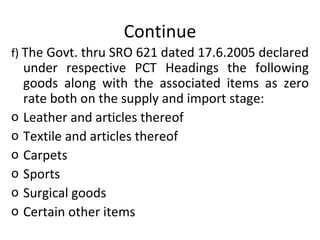

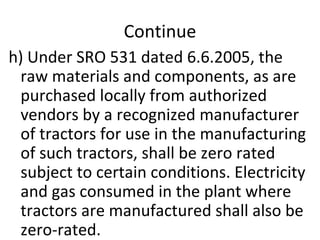

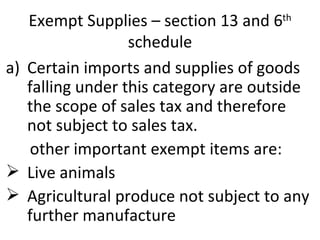

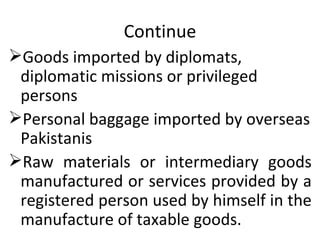

4) The document outlines concepts like zero-rated supplies, exempt supplies, input tax adjustment, and registration requirements.

![Continue Supply against international tenders [Import of raw materials and components is exempt which is required for manufacturing of goods to be supplied against international tender – SRO 608 dated 8.8.1997] Import or supply made to Gawadar Special Economic Zone excluding vehicles Supply of plant, machinery and equipments subject to certain conditions.](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-23-320.jpg)

![Continue c) A person who does not want to avail the facility of zero rating on export of taxable goods may be de-registered on his request [instruction 4 of 2003] d) Sales tax on packing materials etc. used for zero rated supply shall be refunded [instruction 49 of 2002]](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-25-320.jpg)

![Continue Pharmaceutical products registered under Drug Act with certain exceptions [SRO 555 dated 23.8.2002] Pharmaceutical raw material [SRO 673 dt. 2.7.2005] Holy Quran and other holy books or recorded in audio or video cassettes Imported samples](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-29-320.jpg)

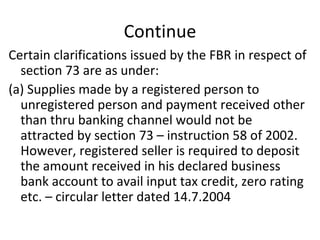

![Continue (b) Actual transfer of payment from buyer’s bank account to seller’s bank account is required and mere issuance of cheque is not sufficient [instruction 68 of 2002] (c) Bearer cheques and traveler cheques are not banking channel. However, crossed traveler cheque issued from the business bank account of the buyer and crossed in the name of the seller is acceptable [instructions 9 and 53 of 2002]](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-45-320.jpg)

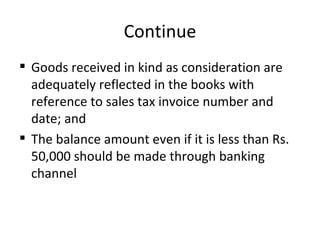

![Continue (d) Can payment be made in kind: Instruction 62 of 2002 / 7 of 2003 clarified that payment can be received in kind provided: Goods received in kind represent taxable goods [or landed property where proper mutation has been executed]](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-46-320.jpg)

![Continue (b) A retailer whose value of supplies (total supplies including exempt supplies) during the last 12 months exceeds Rs.5 million (c) An importer [Importers of taxable items who are not conduction any taxable activity at post import stage are also required to be registered – instruction 14 of 2003]; and (d) A wholesaler, dealer or distributor;](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-55-320.jpg)

![Application for registration (1) A person required to be registered shall apply for registration before making any taxable supply in the prescribed form to LRO having jurisdiction or via e-mail to FBR at [email_address] pk on form STRN-1 after scanning and signing it, namely:](https://image.slidesharecdn.com/ucps-tax-2-110602022832-phpapp02/85/Ucp-s-tax-2-56-320.jpg)