The document provides an overview of the banking industry in India. It discusses the history and evolution of banking in India from the earliest banks established in the late 18th century to the modern banking system. It describes the key types of banks that operate in India including central banks, commercial banks (public sector banks, private sector banks, and foreign banks), cooperative banks, and development banks. It also outlines the major products and services offered by banks, including accepting deposits and granting loans and advances.

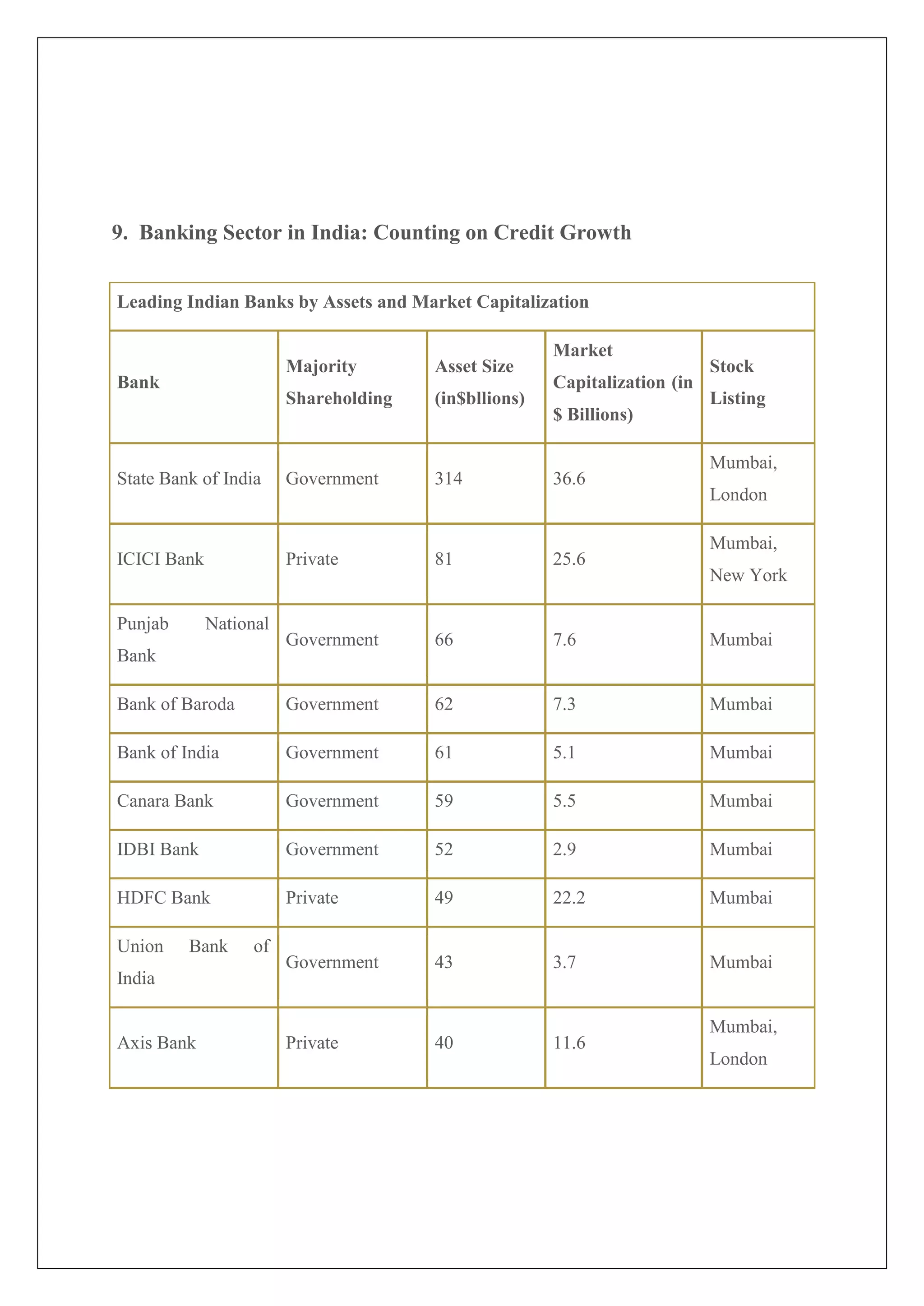

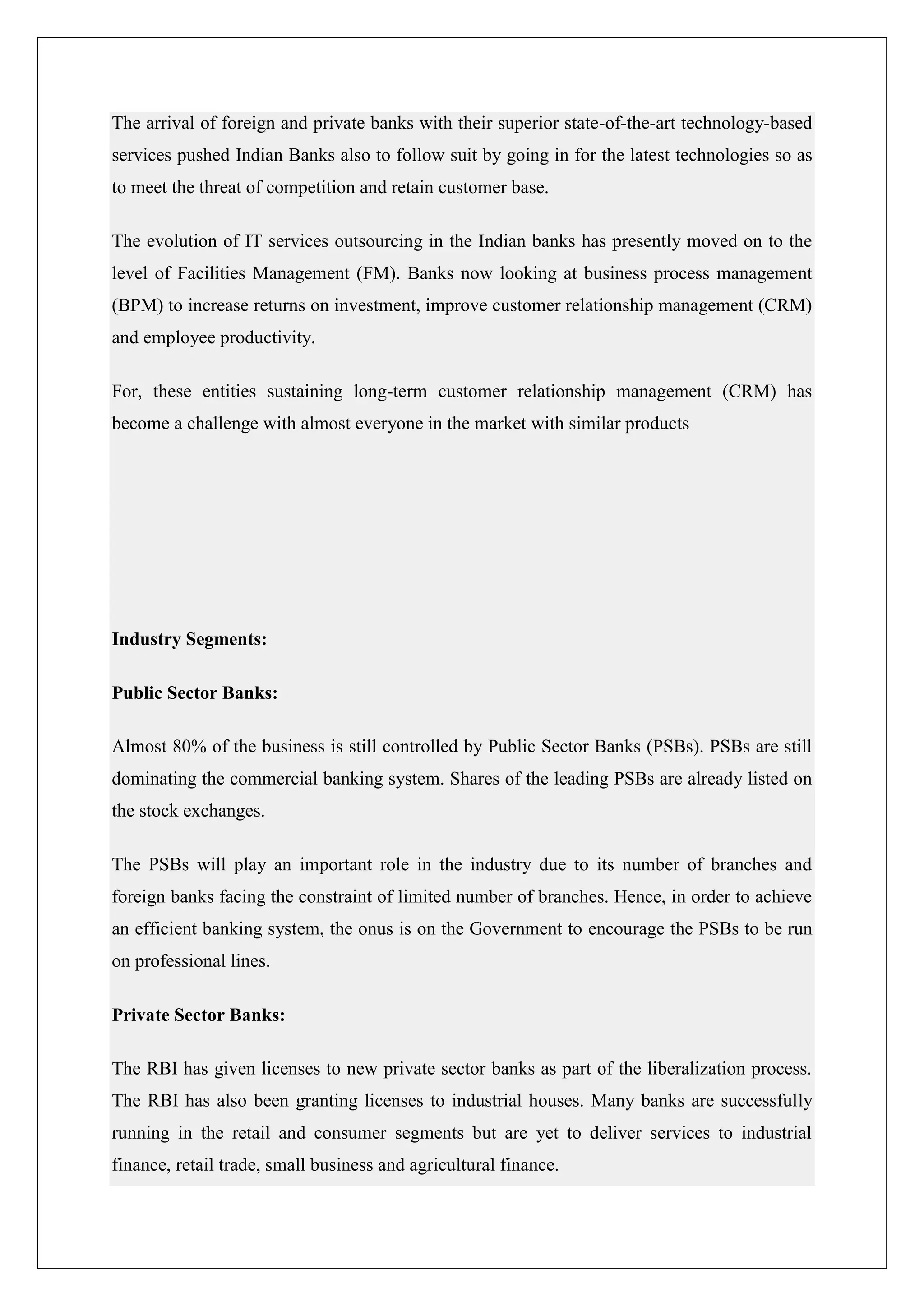

![1.3 Bank Definition

Definition of a bank varies from country to country. See the relevant country page (below)

for more information.

1. Under English common law, a banker is defined as a person who carries on the business of

banking, which is specified as:[6]

conducting current accounts for his customers

paying cheques drawn on him, and

Collecting cheques for his customers.

2. A corporation empowered to deal with cash, domestic and foreign, and to receive the

deposits of money and to loan those monies to third-parties.

3. In 1899, the United States Supreme Court (Austen) used these words to define a bank:

"A bank is an institution, usually incorporated with power to issue its promissory notes

intended to circulate as money (known as bank notes); or to receive the money of others on

general deposit, to form a joint fund that shall be used by the institution, for its own benefit,

for one or more of the purposes of making temporary loans and discounts; of dealing in notes,

foreign and domestic bills of exchange, coin, bullion, credits, and the remission of money; or

with both these powers, and with the privileges, in addition to these basic powers, of

receiving special deposits and making collections for the holders of negotiable paper, if the

institution sees fit to engage in such business."

4. An establishment authorized by a government to accept deposits, pay interest, clear checks,

make loans, act as an intermediary in financial transactions, and provide other financial

services to its customers.

5. Bank is a lawful organization, which accepts deposits that can be withdrawn on

Demand. It also lends money to individuals and business houses that need it.](https://image.slidesharecdn.com/re-geeta-120215082109-phpapp02/75/banking-industry-in-india-8-2048.jpg)

