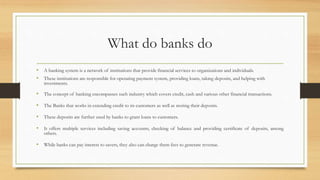

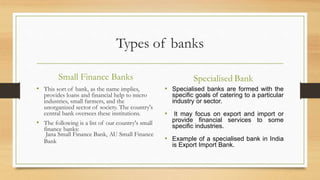

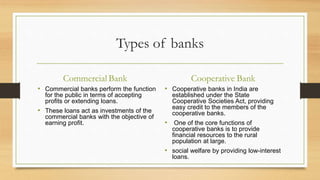

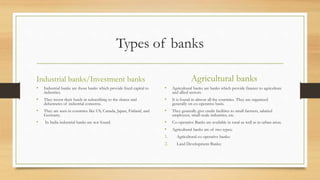

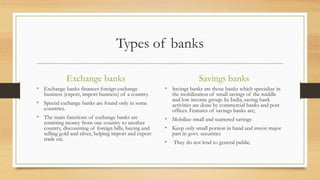

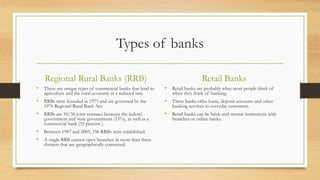

This document provides an overview of the origin and development of banking in India. It discusses the history of banks in India dating back to the 18th century with the establishment of banks like Bank of Hindustan and presidency banks. It then covers the nationalization of banks in India in 1969 and 1980. The document also defines key banking terms like banks, characteristics of banks, and functions of banks such as accepting deposits and lending funds. It provides context on the various types of banks that operate in India and how the banking system works.