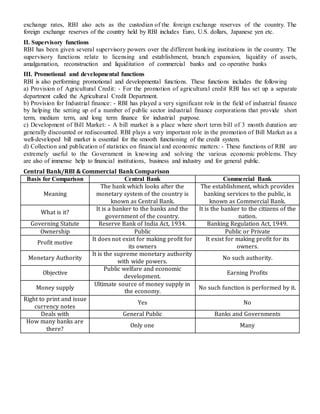

Commercial banking in India began in the 18th century with the establishment of banks by the British East India Company. The three presidency banks - Bank of Bengal, Bank of Bombay, and Bank of Madras - were established in the early 19th century and given rights to issue currency in their regions. Several other banks were established throughout the 19th century. The Reserve Bank of India was established in 1935 and became fully state-owned in 1949. It enacted the Banking Regulation Act to regulate commercial banking. Nationalization of banks in 1969 was a major development in Indian banking. Today there are various types of banks that perform important functions like accepting deposits, lending funds, and providing payment services, which contribute to economic development.