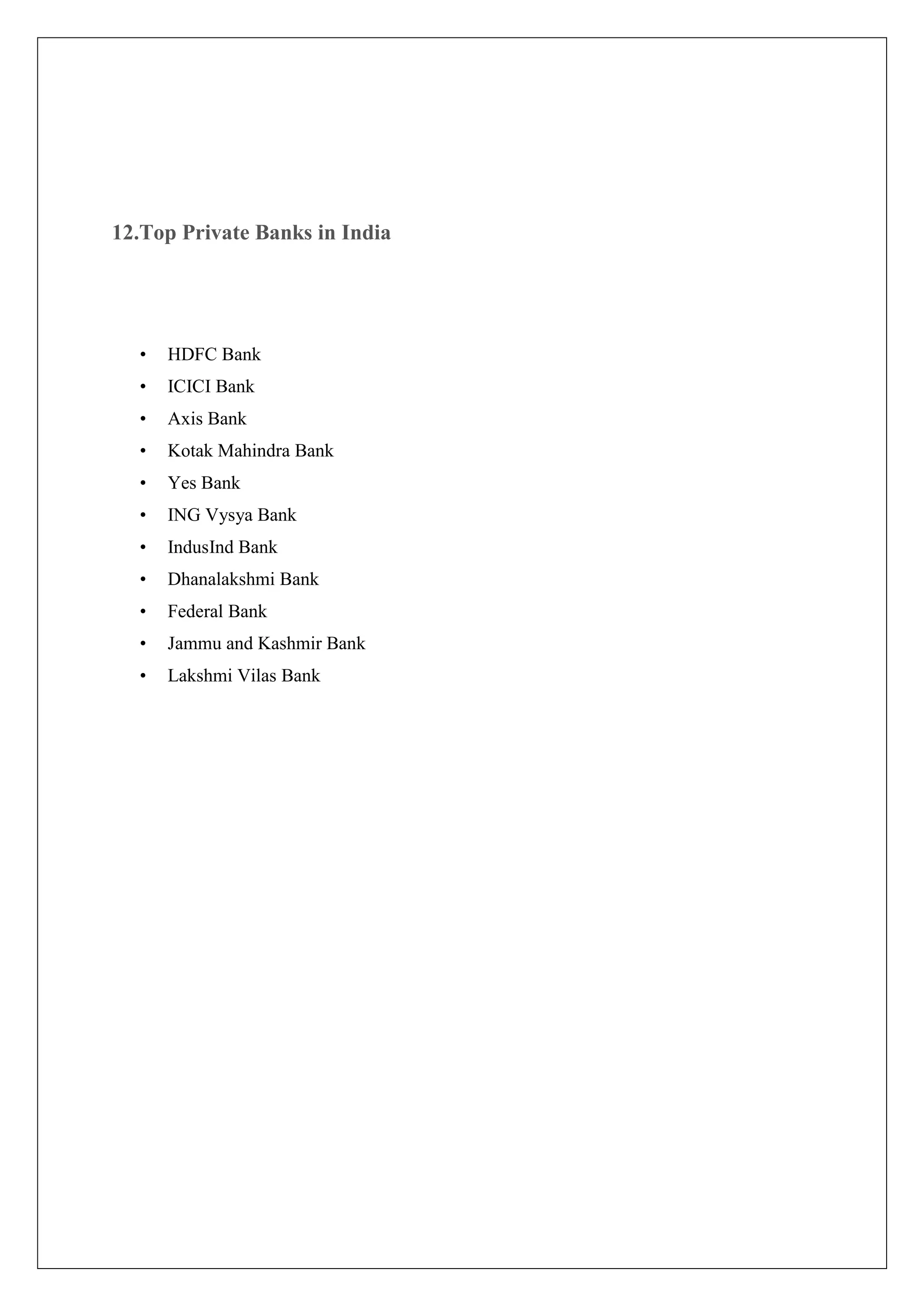

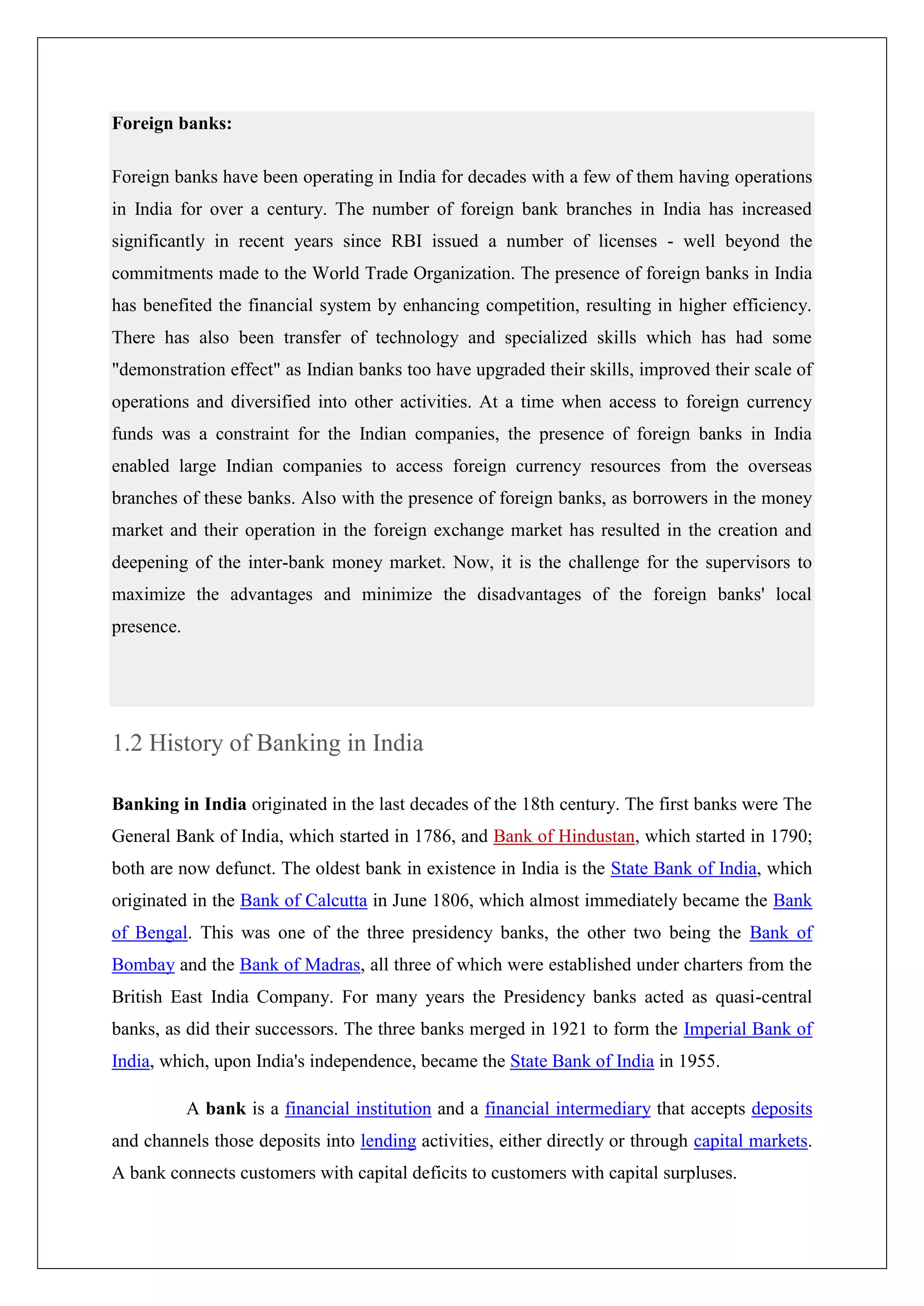

![also usually oversee the commercial banking system of their respective countries. In contrast

to a commercial bank, a central bank possesses a monopoly on increasing the nation's

monetary base, and usually also prints the national currency, which usually serves as the

nation's legal tender.[1][2] Examples include the European Central Bank (ECB), the Federal

Reserve of the United States, and the People's Bank of China.[3]

The primary function of a central bank is to manage the nation's money supply (monetary

policy), through active duties such as managing interest rates, setting the reserve requirement,

and acting as a lender of last resort to the banking sector during times of bank insolvency or

financial crisis. Central banks usually also have supervisory powers, intended to prevent

commercial banks and other financial institutions from reckless or fraudulent behavior.

Central banks in most developed nations are institutionally designed to be independent from

political interference.

2.2 Commercial Banks

Commercial Banks are banking institutions that accept deposits and

grant short-term loans and Advances to their customers. In addition to giving short-term

loans, commercial banks also give Medium-term and long-term loan to business enterprises.

Now-a-days some of the commercial Banks are also providing housing loan on a long-term

basis to individuals. There are also many Other functions of commercial banks, which are

discussed later in this lesson.

Types of Commercial banks: Commercial banks are of three types i.e., Public sector banks,

Private sector banks and foreign banks.

(i) Public Sector Banks: These are banks where majority stake is held by the Government of

India or Reserve Bank of India. Examples of public sector banks are: State Bank of India,](https://image.slidesharecdn.com/re-geeta-120215082109-phpapp02/75/banking-industry-in-india-10-2048.jpg)

