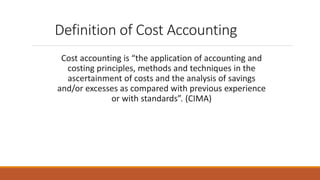

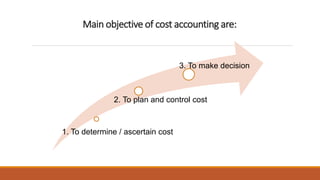

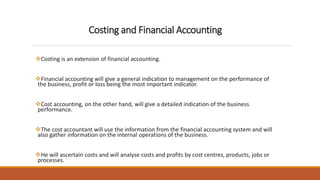

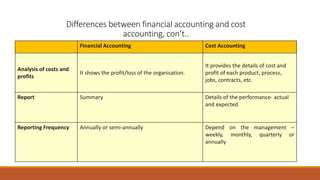

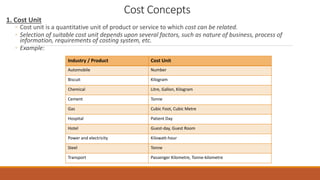

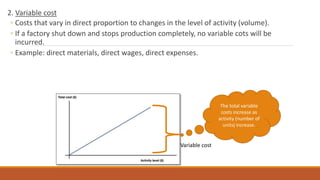

This document provides an introduction to cost accounting concepts. It defines cost accounting and differentiates it from financial accounting. Cost accounting aims to ascertain costs to help with planning, control, and decision making, while financial accounting satisfies external reporting requirements. The document outlines key cost accounting concepts like cost units, cost centers, classifying costs by nature, function, behavior, controllability, and normality. It provides examples of cost statements that bring together different cost elements.