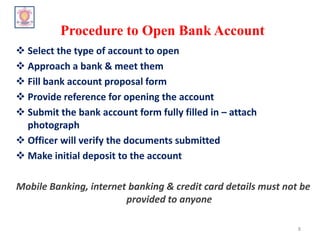

The document discusses various aspects of banking transactions. It defines what a bank is, noting they accept deposits and provide loans. The document outlines bank characteristics like dealing with money and connecting depositors with borrowers. It also describes key bank functions such as accepting deposits, lending money, transferring funds, and collecting payments. Additionally, the document discusses the types of bank accounts including savings, current, recurring, and term deposits. It provides details on opening an account, like selecting an account type and submitting documents, and highlights advantages of having a bank account like safe money storage and access to loans.