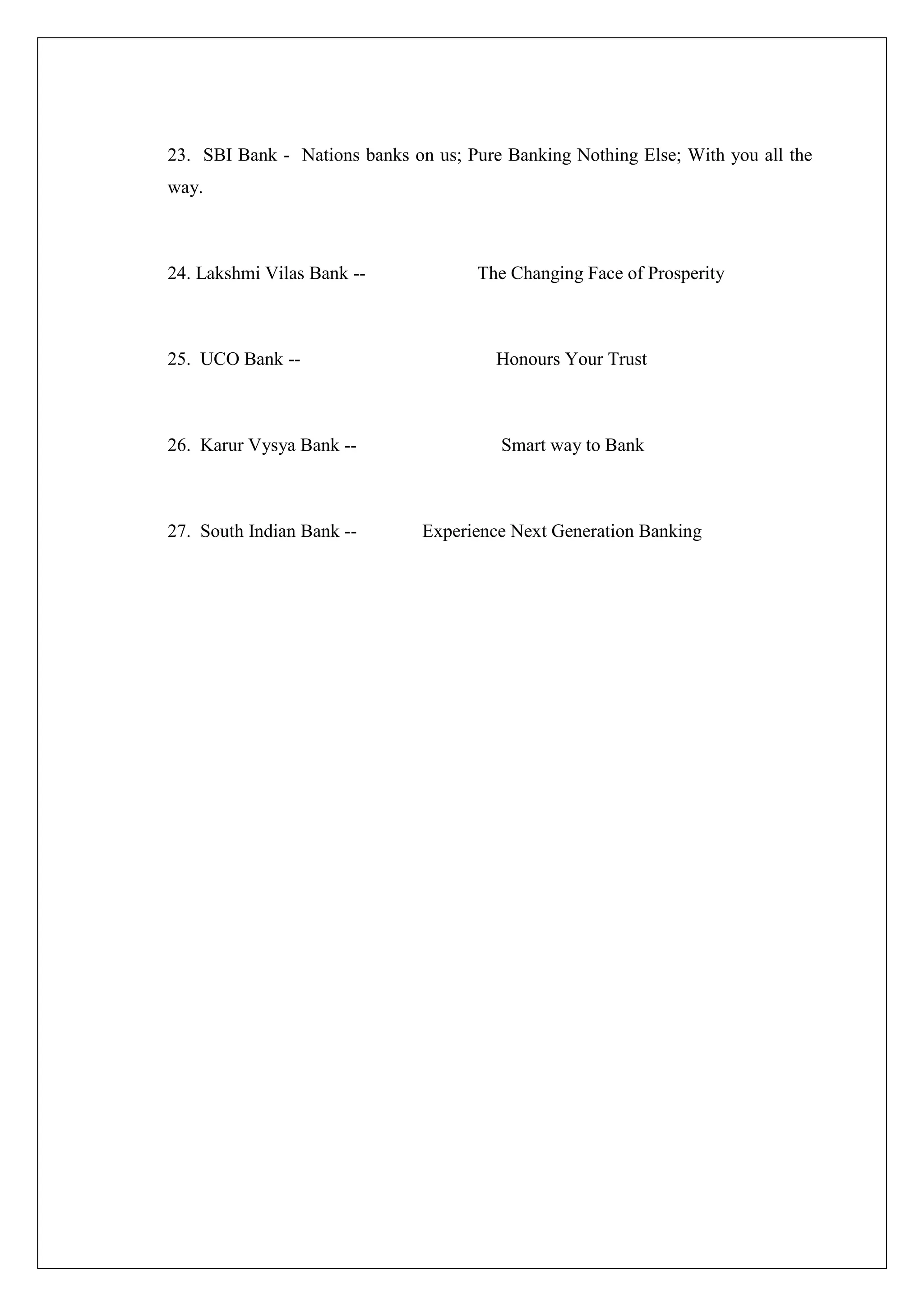

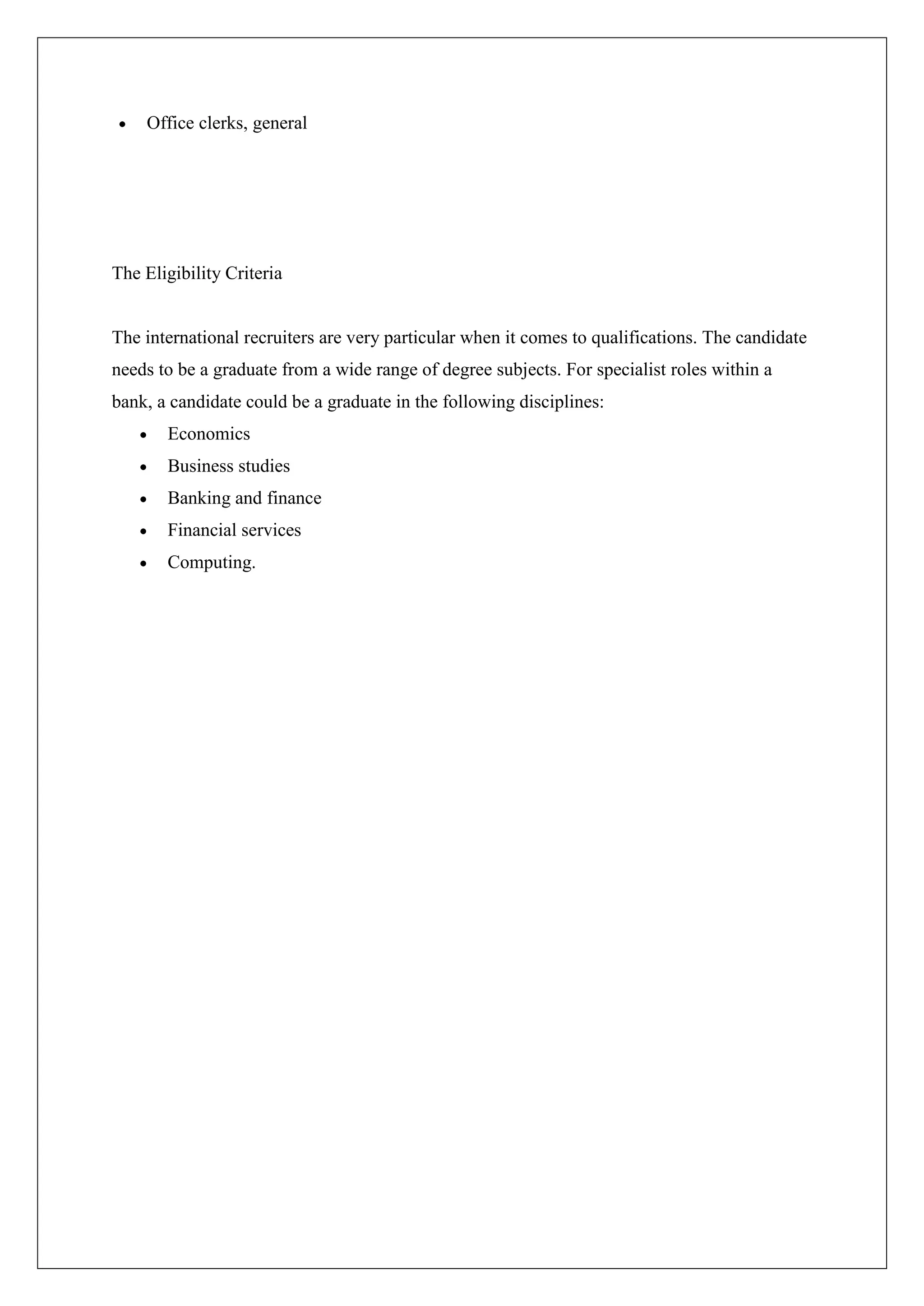

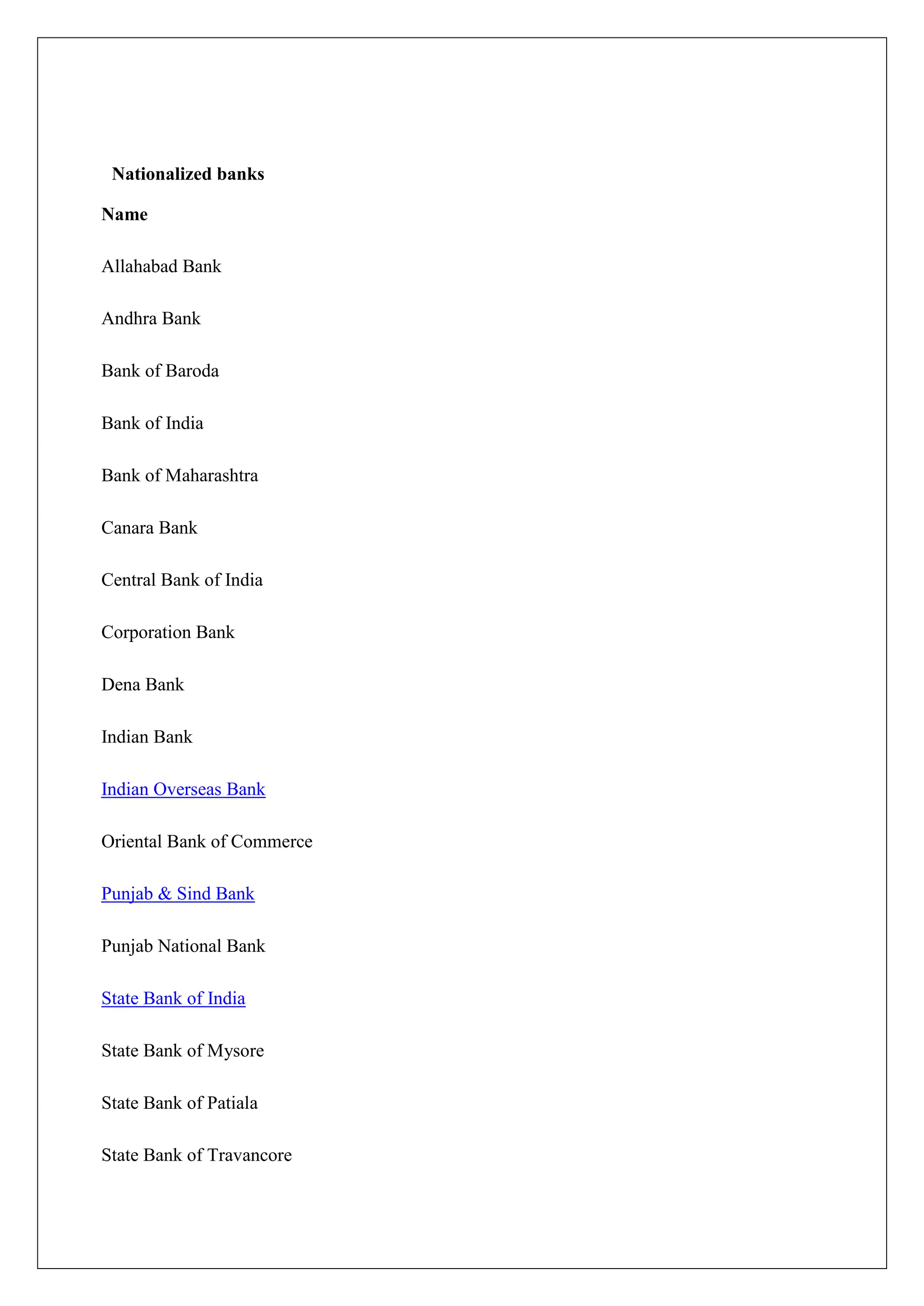

![Barclays Bank PLC

BNP Paribas

Calyon Bank

Chinatrust Commercial Bank

Citibank N.A.

DBS Bank

Deutsche Bank AG

HSBC

JPMorgan Chase Bank

Krung Thai Bank

Mashreq Bank psc

Mizuho Corporate Bank

Royal Bank of Scotland

Shinhan Bank

SCOTIA BANK

Société Générale

Sonali Bank

Standard Chartered Bank

State Bank of Mauritius

UBS

VTB [1]

iv) Development Banks

Business often requires medium and long-term capital for purchase of machinery and

equipment,

Development Banks

Industrial Development Bank of India (IDBI)

Industrial Finance Corporation of India (IFCI)

Export - Import Bank of India (Exim Bank)

Industrial Reconstruction Bank of India (IRBI) now (Industrial Investment

Bank of India)

National Bank for Agriculture and Rural Development (NABARD)](https://image.slidesharecdn.com/re-geeta-120215082109-phpapp02/75/banking-industry-in-india-14-2048.jpg)

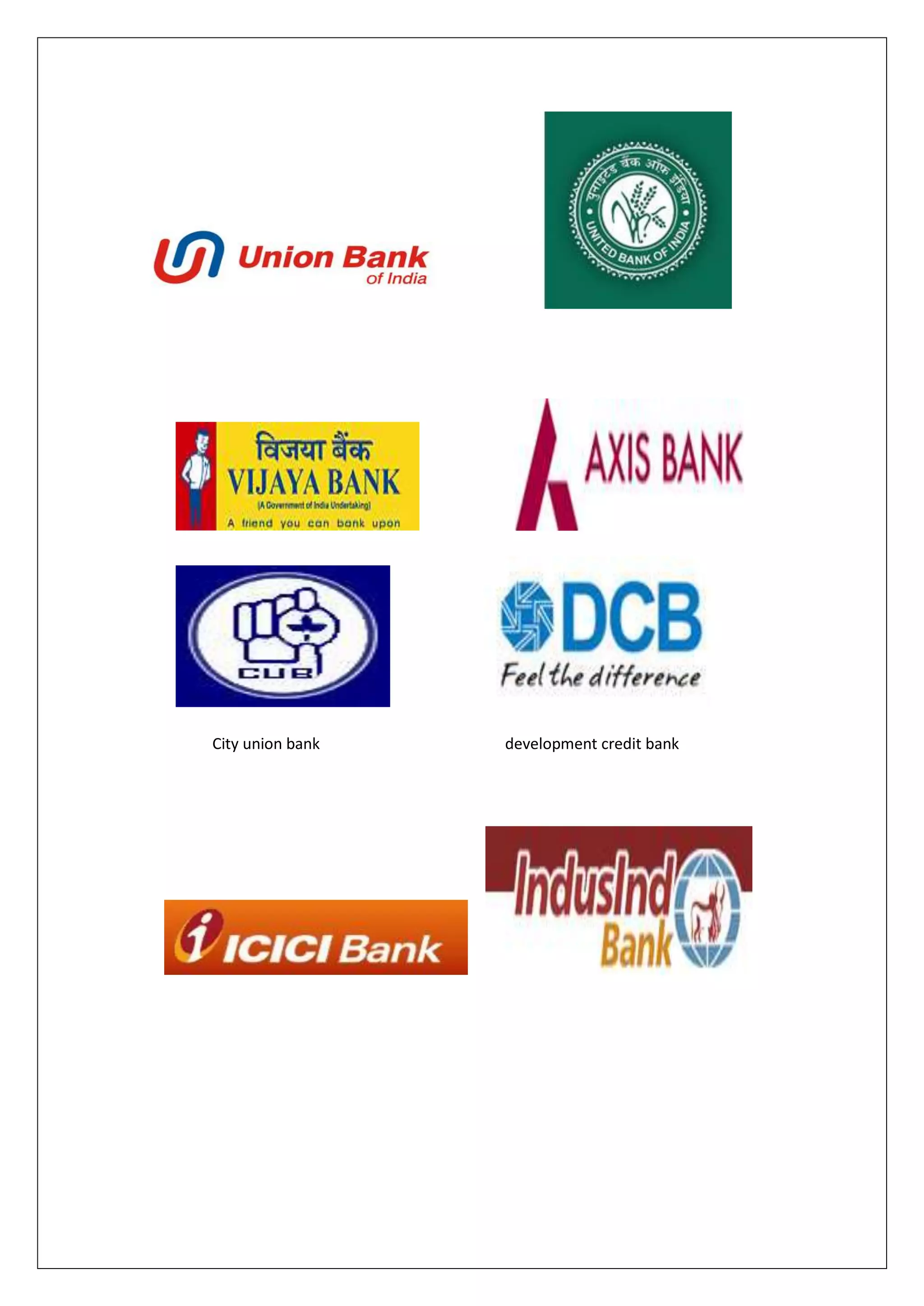

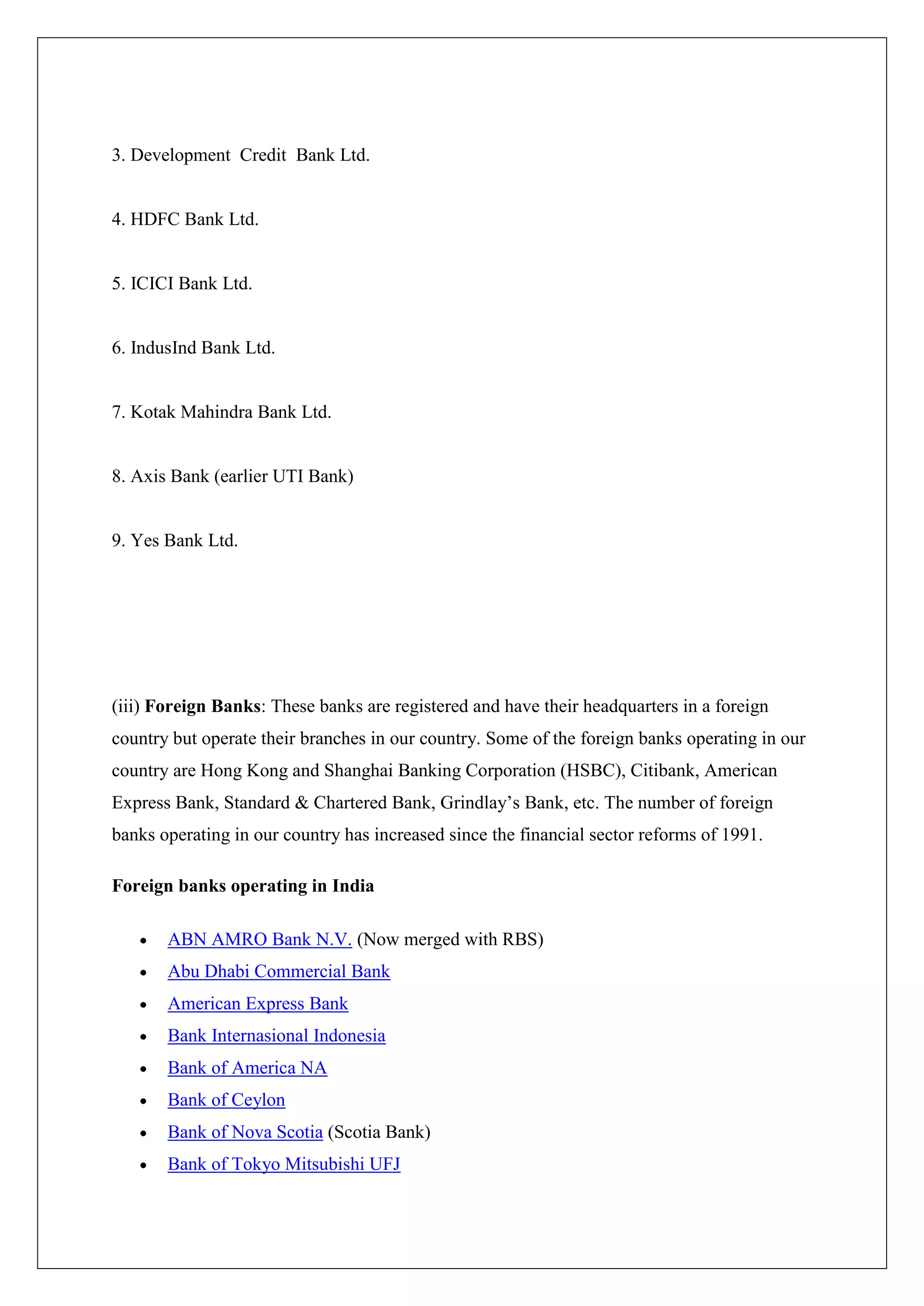

![2.4Scheduled Banks

Scheduled Banks in India are those banks which have been included in the

Second Schedule of Reserve Bank of India (RBI) Act, 1934.[1] RBI in turn includes only

those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the

Act.

2.5Non-scheduled bank in India

"Non-scheduled bank in India" means a banking company as defined in clause

(c) of section 5 of the Banking Regulation Act, 1949 (10 of 1949), which is not a scheduled

bank.](https://image.slidesharecdn.com/re-geeta-120215082109-phpapp02/75/banking-industry-in-india-16-2048.jpg)

![credit, issue of directives etc. At present selective control has been given much importance

and it is more suitable for India.

Monetary policy

Monetary policy is the process by which the monetary authority of a country

controls the supply of money, often targeting a rate of interest for the purpose of promoting

economic growth and stability.[1] [2] The official goals usually include relatively stable prices

and low unemployment. Monetary theory provides insight into how to craft optimal monetary

policy. It is referred to as either being expansionary or contractionary, where an expansionary

policy increases the total supply of money in the economy more rapidly than usual, and

contractionary policy expands the money supply more slowly than usual or even shrinks it.

Expansionary policy is traditionally used to try to combat unemployment in a recession by

lowering interest rates in the hope that easy credit will entice businesses into expanding.

Contractionary policy is intended to slow inflation in hopes of avoiding the resulting

distortions and deterioration of asset values.

Monetary policy differs from fiscal policy, which refers to taxation, government spending,

and associated borrowing

Aims of Monetary policy

• MP is a part of general economic policy of the govt.

• Thus MP contributes to the achievement of the goals of economic policy.

• Objective of MP may be:

Full employment

Stable exchange rate

Healthy Bop

Economic growth

Reasonable Price Stability

Greater equality in distribution of income & wealth](https://image.slidesharecdn.com/re-geeta-120215082109-phpapp02/75/banking-industry-in-india-28-2048.jpg)